In our webinar last week, we discussed how to avoid stocks whose high dividend yields were a trap. This week’s Long Idea not only pays a quality dividend, but when combined with aggressive share repurchases, provides investors a yield over 9%. Best of all, it is anything but a trap. With consistent profit growth, strong free cash flow, and the opportunity for share price appreciation, Brocade Communications Systems (BRCD: $11/share) is this week’s Long Idea.

A Quality Business That Consistently Grows Profits

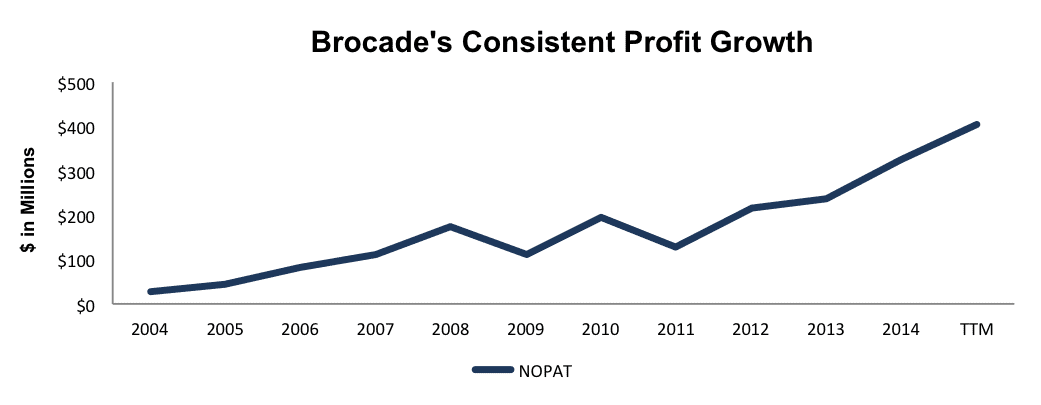

Brocade Communications was our Hot Stock in January 2015, and since then the company has only gotten more attractive. Brocade Communications has built a highly profitable networking hardware and software business. Over the past decade, Brocade Communications has grown after-tax profit (NOPAT) by 28% compounded annually as can be seen in Figure 1.

Figure 1: Brocade’s History of NOPAT Growth

Sources: New Constructs, LLC and company filings

The growth in profits is not only attributable to growing revenues but also to increased operating efficiency. NOPAT margins are up from 5% in 2004 to 18% on a trailing twelve-month basis. Additionally, Brocade earns a top quintile return on invested capital (ROIC) of 17%, which is a vast improvement from the 4% earned in 2004.

Much like other mature technology companies, Brocade has become a cash-generating machine and generated a cumulative $1.6 billion in free cash flow from 2010-2014. Brocade currently earns a 4.4% FCF yield. With such high free cash flow, the company has ample ability to continue paying its dividend, repurchasing shares, and invest in R&D.

Brocade’s Profitability Provides Competitive Advantage

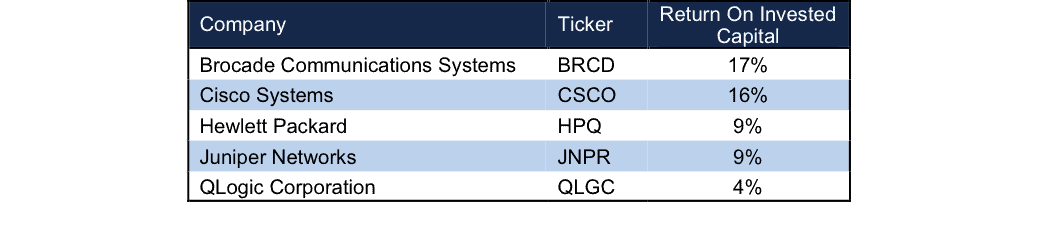

Brocade built its industry leading position by providing fibre channel storage area network (SAN) products to customers throughout the world. With its 17% ROIC, Brocade operates in this market more profitably than its largest competitors, as can be seen in Figure 2. Higher profitability provides Brocade a strong competitive advantage in pricing power and operational flexibility.

Figure 2: Brocade’s Superior Profitability

Sources: New Constructs, LLC and company filings.

Brocade’s industry leading position in the SAN market also provides the company the ability to invest heavily in the future of networking. Since 2010, Brocade has invested anywhere from 16%-18% of revenues in R&D, which has led to the creation of products and services that position Brocade to lead the next generation of data transmission and storage.

Bear Concerns More Than Priced In

As data storage and transmission has moved to the cloud, new requirements have followed suit. Data transmission must be faster, more responsive, and scalable. The old ideas of building traditional data centers no longer apply. Many bears believe that because much of Brocade’s business was built upon fibre channel technology, a system that can be limiting and expensive, they will not be able to succeed moving forward as organizations adapt newer Internet Protocol technologies. Not only is this concern very short sighted, it ignores the success Brocade has already achieved with their IP networking products segment, which provides solutions to today’s constantly changing data/storage needs. This segment aims to bring the same quality and performance Brocade is traditionally known for to new and existing clients looking to “future proof” their data requirements. This segment has seen excellent growth and in 3Q15 made up 28% of revenues, up from 24% in 3Q14. Overall, through 3Q15, IP Networking Products revenue is up 20% year-over-year. Meanwhile, traditional SAN product revenue was down only 3% through 3Q15 and the growth of the IP networking more than offset the decline.

