We published an update on JPM on March 29, 2023. A copy of the associated update report is here.

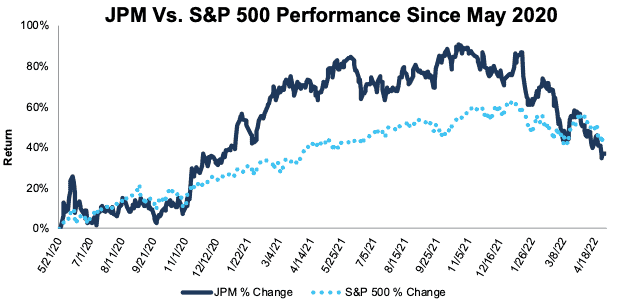

We first made JPMorgan Chase & Company (JPM: $120/share) a Long Idea in May 2020 as part of our “See Through the Dip” thesis. Since then, the stock is up 37% compared to a 42% gain for the S&P 500. Despite slightly underperforming the market, we think the stock is worth $164+/share today and has 33%+ upside. Our last report (April 2021) on JPMorgan is here.

This report leverages our cutting-edge Robo-Analyst technology to deliver proven-superior[1] fundamental research and support more cost-effective fulfillment of the fiduciary duty of care.

JPMorgan’s Stock Has Strong Upside Based on:

- guidance for net interest income growth in 2022

- diversified, global business reduces risk

- strong free cash flow (FCF) generation

- the current price has 33% upside if profits return to 2020 levels

Figure 1: Long Idea Performance: From Date of Publication Through 5/2/2022

Sources: New Constructs, LLC

What’s Working

Steady growth: JPMorgan’s total assets grew 7% YoY in 1Q22 to $4.0 trillion and average deposits rose from $2.2 trillion to $2.5 trillion over the same time. Average loans rose 5% year-over-year (YoY) in 1Q22.

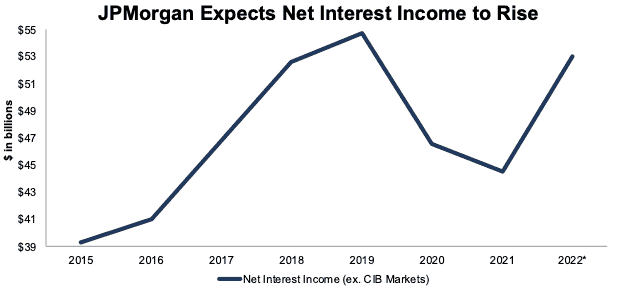

Rising Interest Rates: Economic growth and improved credit conditions in 4Q21 drove net interest income in the banking industry higher. This trend carried forward to JPMorgan’s 1Q22 earnings, when the company reported net interest income[2] rose 9% year-over-year (YoY). Per Figure 2, JPMorgan is guiding for its net interest income to grow 19% year-over-year (YoY), from $44.5 billion in 2021 to $53.0 billion in 2022. Such guidance implies net interest income reaches the bank’s second-highest level in eight years. See Figure 2.

Figure 2: JPMorgan’s Net Interest Income: 2015 – 2022*

Sources: New Constructs, LLC and company filings

*Company guidance for 2022

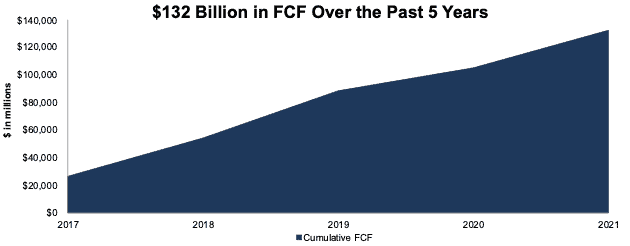

Focus on Free Cash Flow: With headlines casting doubt around the global economic outlook over the next twelve months, JPMorgan’s cash-generating business equips it to meet oncoming challenges. Per Figure 3, JPMorgan’s generated $132 billion (37% of market cap) in cumulative FCF over the past five years.

