Twelve new stocks made our Most Attractive list this month, while three new stocks joined the Most Dangerous list. We published May’s Most Attractive and Most Dangerous stocks to members on May 3, 2023.

April Performance Recap

Our Most Attractive Stocks (-1.7%) underperformed the S&P 500 (+1.9%) last month by 3.6%. The best performing large cap stock gained 14% and the best performing small cap stock was up 13%. Overall, 11 out of the 40 Most Attractive stocks outperformed the S&P 500.

Our Most Dangerous Stocks (+2.9%) underperformed the S&P 500 (+1.9%) as a short portfolio last month by 1.0%. The best performing large cap short stock fell by 4% and the best performing small cap short stock fell by 16%. Overall, 18 out of the 38 Most Dangerous stocks outperformed the S&P 500 as shorts.

The Most Attractive/Most Dangerous Model Portfolios underperformed as an equal-weighted long/short portfolio by 4.6%.

This report leverages our cutting-edge Robo-Analyst technology to deliver proven-superior[1] fundamental research and support more cost-effective fulfillment of the fiduciary duty of care.

All of our Most Attractive stocks have high (and rising) return on invested capital (ROIC) and low price to economic book value ratio. Most Dangerous stocks have misleading earnings and long growth appreciation periods implied by their market valuations.

Most Attractive Stocks Feature for May: Builders FirstSource Inc. (BLDR: $117/share)

Builders FirstSource is the featured stock from May’s Most Attractive Stocks Model Portfolio.

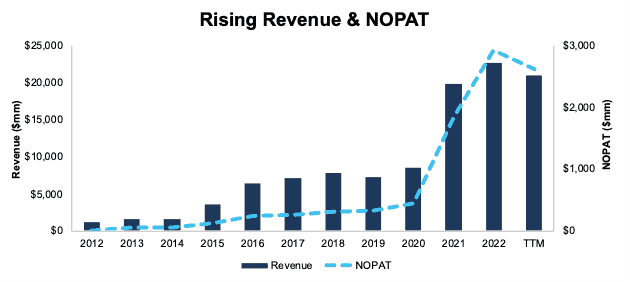

Builders FirstSource has grown revenue by 34% compounded annually and net operating profit after tax (NOPAT) by 53% compounded annually since 2013. Builders FirstSource’s NOPAT margin increased from 3% in 2013 to 13% in the trailing twelve months (TTM), even as invested capital turns decreased from 2.9 to 2.2 over the same time. Rising NOPAT margins drive Builders FirstSource’s return on invested capital (ROIC) from 10% in 2013 to 28% in the TTM.

Figure 1: Builders FirstSource Revenue and NOPAT Since 2012

Sources: New Constructs, LLC and company filings

Builders FirstSource Is Undervalued

At its current price of $117/share, BLDR has a price-to-economic book value (PEBV) ratio of 0.7. This ratio means the market expects Builders FirstSource’s NOPAT to permanently decline by 30%. This expectation seems overly pessimistic for a company that has grown NOPAT by 60% compounded annually since 2017 and 53% compounded annually since 2013.

Even if Builders FirstSource’s NOPAT margin falls to 9% (equal to three-year average vs 13% in the TTM) and the company grows revenue by just 3% compounded annually for the next decade, the stock would be worth $149/share today – a 27% upside. In this scenario, Builders FirstSource’s NOPAT would decline <1% compounded annually through 2032. Should Builders FirstSource grow profits more in line with historical levels, the stock has even more upside.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

Below are specifics on the adjustments we made based on Robo-Analyst findings in Builders FirstSource Industries’ 10-Qs and 10-Ks:

Income Statement: we made $283 million in adjustments, with a net effect of removing $169 million in non-operating expenses (<1% of revenue). Clients can see all adjustments made to Builders FirstSource’s income statement on the GAAP Reconciliation tab on the Ratings page on our website.

Balance Sheet: we made $795 million in adjustments to calculate invested capital with a net increase of $795 million. One of the most notable adjustments was $341 million in adjustments for midyear acquisitions. This adjustment represents 4% of reported net assets. Clients can see all adjustments made to Builders FirstSource’s balance sheet on the GAAP Reconciliation tab on the Ratings page on our website.

