We published an update on this Long Idea on July 28, 2021. A copy of the associated Earnings Update report is here.

In an era of persistently low interest rates, high dividend-yielding stocks can represent an attractive value opportunity especially if accompanied with strong free cash flow and a solid history of dividend growth.

This telecom giant’s dividend looks too good to pass up. While the company has wasted shareholder capital in the past, new management seems committed to capital discipline, cost-cutting, and maximizing cash flows. Verizon (VZ: $58/share) is this week’s Long Idea.

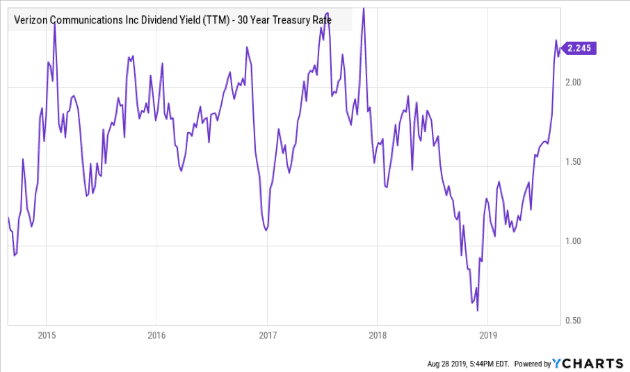

Widening Spread Between VZ and Treasury

On August 28, Josh Brown (aka The Reformed Broker), tweeted:

Brown’s point is a good one. Investors have to be very pessimistic about Verizon (which has increased its dividend in 13 consecutive years) to believe that it should be yielding more than double the 30-year treasury.

As Figure 1 shows, the current spread between Verizon’s dividend yield and the 30-year treasury rate is the highest it’s been in nearly two years. The last time the spread was this high – November 2017 – the stock gained 30% over the following year.

Figure 1: Spread Between VZ Dividend Yield and 30-Year Treasury Rate

Sources: YCharts

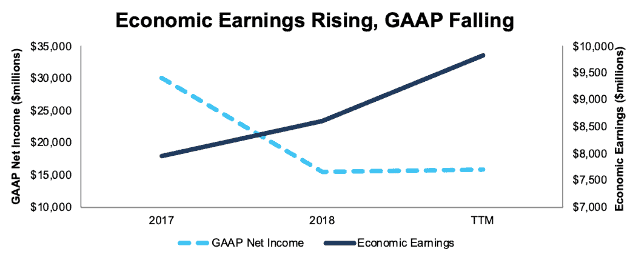

GAAP Earnings Mislead Investors

Verizon’s confusing accounting earnings may account for some of the stock’s undervaluation. As we noted immediately after the company filed its 2018 10-K, a variety of non-recurring items in 2017 and 2018 create a distorted picture of the company’s recent cash flows. GAAP net income is declining, but economic earnings, the true cash flows of the business, are rising.

Figure 2: VZ GAAP vs. Economic Earnings: 2017-TTM

Sources: New Constructs, LLC and company filings

In 2017, VZ’s GAAP net income was overstated due to a $16.8 billion (13% of revenue) benefit from tax reform[1].

Meanwhile, in 2018, GAAP net income understated VZ’s profitability due to two major non-recurring expenses:

- $3.4 billion (3% of revenue) in restructuring and acquisition-related costs

- A $4.6 billion (4% of revenue) write-down to the goodwill in its Oath (AOL and Yahoo) segment

As a result, GAAP earnings per share declined by 49% from 2017-2018, while economic earnings per share grew by 7%.

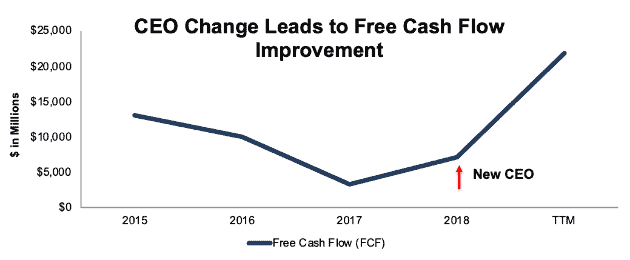

New Management Focused on Capital Discipline

We previously made Verizon a Long Idea on September 15, 2015. At the time, we were bullish on the company’s strong track record of profit growth, and we believed it had a significant opportunity to widen its moat through live streaming content, particularly in sports and entertainment.

Instead, the company pursued a digital media content aggregation strategy centered around the acquisitions of AOL and Yahoo, which cost the company ~$9 billion (4% of market cap). Rather than creating a durable competitive advantage, these acquisitions positioned Verizon as a distant challenger to Alphabet (GOOGL) and Facebook (FB) in the world of online advertising. We were bearish on these acquisitions at the time, and the wasteful capital allocation led us to close our long call in June of 2017, with the stock flat since the original report was published.

In 2018, former CEO Lowell McAdam left the company and was replaced with CTO Hans Vestberg. Since Vestberg become CEO, he has halted the value-destroying acquisition strategy, emphasized cutting costs, and reorganized the company around a focus on its cellular network through the Verizon 2.0 plan. As part of this reorganization, he took the aforementioned write-down on the goodwill from the AOL and Yahoo acquisitions, and effectively admitted the failure of the company’s content aggregation strategy.

