While the market has become skeptical about this firm’s ability to sustain its stellar fiscal 2021 results (as evidenced by shares falling nearly 30% since June), the firm is well-positioned to continue to profit from growth in gaming and work from home. Logitech (LOGI: $95/share) is this week’s Long Idea.

LOGI presents quality risk/reward given:

- the shift to work from home (WFH) will support elevated profits going forward

- its strong position in the gaming peripherals industry, which is expected to grow 10% compounded annually through 2025

- the firm’s history of profitable growth

- the current valuation already implies profits fall 32%

Logitech’s Quality Brand Led to Major Market Share Gains

Logitech’s decades-long reputation for reliability and ease of use helps the firm grow and sustain its market share. For example:

- Ranker.com ranks Logitech as the best mouse manufacturer and the best keyboard manufacturer

- Techradar lists Logitech as the best work-from-home webcam.

- Logitech routinely ranks as the best gaming mouse and CreativeBloq, a platform for digital artists and designers, gives Logitech six spots in its top 10 mice of 2021 list.

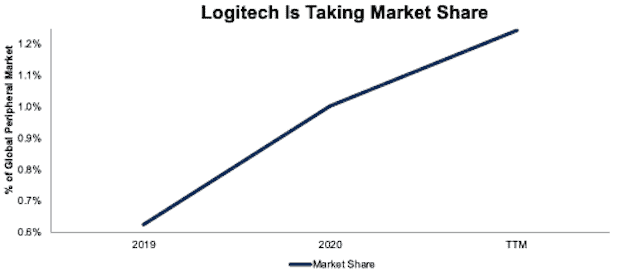

As the demand for computer peripherals rose during 2020 and early 2021, even more customers turned to the trusted Logitech brand, and Logitech’s share of the global computer peripheral equipment market grew from 0.6% in calendar 2019 to 1.0% in calendar 2020. With TTM revenue up 85% year-over-year (YoY), Logitech is on pace to take even more share from a market expected to grow 9% YoY in 2021.

Figure 1: Logitech’s Market Share: 2019 – TTM

Sources: New Constructs, LLC and company filings

2020 Isn’t the Anomaly Some Believe

The biggest bears will argue that Logitech (and the entire computer/gaming industry for that matter) cannot sustain the growth achieved in 2020. While we agree to some extent, the permanent shifts in where employees work and how they spend their free time may have created a new, larger base for Logitech’s sales. For instance, management guided for flat sales growth, plus or minus 5%, in fiscal 2022.

In other words, even after growing revenue 76% YoY in fiscal 2021, at the midpoint of guidance, Logitech management expects to retain nearly, if not, all of that growth in the coming year.

Continued Expansion of Work From Home Means Continued Profit Growth

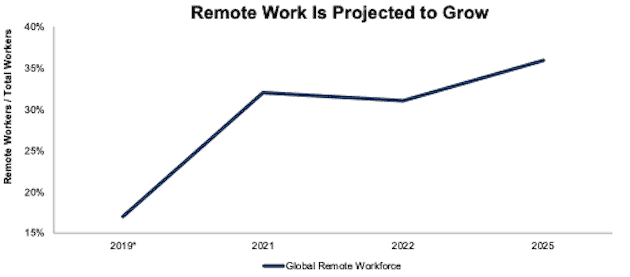

With 83% of employers agreeing that the transition to remote work in 2020 was successful, and only 19% of workforce location plans for fall 2021 to be all in-person, the shift to remote and home-office hybrid work models seems likely to persist beyond the pandemic.

Per Figure 2, global research firm Gartner expects the share of work from home employees worldwide to increase from 32% in 2021 to over 35% in 2025.

Figure 2: Forecasted Global Percent of Work From Home Employees: Through 2025

Sources: New Constructs, LLC and company filings

*Actual (i.e. not forecasted) value

Work From Home Drives Gaming Demand Too

Remote and hybrid work models reduce commuting time, which frees up more time for hobbies such as gaming. As work from home trends persist, so too will increased demand in gaming. Before the pandemic, in 2019, the average one-way commute in the U.S. reached nearly 28 minutes. Without such a commute, Americans spent ~32% of the time saved on leisure activities such as gaming.

