Our Long Ideas leverage our proprietary Robo-Analyst technology[1] to shine lights in the dark corners of financial filings and identify quality companies at undervalued prices. These companies generally have profitable operations, defendable moats and competitive advantages, and an undervalued stock price. Occasionally, we find clusters of these companies in a certain industry or sector.

This week we found a cluster of good stocks in the steel industry, and we’re featuring a Very Attractive ETF in an Unattractive-rated sector. Van Eck Steel ETF (SLX) is this week’s Long Idea.

A Very Attractive ETF With Quality Holdings

Our forward-looking ETF and mutual fund research helps investors do diligence usually possible only on individual stocks. Through this work, we can find hidden pockets of undervalued stocks that others may overlook.

We’ve been bullish on specific Basic Materials stocks for quite some time and have featured many as Long Ideas. More details available to our Professional and Institutional clients

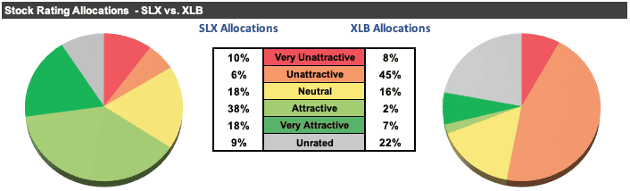

Van Eck Steel ETF provides exposure to this highly profitable industry without buying individual stocks or allocating to the entire sector, which is not as highly-rated. Our analysis of each of the holdings of SLX and the State Street Materials Select Sector SPDR Fund (XLB) reveals SLX allocates more capital to profitable companies with cheaper valuations than XLB. SLX earns our Very Attractive Predictive Fund Rating, while XLB earns an Unattractive rating.

Per Figure 1, SLX allocates 56% of its assets to stocks rated Attractive-or-better compared to just 9% for XLB. On the flip side, SLX allocates 16% of its assets to stocks rated Unattractive-or-worse compared to 53% for XLB.

Figure 1: SLX’s Holdings Are Superior to the Basic Materials Sector

Sources: New Constructs, LLC and company filings

Holdings Better Than The Overall Market

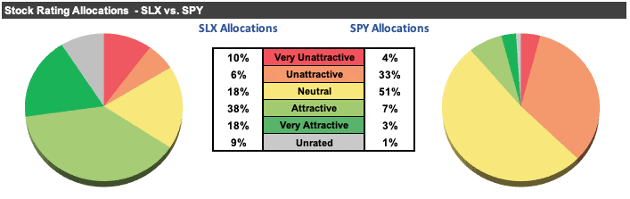

Our analysis of each of the holdings of SLX and the S&P 500, as measured by State Street SPDR S&P 500 ETF Trust (SPY), reveals SLX also allocates more to profitable companies with cheap valuations than SPY as well.

Per Figure 2, SLX allocates 56% of its assets to stocks rated Attractive-or-better compared to just 10% for SPY. On the flip side, SLX allocates only 16% of its assets to stocks rated Unattractive-or-worse compared to 37% for SPY.

Figure 2: SLX’s Holdings Are Superior to the Market

Sources: New Constructs, LLC and company filings

SLX Industry Focus Taps into Macro Tailwinds

Generally, when we feature ETFs or mutual funds, we analyze a fund’s stock selection criteria. However, since SLX is a passive ETF, the focus is more on the industry. In this case, we believe the Steel (and its related inputs) industry is highly undervalued, as we’ve outlined in our Rebuild and Renew Thesis. Once politics are taken out of the picture, the green energy narrative, which has caused investors to shun many Materials and Energy stocks, misses crucial developments:

- Steel plays a crucial role in the development of renewable energy infrastructure and is the most recycled material in the world. The United Nations suggests that global renewable energy capacity needs to be doubled by 2030, which, in turn, will drive long-term demand for steel. The energy transition in the U.S. alone is expected to add 2-3 Mtpa (million tons per annum) in steel demand.

