We closed this position on June 28, 2017. A copy of the associated Position Update report is here.

Telecom and wireless operators are often cited as following the same path as traditional television providers, e.g. Comcast (CMCSA) and Time Warner Cable (TWC), which many believe are being replaced by newer, streaming providers like Netflix (NFLX), Amazon (AMZN), or Google’s (GOOGL) YouTube. This negative view has created an investing opportunity in one of the best companies the telecom industry has to offer. Aside from a long-term track record of profit growth, this company is capitalizing upon the biggest opportunity in the telecom industry, increased data access. Add in an undervalued stock price and it’s clear why this week’s long idea is Verizon Wireless (VZ: $46/share)

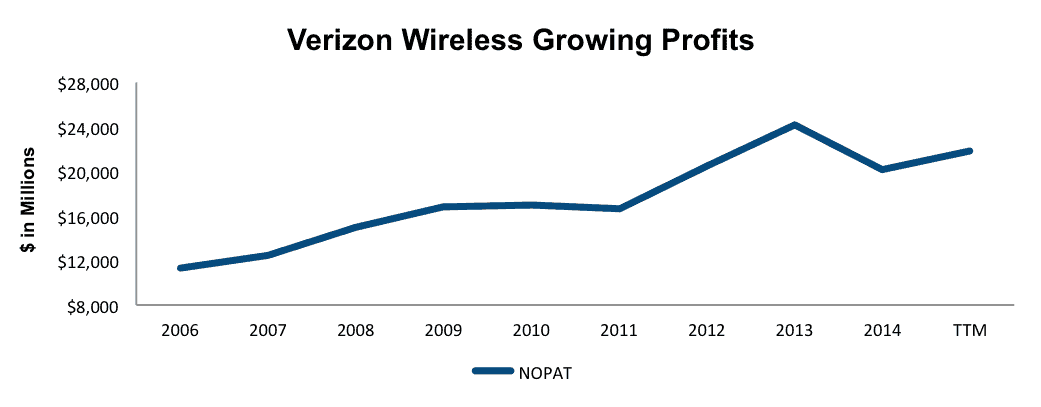

Consistent Profit Growth Throughout History

Verizon Wireless, often one of our favorite telecom stocks, has grown revenue by 5% compounded annually since 2006. Better yet, Verizon has grown after-tax profit (NOPAT) to $20 billion, or 7% compounded annually over this same timeframe.

Figure 1: Robust Profit Growth at Verizon Wireless

Sources: New Constructs, LLC and company filings

Verizon Wireless has also been efficient in managing the capital invested into its business and earns a return on invested capital (ROIC) of 8%, up from 5% at the end of 2006. At the end of the day, Verizon’s business has generated positive economic earnings every year since 2008, a testament to Verizon’s ability to create true shareholder value.

Business Model and Network Provide Strong Competitive Advantages

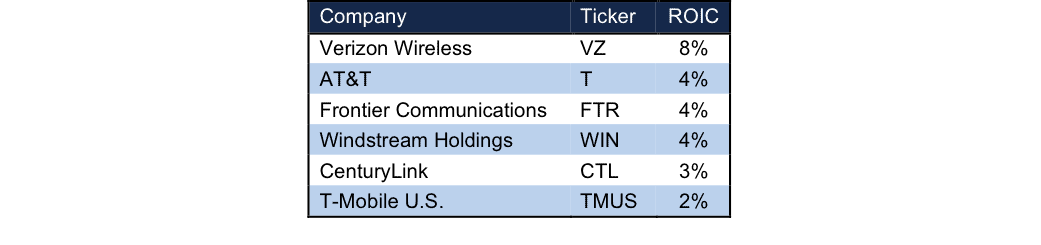

Verizon operates amongst the largest telecom and mobile service providers in the country, namely AT&T (T), T-Mobile (TMUS), and Sprint (S). In addition, Verizon also competes with smaller companies CenturyLink (CTL), Frontier Communications (FTR), and Windstream (WIN). Despite all the competition, Verizon remains the strongest player, i.e. highest ROIC, in the telecom industry.

With an ROIC twice as high as the closest competitor, per Figure 2, VZ has significant pricing power over its competitors and is well positioned to withstand the aggressive pricing of Sprint and T-Mobile, which include tactics such as paying consumers to switch carriers.

Another key competitive advantage for VZ is the strength of its network. In a recent test by PC Mag, Verizon Wireless, for the second year in a row, operated the fastest mobile network and best coverage across the United States. Consumers will pay for a fast and reliable connection, as exhibited by Verizon’s industry leading 133 million subscribers. Encouragingly, Verizon is not resting on its laurels and recently announced the testing of its 5G network, which would provide data speeds 30-50 times faster than the current 4G/LTE network.

Figure 2: Verizon Has a Leg Up On Competition

Sources: New Constructs, LLC and company filings

We understand past success is not necessarily indicative of future success especially in the telecom industry where change is rapidly taking place. Nevertheless, investors should not overlook the formidable competitive advantages that Verizon has built.