By focusing on the company’s core competencies and avoiding value-destroying acquisitions, Vestberg has achieved a significant increase in Verizon’s free cash flow, as shown in Figure 3.

Figure 3: VZ Free Cash Flow: 2015-TTM

Sources: New Constructs, LLC and company filings

Verizon bears have been disappointed with the company’s meager dividend growth (less than 3% annual growth over the past five years), but the recent rise in free cash flow increases the potential for more dividend growth in the future.

Superior Network Provides Competitive Advantages

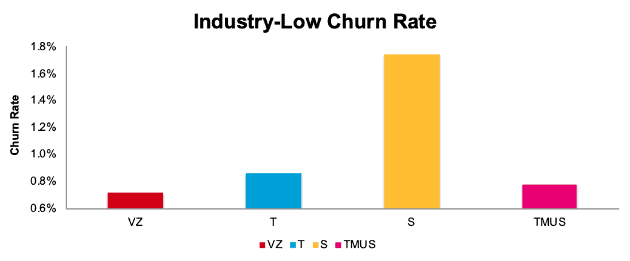

Vestberg’s emphasis on Verizon’s cellular network is not just good for free cash flow, it’s also the right strategy. Verizon’s network coverage is widely recognized as the best in the nation. This superior coverage helps drive its industry-low customer churn rate (0.72%), as shown in Figure 4.

Figure 4: Retail Postpaid Phone Churn Rates: VZ, T, S, TMUS

Sources: New Constructs, LLC and company filings

More impressively, Verizon has maintained the lowest churn rate while raising prices and average revenue per account increasing by 2% year-over-year in the most recent quarter. Meanwhile, T-Mobile (TMUS), the company with the next-lowest churn rate, saw its average revenue per user decline by 1% in the most recent quarter.

Figure 4 also shows why the potential merger of T-Mobile and Sprint (S) should not concern Verizon investors. Even if the merger does go through – which is not a done deal – the combined company will face massive hurdles just to fix Sprint’s struggling network and repair its relationship with its customers, which it loses at an alarming rate. Merging with Sprint might bring T-Mobile extra resources, but it will also take on additional challenges (and ~$50 billion in debt) that do not exactly position the combined companies to dethrone Verizon.

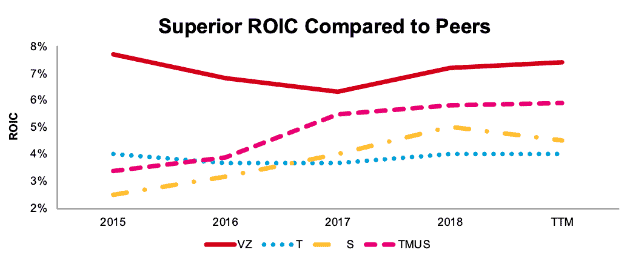

The value of Verizon’s network shows up clearly when we look at return on invested capital (ROIC). As shown in Figure 5, Verizon consistently earns the highest ROIC of any of the big 4 carriers. T-Mobile closed the gap significantly between 2015-2017, but Verizon, under Vestberg, has widened its advantage again.

Figure 5: Return on Invested Capital 2015-TTM: VZ, T, S, TMUS

Sources: New Constructs, LLC and company filings

Underappreciated Profit Growth Opportunities

The bear case on Verizon focuses on the company’s lack of apparent growth opportunities, mostly, as a result of the failure of its content aggregation strategy. While competitor AT&T (T), through its acquisition of Time Warner, made a big push into content, Verizon’s content push fizzled out. In addition, now that smartphones have nearly hit full penetration in the U.S., the potential user growth in the core business is low.

We think 5G brings growth opportunity. First, it allows Verizon to charge more for its wireless plans as it further improves its network capabilities. Second, as part of the transition to 5G, the company is also investing in its “Intelligent Edge Network” to reduce the latency of its service and open up pathways to new applications such as cloud gaming networks and virtual reality.

The potential of these new technologies and applications shows that investors are too quick to assume Verizon will never grow again. Given its competitive position, Verizon has superior resources and scale to develop and monetize new offerings.

Even though we do not expect rapid user growth in the foreseeable future, the company can still grow profits. Revenue, after all, is only one half of the equation. As part of the company’s reorganization, Vestberg plans to cut $10 billion (8% of revenue) in operating expenses by 2021 through voluntary employee buyouts and product realignment.

This cost-cutting effort is already having an effect. From 2017 to 2018, Verizon’s headcount decreased by 7%, and its after-tax profit (NOPAT) margin improved from 15% to 17%. As a result of this cost-cutting, NOPAT increased by 22% even though revenues were up just 4%.

Valuation Implies Permanent Profit Decline

Even if bears are right and Verizon is doomed to zero-growth, the stock is still undervalued. At its current price of $58/share, VZ has a price to economic book value (PEBV) ratio of 0.7. This ratio implies that NOPAT will permanently decline by 30%. For a company that has grown NOPAT by 4% compounded annually over the last decade, this expectation for permanent profit decline seems unlikely.

