Slack Technologies (WORK: $17 billion expected valuation) plans to go public on Thursday, June 20th through a direct listing. This unconventional process – similarly utilized by Spotify (SPOT) last year – means Slack’s shares begin trading without raising any new capital for the company.

Direct listings allow companies to gain liquidity for their stock without paying $100+ million fees to investment banks or diluting existing shareholders. However, without the standard IPO “book building” provided by investment banks, direct listings endure significant uncertainty regarding the initial share price. Slack’s shares have traded at prices anywhere from $8.37 to $31.50/share since January 2018, according to their S-1.

With so much volatility in private markets and limited analyst coverage prior to trading, it can be difficult for investors to determine a fair value for the stock. This report aims to sort through Slack’s fundamentals, project plausible scenarios for the company’s future, and determine the fair value of the using our reverse DCF model.

Slack: The Future of Work?

Slack (an acronym for Searchable Log of All Conversation and Knowledge) began its life as an internal messaging platform for a company developing an online game called Glitch. After the game went defunct, CEO Stewart Butterfield made Slack available to the public in 2013.

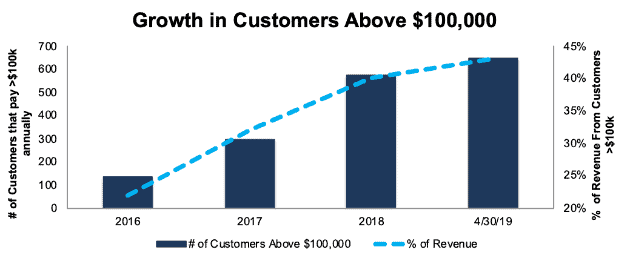

From these humble beginnings, Slack has grown into a service with over 10 million daily active users in more than 500 thousand organizations, including ~2/3 of the Fortune 100. As Figure 1 shows, Slack has more than quadrupled the number of customers that pay over $100 thousand annually since 2017.

Figure 1: Customers Generating >$100 Thousand in Annual Recurring Revenue Since 2016

Sources: New Constructs, LLC and company filings

While the company still has a reputation as a messaging app for startups, Figure 1 shows that it now earns over 40% of its revenue from these mega-customers. Slack ultimately wants to touch every aspect of the workflow process for everyone from small businesses to multinational conglomerates. The company sums up its ambition in a sentence that is repeated four times throughout its S-1:

“Slack is a new layer of the business technology stack that brings together people, applications, and data – a single place where people can effectively work together, access hundreds of thousands of critical applications and services, and find important information to do their best work.”

Slack wants to be the home screen for your office and integrate with thousands of third-party applications to keep every aspect of an organization’s work in a single, easily visible space. Slack needs to be much more than just a messaging app in order to convince companies to keep paying $100 thousand or more annually (or investors to value the company at $17 billion or more). Changing its ticker from SK to WORK symbolizes this ambition to investors

Mounting Competition as Slack Proves Viability

As Slack has pushed to expand the scope of its offering and the size of its clientele, it’s starting to face more competition. Traditional enterprise giants Microsoft (MSFT) and Cisco (CSCO) have introduced Slack competitors, as have tech giants Alphabet (GOOGL) and Facebook (FB).

These competitors have already made significant inroads into the collaboration software market. Microsoft’s Teams app already boasts 500 thousand organizations as users, while Facebook’s Workplace claims over 2 million individuals as paying users.

Slack has some notable advantages over these competitors, especially its brand cachet with young professionals. On the other hand, the tech giants have their own advantages, such as more significant relationships with large enterprise clients, ownership of other essential business applications (i.e. Microsoft Office), and greater resources to devote to research in artificial intelligence and other key areas that could improve the user experience.

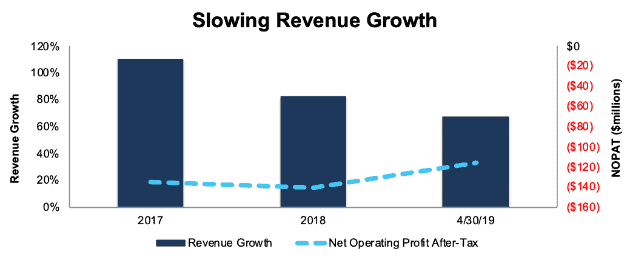

Figure 2 shows that mounting competition has led to slowing growth at Slack. The company’s revenue grew by 110% in 2017, 82% in 2018, and 67% year-over-year in Q1 2019. Meanwhile, profits are non-existent as the company lost over $100 million in 2017 and 2018 and is on pace to do so again in 2019.

Figure 2: Revenue Growth and NOPAT* for WORK: 2017-Q1 2019

Sources: New Constructs, LLC and company filings

*2019 NOPAT represents the annualized results of Q1

Slack’s revenue growth is decelerating despite the fact that the company’s $400 million in 2018 revenue represents just 1% of its projected $28 billion addressable market. This disconnect suggests that either Slack’s market opportunity is less than the company projects or that it is struggling to capture as big a share of the market as it hopes.

