As the market gets overheated, proper due diligence helps investors avoid costly mistakes. Strong business fundamentals and low valuations are key ingredients in the overall evaluation of investments. This week’s stock pick of the week, with high profitability and a compelling valuation, is Microsoft (MSFT).

Stock Price Lags Business Fundamentals

In previous reports, we’ve highlighted the extraordinary consistency of Microsoft’s business. This consistency is not reflected in the stock price as many analysts and market pundits do not fully understand the strength of Microsoft’s business model. As a result, the stock has declined 1% this year, trailing the broader 2% gain of the S&P 500 index. It is time the market stops evaluating Microsoft as the high-flying growth company it once was, but rather as the steady, mature, cash cow it has become.

Microsoft Profits Long Term

Microsoft has remained off the radar for many investors largely due to the emergence of “trendy” cloud technology companies with new product offerings and the “ever impending” end of the PC. However, despite the constant inflow of competitors and declining PC sales, Microsoft continues to grow its business and create shareholder value.

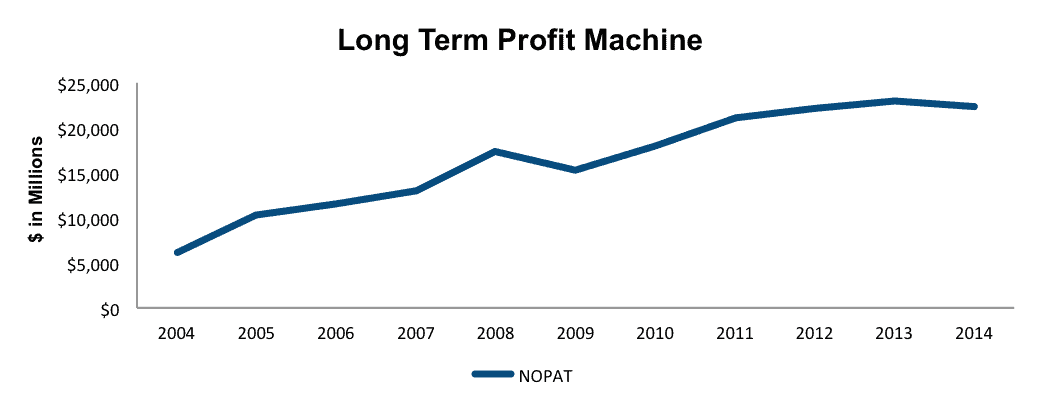

Over the past decade, Microsoft’s after-tax operating profit (NOPAT) has grown by 13% compounded annually. Revenues over this same time have grown 9% compounded annually. In addition, Microsoft currently earns a return on invested capital (ROIC) of 48%, placing it in the top quintile of all companies we cover. Microsoft has also generated positive free cash flow every single year since 2002 for a total of $130 billion over that time. This free cash flow allows Microsoft to buyback lots of stock while growing its dividend by 16% annually over the past five years.

Figure 1: Microsoft’s Robust Profit Growth

Sources: New Constructs, LLC and company filings

Strong Demand Built Through Years of Operations

Some investors might fear that Microsoft has become antiquated and will be, or already has been, surpassed by innovative young startups. Although the technology sector is characterized by massive innovation and change, Microsoft has created a strong competitive position within the industry. The widespread use of Microsoft’s products by some of the largest corporations across the globe creates lasting demand and pricing power.

The foundation of Microsoft’s business success, apart from its operating system, can be attributed to its Office Suite of products. Microsoft’s new business model is largely based on the proliferation of its Windows products throughout the world. Microsoft also continually provides a larger breadth of product offerings to enhance the Office Suite platform. These products, located in areas such as business support, video conferencing, and cyber security create an integrated ecosystem that is difficult to leave. While the Office Suite platform might be the glue that binds Microsoft together, its longstanding success has allowed Microsoft to invest in the future as well.

The Future in the Clouds

Overall, investors are fearful that Microsoft’s late foray into cloud computing places it at a competitive disadvantage relative to peers. However, as we’ve been highly critical of smaller cloud competitors in the past, Microsoft has the one thing that matters to give it a competitive advantage: profitable business lines. Because Microsoft has other products besides cloud services, it has superior cash flows it can use to invest heavily into its cloud offerings while still remaining profitable and generating shareholder value.

With the aforementioned advantage and the realization that the future of computers, mobile phones, tablets, and other devices lies within the cloud, Microsoft has made it a point to expand in this market. Through the integration of Office 365, Microsoft’s Office cloud offering, the office suite is no longer limited to just PC or Mac users, but rather smart devices as a whole. In addition, Microsoft took its competitors head on in the cloud storage space, offering unlimited cloud storage to Office 365 subscribers while Google and Apple offer only a limited amount of storage and charge much higher prices to do so. The transition to Office 365 has been highly successful so far, as subscribers grew 35% year over year in Microsoft’s 3Q15. This subscriber growth also contributed to Microsoft’s cloud revenue increasing 106% year over year as well.

Apart from its Office Suite, Microsoft has been investing heavily into the cloud operations of its Xbox segment as well. While this segment represents a small portion of revenue, it revives focus around Microsoft being an innovator once again. Microsoft’s recent presentation at E3, with the advancement of augmented reality HoloLens and partnerships with Facebook’s Oculus Rift, showcases its ability to continue looking for future avenues of growth.

Impact of Footnotes Adjustments and Forensic Accounting

To reveal the true economic performance of Microsoft, we look deeper into the company’s 10-K reports. For 2014, we made the following adjustments:

We removed $1.8 billion (2% of revenue) in non-operating expenses in our assessment of NOPAT. The net effect of income statement adjustments after removing non-operating income was $176 million.

We made $135 billion worth of balance sheet adjustments to calculate invested capital. The largest adjustment made when calculating invested capital was the removal of $98 billion in excess cash, representing 78% of reported net assets.

As it pertains to Microsoft’s valuation, we made $126 billion worth of adjustments with a net impact of $70 billion. The largest adjustment we made to Microsoft’s shareholder value was $3.8 billion to reflect the claim on cash flows from off balance sheet debt.

The Time to Buy is Now

Despite the positive trends surrounding Microsoft, the stock remains near negative territory for the year. For long-term value investors, this decline provides an excellent entry point. At its current price of $46/share, Microsoft’s price to economic book value (PEBV) ratio is 1.0. This ratio implies the market is expecting profits to never grow from current levels, even in spite of the company’s proven ability to generate double-digit NOPAT growth over the past decade.

If we give Microsoft credit for just 5% compounded annual NOPAT growth for the next decade, the stock is worth $69/share today – a 50% upside. However, if Microsoft’s cloud initiatives continue growing as they have been, the stock could be worth even more. Invest in Microsoft now before the market realizes just how undervalued its shares are.

Disclosure: David Trainer owns MSFT. David Trainer, Allen L. Jackson, and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Photo Credit: Stephen D (Flickr)

4 replies to "Get This Cash Cow at a Discount"

Your 98 billion excess cash is higher than 95 billions reported as total cash in March 2015 Balance Sheet. How is that possible?

Stefano,

The discrepancy is because our excess cash value is a calculated value and not simply the total cash number reported on the balance sheet. We include any short or long-term non-operating investments as part of cash, which can result in excess cash being greater than the reported total cash value.

-Kyle Guske II

Can you be more specific and show me exactly the numbers? Thanks!

7 years later this investment went slightly better than expected. Great research!