Content Strategy Enhances and Leverages Already Profitable Business

Key to maintaining and building on its competitive advantages is Verizon’s new initiative: Go90, a free, ad-based mobile app that will stream live NFL games and concerts, in addition to traditional TV programming. The power of providing access to live sports, especially NFL games, should not be lost on investors. The NFL, and live sports in general, are the most valuable piece of video content available today. While traditional streaming services become commoditized, the ability to provide “DVR proof content,” aka live content, gives Verizon a leg up on traditional streaming giants Netflix and Amazon. Both of these services lack live content apart from costly original content, a problem we’ve previously highlighted in our analysis of Netflix.

The focus on live streaming intelligently positions Verizon to make money in the one area of telecom where we think money is to be made over the long term: data access. We written previously how we do not think there is money to be made by firms like Netflix for providing Internet access to pre-recorded content. Because Verizon owns the pipes, it can be agnostic about what content passes through to the customer.

In the end, we think Verizon is in the catbird’s seat. It is the bridge between the content creators and the content consumers. It does not need to create content or demand for content because that is what the content creators do. Given the size and speed of its network, the content creators, like the NFL, are more likely to choose Verizon as a distribution partner. Verizon simply takes a toll for use of its network while incurring little to none of the rather large costs for content creation and demand cultivation.

We think Verizon’s Go90 strategy will keep the company’s ROIC higher than the competition for the foreseeable future.

Impact of Footnotes Adjustments and Forensic Accounting

We have made several adjustments to Verizon’s 2014 10-K. The adjustments are:

Income Statement: we made $28.1 billion adjustments with a net effect of removing $10.5 billion of unusual expenses (8% of revenue). The largest adjustment was the removal of $7.5 billion related to severance and pension charges. We remove these hidden non-operating expenses to reveal Verizon’s recurring, core NOPAT.

Balance Sheet: we made $131.8 billion balance sheet adjustments to calculate invested capital with a net increase of $89.9 billion. The largest adjustment made was the inclusion of $48.9 billion due to accumulated goodwill. This adjustment represented 24% of reported net assets.

Valuation: we made $222 billion adjustments with a net effect of decreasing shareholder value by $204.5 billion. The largest adjustment to shareholder value was the removal of $41.6 billion in deferred tax liabilities. This liability represents 21% of Verizon’s market cap.

Verizon Shares Are Undervalued

Despite outpacing the market this year, Verizon shares remain significantly undervalued. At its current price of $46/share, Verizon has a price to economic book value (PEBV) ratio of 0.7. This ratio implies that the market expects the company’s NOPAT to permanently decline by 30%. Such low expectations ignore the long-term profit growth shown above as well as the potential of Verizon’s video offerings.

Even if bears are right and Verizon is unable to compete in the price wars of the mobile industry, Verizon’s current economic book value, or no growth value, is $61/share, which represents 33% upside from the current price.

Assuming bears are wrong, as we believe, and Verizon is able to grow NOPAT by 4% compounded annually for the next decade, the stock is worth $83/share today – a 78% upside.

Verizon’s Excellence Will Be Recognized and Shares Will Soar

When Verizon released its 2Q15 earnings, it announced impressive customer additions as well as the lowest churn rate in three years. With the announcement of live video streaming as well as Verizon’s accelerated deployment of 5G services, we believe that it’s only a matter of time before the market realizes the strength of Verizon’s business. We do not expect the marketing gimmicks from T-Mobile and Sprint to be any more successful than they have been to date. Look to Verizon’s next quarterly results for continued signs of growth in customer additions, specifically in the more data heavy smartphone additions. The upcoming release of the new iPhone could very well spur Verizon to another excellent quarter as well.

Insider Trends/Short Interest Raise No Alarms

In the past 12 months, there have been no insider share purchases and only 263 thousand shares sold. This represents less than 1% of shares outstanding. Short interest in VZ stands at 49 million shares, or around 1% of shares outstanding.

Executive Compensation Passes Inspection

Verizon executives receive 10% of their pay in base salary and 90% in the form of cash bonuses and stock options. The cash bonuses are given based largely on adjusted EPS, free cash flow, and revenues. The stock options are granted based on relative total shareholder return, cumulate cash flow, and continued employment with the company. While it would be ideal for a larger percentage of Verizon’s executive compensation to be based on profits, rather than adjusted EPS, the current plan raises no major red flags.

Share Buyback Plans

Through June 2015, Verizon has repurchased 1.5 million shares under its current share repurchase program, which authorizes the repurchase of up to 98.5 million more shares. In a separate transaction, Verizon entered into an accelerated share repurchase in February 2015 to buyback $5 billion worth of shares. This accelerated share repurchase finished in June 2015. In total, Verizon has repurchased 103.1 million shares in 2015, which represents slightly less than 3% of shares outstanding.

Attractive Funds That Hold VZ

- State Street SPDR Technology Select Sector Fund (XLK) – 4.6% allocation and Very Attractive rating

- Schwab U.S. Dividend Equity ETF (SCHD) – 4.5% allocation and Very Attractive rating

- YCG Enhanced Fund (YCGEX) – 3.9% allocation and Very Attractive rating.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Photo Credit: Robert Scoble (Flickr)