Public Shareholders Have No Rights (For Now)

Public shareholders will get almost no voting rights after Slack goes public, as has become the norm in recent years. The Class A shares available on public markets will have one vote, while the Class B shares held by insiders and early investors will get 10 votes per share. The Class B shares held by Slack’s executives and directors currently account for 66% of the voting rights in the company, so Slack will be entirely controlled by insiders after the direct listing.

The one bit of good news for investors is that these Class B shares have a sunset clause. On the 10th anniversary of the filing of the S-1, all outstanding shares will convert automatically into a single share of common stock. They’ll have to wait until 2029, but eventually public shareholders will have a say in the governance of Slack.

What Is Slack Worth?

Given all the concerns, what should investors be willing to pay for Slack? We’ll run three different profitability and growth scenarios through our dynamic DCF model to assign a range of potential valuations:

- The Messaging App Scenario: Slack remains a popular and widely used messaging app, but it fails to gain traction as the go-to application for enterprise collaboration.

- The Future of Work Scenario: Slack succeeds in its ambition to become a major enterprise software platform.

- The Acquisition Scenario: Instead of competing with Slack, one of the tech giants (most likely Microsoft) decides to acquire it instead.

We believe the first and third scenarios are more likely, and they show that Slack is probably not worth the $17 billion ($28/share) it has reportedly been valued at over the past few months.

Note that all our valuation scenarios factor in two significant hidden liabilities that impact WORK’s valuation:

- $185 million in off-balance sheet debt

- $483 million in employee stock option liabilities

Combined, these two items equal $668 million, about 4% of the rumored $17 billion market cap.

Scenario 1: The Messaging App

This scenario assumes that Microsoft, Alphabet, and others leverage their scale and existing relationships with businesses to control the enterprise collaboration software market. Slack remains a popular messaging application, but it doesn’t succeed in becoming “a new layer of the business technology stack.”

In this scenario, we assume Slack grows revenue by 22% compounded annually for 10 years, which equals $2.9 billion (~10% of its projected market opportunity) in revenue in year 10. We also assume the company can achieve long-term NOPAT margins of 16%, equivalent to Citrix Systems (CTRX). In this scenario, WORK has a fair value today of just $5/share, 82% below the reported $28/share valuation. See the math behind this dynamic DCF scenario.

Scenario 2: The Future of Work

Slack succeeds in its goal to become a new layer of the technology stack. It still has competition, but it leverages its brand and friendly user interface to become the primary communication and collaboration application for businesses of all sizes.

In this scenario, Slack grows revenue by 40% compounded annually for 10 years, which equates to $11.4 billion (~40% of its projected market opportunity) in revenue in year 10. We also assume the company can achieve long-term NOPAT margins of 24%, nearly as high as Microsoft. In this scenario, WORK has a fair value today of $39/share, 40% above the reported $28/share valuation. See the math behind this dynamic DCF scenario.

Scenario 3: The Acquisition

No one manages to gain a dominant market share in the industry, and eventually one of Slack’s larger competitors decides to acquire the company. Microsoft seems like the most likely acquirer given its history, but Alphabet or Facebook could also decide to make a play for Slack.

This scenario splits the difference between the first two. We assume that the combined company could have a value equivalent to the “Future of Work” scenario, but that value would be split between Slack and the acquiring company.

To model this split we assume Slack grows revenue by 30% compounded annually for 10 years, which equates to $5.7 billion (~20% of its projected market opportunity) in revenue in year 10. We also assume the company can achieve long-term NOPAT margins of 20%. In this scenario, WORK has a fair value today of just $15/share, 47% below the reported $28/share valuation. See the math behind this dynamic DCF scenario.

Where Will WORK Trade?

A few months ago, we would have expected WORK to trade in the vicinity of our most optimistic scenario, just as Spotify (SPOT) did when it carried out its direct listing last year. However, the disappointing performance from SPOT (down 25% over the past year) and lackluster IPOs from Uber (UBER) and Lyft (LYFT) indicate that investors are growing more skeptical of money-losing tech unicorns. It seems possible that WORK could continue this trend of disappointment by trading closer to our more conservative scenarios.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments[1] we make based on Robo-Analyst[2] findings in Slack’s S-1:

Income Statement: we made $34 million of adjustments, with no net effect. We removed $17 million in non-operating income and $17 million in non-operating expense. You can see all the adjustments made to WORK’s income statement here.

Balance Sheet: we made $365 million of adjustments to calculate invested capital with a net increase of $190 million. You can see all the adjustments made to WORK’s balance sheet here.

Valuation: we made $678 million of adjustments with a net effect of decreasing shareholder value by $678 million. You can see all the adjustments made to WORK’s valuation here.

This article originally published on June 5, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] This paper compares our analytics on a mega cap company to other major providers. The Appendix details exactly how we stack up.

[2] Harvard Business School Features the powerful impact of research automation in the case study New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.