The rise in gaming demand is good news for Logitech as gaming peripherals comprise the firm’s largest business segment. Grand View Research expects the global gaming peripherals market to grow more than 10% compounded annually from 2020 to 2025.

Favorable Product Portfolio Is Positioned to Outperform

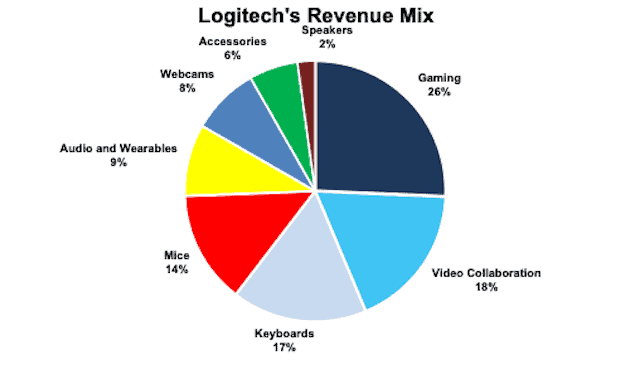

While Research and Markets expects the global computer peripheral equipment market to grow 4% compounded annually from 2021 to 2025, Logitech’s largest segments are projected to grow at much faster rates.

Per Figure 3, Logitech’s four largest segments – gaming, video collaboration, keyboard, and mice – accounted for 75% of fiscal 1Q22 revenue. The following is a list of market growth forecasts from various research providers that correspond to each of the top four segments:

- gaming: 10% compounded annually from 2020 to 2025 according to Grand View Research.

- video collaboration: 11% compounded annually from 2021 to 2028 according to Grand View Research

- keyboards: 4% compounded annually from 2021 to 2025 according to Research and Markets

- mice: 6% compounded annually from 2021 to 2025 according to The Business Research Company

Figure 3: Logitech’s Revenue Mix – Fiscal 1Q22

Sources: New Constructs, LLC and company filings

Leading Market Share Drives Superior Profitability

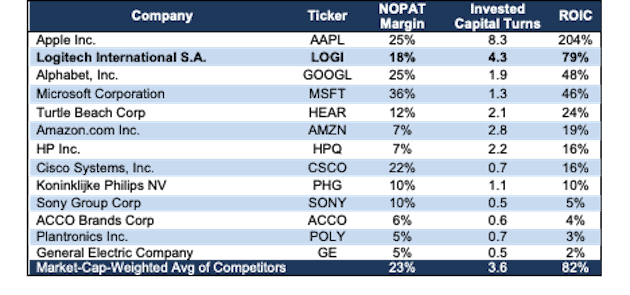

Logitech consistently improved profitability for many years before the pandemic, and its return on invested capital (ROIC) improved YoY every year since 2013 as it rose from 1% to 23% in fiscal 2020. Over the trailing-twelve-month (TTM) period, the firm’s ROIC soared to 79%.

Figure 4 lists the net operating profit after tax (NOPAT) margin, invested capital turns, and ROIC of the major competitors the firm identifies in its fiscal 2021 10-K. Figure 4 shows that Logitech’s ability to meet customer demand and deliver products through any number of outlets (retail, ecommerce, omni-channel) has resulted in some of the highest profitability amongst its competition.

Figure 4: Logitech’s Profitability Vs. Competitors: TTM

Sources: New Constructs, LLC and company filings

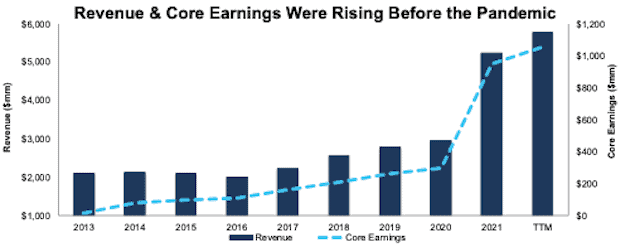

Core Earnings Were Also on the Rise Long Before COVID

While certainly impressive, last year wasn’t the only time Logitech improved profits. Rather, Logitech consistently grew Core Earnings[1] YoY each year since fiscal 2014. During that time, the firm grew Core Earnings from $11 million in fiscal 2013 to $306 million in pre-pandemic fiscal 2020, or 60% compounded annually. Over the TTM, Core Earnings have risen to $997 million.

