We closed this position on January 14, 2020. A copy of the associated Position Update report is here.

Finding profitable firms with strong growth opportunities and an undervalued stock price is becoming more difficult as the bull market carries on. We featured this stock as one of our top picks in our special June 2017 report “Selling Shovels in a Gold Rush,” and recent industry trends make the risk/reward tradeoff even more appealing. With impressive profitability and a significantly undervalued share price, Kulicke & Soffa Industries (KLIC:$23/share) earns a spot in January’s Most Attractive Stocks Model Portfolio and is this week’s Long Idea.

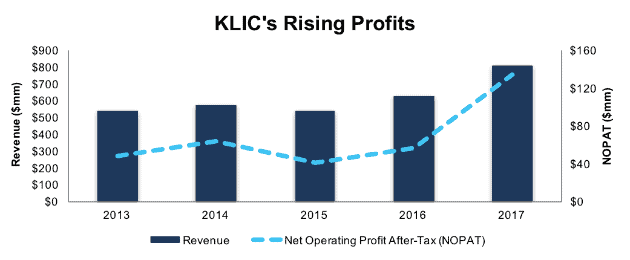

KLIC’s Profits Trending Higher

KLIC has grown revenue by 11% compounded annually since 2013 while after-tax profit (NOPAT) has grown 29% compounded annually, per Figure 1. Improved profit growth has been fueled by rising NOPAT margins, which have improved from 9% in 2013 to 17% in 2017. Longer term, KLIC has grown NOPAT by 14% compounded annually over the past decade.

Figure 1: KLIC’s Revenue & Profit Growth Since 2013

Sources: New Constructs, LLC and company filings

Not only has KLIC managed to grow NOPAT consistently, it has also done well in managing the capital put into the business. Average invested capital turns have increased from 0.9 in 2013 to 1.1 in 2017. Since 2013, KLIC has improved its return on invested capital (ROIC) from 8% to a top-quintile 18% in 2017.

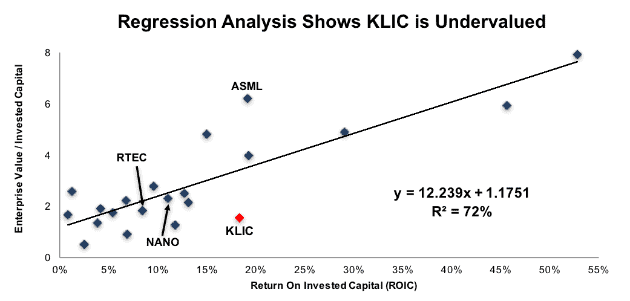

Improving ROIC Correlated with Creating Shareholder Value

Numerous case studies show that getting ROIC right is an important part of making smart investments. Ernst & Young recently published a white paper that proves the material superiority of our forensic accounting research and measure of ROIC.

Per Figure 2, ROIC explains 72% of the difference in valuation for the 21 Semiconductor Equipment & Testing stocks under our coverage. KLIC’s stock trades at a significant discount to peers as shown by its position below the trend line in Figure 2. If the stock were to trade at parity with its peers, it would be worth $45/share – an 83% upside to the current stock price. Given the firm’s improving margins and ROIC, one would think the stock would garner a premium valuation.

Figure 2: ROIC Explains 72% Of Valuation for Semiconductor & Equipment Testing Stocks

Sources: New Constructs, LLC and company filings

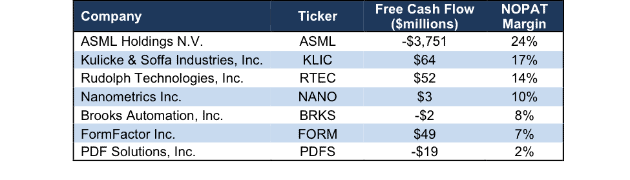

KLIC’s Margins Provide Flexibility and Advantages

Kulicke & Soffa Industries operates in the Back-End Assembly segment of the semiconductor equipment and packaging materials market. The company provides electrical wire bonding machinery that packages semiconductor chips so they can be mounted to circuit boards. The company’s products include traditional wire bonding equipment and more advanced packaging equipment, as well as packaging tools that can be used in competitors’ machinery. The firm provides equipment to global manufacturers such as Haoseng Industrial Co., Siliconware Precision Industries, Amkor Technology (AMKR), Samsung, Texas Instruments (TXN), and even Tesla (TSLA).

Competition in the industry includes many foreign firms such as ASM Pacific Technology, Shinkawa Ltd, and BE Semiconductor Industries. Competitors traded on U.S exchanges include ASML Holdings (ASML), Rudolph Technologies (RTEC), and Nanometrics (NANO).

