Our Long Ideas leverage our proprietary Robo-Analyst technology[1] to shine lights in the dark corners of financial filings to identify quality companies at undervalued prices. These companies generally have profitable operations, defendable moats and competitive advantages, and an undervalued stock price. However, we recognize that not every investor wants to invest in individual stocks.

Some investors would rather allocate to a group of superior stocks in an ETF or mutual fund. Our forward-looking ETF and mutual fund research helps investors do that with the kind of diligence usually available only on individual stocks. This week, we’re featuring a Very Attractive ETF in a particularly attractive sector. State Street Energy Sector SPDR Fund (XLE) is this week’s Long Idea.

A Very Attractive ETF With Quality Holdings

We’ve been bullish on the Energy sector for quite some time. In our Sector Rankings report, which is updated quarterly, the Energy sector has been the top rated sector in each of the past five quarters. We’ve also featured numerous high-quality Energy sector companies as Long Ideas, including some stocks you may never have heard of. More details available to our Professional and Institutional clients.

ETFs provide a way to get exposure to this highly profitable, yet beaten down sector, without buying individual stocks. Our analysis of each of the holdings of XLE and the S&P 500, as measured by State Street SPDR S&P 500 ETF Trust (SPY), reveals XLE allocates more to profitable companies with cheap valuations than SPY. XLE earns our Very Attractive Predictive Fund Rating, while SPY earns an Attractive rating.

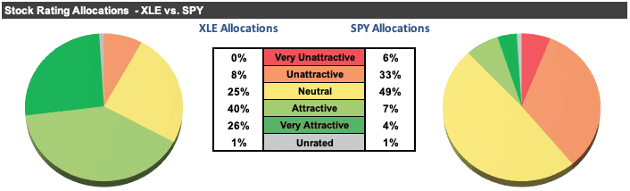

Per Figure 1, XLE allocates 66% of its assets to stocks rated Attractive-or-better compared to just 11% for SPY. On the flip side, XLE allocates only 8% of its assets to stocks rated Unattractive-or-worse compared to 39% for SPY.

Figure 1: XLE’s Holdings Are Superior to the Market

Sources: New Constructs, LLC and company filings

XLE Sector Focus Taps into Multiple Tailwinds

Generally, when we feature ETFs or mutual funds, we analyze a fund’s stock selection criteria. However, since XLE is a passive ETF, the focus is more on the sector. In this case, we believe the Energy sector is highly undervalued, as we’ve outlined in our Rebuild and Renew Thesis. Once partisanship and political bias are taken out of the picture, the clean energy transition, which has caused investors to shun many Energy stocks, misses three crucial facts:

- The demand for fossil fuels will persist (and grow) for decades to come because the clean energy transition, while laudable and inevitable, will take much longer than estimated, regardless of headlines and ribbon-cutting ceremonies.

- The clean energy transition, itself, remains one of the most bullish drivers of the fossil fuel industry. Re-designing and rebuilding the way we produce, utilize, and save energy will take unthinkable amounts of energy, as it is a full-on overhaul of the way we live our lives.

- The clean energy transition will require a vast amount of basic materials: steel for wind turbines and solar equipment, copper for rebuilding our outdated HVAC systems, uranium for clean nuclear energy. The energy required to mine, extract, manufacture, and ship these materials will come from – you guessed it – fossil fuels.

These three facts, combined with the lack of capital invested into the Energy sector in recent years, presents an Energy sector with many highly profitable yet highly undervalued, i.e. Very Attractive and Attractive, stocks.

When we analyze XLE’s holdings, we find that it holds those kinds of stocks.

XLE Provides Better Risk/Reward Than the Market

Since XLE tracks the Energy Select Sector Index, its holdings are mostly large-cap and highly profitable companies. Of the 23 XLE holdings we cover:

- 100% have a positive ROIC,

- 87% have a positive FCF yield,

- 70% have a market-implied GAP of 10 years or less, and

- 87% have a positive PEBV ratio of 1.3 or less.

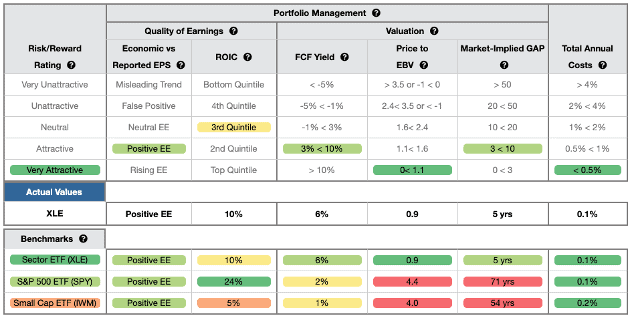

Figure 2 shows our detailed rating for XLE, which includes the criteria used to rate all ETFs under coverage. These criteria are the same for our Stock Rating Methodology, as the performance of an ETF equals the performance of its holdings minus fees. Figure 2 also compares XLE’s ratings with those SPY.

Figure 2: State Street Energy Select Sector SPDR Fund Breakdown

Sources: New Constructs, LLC and company filings

XLE’s holdings are equal or superior to SPY in four of the five criteria that make up our Portfolio Management rating. Specifically:

- XLE’s holdings have a Positive Economic Earnings vs. EPS rating, same as SPY,

- XLE’s FCF yield of 6% is higher than SPY at 2%,

- the PEBV ratio for XLE is 0.9, which is much lower than SPY’s at 4.4, and

- our discounted cash flow analysis reveals an average market-implied GAP of just 5 years for XLE’s holdings compared to 71 years for SPY.

The stocks held by XLE generate high-quality cash flows and have lower valuations than SPY. Market expectations for stocks held by XLE imply profits will permanently fall 10% from current levels (measured by PEBV ratio) while the expectations for SPY’s holdings imply profits will grow 400%+.

XLE Represents the Best in the Sector Too

XLE’s holdings are not only superior to the companies in the S&P 500, but also those in the Energy sector.

For starters, of the 107 ETFs and mutual funds we cover in the Energy sector, 31, or 29%, earn a Neutral-or-worse Risk/Reward rating.

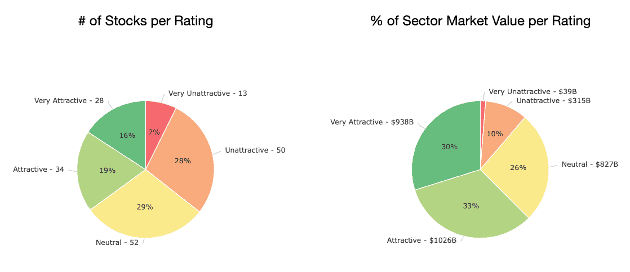

At the individual stock level, XLE’s index tracking avoids many of the bad stocks within the Energy sector. Per Figure 3, 64% of the 177 stocks in the Energy sector earn a Neutral-or-worse rating. These stocks make up 37% of the market cap in the entire Energy Sector. 35% of stocks earn an Unattractive-or-worse rating and make up 11% of the market cap in the sector.

As noted above, just 8% of XLE’s assets are in stocks with Unattractive-or-worse stocks.

Figure 3: Energy Sector Stock Rating Distribution

Sources: New Constructs, LLC and company filings

Low Costs, Too

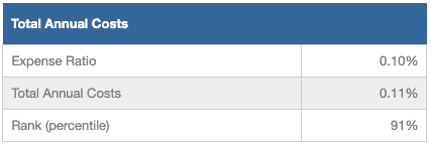

XLE’s 0.11% total annual costs (TAC) are lower than the 1.64% simple average, and 0.71% asset-weighted average of the 107 Energy ETFs and mutual funds under coverage. In fact, XLE’s fees are lower than 91% of the 7,500 ETFs and mutual funds we cover. Figure 4 shows our breakdown of XLE’s total annual costs, which is available for all 7,500 mutual funds and ETFs under coverage.

Figure 4: XLE Total Annual Costs Breakdown

Sources: New Constructs, LLC and company filings

Forward-Looking Research Outperforms

We leverage our Robo-Analyst technology to analyze an ETF’s stock holdings and assess the overall quality of the ETF. Our uniquely rigorous approach enables us to create forward-looking ETF and mutual fund ratings based on the quality of the stocks held in a fund. This holdings-based fund research consistently identifies mutual funds and ETFs that outperform their benchmarks and warns investors of funds most likely to underperform.

On the flip side, most ETF and fund research is backward-looking. In other words, it is based on past price performance. Investors relying on backward-looking research don’t get the full picture of how a fund should perform moving forward.

Get an Edge from Holdings-Based ETF Analysis Based on Superior Stock Research

We offer clients in-depth reports for all ~7,500 ETFs and mutual funds under coverage. Click below for a free copy of our XLE standard ETF report.

Smart ETF (or mutual fund) investing means analyzing each of the holdings of an ETF. Failure to do so is a failure to perform proper due diligence. Simply buying an ETF or mutual fund based on past performance does not necessarily lead to outperformance. Only thorough holdings-based research can help determine if an ETF’s methodology leads managers to pick high-quality or low-quality stocks.

Most investors don’t realize they can access superior fundamental research that enables them to overcome inaccuracies, omissions, and biases in legacy fundamental research and data. Our Robo-Analyst technology analyzes the holdings of all 107 ETFs and mutual funds in the Energy sector and ~7,500 ETFs and mutual funds under coverage to avoid “the danger within”.

Our diligence on holdings allows us to cut through the noise and find ETFs, like State Street Energy Select Sector SPDR Fund (XLE), with holdings that suggest future performance should be strong regardless of market volatility.

This article was originally published on February 14, 2024.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our Society of Intelligent Investors and connect with us directly.

[1] Our Robo-Analyst technology provides superior fundamental data and a novel source of alpha, as proven in The Journal of Financial Economics.