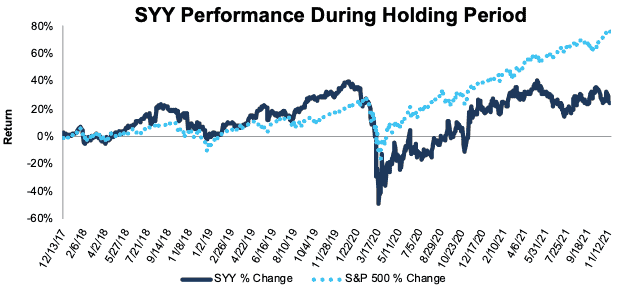

Sysco Inc. (SYY: $76/share) joined our list of Long Ideas in December 2017, and we included it in our “See Through the Dip” thesis in April 2020. The stock outperformed the market pre-COVID but has lagged since. However, the country’s largest food service supplier is outexecuting the competition and taking market share. As we’ll show in this report, the stock could be worth $103/share today.

We leverage more reliable fundamental data, as proven in The Journal of Financial Economics[1], and shown to provide a new source of alpha, with qualitative research to pick this Long Idea.

Scale Advantage Gives Sysco’s Stock More Upside

- Sysco’s 3Q21 earnings reveal the firm’s “moat” is getting larger and could lead to years of profit growth. An extensive and efficient distribution network coupled with a large existing customer base are important drivers of Sysco’s value.

- Sysco’s scale allows it to mitigate supply chain disruptions in serving its customers. Management notes it is able “to deliver higher fill rates for customers than the industry average.” The company added 25,000 service locations in fiscal 2021 and management declared in the fiscal 1Q22 earnings call “we're winning more new business than at any other point in time in Company history”.

- Assuming a return to pre-COVID margins and meeting consensus revenue estimates, the stock is worth $103/share today – 36% above the current price.

Figure 1: Long Idea Performance: From Date of Publication Through 11/16/2021

Sources: New Constructs, LLC and company filings

What’s Working for the Firm

Revenue Grows Above Pre-Pandemic Levels. Sysco beat top-line expectations in fiscal 1Q22, reporting an increase in revenues of 40% year-over-year (YoY). Revenues for the quarter were 8% above pre-pandemic fiscal 1Q20 (13 weeks ended September 28, 2019) levels. The company also provided preliminary October sales results showing a 10% increase over 2019 levels.

Return to Dining, On and Off Premise, Drives Demand. The return of customers to restaurants yielded the increased consumption of paper and disposable products that drove Sysco’s YoY revenue gains. Sales from the company’s paper and disposables segment grew 29% YoY while its overall U.S. Foodservice operations grew 46% YoY. Sales in the company’s SYGMA segment, which encompasses its U.S. distribution operations for quick-service chain restaurants, grew 12% YoY and are 18% above fiscal 1Q20 levels.

Growing Market Share. We noted in our report from April 2020 that the pandemic gave Sysco an opportunity to grow its market share by making smart acquisitions. In fiscal 1Q22, Sysco acquired Greco and Sons as the company seeks to expand its presence in the fast-growing specialty foods segment. The company plans to expand Greco & Sons nationally across the Sysco network and create a nationwide Italian segment platform. Management expects the acquisition to contribute $1 billion (2% of fiscal 2021 revenue) of revenue in fiscal 2022.

Apart from acquisitions, Sysco’s strong sales team and superior distribution network are integral in growing its existing operations. After adding 25,000 service locations in fiscal 2021, a 4% YoY improvement, the company continues to win new customer at a rapid pace. In its fiscal 1Q22 earnings call, the company stated, “we're winning more new business than at any other point in time in Company history” which is leading to market share gains. Sysco’s share of the U.S. foodservice market improved from 16% in calendar 2019 to 17% in calendar 2020. Furthermore, the company believes it’s on target to grow 1.2x the market in fiscal 2022.

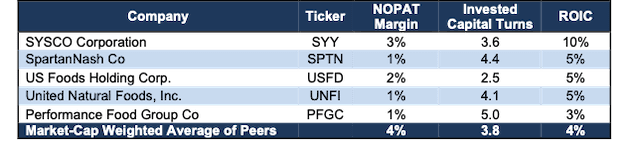

Sysco Is Bigger and More Profitable Than Peers. Sysco’s TTM net operating profit after tax (NOPAT) margin grew from 1% in fiscal 3Q21 to 3% in fiscal 1Q22, while its invested capital turns improved from 2.8 to 3.6 over the same time. Rising NOPAT margins and invested capital turns drive Sysco’s TTM return on invested capital (ROIC) from 3% in fiscal 3Q21 to 10% in fiscal 1Q22. Per Figure 2, Sysco’s ROIC is twice as high as its nearest peer.