Per Figure 3, KLIC’s free cash flow and NOPAT margin rank at or near the top of its peer group. KLIC’s high margins give it the operational flexibility to offer competitive pricing while remaining profitable. In addition, KLIC has generated a cumulative $195 million (11% of market cap) in free cash flow over the past five years and $64 million in 2017 alone. This strong cash flow allows KLIC to invest and improve its offerings and adapt to new demands.

Figure 3: KLIC’s NOPAT Margins Near Top of Competitor Group (Trailing Twelve Months)

Sources: New Constructs, LLC and company filings.

Bear Case: Semiconductor Market Will Hit Cyclical Downturn

As a back-end assembly equipment provider, KLIC’s business is clearly dependent on the continued growth of semiconductor use. KLIC bears are betting on the growth in semiconductors to not only slow, but drastically decline (based on expectations baked into the stock price). As we noted in our special report “Selling Shovels in a Gold Rush”, the semiconductor industry has undergone a shift that could remove much of the past cyclicality in the industry.

Key macro drivers such as customer consolidation, Asian demand, increasing chip complexity, and the Internet of Things are putting more wind in KLIC’s sails. In its 4Q17 earnings call, KLIC management noted overall semiconductor unit production is expected to grow 9% compounded annually through 2021.

Per Figure 4, global semiconductor interconnections have grown by 9% compounded annually since 1995. From 2016-2021, traditional and advanced bonding are expected to grow 7% and 11% compounded annually. Through fiscal 2017, KLIC estimates that 25-30% of its revenue comes from exposure to the faster growing advanced packaging segment. In fiscal 2016, advanced packaging represented under 10% of total revenues.

Figure 4: Semiconductor Interconnection Growth Since 1995

Sources: KLIC 4Q17 Earnings Release, VLSI Research, Gartner

KLIC also operates in specific markets expected to grow even faster than total interconnection and overall semiconductor growth. Semiconductor units are projected to grow compounded annually through 2021 by the following rates:

- Solid-state lighting: 33%

- Autonomous vehicles: 22%

- Industrial electronics: 21%

- Solid-state drives: 16%

- Wearables:15%

- Hybrid/EV vehicles: 15%

VLSI Research, a semiconductor market research provider, estimates the addressable market for back end assembly equipment is currently $5 billion. Within this category, Kulicke & Soffa estimates their addressable market is currently $2.2 billion and will grow to $2.7 billion in 2021. To take advantage of these growth opportunities and capture more of its addressable market, KLIC has acquired or invested in its own operations to improve existing technology. The company has integrated different bonding processes into newer machines to allow customers to gain efficiency and reduce costs of chip packaging. KLIC also created extensions of its ball bonding platforms to provide equipment to meet the needs for NAND flash storage.

More importantly, and most responsible for growing its advanced packaging business, the firm broadened its product line to include flip chip, wafer level packaging, system-in-packaging, and more. Providing equipment specifically for these specialized packaging procedures allows KLIC to expand market reach into the automotive, LED lighting, medical, and industrial segments.

Even without the improving industry trends noted above, the bear case is severely weakened by KLIC’s valuation. The stock’s current valuation ignores the historical profit growth and expects profits to immediately and permanently fall. More details are below.

KLIC’s Undervalued Stock Offers Significant Upside Potential

KLIC is up 32% over the past year and beat the 24% increase in the S&P 500. Even with this recent outperformance, the stock still appears to be undervalued. KLIC looks cheap both by traditional metrics and when analyzing the expectations baked into the stock price. KLIC’s current P/E ratio of 15 is well below the Semiconductor & Semiconductor Equipment industry average of 28. When we analyze the expectations baked into the stock price, we also find that KLIC holds significant upside potential.

At its current price of $23/share, KLIC has a price-to-economic book value (PEBV) ratio of 0.7. This ratio means the market expects KLIC’s NOPAT to permanently decline by 30% from current levels. This expectation seems overly pessimistic for a firm that has grown NOPAT by 29% compounded annually since 2013 and 14% compounded annually over the past decade.

If KLIC can simply maintain 2017 NOPAT margins of 17% and grow NOPAT by just 5% compounded annually for the next decade, the stock is worth $43/share today – an 87% upside. Given the potential growth opportunities in KLIC’s end markets, such a scenario could prove conservative, which would give KLIC even greater upside potential.

Share Repurchases Provide Small Yield Despite No Dividend

KLIC does not pay a dividend but, instead, returns capital to shareholders through share repurchases. In August 2017, the company exhausted its previous $100 million repurchase authorization, which began in August 2014. Upon completion, the Board of Directors approved a new $100 million repurchase plan which expires in 2020.