Figure 5: Logitech’s Revenue & Core Earnings Since 2013

Sources: New Constructs, LLC and company filings.

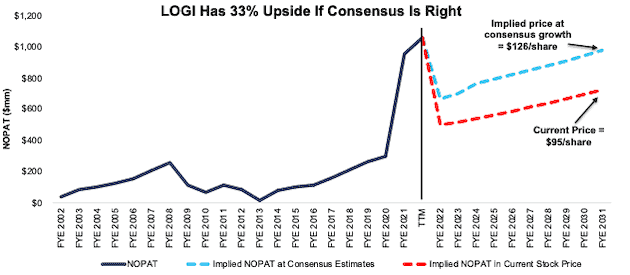

Despite Growth Opportunities, Logitech Is Priced for Profits to Fall by 32%

When we use our reverse discounted cash flow (DCF) model to analyze the future cash flow expectations baked into Logitech’s stock price, we can provide clear mathematical evidence that the current valuation implies profits will fall 32% from current levels. We also provide an additional scenario to highlight the upside potential in shares if Logitech simply grows at consensus rates.

In the first scenario, we assume Logitech’s:

- NOPAT margin falls to 10% (equal to fiscal 2020 vs. 18% TTM) in fiscal 2022 through 2031 and

- revenue falls 5% (low-end of management’s guidance) in fiscal 2022 and

- revenue grows by 4% (equal to market expectations through calendar 2025) compounded annually from fiscal 2022 to fiscal 2031

In this scenario, Logitech’s NOPAT in fiscal 2031 is 32% below TTM levels and the stock is worth $95/share today – equal to the current price.

In this scenario, NOPAT falls 48% in fiscal 2022 and grows just 4% compounded annually from fiscal 2023 to fiscal 2031. For reference, consensus expectations are for EPS to fall 30% in fiscal 2022, rise 12% in fiscal 2023, and rise 14% in fiscal 2024.

DCF Scenario 2: Shares Could reach $126 or Higher: If we assume Logitech’s:

- NOPAT margin falls to 13% in fiscal 2022 and

- revenue grows by 5% (equal to consensus) compounded annually from fiscal 2022-2024 and

- revenue grows by 3.5% each year thereafter through fiscal 2031, then

Logitech is worth $126/share today – a 33% upside to the current price. See the math behind this reverse DCF scenario.

Figure 6: Logitech’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings.

Sustainable Competitive Advantages Will Drive Shareholder Value Creation

Here’s a summary of why we think the moat around Logitech’s business will enable it to continue to generate higher NOPAT than the current market valuation implies. The following competitive advantages also help Logitech grow its market share over the long term:

- highly recognizable, top-ranked, and trusted brand

- superior growth, operational and capital efficiency compared to peers

- product portfolio positioned in high-growth markets

What Noise Traders Miss With Logitech

These days, fewer investors focus on finding quality capital allocators with shareholder friendly corporate governance. Instead, due to the proliferation of noise traders, the focus is on short-term technical trading trends while more reliable fundamental research is overlooked. Here’s a quick summary of what noise traders are missing:

- tailwinds from persistent work from home and gaming trends

- Logitech’s consistent improvement in profitability year-over-year before the pandemic

- the firm’s large market share gains throughout the pandemic

- valuation implies profits will fall 33% from current levels

Earnings Beats or Further Delays in Return to Offices Could Send Shares Higher

According to Zacks, Logitech beat EPS estimates in 11 of the past 12 quarters and doing so again could send shares higher.

Furthermore, if the firm achieves sales greater than what management guided for in fiscal 2022, investors could take notice that the firm is well positioned for future growth and send shares higher.

