We’ve been sounding the alarm on non-GAAP earnings for several years now. Companies exploited the wide leeway granted by the SEC to present their business in a more favorable light. What was originally intended to be a supplement to GAAP results has in many ways replaced them. Too many investors in the market seem to implicitly trust non-GAAP earnings without digging deeper to understand the misleading way companies exclude real expenses.

Non-GAAP continues to gain more traction among public companies. 90% of S&P 500 companies reported some form of non-GAAP results last year.

Going In The Opposite Direction

Unsurprisingly, companies that use non-GAAP earnings tend to make themselves look better. Valeant (VRX), Cornerstone OnDemand (CSOD), and Zillow (Z) stand out among recent companies we’ve put in the Danger Zone for inflating their profitability using non-GAAP.

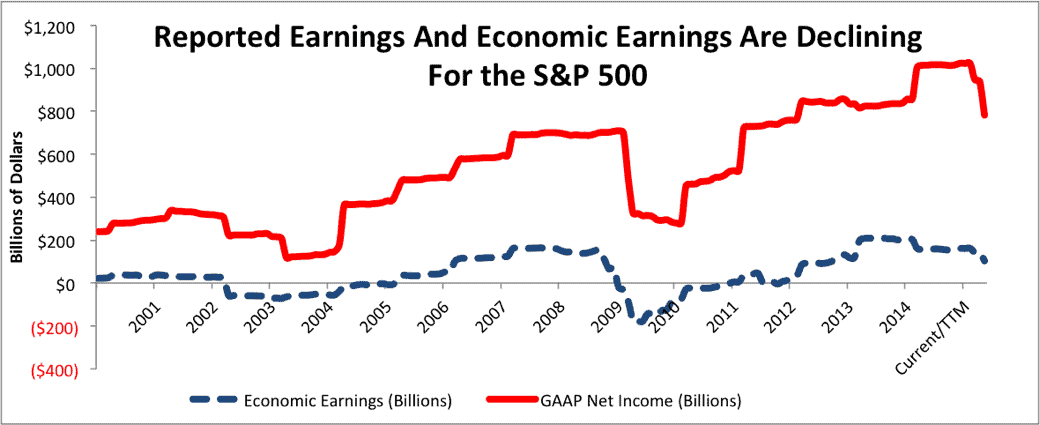

For companies in the S&P 500, non-GAAP net income continued to rise, increasing 6.6% last year. As Figure 1 shows, both GAAP net income and economic earnings are moving in the opposite direction.

Figure 1: Real Profitability Is On The Decline

Sources: New Constructs, LLC and company filings.

Our random sample of 40 S&P companies found that—of those that reported non-GAAP earnings—92% adjusted their earnings higher. That number includes four companies that, when we adjusted their GAAP earnings to net operating profit after tax (NOPAT), ended up with lower profits.

For instance, QEP Resources (QEP) reported a GAAP net loss of $149 million but a non-GAAP profit of $2 million for 2015. Most of that difference can be explained by QEP excluding $184 million in unrealized pretax losses from derivative contracts.

By only excluding unrealized gains/losses, QEP significantly misleads investors. The company also had $461 million in realized gains from derivative contracts in 2015. Excluding the unrealized losses but including the realized gains in non-GAAP income inflates QEP’s reported profitability.

We adjust out all gains and losses from derivatives, as these are not a part of the company’s core operating activity. Our calculation of NOPAT shows that QEP actually lost $190 million last year, more than it reported on a GAAP basis and significantly worse than the misleading non-GAAP numbers it promoted to investors.

Red Flag Adjustments

As anyone that regularly reads our work knows, we have no problem with making adjustments to GAAP accounting data. In fact, we make dozens of adjustments to close accounting loopholes and build models that more accurately reflect the true operating performance of the companies we follow. Many of the adjustments that companies make, such as removing the impact of write-downs, are ones we make too.

The fact that companies report earnings that don’t conform to GAAP standards is not the problem. The problem is that the earnings companies report often have no sound methodological basis and are designed to simply give the illusion of greater profitability.

In particular, companies routinely make the same adjustments that remove real operating expenses from their calculations of non-GAAP income.

- Amortization of Intangible Assets: Serial acquirers love this adjustment. They overpay for acquisitions and don’t have to take responsibility for the destruction of shareholder value that results.

- Stock-Based Compensation: Companies justify removing stock compensation on the grounds that it’s a “non-cash” expense, but that’s simply not true. By diluting the stock, the company is paying its employees with the future cash flows that would have gone to shareholders. More directly, many companies buyback stock to offset the share dilution, leading to a much more immediate cash expense.

- Various Overhead Costs: Companies lump all sorts of minor general and administrative expenses into buckets that they exclude for the purposes of non-GAAP earnings. Eliminating $10 million in “advisory costs” or “personnel costs” here and there can be a great way to just barely meet earnings expectations.

Companies regularly exclude these costs, but they rarely excluded non-operating income. You won’t see many examples of companies using non-GAAP numbers to highlight how their GAAP profits are actually inflated by foreign currency fluctuations, decreasing reserves, or changes in contingent considerations.

GAAP Is A Problem, But Non-GAAP Is Not The Solution

The SEC allows companies to report non-GAAP metrics under the assumption that these numbers can give a better picture of the true business performance to investors. The fact that the SEC allows these nonconforming metrics shows that it understands the issue with current GAAP standards.

GAAP was originally designed for debt investors, not equity investors. It requires companies to report their earnings in a way that can significantly distort the true operating profitability that matters most to equity holders.

Unfortunately, companies led by executives looking to maximize their pay are not motivated to give investors a more accurate picture of their business. They want to give investors the most favorable picture, and non-GAAP has become a handy tool to achieve that goal.

Investors Need To Be More Aware

According to the law, companies are not supposed to place non-GAAP earnings more prominently than GAAP results in their filings. In practice, companies stretch the limits of this rule all the time. They play up the importance of non-GAAP earnings and the financial media and Wall Street follow right along.

When reporting its fourth quarter and full year 2015 results, Ohio-based utility First Energy (FE) led off with its non-GAAP earnings before discussing GAAP results. That sure seems as if non-GAAP was given more prominence.

The financial media certainly gave more prominence to the adjusted figures. Every outlet I could find highlighted how FE “beat” estimates by $0.01 on a non-GAAP basis. Discussions of its GAAP results were either buried far down the page or completely nonexistent.

When CFOs tell you that 20% of companies manipulate their earnings, you should be suspicious of a company that beats expectations by a penny using an opaque and unaudited financial measure of profitability.

The SEC has said it will step up scrutiny of companies using non-GAAP earnings, but they haven’t given many specifics on enforcement. Ultimately, investors have to perform their own diligence to cut through the misleading stories told by companies and understand their true profitability.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Click here to download a PDF of this report.

Photo Credit: 401kcalculator.org (Flickr)