- The Inflation Reduction Act (IRA) has introduced $370 billion in clean energy tax incentives, another potent driver of steel demand. The Biden administration’s target of achieving 30 gigawatts of U.S. offshore wind capacity by 2030 requires extensive infrastructure, which contributes an expected 2-3 Mtpa of additional steel demand.

- The Infrastructure Investment and Jobs Act (IIJA) allocates $550 billion in new funding towards transportation and core infrastructure projects. This legislation is estimated to generate incremental annual steel demand of 3-5 Mtpa.

- The Creating Helpful Incentives for the Production of Semiconductors (CHIPS) Act, aimed at reshoring U.S. manufacturing, brings an additional source of demand. With its allocation of $55 billion, the act is projected to fund over 30 advanced manufacturing projects over the next decade and create an estimated 0.5 Mtpa in steel demand.

These policies and growth expectations, combined with investors chasing more flashy trends (AI and the tech sector for instance), present a Metals and Mining industry with many highly profitable yet highly undervalued, i.e. Very Attractive and Attractive, stocks.

When we analyze SLX’s holdings, we find that it holds those kinds of stocks.

SLX Provides Better Risk/Reward Than Basic Materials and the Market

Since SLX tracks the NYSE Arca Steel Index, its holdings are mostly mid- and large-cap and highly profitable companies. Of the 21 SLX holdings we cover:

- 100% have a positive ROIC,

- 86% have a positive FCF yield,

- 67% have a market-implied GAP of 10 years or less, and

- 67% have a positive PEBV ratio of 1.5 or less.

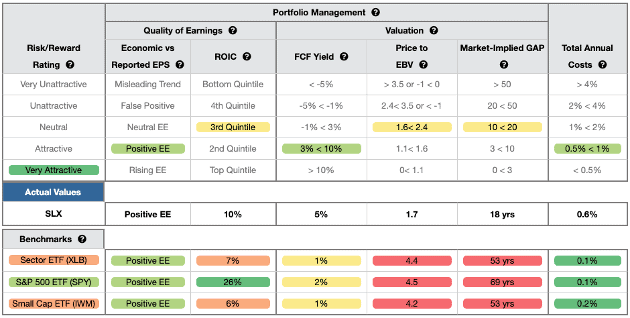

Figure 3 shows our detailed rating for SLX, which includes the criteria used to rate all ETFs under coverage. These criteria are the same for our Stock Rating Methodology, as the performance of an ETF equals the performance of its holdings minus fees. Figure 3 also compares SLX’s ratings with those of XLB and SPY.

Figure 3: VanEck Steel ETF Breakdown

Sources: New Constructs, LLC and company filings

SLX holdings are equal or superior to XLB in four of the five criteria that make up our Portfolio Management rating and three of the five vs. SPY. Specifically:

- SLX’s holdings have a Positive Economic Earnings vs. EPS rating, same as XLB and SPY,

- SLX’s ROIC of 10% is higher than XLB’s at 7%,

- SLX’s FCF yield of 5% is higher than XLB at 1% and SPY at 2%,

- the PEBV ratio for SLX is 1.7, which is much lower than XLB’s at 4.4 and SPY’s at 4.5, and

- our discounted cash flow analysis reveals an average market-implied GAP of just 18 years for SLX’s holdings compared to 53 years for XLB and 69 years for SPY.

The stocks held by SLX generate high-quality cash flows and have lower valuations than XLB and SPY. Market expectations for stocks held by SLX imply profits will grow 70% from current levels (measured by PEBV ratio) while the expectations for XLB’s and SPY’s holdings imply profits will grow 400%+.

SLX Represents the Best in the Sector Too

As we’ve noted, SLX’s holdings are not only superior to the companies in the S&P 500, but also those in the Basic Materials sector.

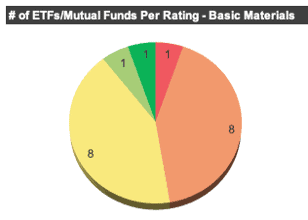

Of the 19 ETFs and mutual funds we cover in the Basic Materials sector, 17, or 89%, earn a Neutral-or-worse Risk/Reward rating. Only two ETFs get an Attractive or Very Attractive Rating. Without doing our diligence and analyzing all stocks and ETFs in the sector, we’d never know there were good stocks or ETFs in this sector. See Figure 4.