Further diminishing the bear case, it is estimated the Enterprise data storage market will grow 15% compounded annually from 2015-2019. As long as companies continue to store large amounts of data and consumers continue to consume that data, there will be a need for Brocade’s products to help facilitate the transmission of the data in an effective and efficient way. Better yet, over 1/3 of Internet traffic moves across Brocade devices and 90% of Global 1000 organizations use Brocade devices. This vast reach provides Brocade ample opportunities to upsell new IP products and continue growing the business. By continually investing in R&D, Brocade has positioned itself to meet the needs of virtualization, cloud adoption, and the Internet of Things movement. Nevertheless, the current share price would imply that Brocade has lost all competitive advantages and will cease to grow profits moving forward, as we’ll show below.

Share Price Is Significantly Undervalued

Despite the excellent fundamentals and competitive position highlighted above, BRCD is down 10% year-to-date. This decline has left shares undervalued and provides an excellent entry point for investors. At its current price of $11/share, Brocade has a price to economic book value (PEBV) ratio of 0.8. This ratio means that the market expects the company’s profits to permanently decline by 20%. This expectation seems rather pessimistic given that Brocade grew NOPAT by 28% compounded annually over the past decade.

Even if Brocade were to never again grow profits from their current levels, the economic book value, or no growth value of the firm is $13/share – a 30% upside from current prices.

But if Brocade can grow NOPAT by just 6% compounded annually for the next decade, the stock is worth $15/share today – a 50% upside.

Dividends and Share Repurchases Reward Shareholders

At the end of Brocade’s 3Q15, the company had repurchased $312 million worth of shares and had $352 million remaining in authorized repurchases. In September, the company announced an addition of $700 million to its repurchase program, which increased the total authorized to just over $1 billion. If Brocade continues repurchasing shares consistent with fiscal 2014 levels ($335 million), the current authorization would last another three years. $335 million represents 7.6% of the current market cap, which provides investors with a total yield of 9.3% when combined with Brocade’s 1.7% dividend yield. Management has recognized the current undervaluation of shares and is taking the opportunity to reward shareholders with an impressive 9% yield. Best of all, with positive free cash flow and a free cash flow yield of 4%, Brocade certainly doesn’t appear to be a yield trap.

Negative Expectations Allow Room for Shares To Rise

When competitor QLogic (Neutral Rating) warned that its previous revenue guidance was well above what actual results would be in July, the entire data storage industry sold off, including Brocade. This warning also caused the market to adjust its view of Brocade, which has provided ample room for the company to surpass such low expectations. Those who sold BRCD when QLCG warned ignored the vastly different profitability of the two companies (4% ROIC for QLGC vs. 17% ROIC for BRCD). With greater pricing power and significant cash flow generation, Brocade can withstand a slowed market much better than competitors. Moving forward, we believe Brocade will continue to impress the market with the expansion/upsell of its IP Network products and continue generating profits from the traditional SAN network, even if at a lower pace than in the past. With such low expectations, significant upside, and 9% yield, it’s clear there are multiple catalysts to push BRCD higher.

Insider Trends/ Short Sales Raise No Red Flags

Over the past 12 months, insiders have purchased ~139,000 shares and sold ~643,000 shares for a net effect of ~504,000 insider shares sold. This amount represents less than 1% of shares outstanding. Additionally, short interest sits at just 10.5 million shares, or just above 2% of shares outstanding.

Executive Compensation Passes The Test

Brocade’s executive compensation could be improved by focusing on ROIC, which better measures shareholder value creation. Nevertheless, the current executive compensation plan gives no cause for alarm. Brocade executives receive at-risk performance-based awards, either cash or equity awards, for up to 90% of their compensation. Cash awards are given based upon meeting target total revenue, data center IP revenue, and free cash flow metrics. Equity awards are given in accordance with peer group analysis and the total awards issuable are based upon BRCD’s stock performance relative to the NASDAQ Telecom Index. While Brocade’s executive compensation plan could certainly be improved, it has not detracted management from creating true shareholder value over the company’s history.

Impact of Footnotes Adjustments and Forensic Accounting

We have made several adjustments to Brocade’s 2014 10-K. The adjustments are:

Income Statement: we made $182 million adjustments with a net effect of removing $88 million (3% of revenue) of non-operating expenses. We removed $47 million in non-operating income and removed $135 million in non-operating expenses.

Balance Sheet: we made $1.7 billion of balance sheet adjustments to calculate invested capital with a net decrease of $827 million. The largest adjustment made was the removal of $1.1 billion due to excess cash. This adjustment represented 36% of reported net assets.

Valuation: we made $2.1 billion of shareholder value adjustments with a net increase of $334 million. The most notable adjustment to shareholder value was the removal of $61 million due to off-balance sheet operating leases, which represents 1% of Brocade’s market cap.

Attractive Funds That Hold BRCD

The following funds receive our Attractive-or-better rating and allocate significantly to Brocade.

- iShares Goldman Sachs Network Index Fund ETF (IGN)– 3.8% allocation and Attractive rating

- Fidelity Select Communications Equipment Portfolio (FSDCX) – 5% allocation and Very Attractive rating

- Fidelity Advisor Series VII Communications Equipment Fund (FDMIX) –3.4% allocation and Attractive rating.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Photo Credit: st4nd3l (Flickr)