Like our Danger Zone fund picks, our Long Idea fund picks have outperformed. 15 of our 29 Long Idea fund picks[1] beat their benchmarks since November 17, 2016, when we first picked a mutual fund as a Long Idea.

PERFORMANCE OF FUND = PERFORMANCE OF IT’S HOLDINGS – FEES

Our mutual fund and ETF ratings leverage our proven-superior fundamental research on fund holdings to help investors fulfill their fiduciary duty of care more efficiently when selecting funds.

89% of Mutual Fund & ETF Long Ideas Have Beaten Their Benchmark Since 2020

Finding a fund that outperforms its benchmark is no easy task. About 80% of all actively managed U.S. stock mutual funds underperformed in 2021.

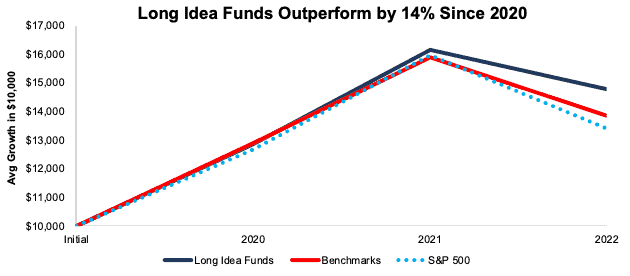

From 2016-2020 our success rate (15 of 29) for picking fund Long Ideas was better than the market, but clearly there was room for improvement. We continued refining our selection criteria and research process, and our performance improved. Since 2020, eight of the nine ETFs and mutual funds we made Long Ideas have outperformed their benchmark. Figure 1 shows the hypothetical growth of $10,000 invested in the funds we’ve featured as Long Ideas since 2020. These funds have outperformed their respective benchmarks[2] by 9% and the S&P 500 by 14%.

Figure 1: Long Idea Fund Performance Vs. Benchmarks & S&P 500 Since 2020

Sources: New Constructs, LLC and company filings.

57% of Mutual Fund & ETF Long Ideas Have Beaten Their Benchmark Since 2018

Conducting a stock-by-stock analysis of a fund’s holdings can help investors identify funds likely to outperform their benchmark. Since 2018, 13 of the 23 funds we’ve selected, or 57%, have outperformed their benchmark.

Anyone focused on fulfilling the fiduciary duty of care recognizes that analyzing the holdings[3] of an ETF or mutual fund is critical to identifying funds that offer attractive risk/reward. Our predictive mutual fund and ETF research is forward-looking because it is based on proven-superior stock ratings[4] on each individual fund holding. Backward-looking legacy fund research is primarily based on past price performance.

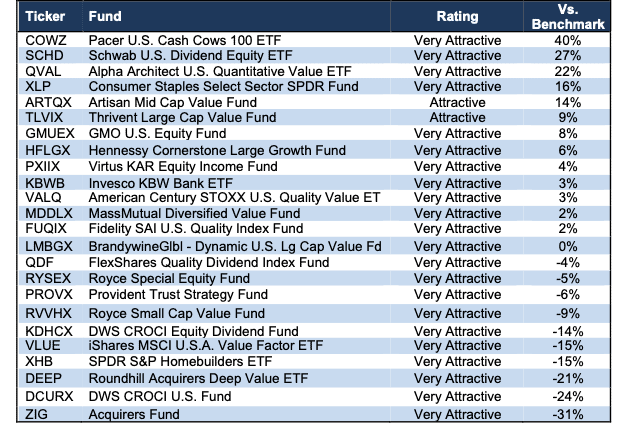

The five funds that have most outperformed their respective benchmarks since each report was published are Pacer U.S. Cash Cows 100 ETF (COWZ), Schwab U.S. Dividend Equity ETF (SCHD), Alpha Architect U.S. Quantitative Value ETF (QVAL), Consumer Staples Select Sector SPDR Fund (XLP), and Thrivent Large Cap Value Fund (TLVIX).

Figure 2: Five Best Performing Long Idea Funds Through 5/16/2022

| Ticker | Fund | Vs. Benchmark |

| COWZ | Pacer U.S. Cash Cows 100 ETF | 40% |

| SCHD | Schwab U.S. Dividend Equity ETF | 27% |

| QVAL | Alpha Architect U.S. Quantitative Value ETF | 22% |

| XLP | Consumer Staples Select Sector SPDR Fund | 16% |

| ARTQX | Artisan Mid Cap Value Fund | 14% |

Sources: New Constructs, LLC and company filings.

Figure 2 excludes Rydex Energy Services Fund (RYESX) as the mutual fund is no longer in our coverage universe.