For several years prior to 2022, the market focused almost exclusively on top-line growth. Now, with the easy-money days in the past, the market is punishing cash-burning companies harshly and will continue to do so as long as interest rates are no longer falling. JPMorgan’s steady cash-generating operation provides stability and safety in a market rationalizing prices to value.

Figure 3: Cumulative Free Cash Flow: 2017 – 2021

Sources: New Constructs, LLC and company filings

What’s Not Working

Investment Banking Woes: After seeing large gains in 2021, revenue from JPMorgan’s investment banking segment fell 28% YoY in 1Q22 and drove noninterest revenue 12% below 1Q21 levels. However, JPMorgan’s well-diversified business reduces the bank’s companywide risk. Though investment banking fees fell in 1Q22, average loans, average deposits, and net interest income rose over the same time.

Short-term Risks Keep Shares Lower: In the near term, JPMorgan’s operations carry downside risk should the yield curve continue to flatten, or the economy slow down further. Additionally, rising interest rates could reduce loan demand even if corporate and consumer balance sheets are in excellent shape.

However, over the long term, JPMorgan’s market-leading position, strong balance sheet, and critical role in the economy means the bank will prosper long term. While we recognize uncertainty surrounding the current economy adds short-term downside risk to owning JPM, we believe investors should focus on the bank’s long-term position and history of cash flow generation. We view any additional downward movement in the stock price as an opportunity for investors to accumulate more shares given JPMorgan’s long-term competitive strengths.

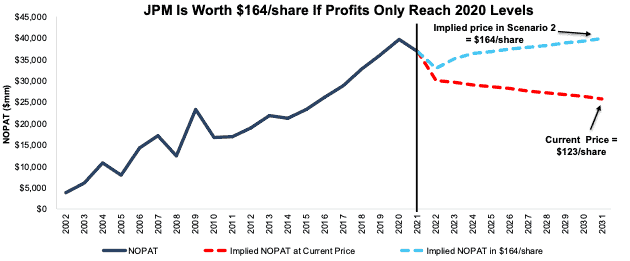

Stock Is Priced for Profits to Only Return to 2020 Levels

Economic uncertainty has driven JPMorgan’s stock price too low. Despite being the largest bank in the U.S. and growing profits for decades, JPMorgan’s price-to-economic book value (PEBV) ratio is just 0.7, which means the market expects its profits to permanently fall 30% from 2021 levels. Below, we use our reverse discounted cash flow (DCF) model to analyze the expectations for future growth in cash flows baked into a couple of stock price scenarios for JPMorgan.

In the first scenario, we quantify the expectations baked into the current price.

- NOPAT margin falls to 24% (ten-year average vs. 29% in 2021) from 2022 – 2031, and

- revenue falls 2% compounded annually from 2022 to 2031.

In this scenario, JPMorgan’s NOPAT falls 4% compounded annually to $25.8 billion in 2031, and the stock is worth $123/share today – equal to the current price. At $25.8 billion, JPMorgan’s 2031 NOPAT in this scenario is 1% below 2016 levels and 9% below its average NOPAT over the past decade.

Shares Could Reach $164+

If we assume JPMorgan’s:

- NOPAT margin falls to pre-pandemic 2019 levels of 25% from 2022 – 2031,

- revenue grows at a 4% CAGR from 2022 – 2024, and

- revenue grows by just 1% compounded annually from 2025 – 2031, then

the stock is worth $164/share today – 33% above the current price. In this scenario, JPMorgan’s NOPAT grows by just 1% compounded annually and NOPAT in 2031 equals 2020 levels. For reference, JPMorgan has grown NOPAT by 8% compounded annually over the past decade and 10% compounded annually since 1998 (earliest available data). Should JPMorgan grow NOPAT more in line with historical levels, the stock has even more upside.

Figure 4: JPMorgan’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

This article originally published on May 4, 2022.

Disclosure: David Trainer owns JPM. David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.

[2] This analysis uses JPMorgan’s management-derived net interest income metric that excludes CIB Markets, which consists of fixed income markets and equity markets.

2 replies to "Favorable Risk/Reward Clouded by Short-term Uncertainty"

Thanks I agree

Thanks I disagree, Chase is a big promoter of fossil fuel industry, among other things.