In fiscal 2016 and fiscal 2017, KLIC repurchased $14.6 million and $18.2 million worth of shares, respectively. If KLIC management purchased shares in line with the averages of the past two years, it would repurchase $16 million per year. A repurchase of this size equates to 0.9% of the current market cap.

Growing Industry Should Spur Earnings Beats and Send Shares Higher

KLIC has seen large price movements based on its earnings beating or missing expectations. Over the past four quarters, shares have moved as detailed below.

- Fiscal 4Q17 – top and bottom line beat – shares jumped 20% the following day

- Fiscal 3Q17 – top and bottom line miss – shares fell 12% the following day

- Fiscal 2Q17 – top and bottom line beat – shares jumped 5% the following day

- Fiscal 1Q17 – top and bottom line beat – shares jumped 10% the following day

Longer-term, KLIC has beat expectations in eight of the last nine quarters. More impressive, consensus expectations have been rising over the past two years, which means KLIC is not simply beating lowered expectations, but surpassing a rising bar.

With strong overall industry and specific end market projected growth rates, KLIC is positioning itself to continue beating expectations and growing profits. In July 2017, the company acquired Liteq, a lithography solutions provider for advanced packaging. By acquiring Liteq, KLIC expands its back-end assembly operations in the faster growing (relative to traditional market) advanced packaging market. Additionally, the company is adapting its bonding products to meet demands of high growth emerging markets, such as those noted earlier.

After raising fiscal 1Q guidance during its last earnings call, continued profit growth and earnings beats should send shares higher.

Executive Compensation Plan Could be Improved but Hasn’t Led to Value Destruction

KLIC’s executive compensation plan, which includes base salary, cash incentives, and performance based equity awards, is based on reaching target goals in net income, operating margin, and total shareholder return. Net income and operating margin are equally weighted when awarding cash incentives. Total shareholder return is measured over a three-year period when awarding equity awards. Metrics such as those in KLIC’s executive compensation plan are better than commonly used non-GAAP metrics, but could still be improved.

We would prefer to see executive compensation tied directly to value creation, specifically tied to ROIC, since there is a strong correlation between improving ROIC and increasing shareholder value. However, KLIC’s current exec comp plan has not led to executives getting paid while destroying shareholder value. The company has generated positive economic earnings, the true cash flows of the business, in four of the past five years and increased economic earnings from -$3 million in 2015 to $85 million in 2017.

Insider Trading and Short Interest Trends Are Minimal

Insider activity has been minimal over the past twelve months with 260 thousand shares purchased and 162 thousand shares sold for a net effect of 98 thousand shares purchased. These purchases represent less than 1% of shares outstanding. There are currently 537 thousand shares sold short, which equates to 1% of shares outstanding and one day to cover. Short interest has fallen nearly 47% from one million shares in August 2017, which could signal a bullish change in sentiment regarding KLIC.

Auditable Impact of Footnotes & Forensic Accounting Adjustments

Our Robo-Analyst technology enables us to perform forensic accounting with scale and provide the research needed to fulfill fiduciary duties. In order to derive the true recurring cash flows, an accurate invested capital, and an accurate shareholder value, we made the following adjustments to Kulicke & Soffa Industries’ 2017 10-K:

Income Statement: we made $66 million of adjustments, with a net effect of removing $22 million in non-operating expense (3% of revenue). We removed $22 million in non-operating income and $44 million in non-operating expenses. You can see all the adjustments made to KLIC’s income statement here.

Balance Sheet: we made $1 billion of adjustments to calculate invested capital with a net decrease of $246 million. The most notable adjustment was $326 million in asset write-downs. This adjustment represented 34% of reported net assets. You can see all the adjustments made to KLIC’s balance sheet here.

Valuation: we made $603 million of adjustments with a net effect of increasing shareholder value by $532 million. The largest adjustment to shareholder value was $568 million in excess cash. This cash adjustment represents 33% of KLIC’s market cap.

Attractive Funds That Hold KLIC

The following funds receive our Attractive-or-better rating and allocate significantly to Kulicke & Soffa Industries.

- River Oak Discovery Fund (RIVSX) – 3.9% allocation and Attractive rating.

- Monteagle Value Fund (MVRGX) – 3.7% allocation and Attractive rating.

- PowerShares Dynamic Semiconductors Portfolio (PSI) – 2.6% allocation and Attractive rating.

This article originally published on January 31, 2018.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Click here to download a PDF of this report.

Photo Credit: Pixabay (Pexels)

1 Response to "Highly Profitable Tech Stock with Significant Growth Opportunities"

It looks like the market is saying that the Competitive Advantage Period is shorter than yours.