We closed this position on April 30, 2021. A copy of the associated Position Update report is here.

Retail is often viewed through a negative lens, as numerous firms struggle under the weight of lofty store counts, underperforming locations, and even high debt levels. However, this firm operates a franchise model that leverages the success of specialized brands, without the heavy capital expense of a traditional retail build-out. With strong fundamentals and an undervalued stock price, this firm not only finds itself in October’s Most Attractive Stocks Model Portfolio, but Winmark Corp (WINA: $130/share) is also this week’s Long Idea.

WINA’s Consistent Profit Growth

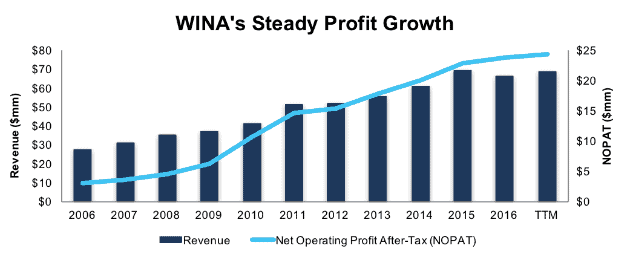

WINA has grown revenue 9% compounded annually over the past decade. Over the same period, after-tax profit (NOPAT) has increased 23% compounded annually, per Figure 1. Improved profit growth has been fueled by rising NOPAT margins, which have increased from 11% in 2006 to 35% over the last twelve months (TTM). Over the long-term, WINA has grown NOPAT by 13% compounded annually since 1996.

Figure 1: WINA Profit Growth Over Past Decade

Sources: New Constructs, LLC and company filings

WINA has generated a cumulative $90 million (16% of market cap) of free cash flow (FCF) over the past five years. WINA’s $21 million in FCF over the last twelve months equates to a 3% FCF yield compared to 2% for the average S&P 500 stock.

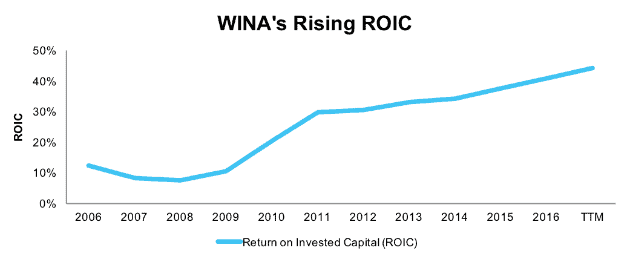

WINA has also exhibited excellent stewardship of capital by leveraging its franchise business model to generate impressive returns on invested capital (ROIC). Over the past decade, WINA has improved its ROIC from 13% in 2006 to a top-quintile 44% TTM, per Figure 2 below. WINA has earned a double digit return on invested capital (ROIC) in 15 of the past 18 years.

WINA’s improving balance sheet efficiency is further evidence of good capital stewardship. Since bottoming in 2008, WINA’s invested capital turns have increased from 0.58 to 1.26 TTM.

Figure 2: WINA’s ROIC Improvement Over the Past Decade

Sources: New Constructs, LLC and company filings

Improving ROIC Correlated with Creating Shareholder Value

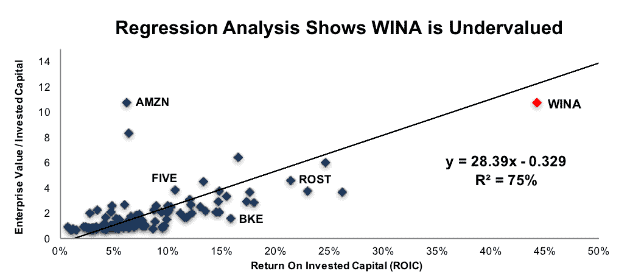

We know from Figure 3 below, and numerous case studies, that changes in stock prices are strongly correlated with ROIC. As such, getting ROIC right is an important part of the investment decision making process. A recent white paper published by accounting firm, Ernst & Young shows material superiority of our forensic accounting research and measure of ROIC versus the largest research providers.

