We published an update on this Danger Zone pick on January 18, 2022. A copy of the associated Earnings Update report is here.

“Do u have more than 1k on [Robinhood]? If so I recommend using margin.”

– featured in The Wall Street Journal’s Robinhood, Three Friends and the Fortune That Got Away

As more investors willfully admit they are gambling on stocks, we feel compelled to offer an easy way to make more informed decisions, and, hopefully, save people lots of money. Over the past few weeks, we gave investors research that shows when meme stocks’ valuations get crazy. See our prior reports on GameStop (GME), AMC Entertainment (AMC), Express (EXPR), and even Netflix (NFLX). This week, we focus on Koss Corp (KOSS: ~$20/share) and put it in the Danger Zone.

Why Investors Need Independent Research

Wall Street isn’t in the business of warning investors of the dangers in risky stocks because they make too much money from their trading volume and underwriting of debt and equity sales.

Only independent firms are free to provide unconflicted research and navigate Wall Street conflicts and analyst biases. With new technology to cut through the deluge of data in financial filings and overcome the flaws in Wall Street research, self-directed investors are better positioned than ever to make informed decisions.

Misinformation + Margin Debt = Red Flag

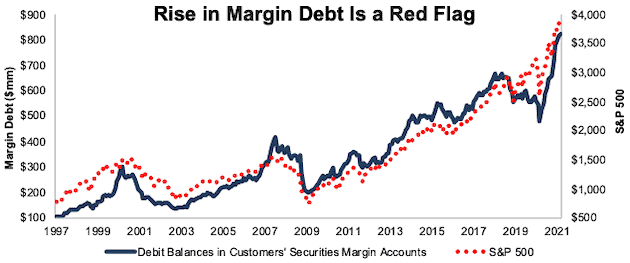

Crowdsourced information for stocks on forums like Reddit can lead investors to gamble by buying dangerous stocks and take on high levels of risk that they do not fully understand. Per Figure 1, debit balances in margin accounts, or the amount owed by a customer to a broker, soared in 2020 and early 2021 to the highest levels in U.S. history. This rise in margin debt corresponds with the rise in retail traders entering the market. According to E*Trade, the number of monthly new retail trading accounts jumped from ~43 thousand in February 2020 to ~260 thousand in March 2020.

Margin debt sports a 93% correlation with the price of the S&P 500. Inexperienced traders fueled by WallStreetBets are taking on ever increasing risk, especially if they are levering up to buy meme stocks.

Figure 1: U.S. Margin Debt Is at All-Time High

Sources: The Wall Street Journal for S&P 500 price and FINRA

Meme Stock #4: Koss Corp: Danger Zone Above $3

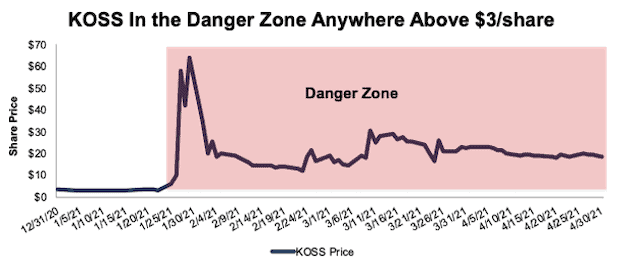

KOSS is not worth owning at any price above $3/share, and even that price assumes the company is able to reverse years of declining revenue and grow at industry growth rates. Nevertheless, the stock went on to climb as high as $64/share before taking a roller coaster ride back to ~$20/share.

Figure 2: Fundamental Research to Know When to Sell KOSS

Sources: New Constructs, LLC and company filings

Shrinking While The Industry Is Growing

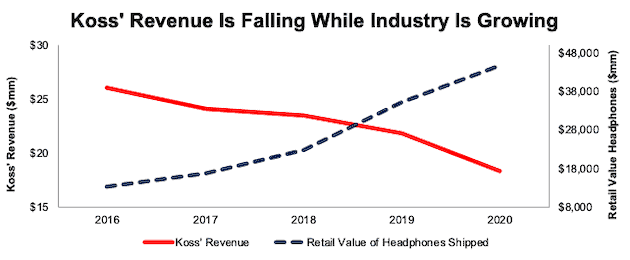

The retail dollar value of global headphone shipments has grown by 35% (vs -8% for KOSS) compounded annually since 2016. In other words, Koss’ revenue fell 30% while the retail dollar value of global headphone shipments rose 233% over the same time. Naturally, Koss’ market share fell from 0.19% in 2016 to 0.04% in 2020. If Koss can’t grow revenue in such a good environment, one must ask, “when will it?”

Figure 3: Koss and Industry Revenue 2016 - 2020

Sources: New Constructs, LLC and Statista

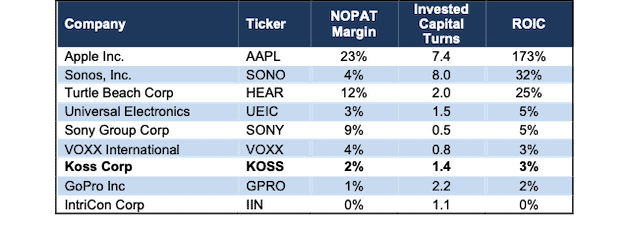

Fundamentals Were Only Positive During the Pandemic

Koss’ revenue has been deteriorating for many years, which underscores how little the stock’s recent rise is related to fundamentals. With the exception of the TTM period, Koss’ return on invested capital (ROIC) and NOPAT margin have been negative every year since 2016. Although Koss’ fundamentals improved slightly in a very favorable environment for headphones over the TTM, this improvement is unlikely to last as the pandemic wanes. Figure 4 compares Koss’ fundamentals to its peers.