Additionally, some of the largest firms in the world are reassessing their return to office plans. For instance, Google recently delayed its return until at least January 2022. Google had previously planned a return in September. Should more firms delay, or even permanently end return to office plans, Logitech could see continued sales growth, which would help drive additional profit and boost shares.

Share Repurchases and Dividends Could Provide 2.4%+ Yield

Logitech has increased its dividend each year since 2013. Since fiscal 2017, the firm has paid $582 million in cumulative dividends. Logitech’s current dividend provides a 1.0% yield.

Logitech has also traditionally returned capital to shareholders through share repurchases. From fiscal 2017 to fiscal 2021, the firm repurchased $362 million (2% of current market cap). Logitech has $780 million remaining for future repurchases under its current authorization. If the firm repurchases shares in line with TTM levels of $220 million in fiscal 2022, the repurchase would yield an additional 1.4% at its current valuation.

The firm’s strong free cash flow (FCF) supports its dividend payments and share repurchases. Since fiscal 2017, the firm returned a combined $945 million to shareholders while generating $1.6 billion in FCF.

Executive Compensation Could be Improved

No matter the macro environment, investors should look for companies with executive compensation plans that directly align executives’ interests with shareholders’ interests. Quality corporate governance holds executives accountable to shareholders by incentivizing them to allocate capital prudently.

Logitech compensates executives with salaries, cash bonuses, and long-term equity awards. Cash bonuses are tied to revenue and non-GAAP operating income, while long-term incentives are tied to three-year weighted average revenue growth, three-year relative total shareholder return, and three-year cumulative non-GAAP operating income.

Logitech should instead tie performance compensation to improvement in ROIC, as there is a strong correlation between improving ROIC and increasing shareholder value. Tying executive compensation to ROIC also ensures that executives’ interests are actually aligned with shareholders’ interests.

Despite not using ROIC when measuring performance, Logitech’s compensation plan has not compensated executives while they destroyed shareholder value. Logitech grew economic earnings by 38% compounded annually from fiscal 2010 through fiscal 2020 (pre-pandemic), and 19% compounded annually from fiscal 2002 through fiscal 2020. If we include the growth in economic earnings during fiscal 2021 (pandemic year), the CAGR is even greater.

Insider Trading and Short Interest Trends

Over the past three months, insiders have bought 24 thousand shares and sold 16 thousand shares for a net effect of 8 thousand shares purchased. These purchases represent less than 1% of shares outstanding.

There are currently 12.3 million shares sold short, which equates to 7% of shares outstanding and more than 15 days to cover. Short interest is down 27% from the prior month, so if more shorts cover their positions in the near-term, shares could move higher.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

Fact: we provide more reliable fundamental data and earnings models – unrivaled in the world.

Proof: Core Earnings: New Data & Evidence, forthcoming in The Journal of Financial Economics.

Below are specifics on the adjustments we make based on Robo-Analyst findings in Logitech’s 10-K and 10-Qs:

Income Statement: we made $26 million of adjustments, with a net effect of removing $6 million in non-operating expenses (<1% of revenue). You can see all the adjustments made to Logitech’ income statement here.

Balance Sheet: we made $2.4 billion of adjustments to calculate invested capital with a net decrease of $1.3 billion. One of the largest adjustments was $380 million in asset write-downs. This adjustment represented 15% of reported net assets. You can see all the adjustments made to Logitech’s balance sheet here.

Valuation: we made $1.4 billion of adjustments with a net effect of increasing shareholder value by $1.1 billion. One of the most notable adjustments to shareholder value was $1.2 billion in excess cash. This adjustment represents 7% of Logitech’s market cap. See all adjustments to Logitech’s valuation here.

Attractive Funds That Hold LOGI

There are no funds that receive our Attractive-or-better rating and allocate significantly to LOGI.

This article originally published on September 23, 2021.

Disclosure: David Trainer, Kyle Guske II, Alex Sword, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Only Core Earnings enable investors to overcome the inaccuracies, omissions and biases in legacy fundamental data and research, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.