Per Figure 3, ROIC explains 75% of the difference in valuation for the 105 Retail peers under coverage with positive ROIC’s. Despite WINA’s 44% ROIC, which is well above the 10% average of the peer group, the firm’s stock trades at a discount to peers as shown by its position below the trend line in Figure 3. If the stock were to trade at parity with its peers, it would be $151/share – 15% above the current stock price. Given the firm’s rising ROIC and consistent profit growth, one would think the stock would garner a premium valuation.

Figure 3: ROIC Explains 75% Of Valuation for Retailing Stock

Sources: New Constructs, LLC and company filings

WINA’s Asset Light Franchise Model Also Earns Leading Margins

Winmark generates nearly three fourths of revenue through royalties (66%), merchandise sales (3%), and franchise fees (2%) from its five brands, Plato’s Closet, Once Upon a Child, Play It Again Sports, Music Go Round, and Style Encore. The remaining 25% of revenue is generated via its Winmark Capital equipment leasing business.

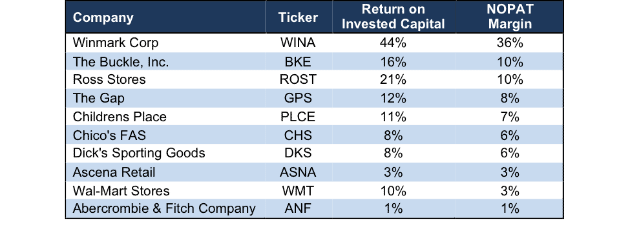

Winmark faces competition from numerous firms as it operates in multiple different segments of the retail industry, such as sporting goods, children apparel, teen apparel and women’s apparel. Competitors include The Buckle, Inc. (BKE), The Gap (GPS), Childrens Place (PLCE), Chico’s FAS (CHS), Dick’s Sporting Goods (DKS), and Abercrombie & Fitch (ANF). In addition, WINA faces competition from less specialized retailers such as Ross Stores (ROST), Amazon (AMZN) and Wal-Mart (WMT).

Together, Winmark’s five brands generated over $1 billion in sales in 2016, of which Winmark receives anywhere from 3-5% in royalty payments. This asset-light business model requires little capital expenditure, outside of marketing and support of franchisees and leaves WINA with significantly higher margins than a standard retail firm. Per Figure 4, WINA’s ROIC and NOPAT margin far exceed even the closest competitor.

Furthermore, WINA’s ability to continually improve its margins even in a difficult retail environment represents a strong competitive advantage in a market filled with competition. Winmark is less focused on traditional retail worries such as the latest fashion trends and more focused on finding profitable store locations and maximizing the efficiency of each franchisee. At the same time, WINA is able to continue investing in its brands and increase awareness while maintaining profitability.

Figure 4: Winmark’s Profitability Significantly Higher Than Peers

Sources: New Constructs, LLC and company filings.

Bears Ignore Profitable Industries and Strength of Franchise Business Model

While it’s easy to lump WINA together with traditional retailers, doing so requires ignoring this gem’s differentiated and highly profitable business model. Nevertheless, bears will lament WINA’s exposure to traditional retail. As a consignment/resale business, however, WINA has been able to break the trend of weak sales in its apparel markets while avoiding the pitfalls of large store footprints and their equally large overhead. The business’ high margins and ROICs prove management’s ability to only invest in best of breed brands and opportunities while ignoring low return locations or store concepts.

Rather than attempting to predict what the consumer will want next, WINA diversifies its franchise brands across a variety of discount goods while also fulfilling consumer desires to be paid for old, used items. Through proprietary software WINA balances the amount of money spent for each good a consumer brings in and focuses on maximizing the profit on each item sold, all while still providing a discount to consumers.