Valuation: we made $3.7 billion in adjustments, all of which decreased shareholder value. Apart from total debt, the most notable adjustment was $248 million in net deferred tax liabilities. This adjustment represents 2% of Builders FirstSource’s market value. Clients can see all adjustments to Builders FirstSource’s valuation on the GAAP Reconciliation tab on the Ratings page on our website.

Most Dangerous Stocks Feature: Avient Corp (AVNT: $39/share)

Avient Corp (AVNT) is the featured stock from May’s Most Dangerous Stocks Model Portfolio.

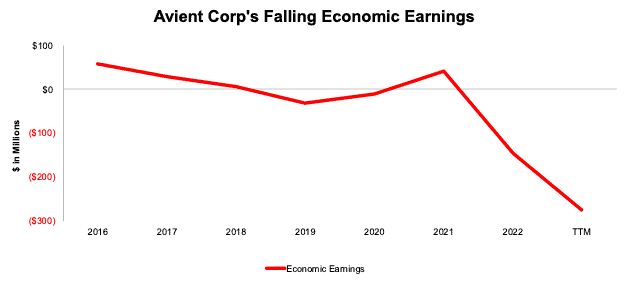

Avient’s revenue fell 2% compounded annually from 2017 to the TTM. Over the same time, Avient’s NOPAT margin fell from 7% to 5%, while invested capital turns fell from 1.2 to 0.6. Falling NOPAT margins and invested capital turns drive Avient’s ROIC from 9% in 2017 to 3% over the TTM. Avient’s economic earnings, the true cash flows of the business, have fallen from $58 million 2017 to -$274 million in the TTM. See Figure 2.

Figure 2: Avient Economic Earnings Since 2016

Sources: New Constructs, LLC and company filings

Avient Provides Poor Risk/Reward

Despite its poor fundamentals, Avient’s stock is priced for significant profit growth, and we believe the stock is overvalued.

To justify its current price of $39/share, Avient must improve its NOPAT margin to 7% (vs. 5% over the TTM) and grow revenue by 9% compounded annually for the next decade (compared to consensus estimates of -11% growth in 2023 and 6% in 2024). In this scenario, Avient’s NOPAT in 2032 would equal $563 million, or more than 4x higher than the company’s TTM NOPAT and 2x higher than the company’s best-ever NOPAT achieved in 2021. We think these expectations are overly optimistic.

Even if Avient improves its NOPAT margin to 7% and grows revenue and NOPAT by 3% compounded annually for the next decade, the stock would be worth no more than $13/share today – a 67% downside to the current stock price.

Each of these scenarios also assumes Avient can grow revenue, NOPAT, and FCF without increasing working capital or fixed assets. This assumption is unlikely but allows us to create best case scenarios that demonstrate the high expectations embedded in the current valuation.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

Below are specifics on the adjustments we made based on Robo-Analyst findings in Avient’s 10-Qs and 10-Ks:

Income Statement: we made $924 million in adjustments, with a net effect of removing $483 million in non-operating income (16% of revenue). Clients can see all adjustments made to Avient’s income statement on the GAAP Reconciliation tab on the Ratings page on our website.

Balance Sheet: we made $2.3 billion in adjustments to calculate invested capital with a net decrease of $620 million. One of the most notable adjustments was $936 million in midyear acquisitions. This adjustment represented 18% of reported net assets. Clients can see all adjustments made to Avient’s balance sheet on the GAAP Reconciliation tab on the Ratings page on our website.

Valuation: we made $3.0 billion in adjustments, with a net decrease to shareholder value of $2.1 billion. Apart from total debt, the most notable adjustment to shareholder value was $259 million in net deferred tax liabilities. This adjustment represents 1% of Avient’s market value. Clients can see all adjustments to Avient’s valuation on the GAAP Reconciliation tab on the Ratings page on our website.

This article was originally published on May 12, 2023.

Disclosure: David Trainer, Kyle Guske II, and Italo Mendonça receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our Society of Intelligent Investors and connect with us directly.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.