From the 231 filings our Robo-Analyst analyzed last week, we’re highlighting unusual items in the filings of Ingersoll Rand (IR) and several other companies during the third week of The Real Earnings Season.

Ingersoll Rand’s Hidden Non-Operating Items Make 2020 Look Even Worse

In its 2020 10-K, analyst Hunter Anderson found that Ingersoll Rand recorded multiple unusual charges that were hidden in “other operating expense, net.” Detailed below, these hidden unusual items along with reported unusual items, amount to -$153 million in Earnings Distortion and materially distort (by 459%) Ingersoll Rand’s GAAP earnings:

Hidden Unusual Items = -$146 million:

- $93 million restructuring charges – Page 108 2020 10-K

- $44 million acquisition related expenses bundled in other operating expense – Page 36 2020 10-K

- $13 million foreign currency transaction losses bundled in other operating expense – page 36 2020 10-K

- $8 million reimbursement of previously expensed legal defense costs – Page 105 2020 10-K

- $3 million severance, sign on, relocation, and executive search costs – Page 108 2020 10-K

- $2 million facility reorganization, relocation and other costs – Page 108 2020 10-K

Reported Unusual Items = -$18 million:

- $20 million impairment of other intangible assets reported on the income statement – 2020 10-K

- $8 million other income reported on the income statement – 2020 10-K

- $4 million adjustment for contra earnings distortion from recurring pension costs disclosed in non-recurring items

- $2 million loss on extinguishment of debt reported on the income statement – 2020 10-K

In addition, we made an $11 million adjustment for income tax distortion to normalize reported income taxes by removing the impact of unusual items.

After removing Earnings Distortion, which totals -$0.40/share, or 459% of GAAP EPS, Ingersoll Rand’s 2020 Core Earnings of $0.31/share are much greater than GAAP EPS of -$0.09.

How We Treat Non-Operating Items: Non-operating items, such as restructuring or foreign exchange charges are one of many reasons why GAAP net income doesn’t tell the whole story of a company’s profitability.

Unlike other research firms[1], we remove all unusual gains/losses, including restructuring charges, to calculate Ingersoll Rand’s true recurring profits, i.e. Core Earnings.

Without careful footnotes research, investors would never know that these non-recurring expenses distort GAAP numbers to the point where traditional, unscrubbed earnings for U.S. stocks are off by an average of ~20%.

Other Material Earnings Distortions & Red Flags We Found

Since February 19, 2021, we have parsed 1,626 10-Q and 10-K filings, and Ingersoll Rand’s hidden non-operating items aren’t the only unusual items our analysts have found. Below are a few other highly material Earnings Distortions that we discovered while rigorously analyzing the footnotes and MD&A:

The Michaels Companies (MIK) – Unusual COVID-19 expenses

- While analyzing The Michaels Companies’ fiscal 2020 10-K, analyst Devyn DeLange found that on page 40 The Michaels Companies recognized a $20 million COVID-19 expense, which included hazard pay, costs associated with furloughed employees, inventory charges, and sanitation supplies. We remove this non-operating charge from our measure of net operating profit after-tax (NOPAT) and Core Earnings to calculate the true recurring profits of the business. After removing all Earnings Distortion (31% of GAAP EPS in fiscal 2020), The Michaels Companies fiscal 2020 Core Earnings of $2.61/share are greater than GAAP EPS of $1.98, which could help explain why the firm recently received an acquisition offer from Apollo Global Management.

3D Systems (DDD) – Non-operating charge due to workforce reduction

- Analyst Robbie Woodward noticed on page F-38 (page 83 overall) of 3D System’s 2020 10-K that the firm recognized $20 million in restructuring and exit activity costs related to organizational realignment, which included reducing its workforce by 20%. We remove this non-operating charge from our measure of NOPAT and Core Earnings to calculate the true recurring profits of the business. After removing all Earnings Distortion (71% of GAAP EPS in 2020), 3D System’s Core Earnings improved from -$0.50/share in 2019 to -$0.37/share in 2020 while GAAP EPS fell from -$0.61 to -$1.27 over the same time.

The Power of the Robo-Analyst

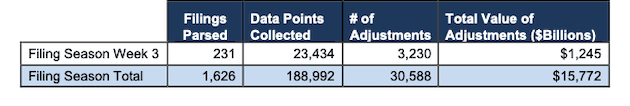

We analyzed 231 10-K and 10-Q filings last week, from which our Robo-Analyst[2] technology collected 23,434 data points. Our analyst team made 3,230 forensic accounting adjustments with a dollar value of $1.2 trillion. The adjustments were applied as follows:

- 1,211 income statement adjustments with a total value of $62 billion

- 1,356 balance sheet adjustments with a total value of $590 billion

- 663 valuation adjustments with a total value of $593 billion

Figure 1: Filing Season Diligence for the Week of March 8 – March 12

Sources: New Constructs, LLC and company filings.

Every year in this six-week stretch from mid-February through the end of March, we parse and analyze roughly 2,000 10-Ks to update our models for companies with 12/31 and 1/31 fiscal year ends. This effort is made possible by the combination of expertly trained human analysts with our “Robo-Analyst.” Featured by Harvard Business School in “Disrupting Fundamental Analysis with Robo-Analysts”, our Robo-Analyst research automation technology uses machine learning and natural language processing to automate and improve financial modeling.

Only our “novel dataset”, which leverages our Robo-Analyst technology, enables investors to overcome flaws with legacy fundamental datasets to apply reliable fundamental data in their research. Core Earnings: New Data & Evidence, forthcoming in The Journal of Financial Economics, reveals the problems with fundamental data provided by legacy firms like Bloomberg, Refinitiv, FactSet (FDS) and S&P Global (SPGI).

This article originally published on March 22, 2021.

Disclosure: David Trainer, Hunter Anderson, Devyn DeLange, Robbie Woodward, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] In Core Earnings: New Data & Evidence, professors from Harvard Business School & MIT Sloan expose the flaws in traditional, legacy fundamental data and research providers.

[2] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.