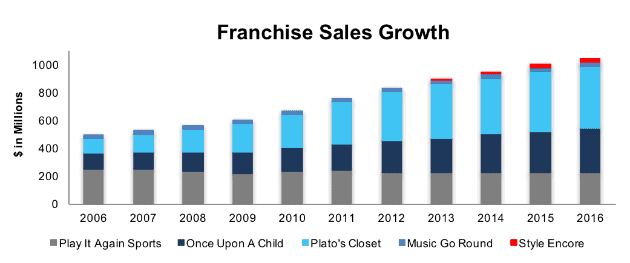

This focus has allowed WINA to create highly successful franchises that have consistently grown over the past decade, unlike many other retailers. Figure 5 shows that not only have total franchise sales grown 8% compounded annually over the past decade, Plato’s Closet and Once Upon A Child have achieved significantly higher growth rates and now account for nearly 75% of sales generated by WINA’s franchise brands.

Figure 5: Winmark’s Franchise Sales Growth

Sources: New Constructs, LLC and company filings.

Over the past decade, Plato’s Closet and Once Upon a Child sales have grown 16% compounded annually and 11% compounded annually, respectively. WINA’s new franchise, Style Encore, has seen sales grow 312% compounded annually since opening in 2013 and its total sales have nearly surpassed that of Music Go Round.

Most impressive, and key to a long-term bull thesis, is that the growth of these franchises is not a one-time event, but rather the continuation of long-term trends. Plato’s Closet and Once Upon a Child sales have grown year-over-year in each of the last 10 years, while Music Go Round has seen sales increase the last three years and Style Encore has grown sales in each of its first four years. With strong sales growth, it’s not surprising that the average franchise renewal rate is 98% over the past decade. These renewals create a consistent and recurring source of revenue that WINA can then use to reinvest in the business.

In addition to underappreciating the hybrid retail model, the bear case is further weakened by analyzing WINA’s valuation. The stock’s current valuation ignores WINA’s years of profit growth and significantly undervalues its business. More details are below.

Recent Pullback Creates WINA Buying Opportunity

WINA is up 22% over the past two years and has slightly outperformed the S&P 500, which is up 20% over the same time. However, a 6% drop in share price over the past week creates an opportunity to own a quality stock at an even better price. The disconnect between the fundamentals of the business and WINA’s valuation presents a buying opportunity.

At its current price of $130/share, WINA has a price-to-economic book value (PEBV) ratio of 1.0. This ratio means the market expects no meaningful growth in WINA’s NOPAT over the remaining life of the firm. This expectation seems overly pessimistic for a firm that has grown NOPAT by 23% compounded annually over the past decade and 13% compounded annually over the past two decades.

If WINA can simply maintain TTM NOPAT margins (35%) after 11 consecutive years of margin improvement and grow NOPAT by just 6% compounded annually for the next decade, the stock is worth $205/share today – a 58% upside. Add in the potential 1% yield detailed below, and it’s clear why WINA could be a great portfolio addition.

Share Repurchases Plus Dividends Yield 1% With Possible Upside

WINA repurchased $1.6 million of stock in 2016 and $0.6 million in 2015 through standard repurchase authorizations. The company also repurchased an additional $74.3 million in 2015 (20% of 2015 market cap) and $49.9 million in 2017 (9% of current market cap) via two separate tender offers. Outside of the tender offers, WINA is authorized to purchase an additional 143 thousand shares, which, at current prices, would equal $18.6 million. If WINA management repurchased shares in line with the averages of 2015 and 2016 (excluding tender offers) it would repurchase ~$1.5 million per year at current prices. A repurchase of this size equates to just 0.3% of the current market cap. When combined with the 0.3% dividend yield, the total yield to shareholders could approach 0.6%. However, shareholders could see significantly higher repurchase yield (upwards of 20%) were WINA management to institute another tender offer and repurchase shares in bulk.

Continued Earnings Growth Could Boost Shares

With no analyst coverage, there is no set consensus expectations for WINA moving forward. As such, a single earnings beat is not likely to move shares towards a level one would expect them to trade given the firm’s strong fundamentals and history of profit growth. Rather, a continued long-term uptrend in sales and profits should continue to drive shares much as it has in the past.