Figure 4: Profitability Metrics: Koss vs. Peers: 2020

Sources: New Constructs, LLC and company filings

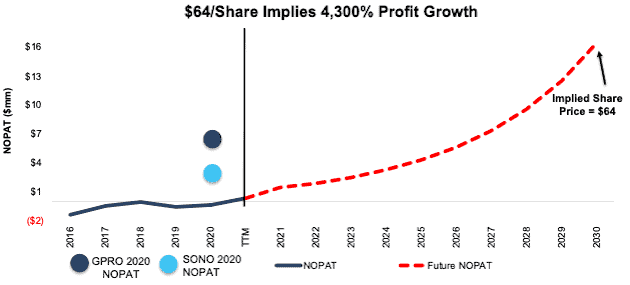

Poor fundamentals and declining market share, however, didn’t stop Koss’ stock from soaring during the meme-stock frenzy. To give a sense of just how crazy-overvalued the stock was at its peak, we do the math and show how the business would have to perform to justify $64/share.

“Crazy” at $64 Explained: Implies More Profit Than GoPro

Our reverse discounted cash flow (DCF) model is an excellent research tool for analyzing the expectations implied by stock prices. To justify $64/share, it shows that Koss must:

- immediately improve its profit margin to 6% (3x its highest ever margin of 2% TTM vs. a 5-year average margin of -3%) and

- grow revenue by 31% compounded annually through 2030 (which is nearly 3x the projected industry growth through 2026, vs. Koss’ -6% CAGR over the past five years)

In this scenario, Koss earns $16.4 million in net operating profit after-tax (NOPAT) in 2030, which is more than 43x its TTM NOPAT, nearly 5x the 2020 NOPAT of speaker manufacturer Sonos, Inc. (SONO), and nearly 2.5X the 2020 NOPAT of consumer electronics provider GoPro Inc. (GPRO). See Figure 5 for details.

Figure 5: Koss’ Historical NOPAT vs. DCF-Implied NOPAT: Scenario 1

Sources: New Constructs, LLC and company filings

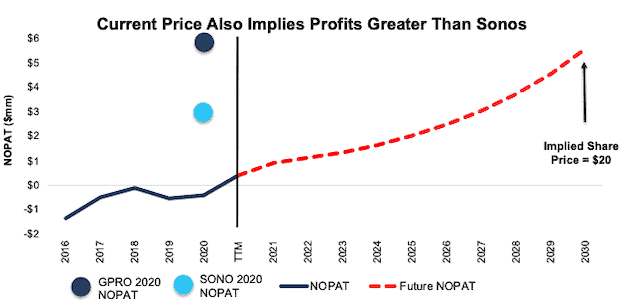

Still Crazy At ~$20/share

We run the same analysis to show what the company must do to justify the current price, ~$20/share:

- improve its profit margin to 4% (equal to Sonos’ TTM margin vs. Koss’ 2% TTM margin) and

- grow revenue by 22% compounded annually through 2030 (which is 2x the projected industry growth through 2026)

In this scenario, Koss earns over $5 million in NOPAT in 2030, which is 147% of Sonos’ 2020 NOPAT and just 17% below GoPro’s 2020 NOPAT. See Figure 6 for details.

Figure 6: Koss Historical NOPAT vs. DCF-Implied NOPAT: Scenario 2

Sources: New Constructs, LLC and company filings

Good Reason for High Short Interest

Since short interest in the stock recently reclaimed the January levels (27%) that made it a target and precipitated the last squeeze that drove up the stock, another squeeze could be on the way.

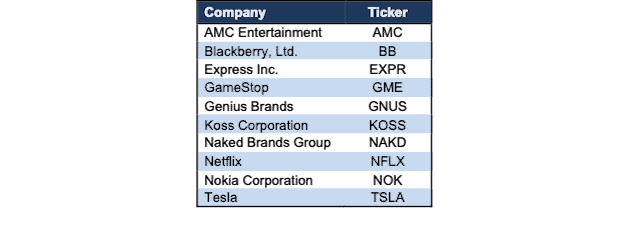

More Reliable Fundamental Research on other Meme Stocks

With a better grasp on fundamentals[1], investors have a better sense of when to buy and sell – and – know how much risk they take when they own a stock at certain levels.

We’ve already illustrated the extreme risk investors are taking buying GameStop and AMC Entertainment, Express, and Netflix. In the coming weeks, we will continue to perform this same analysis on other meme stocks: Blackberry (BB), Genius Brands (GNUS), Naked Brands Group (NAKD), and Nokia (NOK). Each of these stocks were on Robinhood’s restricted stocks list and each saw a major rise and fall in late January.

We will also feature other meme stocks that trade at levels entirely disconnected from fundamental reality, such as Tesla (TSLA).

Figure 7: Meme Stocks Disconnected From Fundamental Reality

Sources: New Constructs, LLC and company filings

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

This article originally published on May 3, 2021.

Disclosure: David Trainer, Kyle Guske II, Alex Sword, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Only Core Earnings enable investors to overcome the inaccuracies, omissions and biases in legacy fundamental data and research, as proven in Core Earnings: New Data & Evidence, a forthcoming paper in The Journal of Financial Economics written by professors at Harvard Business School (HBS) & MIT Sloan.