We closed this position on September 23, 2024. A copy of the associated Position Update report is here.

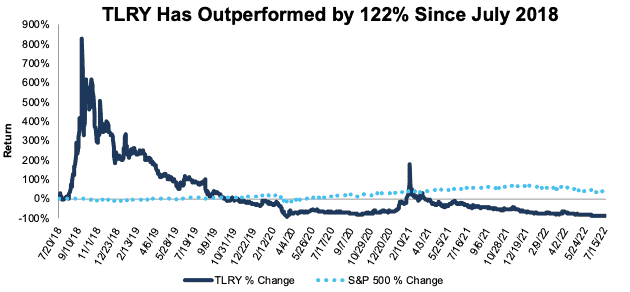

We put Tilray (TLRY: $3.50/share) in the Danger Zone in July 2018, prior to its IPO. Since our report, the stock has outperformed the S&P 500 as a short by 122%. Even after falling 98% from its 2018 high and 53% year-to-date, we think the stock has much more downside.

This report leverages our cutting-edge Robo-Analyst technology to deliver proven-superior fundamental research and support more cost-effective fulfillment of the fiduciary duty of care[1].

Cannabis stocks experienced a bubble and a burst in 2019, then staged a false rally in 2021 that has left prices falling for the past fifteen months. After a burnout like that, one might expect to find deals galore, and value investors are shopping the sector in earnest. Even after large declines, betting on these companies beating the expectations baked into their stocks’ prices isn’t for the sober minded. We warn investors against entering these value traps (look forward to more on this topic) until the industry experiences a wave of consolidation and the smoke has cleared.

TLRY Remains Risky Given the Company’s:

- Unattractive Credit Rating

- negative $3.8 billion in FCF in fiscal 2021

- stock could be worth as little as $1.50/share

Figure 1: Performance: From IPO Opening Through 7/18/2022

Sources: New Constructs, LLC

Why We’re Keeping Tilray in the Danger Zone

Our original report noted Tilray’s GAAP earnings masked growing losses, its revenue growth failed to create real profits, and its valuation was expensive. We warned that the company needed to contain its expense growth to become profitable. However, Tilray’s fiscal 3Q22 net operating profit after tax (NOPAT) margin of -27%, which is much worse than its fiscal 2021 margin of -9%, reveals the company’s operating expenses are headed the wrong way.

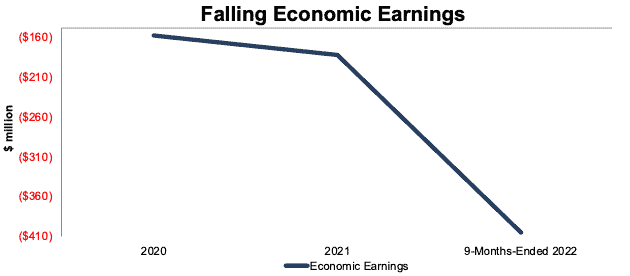

So far, our thesis has been right on the mark. After the reverse takeover deal with Aphria, Tilray’s profitless growth has accelerated. While Tilray’s revenue grew 27% year-over-year (YoY) in fiscal 2021, its economic earnings fell from -$159 million in fiscal 2020 to -$404 million through the fiscal nine-months-ended 2022, per Figure 2.

Furthermore, Tilray’s -$496 million (33% of market cap) in free cash flow (FCF) in fiscal 2021 contributes to the company’s Unattractive Credit Rating.

Figure 2: Tilray’s Economic Earnings: Fiscal 2020 through 9-Months-Ended 2022

Sources: New Constructs, LLC and company filings

Reverse DCF Math: Tilray’s Shares Have 50%+ More Downside

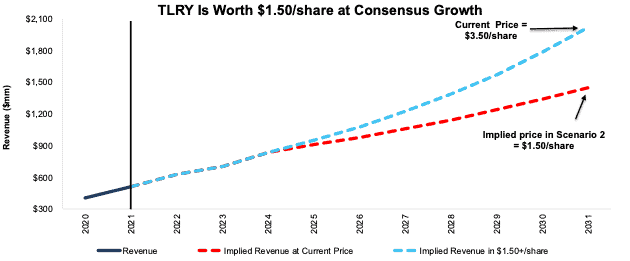

Below we use our reverse discounted cash flow (DCF) model to analyze the future cash flow expectations baked into Tilray’s stock price. We also provide an additional scenario to highlight the downside potential in shares if Tilray’s revenue grows at more reasonable rates.

If we assume Tilray’s:

- NOPAT margin immediately improves to 10% (more than double the 4% margin of farming companies under coverage[2], compared to Tilray’s -9% margin in fiscal 2021) and

- revenue grows at the 2022 – 2024 consensus CAGR of 18% through fiscal 2024, and

- revenue grows 13% compounded annually from fiscal 2025 – 2031, then

the stock would be worth $3.50/share today – nearly equal to the current stock price.

In this scenario, Tilray would generate $2.0 billion in revenue in fiscal 2031, which is 4x its fiscal 2021 revenue and 5x its fiscal 2020 revenue. We think it is overly optimistic to assume Tilray will grow revenue by 15% compounded annually over the next decade while achieving NOPAT margins more than twice the traditional farming industry. In a more realistic scenario, detailed below, the stock has large downside risk.

TLRY Has 57%+ Downside if Consensus Is Right

We perform a second DCF scenario to highlight the downside risk in owning Tilray should it grow at consensus revenue estimates. If we assume Tilray’s

- NOPAT margin improves to -5% in fiscal 2022, 0% in fiscal 2023, 5% in fiscal 2024, and 10% from fiscal 2025 – 2031,

- revenue grows at consensus rates in fiscal 2022, 2023, and 2024, and

- revenue grows 7% a year in fiscal 2025-2031, then

the stock would be worth just $1.50/share today – a 57% downside to the current price. This scenario still implies Tilray’s revenue grows to $1.4 billion in fiscal 2031.

If Tilray fails to achieve the revenue growth or margin improvement we assume for this scenario, the downside risk in the stock would be even higher.

Figure 3 compares Tilray’s historical revenue to the revenue implied by each of the above DCF scenarios.

Figure 3: Tilray’s Historical and Implied Revenue: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings.

Dates represent Tilray’s fiscal year, which runs through May of each year

Each of the above scenarios also assumes Tilray grows revenue, NOPAT, and FCF without increasing working capital or fixed assets. This assumption is highly unlikely but allows us to create best-case scenarios that demonstrate the expectations embedded in the current valuation. For reference, Tilray’s invested capital increased from $1.4 billion in fiscal 2020 to $5.2 billion in fiscal 2021. If Tilray’s invested capital increases further from fiscal 2021 levels, the downside risk is even larger.

This article originally published on July 20, 2022.

Disclosure: David Trainer, Kyle Guske II, Matt Shuler, and Brian Pellegrini receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.

[2] Farming companies include Alico (ALCO), Cal-Maine Foods (CALM), Corteva (CTVA), Fresh Del Monte Produce (FDP), Limoneira Company (LMNR), Phibro Animal Health Corp (PAHC), SiteOne Landscape Supply (SITE), and The Andersons (ANDE).