If VZ can maintain its TTM NOPAT margin of 18% and grow NOPAT by just 2% compounded annually for the next 10 years, the stock is worth $109/share today, an 88% upside to the current stock price. See the math behind this dynamic DCF scenario.

Verizon may not be a high-growth company, but at the right valuation, even low growth can translate to significant gains for investors.

Sustainable Competitive Advantages That Will Drive Shareholder Value Creation

Here’s a summary of why we think the moat around Verizon’s business will enable the company to generate higher profits than the current valuation of the stock implies. This list of competitive advantages helps VZ offer better products/services at a lower price and prevents competition from taking market share.

- Superior network quality that drives lower churn and higher prices

- Management focused on core competencies and constant improvement to the network

- Superior capital efficiency compared to peers

What Noise Traders Miss with VZ

These days, fewer investors focus on finding quality capital allocators with shareholder friendly corporate governance. Instead, due to the proliferation of noise traders, the focus tends toward technical trading tends while high-quality fundamental research is overlooked. Here’s a quick summary for noise traders when analyzing VZ:

- Spread between VZ’s dividend and U.S. treasury is unusually high

- New management’s focus on capital discipline drives higher cash flow and dividend growth potential

- GAAP earnings mislead investors and hide real profit growth

Catalyst: Growth and Rate Cuts Could Send Shares Higher

With the largest network and the lowest churn, Verizon has excellent growth opportunities. Its superior scale and distribution enable it to monetize new services related to 5G or any other wireless offerings better and faster than its competition. We think it is naïve to believe that management is not fully aware of these competitive advantages and planning to exploit them.

Most analysts see the Fed continuing to cut rates in the near future, with some even predicting a return to near-zero rates. With inflation still below 2% and GDP growth slowing, it seems likely that overall interest rates will continue to decline. This decline will only serve to make Verizon’s high, stable dividend more appealing.

In addition, Verizon could hike its dividend more than expected. The company’s next dividend announcement should be coming in September, and if Verizon raises its dividend substantially more than its ~3% historic rate, that would serve to make the stock more appealing to investors.

Accounting earnings should start to catch up to economic earnings at the end of this year when the impact of restructuring charges and write-downs no longer depress TTM earnings. This tailwind for reported EPS boosts growth and should put the stock on the radar of more investors.

Corporate Governance Could Be Improved

Despite the CEO transition in 2018, Verizon’s executive compensation plans remain unchanged. 45% of annual bonuses are tied to adjusted EPS targets, 25% to free cash flow, 25% to total revenue, and 5% to diversity and sustainability initiatives. Long-term bonuses are based on a combination of free cash flow and total shareholder return.

We’re glad that the free cash flow target gives executives at least some incentive to think about capital allocation, but Verizon should not be placing so much emphasis on an easily manipulated target like adjusted EPS.

Ultimately, ROIC is the primary driver of shareholder value, and it’s the best metric to align executive’s interests with shareholder’s interests. This is the view of buy-side investors (77% of whom believe management pay should be linked to ROIC) and it is backed up by empirical research.

We’re encouraged by Verizon’s recent capital discipline, but if the company wants to ensure that executives stick to this new approach, they should reform their corporate governance and tie executive compensation to ROIC.

Insider Trading and Short Interest Trends are Minimal

Insider activity has been minimal over the past 12 months, 637 shares sold and no shares purchased. While the lack of share purchases is not ideal, it makes more sense due to the fact that Vestberg became CEO slightly more than a year ago and received a large stock award at that time. In addition, insider sales represent less than 1% of shares outstanding.

There are currently 33 million shares sold short, which equates to less than 1% of the float and 3 days to cover. There doesn’t appear to be much appetite to bet against this stock.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments we make based on Robo-Analyst[2] findings in Verizon’s 2018 10-K:

Income Statement: we made $21.6 billion of adjustments, with a net effect of removing $7.1 billion in non-operating expense (5% of revenue). We removed $7.3 billion in non-operating income and $14.4 billion in non-operating expenses. You can see all the adjustments made to VZ’s income statement here.

Balance Sheet: we made $172.9 billion of adjustments to calculate invested capital with a net increase of $83 billion. You can see all the adjustments made to VZ’s balance sheet here.

Valuation: we made $193.6 billion of adjustments with a net effect of decreasing shareholder value by $193.6 billion. Despite this decrease in value, VZ remains undervalued. You can see all the adjustments made to VZ’s valuation here.

Attractive Funds That Hold VZ

The following funds receive our Attractive-or-better rating and allocates significantly to Verizon.

- iShares US Telecommunications ETF (IYZ) – 21.4% allocation and Very Attractive rating

- ProShares Ultra Telecommunications ETF (LTL) – 15.8% allocation and Attractive rating

- Vanguard Communications Services Index Fund (VOX, VTCAX) – 7% allocation and Attractive rating

- First Trust Morningstar Dividend Leaders Index Fund (FDL) – 6.8% allocation and Attractive rating

This article originally published on September 4, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] After the passage of the tax law, we listed VZ as one of our “Tax Reform Winners” due to its large amount of deferred tax liabilities.

[2] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.