Figure 2: Sysco’s Profitability Vs. Peers: TTM

Sources: New Constructs, LLC and company filings

What’s Not Working for the Firm

International Exposure Has Slowed Sysco’s Recovery. COVID-19-related disruptions impacted the company’s international business (16% of revenue in fiscal 2021) more than its other segments. Sysco’s international sales remain <1% below fiscal 1Q20 (pre-pandemic) levels but did rise 34% YoY in fiscal 1Q22.

Order Fulfillment Rates Need to Improve. Supply chain issues have affected the entire foodservice industry, and Sysco admits that its fill rates are below its historical standards. However, given Sysco’s scale, the company is experiencing less disruption than its peers, and management notes it is able “to deliver higher fill rates for customers than the industry average.” The ability for the company to service its customers even in a challenging environment contributes to the market share it has gained in each of the past 10 months.

Challenging Labor Market Could Disrupt Operations. While the challenging labor market could pose a threat to Sysco’s operations in the future, the company is not experiencing major staffing shortages at this time. Before the strain in the labor market, Sysco already offered competitive wages and has since streamlined its hiring process. The company’s efforts to attract employees appear to be working and in a one-day nationwide recruiting event in October, the company hired 1,000 employees.

However, should the labor market tighten further, labor costs could present a headwind to Sysco’s operations.

Inflation Remains a Threat. Higher levels of inflation also create headwinds for Sysco’s profitability if it is unable to pass through higher costs onto its customers. So far, the company notes it “has not seen much push back on our ability to pass along pricing” and recently deployed a new pricing tool that can dynamically pass-through inflation increases on specific customer items. Management expects inflation to maintain at current rates through fiscal 2Q22 before tapering later in the fiscal year.

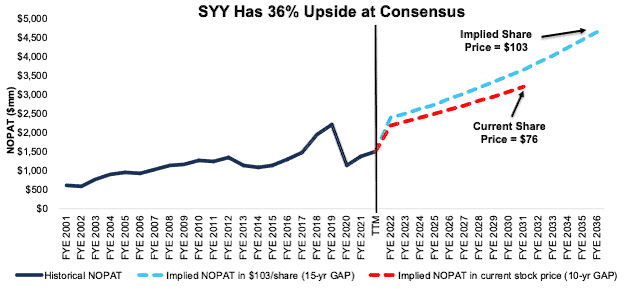

Sysco Is Priced For Historically Low Profit Growth

Below, we use our reverse discounted cash flow (DCF) model to analyze the expectations for future growth in cash flows baked into a couple of stock price scenarios for Sysco.

In the first scenario, we assume Sysco’s:

- NOPAT margin recovers to pre-pandemic fiscal 2019 levels of 3.7% from fiscal 2022-2031, and

- revenue grows by 8% compounded annually from fiscal 2022-2024 (vs. consensus CAGR of 12% for fiscal 2022-2024), and

- revenue grows by 5% compounded annually from fiscal 2025-2031 (equal to Sysco’s 10-year pre-pandemic revenue CAGR from fiscal 2009-2019 and below expected industry growth through 2026)

In this scenario, Sysco’s NOPAT grows by 4% compounded annually from pre-pandemic fiscal 2019 to fiscal 2031 and the stock is worth $76/share today – equal to the current price. See the math behind this reverse DCF scenario. For reference, Sysco grew NOPAT by 6% compounded annually from fiscal 2009-2019.

Sysco’s Large Moat Means Shares Could Reach $103 or Higher

Our reverse DCF model allows us to account for Sysco’s considerable moat, which is bolstered by its distribution network and existing customer base, by evaluating its growth appreciation period (GAP). The GAP represents the number of years Sysco can grow while earning an ROIC greater than its weighted average cost of capital (WACC). Warren Buffett refers to GAP as the moat around a business’ castle.

The following valuation scenario assumes a GAP of 15 years, which could prove to be a conservative assumption due to the strength of Sysco’s expanding moat.

If we assume Sysco’s:

- NOPAT margin recovers to pre-pandemic fiscal 2019 levels of 3.7% from fiscal 2022-2031, and

- revenue grows by 12% compounded annually from fiscal 2022-2024 (equal to consensus CAGR of 12% for fiscal 2022-2024), and

- revenue grows by 4% compounded annually from fiscal 2025-2036 (below Sysco’s 15-year pre-pandemic revenue CAGR from fiscal 2004-2019), then

the stock is worth $103/share today – 36% above the current price. See the math behind this reverse DCF scenario. In this scenario, Sysco’s NOPAT CAGR from fiscal 2019-2036 is 4%. Should Sysco’s GAP extend beyond 15 years, the stock has even more upside.

Figure 3: Sysco’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

This article originally published on November 18, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.