We closed this Long Idea on January 24, 2024. A copy of the associated Position Close report is here.

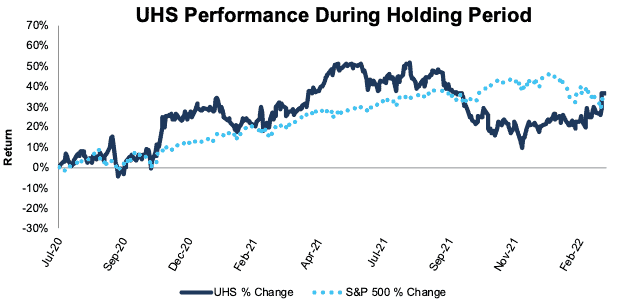

We first made Universal Health Services, Inc. (UHS: $144/share) a Long Idea in July 2020 as part of our “See Through the Dip” thesis. Since then, the stock is up 36% compared to a 34% gain for the S&P 500. The stock still presents excellent risk/reward and could be worth $228+/share today – a 58%+ upside. See our most recent report from March 2021 on Universal Health Services here.

We leverage more reliable fundamental data[1], shown to provide a new source of alpha, with qualitative research to pick this Long Idea.

Universal Health Services’ Stock Has Strong Upside Based on:

- long-term population growth trends drive profit growth

- return to post-pandemic normalcy drives rebound in acute care segment and should ease labor shortage

- the pandemic has created a huge backlog of health issues among an ever-aging population

- current valuation of the stock implies profits will permanently fall 30% below current levels.

Universal Health Services’ year-over-year (YoY) decline in return on invested capital (ROIC) in 2021 caused its Stock Rating to fall to Neutral. Despite the decline in 2021, we expect the company’s ROIC to improve going forward, in which case its stock rating will also improve.

Figure 1: Long Idea Performance: From Date of Publication Through 3/1/2022

Sources: New Constructs, LLC

What’s Working

Long-Term Market Trends: With an average number of 6,543 licensed acute care beds and 23,740 licensed behavioral care beds across more than 400 facilities, Universal Health Services is well positioned to grow revenue and profits in the midst the following secular tailwinds:

- Growing acute hospital care market: Demand for elective procedures will continue to rebound and drive growth for acute hospital care. Research and Markets expects the global acute hospital care market to grow at an 8% CAGR from 2021 – 2027.

- Growing behavioral health expenditures: With 73 million people in the U.S. with diagnosable mental illnesses, there is a significant need for Universal Health Services’ behavioral care. Report Ocean expects the global mental health market to grow at a 4% CAGR from 2022 – 2030.

- Aging population: In 2019, the 17% of the U.S. population 65 years and older represented 35% of total spending on health. The U.S. Census Bureau expects the 65+ population to grow from 56 million in 2020 to 84 million by 2050 in its low immigration scenario.

Additionally, according to Universal Health Services, its acute care centers are in markets projected to grow twice as fast as the U.S. acute care market through 2024.

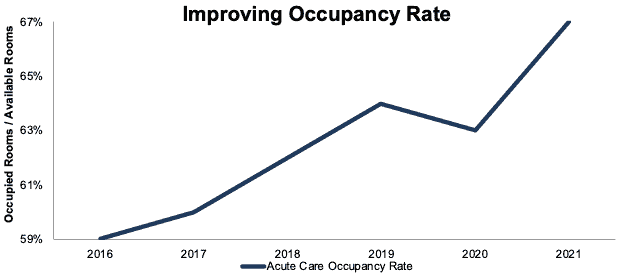

Improved Acute Segment: Universal Health Services has increasingly improved the efficiency of its acute care segment. Per Figure 2, the company improved its occupancy rate (occupied rooms / available rooms) from 59% in 2016 to 67% in 2021. Excluding 2020, the company improved its occupancy rate each year since 2017.

Figure 2: Acute Care Occupancy Rate: 2016 – 2021

Sources: New Constructs, LLC and company filings

What’s Not Working

Threats of Technological Advancements Slowing Demand: Deloitte predicts that emerging technology and the increased ability to cure and prevent diseases will cause U.S. healthcare expenditures to grow slower than the 5% CAGR over the next twenty years that the Centers for Medicare & Medicaid Services (CMS) projects. However, even when accounting for Deloitte’s projections, healthcare expenditures will still grow by 4% compounded annually, from $3.8 trillion in 2019 to $8.3 trillion in 2040.

The idea that technology will reduce spending on health care, even if amazing cures are provided, defies logic. Medical technology break throughs tend to require lots of spending, which they will not be free for patients. We can expect spending on healthcare to increase based on the growing need for treatments, whatever form those treatments take. Furthermore, technology is likely to continue to most benefit larger systems with economies of scale, such as Universal Health Services, who can maximize the number of patients per machine per day.

Rising Labor Costs: The COVID-19 pandemic and government responses to the pandemic have created a challenging labor market in the behavioral and acute care fields of medicine. This challenge has been exacerbated during regional surges in COVID-19 cases, which increases patient loads and reduces available staff. The company has successfully kept its operations well-staffed by paying premium wages. Universal Health Services salary, wages, and benefits rose 10% year-over-year (YoY) in 4Q21.

The rising cost of labor will certainly challenge the company’s margins over the near-to-midterm. The company’s net operating profit after tax (NOPAT) margin fell from 9% in 2019 to just 8% in 2021. However, even with lower margins, the expectations implied in the stock for the healthcare providers’ future cash flows are too negative, as we’ll show below.

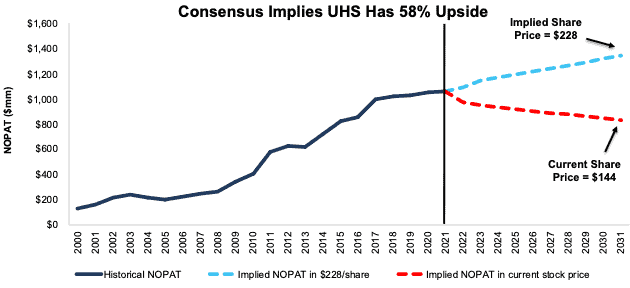

Stock Is Priced for Permanent Profit Decline of 30%

Universal Health Services’ price-to-economic book value (PEBV) ratio of 0.7 means the stock is priced for profits to fall, permanently, by 30% from current levels. Below, we use our reverse discounted cash flow (DCF) model to analyze the expectations for future growth in cash flows baked into a couple of stock price scenarios for Universal Health Services.

In the first scenario, we assume Universal Health Services’:

- NOPAT margin falls to 7.8% (10-year low vs. 8.4% in 2021) from 2022 – 2031, and

- revenue falls by 2% compounded annually from 2022 – 2031.

In this scenario, Universal Health Services’ NOPAT falls 3% compounded annually over the next decade and the stock is worth $144/share today – equal to the current price. For reference, Universal Health Services grew NOPAT by 6% compounded annually over the past decade.

Shares Could Reach $228 or Higher

If we assume Universal Health Services’:

- NOPAT margin remains at 2021 levels of 8.4% in 2022 – 2031,

- revenue grows at consensus estimates of 3% in 2022 and 5% in 2023, and

- revenue grows by just 2% compounded annually from 2024 – 2031, then

the stock is worth $228/share today – 58% above the current price. In this scenario, Universal Health Services grows NOPAT by just 2% compounded annually from 2022 to 2031. Should Universal Health Services grow NOPAT more in line with historical growth rates, the stock has even more upside.

Figure 3: Universal Health Services’ Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

This article originally published on March 2, 2022.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.