Figure 4: Basic Materials ETF & Mutual Fund Rating Distribution

Sources: New Constructs, LLC and company filings

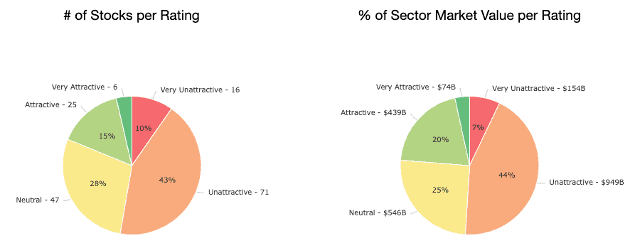

At the individual stock level, SLX’s steel focus avoids many of the bad stocks within the Basic Materials sector. Per Figure 5, 81% of the 165 stocks in the Basic Materials sector earn a Neutral-or-worse rating. These stocks make up 76% of the market cap in the entire Basic Materials Sector. 53% of stocks earn an Unattractive-or-worse rating and make up 51% of the market cap in the sector.

However, just 16% of SLX’s assets are in stocks with Unattractive-or-worse ratings and 56% of its assets are in stocks with Attractive-or-better ratings.

Figure 5: Basic Materials Sector Stock Rating Distribution

Sources: New Constructs, LLC and company filings

Low Costs for Premium Holdings

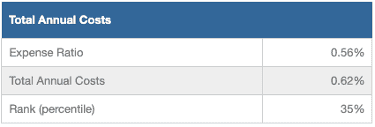

SLX’s 0.62% total annual costs (TAC) are lower than the 0.84% simple average and nearly equal to the 0.59% asset-weighted average of the 19 Basic Materials ETFs and mutual funds under coverage. SLX’s fees are lower than 83% of the 7,500 ETFs and mutual funds we cover. Figure 6 shows our breakdown of SLX’s total annual costs, which is available for all 7,500 mutual funds and ETFs under coverage.

Figure 6: SLX’s Total Annual Costs Breakdown

Sources: New Constructs, LLC and company filings

Forward-Looking Research Outperforms

We leverage our Robo-Analyst technology to analyze an ETF’s stock holdings and assess the overall quality of the ETF. Our uniquely rigorous approach enables us to create forward-looking ETF and mutual fund ratings based on the quality of the stocks held in a fund. This holdings-based fund research consistently identifies mutual funds and ETFs that outperform their benchmarks and warns investors of funds most likely to underperform.

On the flip side, most ETF and fund research is backward-looking. In other words, it is based on past price performance. Investors relying on backward-looking research don’t get the full picture of how a fund should perform moving forward.

Get an Edge from Holdings-Based ETF Analysis Based on Superior Stock Research

We offer clients in-depth reports for all ~7,500 ETFs and mutual funds under coverage. Click below for a free copy of our SLX standard ETF report.

Smart ETF (or mutual fund) investing means analyzing each of the holdings of an ETF. Failure to do so is a failure to perform proper due diligence. Simply buying an ETF or mutual fund based on past performance does not necessarily lead to outperformance. Only thorough holdings-based research can help determine if an ETF’s methodology leads managers to pick high-quality or low-quality stocks.

Most investors don’t realize they can access superior fundamental research that enables them to overcome inaccuracies, omissions, and biases in legacy fundamental research and data. Our Robo-Analyst technology analyzes the holdings of all 19 ETFs and mutual funds in the Basic Materials sector and ~7,500 ETFs and mutual funds under coverage to avoid “the danger within”.

Our diligence on holdings allows us to cut through the noise and find ETFs, like VanEck Steel ETF (SLX), with holdings that suggest future performance should be strong regardless of market volatility.

This article was originally published on April 10, 2024.

Disclosure: Hakan Salt owns SLX. David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our Society of Intelligent Investors and connect with us directly.

[1] Our Robo-Analyst technology provides superior fundamental data and a novel source of alpha, as proven in The Journal of Financial Economics.