Relying on Traditional Ratings Can Cost You

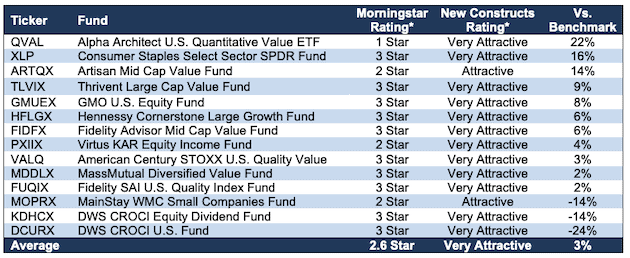

Our forward-looking ETF and mutual fund ratings are often very different from backward-looking legacy ratings, such as those from Morningstar (MORN). Nearly all of our Long Idea fund picks had Attractive-or-better (equivalent to 4 or 5 stars) ratings versus a Morningstar rating of 3 stars or worse.

Investing based on legacy ratings could cost you. For example, of the three-star-or-worse Morningstar rated funds we’ve made Long Ideas since 2016, 79% have outperformed their benchmark. Details in Figure 3.

Figure 3: Long Idea Funds That Got a 3-Star-or-Worse Morningstar Rating: Performance Through 5/16/22

Sources: New Constructs, LLC and company filings.

*as of the publication date of the Long Idea

Differences in Our Ratings Add Value

Alpha Architect U.S. Quantitative Value ETF (QVAL) illustrates how our forward-looking, holdings-based ratings are superior to backward-looking ratings. When we made QVAL a Long Idea on October 14, 2020, it received our Very Attractive (equivalent to 5 stars) fund rating, while Morningstar gave the fund a one Star rating. Since then, the fund is up 38% versus just 16% for its benchmark, iShares Russell Mid-Cap ETF (IWR). In the five years prior to our report, QVAL returned just 15% compared to 64% for IWR. Ratings based on past performance can cost you.

Five Funds with Big Difference in Ratings

Morningstar rates these funds 1- or 2-stars, while we rate them Attractive or Very Attractive.

- Alpha Architect U.S. Quantitative Value ETF (QVAL)

- Artisan Mid Cap Value Fund (ARTQX)

- DWS CROCI Equity Dividend Fund (KDHCX)

- iShares MSCI U.S.A. Value Factor ETF (VLUE)

- DWS CROCI U.S. Fund (DCURX)

These Funds Remain Attractive

Figure 4 shows the five funds we’ve made Long Ideas that still receive an Attractive-or-better rating. These funds still allocate to high-quality stocks and charge relatively low fees. 13 out of 24 of the Long Ideas that still earn an Attractive-or-better rating have outperformed their benchmark since our original report.

Figure 4: Open Long Idea Funds: Performance through 5/16/22

Sources: New Constructs, LLC and company filings.

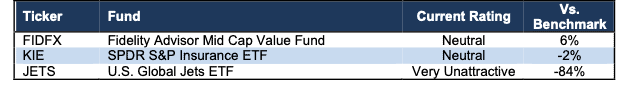

Closing These Long Ideas

Figure 5 shows the ETFs and mutual funds that no longer receive an Attractive-or-better rating (or are no longer in our coverage universe). The risk reward profile of these funds has changed since our original report, and we’re closing them as Long Ideas.

Figure 5: Closed Long Ideas: Performance through 5/16/22

Sources: New Constructs, LLC and company filings.

How to Avoid “The Danger Within”

Why do you need to know the holdings of an ETF or mutual funds before you buy?

You need to be sure you do not buy a fund that might blow up. Buying a fund without analyzing its holdings is like buying a stock without analyzing its business and finances. No matter how cheap, if it holds bad stocks, the mutual fund’s performance will be bad. Don’t just take my word for it, see what Barron’s says on this matter.

PERFORMANCE OF FUND’S HOLDINGS – FEES = PERFORMANCE OF FUND

Analyzing each holding within funds is no small task. Our Robo-Analyst technology enables us to perform this diligence with scale and provide the research needed to fulfill the fiduciary duty of care. More of the biggest names in the financial industry (see At BlackRock, Machines Are Rising Over Managers to Pick Stocks) are now embracing technology to leverage machines in the investment research process. Technology may be the only solution to the dual mandate for research: cut costs and fulfill the fiduciary duty of care. Investors, clients, advisors and analysts deserve the latest in technology to get the diligence required to make prudent investment decisions.

This article originally published on May 18, 2022.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] This analysis excludes AllianceBernstein FlexFee Large Cap Growth Portfolio (FFLYX) and American Beacon Alpha Quant Quality Fund (AQQPX). FFLYX merged with AB Large Cap Growth Fund, Inc (APGAX) and AQQPX liquidated.

[2] Excluding Figure 1, performance of each ETF/mutual fund, the S&P 500, and benchmark is based on growth in $10,000 as reported by Morningstar from the date each Long Idea was published through 5/16/22.

[3] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[4] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics."