We published an update on the Beyond Meat Danger Zone pick on August 1, 2022. A copy of the associated report is here.

Our Focus List Stocks: Short Model Portfolio outperformed the S&P 500 as a short portfolio by 36% in 2021 with 29 out of our 31 picks outperforming the index. This is the second of three reports reviewing the biggest winners from this Model Portfolio last year and their potential returns for this year. We reviewed our worst performers from 2021 here.

Beyond Meat (BYND: $70/share) outperformed as a short in 2021 and we remain bearish on the stock. We also feature two other Focus List: Short stocks that outperformed in 2021, Koss Corp (KOSS) here and Peloton (PTON) here.

Focus List Stocks: Short Outperformed in 2021

The Focus List Stocks: Short Model Portfolio contains the best of our Danger Zone picks and leverages superior fundamental data, as proven in The Journal of Financial Economics[1], which provides a new source of alpha. This Model Portfolio is available in real-time to Pro and higher members, or you can purchase the current version of the Model Portfolio here.

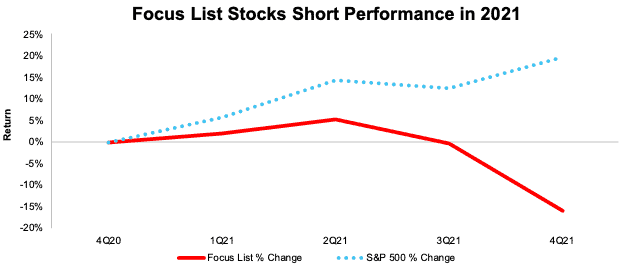

The Focus List Stocks: Short Model Portfolio fell, on average, -16% in 2021 compared to an average return of 20% for the S&P 500, per Figure 1[2].

Figure 1: Focus List Stocks: Short Model Portfolio Performance from Period Ending 4Q20 to 4Q21

Sources: New Constructs, LLC

Because our Focus List Stocks: Short Model Portfolio represents the best of the best picks, not all Danger Zone picks we publish make the Model Portfolio. We published 46 Danger Zone Reports in 2021 but added just 11 of those picks to the Focus List Stocks: Short Model Portfolio during the year. Currently, the Focus List Stocks: Short Model Portfolio holds 28 stocks.

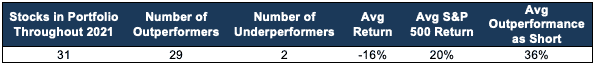

Figure 2 shows a more detailed breakdown of the Model Portfolio’s performance, which encompasses all the stocks that were in the Model Portfolio at any time in 2021.

Figure 2: Performance of Stocks in the Focus List Stocks: Short Model Portfolio in 2021

Sources: New Constructs, LLC

Performance includes the performance of stocks currently in the Focus List Stocks: Short Model Portfolio, as well as those removed during the year, which is why the number of stocks in Figure 2 (31) is higher than the number of stocks currently in the Model Portfolio (28).

Winner: Focus List Stocks: Short: Beyond Meat (BYND): Down 48% vs. S&P 500 Up 27% in 2021

We originally added Beyond Meat to the Focus List Stocks: Short Model Portfolio in September 2020 and it outperformed as a short by 75% in 2021. Even after the stock price decline, Beyond Meat remains overvalued and investors hoping for a turnaround are taking on unnecessary risk.

Main Reason for Short Outperformance: Slowing Growth and No Profits: Beyond Meat was supposed to not only take over the alternative meat market but transform the meat market as a whole. In early years, the company produced impressive top-line growth rates that enticed growth investors looking for the next high-flyer. Growth slowed significantly in 2021, with total revenue through the first three fiscal quarters growing just 19% YOY, compared to 53% YoY growth in the same pierid in 2020. U.S Retail revenue fell 4% YoY through the first three fiscal quarters of 2021 and the company guided for fiscal 4Q revenue (at the midpoint) 24% below consensus expectations.

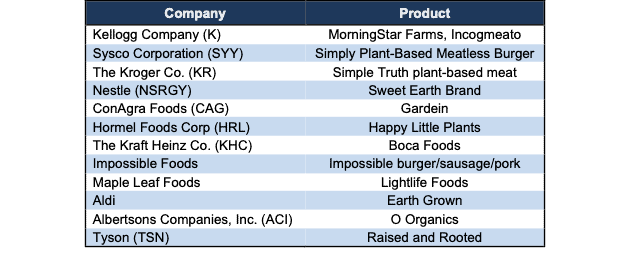

Why Beyond Meat Remains Beyond Overvalued: Competition Can Eat Its Lunch: We provide more details about the challenges Beyond Meat faces in our report here. The main obstacle to Beyond Meat justifying the expectations baked into its stock price continues to be the ample competition all striving to replace what is already a commoditized product (traditional meat).

Competition, from both incumbent meat processors and distribution partners, continues to undermine Beyond Meat’s growth and profitability. These competitors can leverage superior production scale, distribution scale, and more retail shelf space to sell their alternative meat products more and more effectively.

Figure 3: Full Plate of Competition For Beyond Meat

Sources: New Constructs, LLC and company filings.

The cost of developing new products, marketing those products to consumers, and fending off these competitors is getting more and more expensive for Beyond Meat:

- selling, general, and administrative costs rose from 25% of revenue in 2019 to 39% of revenue over TTM.

- Research and development costs rose from 7% of revenue in 2019 to 12% over the TTM.

- operating expenses, after falling to 34% of revenue in 2019, rose to 54% of revenue over the TTM.

While Beyond Meat is great at grabbing headlines with new partnerships and product launches, the firm is still guiding for revenue below expectations. Furthermore, management notes that uncertainty related to COVID-19, labor availability, and supply chain disruptions continue to weight on results.

Current Price Implies Beyond Meat Increases Market Share from 7% to 23%

We use our reverse discounted cash flow (DCF) model to quantify the expectations for future profit growth baked into the current stock price and see what the stock would be worth assuming more reasonable growth.

To justify its current price of $70/share, Beyond Meat must:

- immediately improve NOPAT margin to 6% (which equals Tyson’s [TSN] 5-year average margin, double Beyond Meat’s best ever margin, and above Beyond Meat’s -22% TTM margin) and

- grow revenue at a 36% CAGR through 2027 (over 2x projected industry growth).

In this scenario, Beyond Meat would generate nearly $3.5 billion in revenue in 2027, which is eight times its TTM revenue and 23% of the global plant-based meat market[3] in 2027. Based on its 2020 revenue, we estimate Beyond Meat’s market share was 7% of the global plant-based meat market in 2020.

For reference, in the more mature $1.3 trillion global meat market, JBS S.A., the largest meat processor in the world, has only 4% market share. Beyond Meat’s 7% share of the plant-based meat market is high now, due to its first mover advantage, but as more competition enters the market, we expect its market share to fall, not rise.

We think it’s beyond optimistic (pun intended) to assume Beyond Meat’s share of the global plant-based meat market will ever be as high as implied by the stock price, especially considering its competition. Additionally, it seems unlikely Beyond Meat will raise margins to match one of the largest meat processers in the world while also growing at more than 2x projected industry growth. Companies that grow revenue by 20%+ compounded annually for such a long period are unbelievably rare, making the expectations in Beyond Meat’s share price outright unrealistic.

There is a 57%+ Downside If Consensus is Right: In this scenario, Beyond Meat’s:

- NOPAT margin improves to 6%,

- revenue grows at consensus rates in 2021, 2022, and 2023, and

- revenue grows 24% a year from 2023-2027 (continuation of 2023 consensus), then

the stock is worth just $30/share today – a 57% downside to the current price. This scenario still implies that Beyond Meat increases its market share from 7% in 2020 to 13% in 2027. If Beyond Meat’s growth continues to slow, it is unable to boost falling retail sales in the United States, or fails to reverse rising costs, the downside risk in the stock is even higher, as we show below.

There’s 76%+ Downside If Growth Slows to More Reasonable Level: In this scenario, Beyond Meat’s:

- NOPAT margin improves to 6% and

- revenue grows at consensus rates in 2021, 2022, and 2023, and

- revenue growth slows beyond 2023, and grows at 20% in 2024, 15% in 2025, and 12% in 2026 and 2027, then

the stock is worth just $17/share today – a 76% downside to the current price.

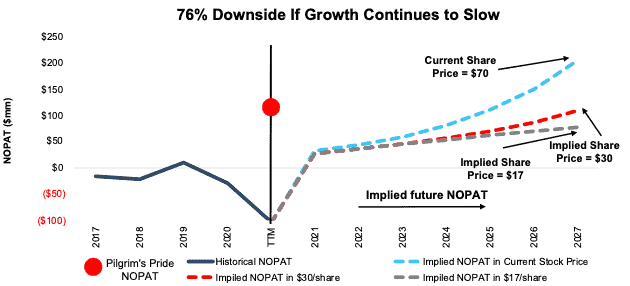

Figure 4 compares the firm’s historical NOPAT and implied NOPATs for the three scenarios we presented to illustrate just how high the expectations baked into Beyond Meat’s stock price remain. For reference, we also include the TTM NOPAT of meat product peer Pilgrim’s Pride (PPC).

Figure 4: Beyond Meat’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

Each of these scenarios also assumes Beyond Meat can grow revenue, NOPAT, and free cash flow without increasing working capital or fixed assets. This assumption is unlikely but allows us to create best-case scenarios that demonstrate how high expectations embedded in the current valuation are. For reference, Beyond Meat’s invested capital has grown 57% compounded annually since 2017.

This article originally published on January 18, 2022.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.

[2] Performance represents the price performance of each stock during the time in which it was on the Focus List Stocks: Short Model Portfolio in 2021. For stocks removed from the Focus List in 2021, performance is measured from the beginning of 2021 through the date the ticker was removed from the Focus List. For stocks added to the Focus List in 2021, performance is measured from the date the ticker was added to the Focus List through December 31, 2021.

[3] We estimate market share using Research and Market’s projection that the global plant-based meat market will grow 15% compounded annually to nearly $15 billion in 2027.