We published an update on SYY on Nov 18, 2021. A copy of the associated Earnings Update report is here.

The COVID-19 pandemic has created significant upheaval in the restaurant and food service industries. But, the selloff in some restaurant-related stocks is too severe. Now is an excellent time for investors to buy quality businesses, with the cash flows to survive the downturn, at significant discounts. SYSCO Corporation (SYY: $48/share) is this week’s Long Idea.

SYY’s History of Consistent Profit Growth

We first made SYSCO a Long Idea in December 2017 and highlighted its high ROIC again in March 2020. Since our March report, SYY is up 55% while the S&P 500 is up 19%. However, the stock is still down 44% year-to-date (YTD) and trades at a cheaper valuation than it did in the previous economic crisis in 2008-2009.

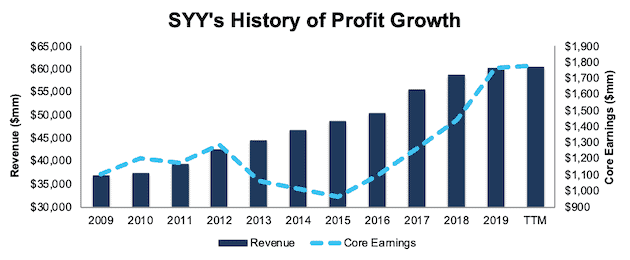

Prior to the COVID-19 outbreak, SYY had a strong history of consistent profit growth. Over the past decade, SYY grew revenue and core earnings[1] by 5% compounded annually, per Figure 1. The firm increased its core earnings margin year-over-year (YoY) in each of the last four years and its core earnings margin of 3% over the trailing-twelve-months (TTM) is up from 2% in 2015.

Figure 1: SYY Core Earnings & Revenue Growth Since 2009

Sources: New Constructs, LLC and company filings

SYY leverages its industry leading position and rising profitability to generate significant free cash flow (FCF). The company generated positive FCF in eight of the past 10 years and a cumulative $3.5 billion (14% of market cap) over the past five years. SYY’s $1.6 billion in FCF over the TTM period equates to a 5% FCF yield, which is greater than the Consumer Non-cyclicals sector average of 4%.

Executive Compensation Plan Ensures Prudent Capital Stewardship During Difficult Times

In an economic downturn, when resources are more thinly stretched, investors should look for companies with executive compensation plans that properly align executives’ interests with shareholders’ interests. Quality corporate governance ensures executives are incentivized to create shareholder value and are held accountable for capital stewardship. SYY’s compensation plan does just that.

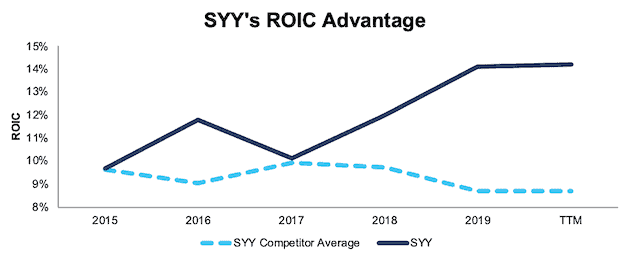

In fiscal 2019, one-third of SYY executive’s performance shares were awarded based on the firm’s three-year average adjusted return on invested capital (ROIC). SYY has included ROIC as a performance metric in its executive compensation plan since 2012. The focus on improving ROIC aligns the interests of executives and shareholders and helps to ensure quality capital allocation. Despite only including ROIC since 2012, SYY has a long history of generating a quality ROIC. The firm has maintained an ROIC above 10% in every year going back to 1998. The firm’s current ROIC of 14% is above the firm’s five-year average ROIC of 12%.

SYY’s Profitability Ranks Top Amongst Competition

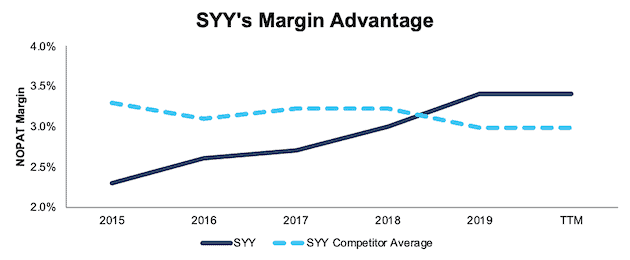

Before the stay-at-home and lockdown orders were issued across the globe, SYSCO’s profitability was trending higher while peers’ was stagnant or even falling. This superior profitability provides SYY greater resources to survive the current downturn, while also benefiting from the economic bounce back once we’re clear of the COVID-19 constraints on economic activity.

Based on data from Technomic, SYY estimates it holds 16% of the foodservice market in the U.S. The closest competitor, U.S. Foods (USFD), holds an estimated 9% of the market. SYSCO has leveraged its vast distribution network (169 distribution facilities in the U.S. and 325 worldwide) to drive competitive advantages and maintain its industry leading position. For comparisons, USFD has 72 distribution centers in the U.S.

Per Figure 2, SYY’s net operating profit after-tax (NOPAT) margin has improved from 2.3% in 2015 to 3.4% TTM. Meanwhile, the market-cap weighted average of the 14 Food Retail & Distribution firms, plus Performance Food Group (PFGC), has fallen from 3.3% to 3.0% over the same time. Peers in the group include USFD, PCGC, United Natural Foods (UNFI), SpartanNash Co. (SPTN), Core-Mark Holding Co. (CORE), and more.

Figure 2: SYY’s NOPAT Margin Vs. Competitors

Sources: New Constructs, LLC and company filings.

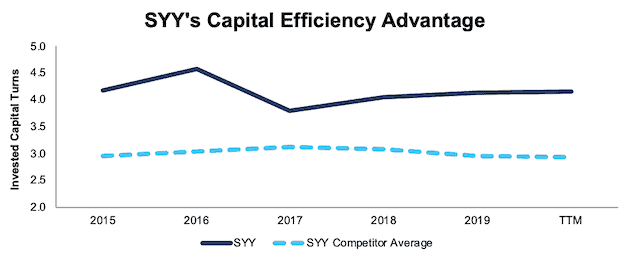

SYY’s capital efficiency is also well above peers’. Per Figure 3, SYY improved its invested capital turns from 3.8 in 2017 to 4.2 TTM. Meanwhile, the market-cap weighted average of peers fell from 3.1 to 2.9 over the same time.

Figure 3: SYY’s Invested Capital Turns Vs. Competitors

Sources: New Constructs, LLC and company filings.

The combination of rising margins and invested capital turns drives SYY’s ROIC higher. SYY has improved its ROIC from 10% in 2015 to 14% TTM. Per Figure 4, the market-cap weighted average of peers actually fell from 10% to 9% over the same time.

Figure 4: SYY’s ROIC vs. Competitors

Sources: New Constructs, LLC and company filings.

SYY’s superior profitability shows that its investment in distribution facilities, along with effective cost controls, give it a competitive advantage. Moving forward, SYY’s higher profitability allows the firm to better adapt to decreased demand in the restaurant sector while also expanding its services to other customers such as healthcare facilities and grocery stores.

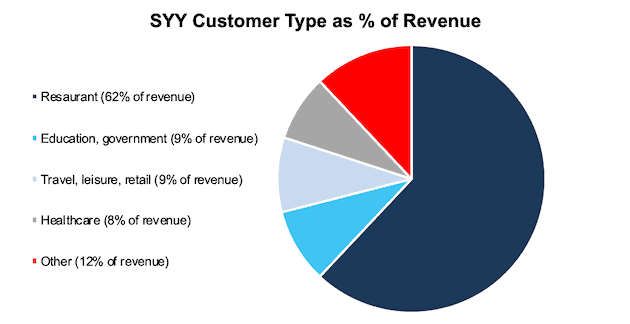

Bear Case Assumes Restaurant Sales Never Recover

There’s no refuting that the COVID-19 pandemic, has, and will, permanently alter the overall restaurant industry. With 62% of fiscal 2019 sales from restaurant customers (per Figure 5), the impact of the virus will alter SYSCO’s business as well.

Figure 5: SYSCO Customer Type Revenue Breakdown – Fiscal 2019

Sources: New Constructs, LLC and company filings

However, to believe SYY is fairly valued, one must believe that (1) the company has no ability to generate revenue during the pandemic and (2) the restaurant sector never recovers.

SYSCO has the unique benefit of being a key supplier to many restaurants still open for takeout and delivery, as these dining options see increased demand. Furthermore, SYSCO relies on a highly diversified group of suppliers, with no supplier accounting for more than 10% of purchases in fiscal 2019. This diversification provides SYY significant flexibility to shift purchases and continue providing products in a timely manner for restaurants and other customers.

To best mitigate the impacts of decreased foot traffic in restaurants, SYSCO is increasing its sales force’s focus on providing restaurant cleaning and takeout products, such as to-go containers and utensils. Furthermore, the firm is working with customers that don’t normally provide takeout or delivery to help enable these alternate methods of service.

Beyond restaurants, SYSCO’s sales force is focusing on expanding services in the grocery store business, as grocery stores struggle to meet consumer demand. The firm believes its scale and network of distribution centers offer key advantages in supplying the grocery industry in the current times. Specifically, SYY is aiming to provide logistics services to retail grocery stores and supplying grocery stores with products. These new services, which further integrate SYSCO into the grocery industry supply chain, could also provide additional growth opportunities post the COVID-19 pandemic.

SYSCO’s Financial Position Provides Liquidity

SYSCO recently announced, as of March 20, 2020, the firm had ~$2 billion in cash on hand, including the recent $1.5 billion withdrawal under its revolving credit facility. The firm also has no debt maturities within the next six months. Additionally, SYY is working with its bank partners to explore other opportunities to “raise additional funds and further strengthen its liquidity.”

Government Assistance Provides Restaurant Industry Relief

The U.S. government has provided significant relief to individuals and restaurants to help weather the downturn and remain operational until the stay-at-home orders are lifted. On March 27, 2020, President Trump signed the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which is the single largest economic relief package in U.S. history.

As part of the CARES Act, the paycheck protection program provides $349 billion in funding for small businesses, such as restaurants, adversely impacted by the coronavirus pandemic. This cash flow assistance will enable small businesses to maintain payroll, pay interest on rent/lease obligations, and cover utility payments.

This much needed assistance not only provides a stop-gap measure to keep restaurants from permanently closing during the downturn, but it also ensures restaurants are able to better serve customers once the pandemic is more under control and consumers can once again eat out. Such measures are aimed at ensuring the long-term health of the industry, and SYSCO is best positioned to aid restaurants along their path to recovery.

Executive Turnover Creates Risk, but Comes with Experience

On February 1, 2020, Kevin Hourican assumed the role of SYSCO’s president and chief executive officer, as former CEO Tom Bene stepped down. While executive turnover always creates a level of uncertainty, Mr. Hourican brings with him many years of retail and supply chain experience. Prior to SYSCO, he was executive vice president of CVS Health Corp (CVS) and president of CVS Pharmacy.

Additionally, SYSCO has weathered executive turnover in the past (Tom Bene was only in the position for two years), while continuing to grow profits and create shareholder value.

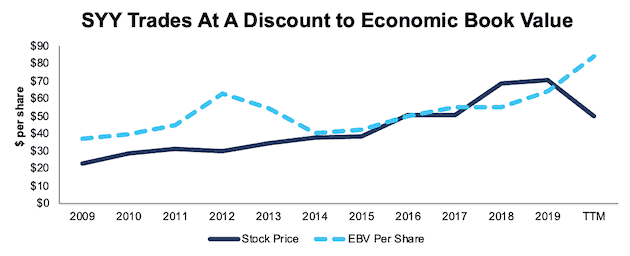

SYY Trades at Cheapest Level in Years

For long-term investors, SYY’s current price presents an opportunity to get a high-quality business at historically cheap levels. At its current price of $48/share, SYY has a price-to-economic book value (PEBV) ratio of 0.6. This ratio means the market expects SYY’s NOPAT to permanently decline by 40%. This expectation seems overly pessimistic over the long-term. For reference, SYY actually grew NOPAT YoY in 2007, 2008, and 2009 (the last prolonged economic downturn).

After falling 44% YTD, SYY now trades well below its economic book value, or no-growth value, per Figure 6. SYY hasn’t been this cheap, as measured by its PEBV ratio, since 2012.

Figure 6: SYY’s Stock Price vs. Economic Book Value (EBV)

Sources: New Constructs, LLC and company filings.

SYY’s current economic book value is $84/share – a 75% upside to the current price. Even in a conservative growth scenario, SYY has more upside potential.

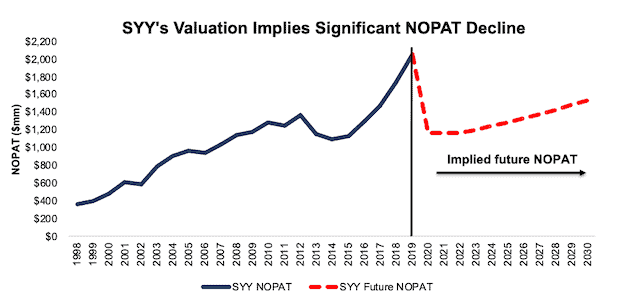

SYY’s Price Already Implies Worst-Case Scenario

Below, we use our reverse DCF model to quantify the cash flow expectations baked into SYY’s current stock price. Then, we analyze the implied value of the stock based on different assumptions about COVID-19’s impact on the restaurant industry and SYY’s future growth in cash flows.

Scenario 1: Using industry projections, SYY’s revenue breakdown, and its historical margins, we can model the worst-case scenario already implied by SYY’s current stock price. In this scenario, we assume the following:

- Margins permanently fall to 2.3% (lowest in company history), as the firm is stuck with excess inventory and too many distribution centers in an industry with reduced demand

- Restaurant industry sales fall 27% in 2020 – which is the worst-case scenario proposed by Technomic, a foodservice industry research provider – and don’t grow again for two more years

- Sales begin growing again in 2023, but only at 3.5% a year, which equals the average global GDP growth rate since 1961.

In this scenario, SYY’s NOPAT declines 44% in 2020, and 3% compounded annually over the next 11 years, and the stock is worth $48/share today – equal to the current stock price. See the math behind this reverse DCF scenario.

Figure 7 compares the stock’s implied future NOPAT decline to the firm’s historical NOPAT growth in this scenario. This worst-case scenario implies SYY’s NOPAT 11 years from now will be 25% below its 2019 NOPAT. In other words, this scenario implies that over a decade after the COVID-19 pandemic, SYSCO’s profits will have only recovered to the same level achieved in 2017. In any scenario better than this one, SYY holds significant upside potential, as we’ll show below.

Figure 7: SYY’s Implied NOPAT Decline is Severe and Long-Term

Sources: New Constructs, LLC and company filings.

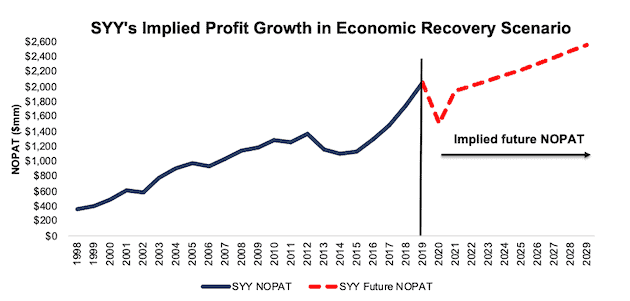

Scenario 2: Cheap Valuation Provides Significant Upside

If we assume, as does the International Monetary Fund (IMF) in its base case for GDP growth, that the pandemic threat is lessened in the second half of the year and through 2021, SYY looks even more undervalued.

In this scenario, we assume:

- Margins fall to 2.8% in 2020 (average of past five years) before returning to TTM levels (3.4%) in the following years

- Restaurant industry sales fall 17% in 2020, which is the mid-case scenario outlined by Technomic

- Sales growth returns in 2021 at the IMF’s global base-case GDP growth rate of 5.8%

- Sales continue to grow at 3.5% a year, or the average global GDP growth rate sine 1961, each year thereafter

In this scenario, SYY’s NOPAT falls 26% in 2020 and grows by just 2% compounded annually over the next decade, and the stock is worth $95/share today – a 98% upside to the current price. See the math behind this reverse DCF scenario.

It’s not often investors get the opportunity to buy an industry leader at such a discounted price.

Figure 8 compares the stock’s implied future NOPAT to the firm’s historical NOPAT in scenario 2.

Figure 8: SYY’s Implied NOPAT Assuming Global Recovery in 2021

Sources: New Constructs, LLC and company filings.

Sustainable Competitive Advantages Will Drive Shareholder Value Creation

Here’s a summary of why we think the moat around SYY’s business will enable it to continue to generate higher NOPAT than the current market valuation implies. The following competitive advantages help SYY source and provide more products at competitive prices and prevent competition from taking market share:

- Higher capital and operational efficiency than industry peers and competitors

- Industry leading distribution network achieves economies of scale

- Long-standing relationships with existing customers and ability to help new customers during time of crisis

What Noise Traders Miss with SYY

These days, fewer investors focus on finding quality capital allocators with shareholder friendly corporate governance. Instead, due to the proliferation of noise traders, the focus is on short-term technical trading trends while high-quality fundamental research is overlooked. Here’s a quick summary of what noise traders are missing:

- Consistent core earnings growth and free cash flow generation over the past decade

- Long-term industry leader best positioned to excel after the global pandemic subsides

- Valuation implies the economy never fully recovers from COVID-19

Dividend Offers Nearly 4% Yield

SYY has paid a dividend in every quarter since its founding as a public company in 1970. From fiscal 2015-2019, SYY increased its dividend by 6% compounded annually. SYY’s current quarterly dividend of $0.45/share equates to an annualized payout of $1.80/share, which gives SYY a current dividend yield of 3.8%.

In addition to dividends, SYY has returned capital to shareholders through share repurchases. However, to maintain flexibility during the current pandemic, SYY suspended its share buyback program on March 30, 2020.

Investors buying SYY at this discounted price are rewarded with a long-history of dividend growth and a current 3.8% dividend yield. Should SYY return to repurchasing shares, it could provide investors even greater yield.

An Earnings Beat of Depressed Expectations Could Send Shares Higher

The COVID-19 pandemic has sent stock prices falling, and it’s had a similar effect on consensus estimates. According to Zacks, consensus estimates at the end of February pegged SYY’s 2020 earnings at $3.79/share. Jump forward to April 13, and consensus estimates for SYY’s 2020 earnings have fallen to just $2.56/share.

While the short-term impact of the COVID-19 pandemic is yet to be seen, these lowered expectations provide a great opportunity for a high-quality business, such as SYY, to beat consensus estimates. Though our current Earnings Distortion Score for SYY is “In-Line”, SYY beat earnings estimates in 10 of the past 12 quarters, and doing so again, in the midst of such market turmoil, could send shares higher.

New Growth Opportunities From COVID-19

While eat-in demand is in decline, food delivery is growing like never before and is offsetting declines in other parts of SYSCO’s business. According to FoodBoss, an online food ordering search engine, demand for food delivery was up 23% in March over February. In Europe, delivery companies note demand is picking up and consumers are ordering much more frequently than before the outbreak.

Food delivery has long been the “future of the industry”, with billions invested into delivery platforms. The COVID-19 pandemic could push this method of business even further into the mainstream, which represents opportunity for food service providers. SYSCO’s ability to support food-delivery services, by providing takeout supplies and technological support[2], during turbulent times could build long-term relationships that capitalize on the expected growth of food delivery post the COVID-19 pandemic.

Cheap Acquisition Targets Could Drive Future Growth

Historically, SYSCO has expanded its business through the acquisition of smaller competitors and firms that complement SYSCO’s existing services. To date, SYSCO has been a smart acquirer as evidenced by its steadily rising ROIC.

A recent case in point - in 2016 SYSCO acquired Brakes Group, a leading foodservice provider in portions of Europe, for $3.1 billion. Despite the price tag, SYSCO’s ROIC improved from 12% in 2016 to 14% TTM. Furthermore, its economic earnings increased from $901 million in 2016 to $1.4 billion TTM, a clear sign of shareholder value creation.

SYSCO could benefit from the impact of COVID-19 by buying smaller players in the industry that are also trading at depressed levels. In doing so, SYSCO could grow its market share, expand its presence and/or services offered, and take advantage of lower valuations. Such prudent capital allocation could allow SYSCO to drive revenue growth even faster during any economic recovery post the current pandemic.

Insider Trading and Short Interest Trends

Over the past 12 months, insiders have purchased a total of 256 thousand shares and sold 760 thousand shares for a net effect of 504 thousand shares sold. These sales represent less than 1% of shares outstanding.

There are currently 10.4 million shares sold short, which equates to 2% of shares outstanding and 2 days to cover. Short interest is down 7% from the prior month and indicates investors are largely unwilling to bet against this industry leader.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings as shown in the Harvard Business School and MIT Sloan paper, "Core Earnings: New Data and Evidence”.

Below are specifics on the adjustments we make based on Robo-Analyst findings in SYSCO Corporation’s 2019 10-K:

Income Statement: we made $1.1 billion of adjustments with a net effect of removing $382 million in non-operating expenses (1% of revenue). See all adjustments made to SYY’s income statement here.

Balance Sheet: we made $2.7 billion of adjustments to calculate invested capital with a net increase of $2.6 billion. One of the most notable adjustments was $1.6 billion (14% of reported net assets) related to accumulated other comprehensive income. See all adjustments to SYY’s balance sheet here.

Valuation: we made $10.7 billion of adjustments with a net effect of decreasing shareholder value by $10.7 billion. There were no adjustments that increased shareholder value. Apart from $9.8 billion in total debt, the most notable adjustment to shareholder value was $695 million in underfunded pensions. This adjustment represents 3% of SYY’s market cap. See all adjustments to SYY’s valuation here.

Attractive Funds That Hold SYY

The following funds receive our Attractive-or-better rating and allocate significantly to SYSCO Corporation.

- First Trust Consumer Staples AlphaDex Fund (FXG) – 4.3% allocation and Very Attractive rating.

- Invesco DWA Consumer Staples Momentum ETF (PSL) – 2.8% allocation and Very Attractive rating.

- Carillon Eagle Growth & Income Fund (HIGJX) – 2.7% allocation and Attractive rating.

- Invesco S&P 500 Equal Weight Consumer Staples ETF (RHS) – 2.6% allocation and Very Attractive rating.

- Parnassus Core Equity Fund (PRBLX) – 2.5% allocation and Attractive rating.

This article originally published on April 15, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our core earnings are a superior measure of profits, as demonstrated in In Core Earnings: New Data & Evidence a paper by professors at Harvard Business School (HBS) & MIT Sloan. The paper empirically shows that our data is superior to IBES “Street Earnings”, owned by Blackstone (BX) and Thomson Reuters (TRI), and “Income Before Special Items” from Compustat, owned by S&P Global (SPGI).

[2] SYSCO’s restaurant management system, Cake, enables restaurants to streamline payments, waitlists, and even accept online and third-party delivery orders.