Macro-economic trends bode well for continued growth. Kiplinger’s projects retail sales to grow by 4% in 2018, which is an improvement over 2017 and 2016. Winmark’s franchise sales have traditionally grown at a higher pace than the overall retail market. Continued retail growth should provide WINA the upward trajectory to maximize its business and continue creating shareholder value.

However, a strong earnings report could also boost shares as we’ve seen in the past. Leading into WINA’s 1Q17 earnings, the stock jumped 15% in the week following the earnings report.

Regardless, this stock offers low valuation risk, a small yield and significant upside potential.

Executive Compensation Plan Could Be Improved but Raises No Alarms

WINA’s executive compensation plan, which includes base salary, annual incentives, and long-term incentives, is structured around group achievement, rather than individual performance. The compensation committee bases bonuses and incentive compensation on long-term goals such as cash flow, earnings per share, and human resources management. However, final decisions remain largely subjective, as the committee notes it does not tie any elements of compensation to the attainment of one specific goal but rather views all factors in totality when awarding compensation. Annual incentives are limited to no greater than 100% of an executive’s salary and equity based compensation is awarded via stock options that vest over time.

We would prefer to see executive compensation more clearly measured, and specifically tied to ROIC, since there is a strong correlation between improving ROIC and increasing shareholder value. However, WINA’s current exec comp plan has not led to executives getting paid while destroying shareholder value. In fact, quite the opposite is true for WINA. Economic earnings, the true cash flows of the business, have grown from $1 million in 2006 to $22 million TTM, or 31% compounded annually.

Insider Trading and Short Interest Trends

There is little insight to be gained from recent insider trading trends. Insider activity has been minimal over the past six months with 74 thousand shares purchased and 47 thousand shares sold for a net effect of 27 thousand shares purchased. These sales represent less than 1% of shares outstanding.

Short interest trends are more insightful. There are currently 54 thousand shares sold short, which equates to 1% of shares outstanding and 7 days to cover. Short interest has risen 46% from 37 thousand shares at the end of December 2016, as investors have taken a negative view on retail. However, WINA has proven its ability to buck the trend and any positive earnings report could squeeze shorts and send shares even higher.

Auditable Impact of Footnotes & Forensic Accounting Adjustments

Our Robo-Analyst technology enables us to perform forensic accounting with scale and provide the research needed to fulfill fiduciary duties. In order to derive the true recurring cash flows, an accurate invested capital, and an accurate shareholder value, we made the following adjustments to Winmark’s 2016 10-K:

Income Statement: we made $3 million of adjustments, with a net effect of removing $1 million in non-operating expense (2% of revenue). We removed $1 million in non-operating income and $2 million in non-operating expenses. You can see all the adjustments made to WINA’s income statement here.

Balance Sheet: we made $18 million of adjustments to calculate invested capital with a net increase of $17 million. The most notable adjustment was $13 million in asset write-downs. This adjustment represented 31% of reported net assets. You can see all the adjustments made to WINA’s balance sheet here.

Valuation: we made $61 million of adjustments with a net effect of decreasing shareholder value by $61 million. There were no adjustments that increased shareholder value. Apart from $33 million in total debt, which includes $2 million in off-balance sheet operating leases, the largest adjustment was $25 million in outstanding employee stock options. This option adjustment represents 4% of WINA’s market cap. Despite the net decrease in shareholder value, WINA remains undervalued.

Attractive Funds That Hold WINA

The following funds receive our Attractive-or-better rating and allocate significantly to WINA.

- Johnson Opportunity Fund (JOPPX) – 2.0% allocation and Attractive rating.

This article originally published on October 26, 2017.

Disclosure: David Trainer, Kyle Guske II, and Kenneth James receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Click here to download a PDF of this report.

Photo Credit: Burst (Pexels)