New Constructs is committed to all investors who are active in the market. This month, we are bringing you something very special. Not only is the featured stock in this Model Portfolio, it is also on our Focus List Stocks: Long.

Now, you may be asking yourself, why would we give away something so valuable? The answer:

- We genuinely believe in improving the integrity of the stock market.

- We hope to get your business one day.

The featured stock summary is an example of the research we do. It is not a full report, but we do think it is important that you’re able to see stocks like this on a regular basis. We hope you come back, and we want you to see the extreme value we deliver.

Usually, when people give away things for free, it’s because it’s worthless to them. That’s not the case here.

We usually charge $600 to $1,000 per month for access to stocks in these Model Portfolios.

We want to earn your trust. Out of the 15 stocks in the Model Portfolio this month, we chose Nucor because of the crossover with our Focus List.

Our write-up is below. We hope you enjoy it. We hope you find value. Please share with family and friends if you think it would be of interest.

As David shared in a recent training, this Model Portfolio is his favorite because you can’t put a price on the value of knowing executives’ pay is tied to creating value for investors. There’s a huge amount of work that goes into getting ROIC right, and even more to evaluate executive compensation plans. In our opinion, there’s not a better group of stocks out there.

We update this Model Portfolio monthly, and July’s Exec Comp Aligned with ROIC Model Portfolio was updated and published for clients on July 12, 2024.

Recap from June’s Model Portfolio

Our Exec Comp Aligned with ROIC Model Portfolio (-2.3%) underperformed the S&P 500 (+3.4%) from June 14, 2024 through July 10, 2024. The best performing stock in the portfolio was up 6%. Overall, 1 of the 15 Exec Comp Aligned with ROIC Stocks outperformed the S&P from June 14, 2024 through July 10, 2024.

This report leverages our cutting-edge Robo-Analyst technology to deliver proven-superior[1] fundamental research and support more cost-effective fulfillment of the fiduciary duty of care.

This Model Portfolio includes stocks that earn an Attractive or Very Attractive rating and align executive compensation with improving ROIC. This combination provides a unique list of long ideas as the primary driver of shareholder value creation is return on invested capital (ROIC).

Stock Feature for July’s Model Portfolio: Nucor Corporation (NUE: $166/share)

Nucor corporation (NUE) is the featured stock in July’s Exec Comp Aligned with ROIC Model Portfolio.

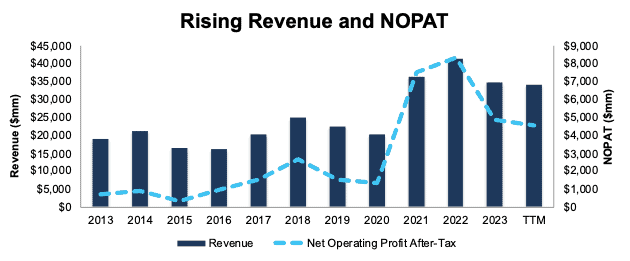

Nucor has grown revenue and net operating profit after tax (NOPAT) by 6% and 20% compounded annually, respectively, since 2013. The company’s NOPAT margin improved from 4% in 2013 to 13% in the TTM, while its invested capital turns fell from 1.5 to 1.3 over the same time. Rising NOPAT margins are enough to offset falling invested capital turns and drive the company’s return on invested capital (ROIC) from 5% in 2013 to 18% in the TTM.

Figure 1: Nucor’s Revenue & NOPAT: 2013 – TTM

Sources: New Constructs, LLC and company filings

Executive Compensation Properly Aligns Incentives

Nucor’s executive compensation plan aligns the interests of executives and shareholders by tying 25% of its annual incentive awards and 100% of the cash and restricted stock portion of its long-term incentive plan to annual Return on Average Invested Capital (ROAIC). According to Nucor’s proxy statement, the company’s executive compensation, which includes ROAIC as a key indicator of performance, is “designed to create long-term value for our stockholders and to reinforce a strong culture of ownership.”

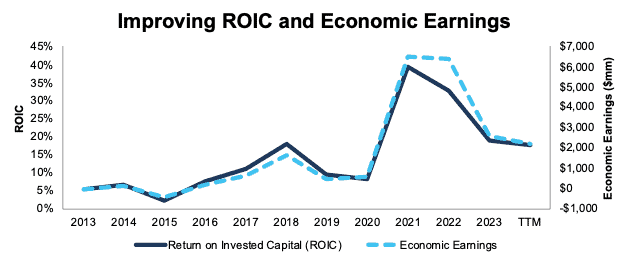

The company’s inclusion of ROAIC, a variation of ROIC, as a performance goal has helped create shareholder value by driving higher ROIC and economic earnings. When we calculate ROIC using our superior fundamental data, we find that Nucor’s ROIC has increased from 5% in 2013 to 18% in the TTM. Economic earnings rose from -$23 million to $2.2 billion over the same time.

Figure 2: Nucor’s ROIC & Economic Earnings: 2013 – TTM

Sources: New Constructs, LLC and company filings

NUE Has Further Upside

At its current price of $166/share, NUE has a price-to-economic book value (PEBV) ratio of 0.9. This ratio means the market expects Nucor’s NOPAT to permanently fall 10% from current levels. This expectation seems overly pessimistic for a company that has grown NOPAT 11% compounded annually over the last five years and 20% compounded annually since 2013.

Even if Nucor’s

- NOPAT margin falls to 12% (below TTM NOPAT margin of 13% and five-year average of 14%) and

- revenue grows 3% (below the 6% CAGR over the last ten years) compounded annually through 2033 then,

the stock would be worth $213/share today – a 28% upside. See the math behind this reverse DCF scenario. In this scenario, Nucor’s NOPAT would only grow 1% compounded annually from 2023 through 2033.

Should the company grow NOPAT more in line with historical growth rates, the stock has even more upside.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

Below are specifics on the adjustments we made based on Robo-Analyst findings in Nucor’s 10-Ks and 10-Qs:

Income Statement: we made over $900 million in adjustments with a net effect of removing over $300 million in non-operating expense. Professional members can see all adjustments made to Nucor’s income statement on the GAAP Reconciliation tab on the Ratings page on our website.

Balance Sheet: we made over $8 billion in adjustments to calculate invested capital with a net decrease of over $4 billion. One of the most notable adjustments was several billion in asset write downs. Professional members can see all adjustments made to Nucor’s balance sheet on the GAAP Reconciliation tab on the Ratings page on our website.

Valuation: we made over $13 billion in adjustments, with a net effect of decreasing shareholder value by over $3 billion. The most notable adjustment to shareholder value was for excess cash. Professional members can see all adjustments to Nucor’s valuation on the GAAP Reconciliation tab on the Ratings page on our website.

This article was originally published on July 19, 2024.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.