Six new stocks make our Dividend Growth Stocks Model Portfolio this month, which was made available to members on October 28, 2021.

Recap From September’s Picks

On a price return basis, our Dividend Growth Stocks Model Portfolio (+0.7%) underperformed the S&P 500 (+5.0%) by 4.3% from September 29, 2021 through October 26, 2021. On a total return basis, the Model Portfolio (+0.8%) underperformed the S&P 500 (+5.0%) by 4.2% over the same time. The best performing stock was up 8%. Overall, 6 out of the 30 Dividend Growth Stocks outperformed the S&P 500 from September 29, 2021 through October 26, 2021.

More reliable & proprietary fundamental data, proven in The Journal of Financial Economics, drives our research and provides investors with a new source of alpha. Our proprietary Robo-Analyst technology[1] scales our forensic accounting expertise (featured in Barron’s) across thousands of stocks[2] to produce an unrivaled database of fundamental data.

The methodology for this model portfolio mimics an All Cap Blend style with a focus on dividend growth. Selected stocks earn an Attractive or Very Attractive rating, generate positive free cash flow (FCF) and economic earnings, offer a current dividend yield >1%, and have a 5+ year track record of consecutive dividend growth. This model portfolio is designed for investors who are more focused on long-term capital appreciation than current income, but still appreciate the power of dividends, especially growing dividends.

Featured Stock From October: Intel Corporation (INTC: $50/share)

Intel Corporation (INTC) is the featured stock from October’s Dividend Growth Stocks Model Portfolio. We made Intel a Long Idea in August 2020 and reiterated the idea in April 2021.

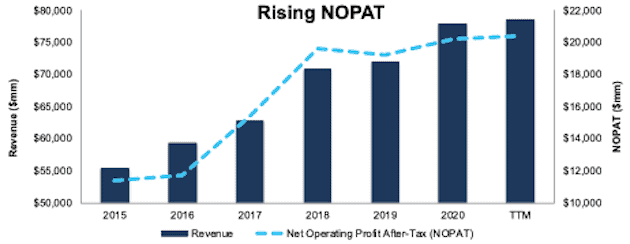

Intel has grown revenue by 7% compounded annually and net operating profit after-tax (NOPAT) by 12% compounded annually over the past five years. The firm’s NOPAT margin rose from 21% in 2015 to 26% over the trailing-twelve-months (TTM). Return on invested capital (ROIC) rose from 17% to 18% over the same time.

Figure 1: Intel’s NOPAT & Revenue Since 2015

Sources: New Constructs, LLC and company filings

Steady Dividend Growth Supported by FCF

Intel increased its regular dividend from $0.96/share in 2016 to $1.32/share in 2020, or 6% compounded annually. The current quarterly dividend, when annualized, equals $1.39/share and provides a 2.8% dividend yield.

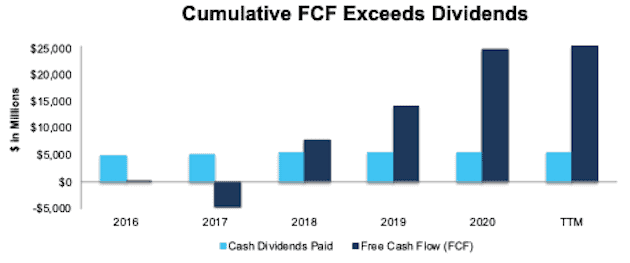

More importantly, Intel’s strong free cash flow (FCF) supports the firm’s growing dividend payments. Intel generated a cumulative $67.5 billion (33% of current market cap) in FCF while paying $32.3 billion in dividends from 2016 to 2020, per Figure 2. Over the TTM, Intel generated $25.8 billion in FCF and paid $5.6 billion in dividends.

Figure 2: Free Cash Flow vs. Regular Dividend Payments

Sources: New Constructs, LLC and company filings

Companies with FCF well in excess of dividend payments provide higher quality dividend growth opportunities because we know the firm generates the cash to support a higher dividend. On the other hand, the dividend of a company where FCF falls short of the dividend payment over time cannot be trusted to grow or even maintain its dividend because of inadequate free cash flow.

INTC Has Upside Potential

At its current price of $50/share, INTC has a price-to-economic book value (PEBV) ratio of 0.6. This ratio means the market expects Intel’s NOPAT to permanently decline by 40%. This expectation seems overly pessimistic for a firm that has grown NOPAT by 6% compounded annually over the past decade.

Even if Intel’s NOPAT margin falls to 20% (equal to five-year low, compared to 26% TTM) and the firm’s NOPAT falls by 2% compounded annually for the next decade, the stock is worth $73/share today – a 46% upside. See the math behind the reverse DCF scenario.

Should the firm grow NOPAT more in line with historical growth rates, the stock has even more upside. Add in Intel’s 2.8% dividend yield and history of dividend growth, and it’s clear why this stock is in October’s Dividend Growth Stocks Model Portfolio.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

Fact: we provide superior fundamental data and earnings models – unrivaled in the world.

Proof: Core Earnings: New Data and Evidence, published in The Journal of Financial Economics.

Below are specifics on the adjustments we make based on Robo-Analyst findings in Intel’s 10-Qs and 10-K:

Income Statement: we made $4.6 billion in adjustments with a net effect of removing $665 million in non-operating income (1% of revenue). See all adjustments made to Intel’s income statement here.

Balance Sheet: we made $57.3 billion of adjustments to calculate invested capital with a net decrease of $16 billion. The most notable adjustment was $9.1 billion (7% of reported net assets) in asset write-downs. See all adjustments to Intel’s balance sheet here.

Valuation: we made $93.6 billion in adjustments with a net effect of decreasing shareholder value by $708 million. Other than total debt, the most notable adjustment to shareholder value was $40.1 billion in excess cash. This adjustment represents 20% of Intel’s market value. See all adjustments to Intel’s valuation here.

This article originally published on November 4, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features our research automation technology in the case Disrupting Fundamental Analysis with Robo-Analysts.

[2] See how our models and financial ratios are superior to Bloomberg and Capital IQ’s (SPGI) analytics in the detailed appendix of this paper.