Our Long Idea reports aim to identify firms that, despite market fears, unimpressive GAAP earnings, and other noise, have profitable businesses and highly undervalued stock prices.

All of our reports aim to show investors how to use our research and display the transparency of our analytical process. However, we understand that at the end of the day, investors care about one thing: performance. It matters very little what we think about our analysis if the market disagrees.

2018 was not a good year for our Long Ideas. Just 18 out of 50 Long Ideas outperformed the market. The average performance of our picks was -13% compared to -7% for the S&P 500.

Just as we did with our Danger Zone picks, we’re going to examine some of our worst-performing calls from 2018 and determine which picks were bona fide mistakes and which only offer more upside.

The Retail Rebound

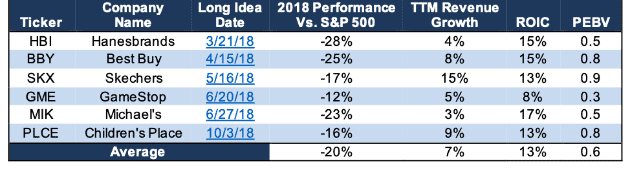

We bet big on retail in 2018. Some of our retail picks, such as Winmark (WINA) and Walmart (WMT), outperformed, but most struggled. In particular, we recommended a number of small, specialty retailers that we believed had carved out defensible niches. As Figure 1 shows, our Long Ideas on Hanesbrands (HBI), Best Buy (BBY), Skechers (SKX), GameStop (GME), Michael’s (MIK), and Children’s Place (PLCE) all underperformed the S&P 500 by double digits.

Figure 1: Performance of Retail Picks 2018

Source: New Constructs, LLC and company filings

However, Figure 1 also shows that the fundamentals of these firms remain strong. On average, these six companies have grown revenue by 7% over the TTM period and earn a return on invested capital (ROIC) of 13%.

Despite the fact that these are profitable and growing businesses, the stocks have an average price to economic book value (PEBV) ratio of 0.6, which means the market expects the net operating profit after tax (NOPAT) of these companies to permanently decline by 40%.

The market still seems to be buying into the “Retail Apocalypse” narrative. The primary scenario that justifies the market’s low expectations is the one where Amazon (AMZN) and other e-tailers take massive chunks of market share from these companies. This scenario, as we’ve shown, ignores the reality that brick and mortar sales continue to grow at a steady pace, not decline as the stock prices predict.

The persistent and growing undervaluation of these stocks speaks to the rising influence of noise traders in the market and the ways in which valuations can remain irrational for extended periods of time.

The Rise of the Noise Traders

Noise traders – individuals that distort the market by trading on incomplete or inaccurate information – have been discussed by academics and investors alike for decades.[1] However, the rise of self-directed investors, the relentless noise of the financial press, and the increasing flow of capital to passive index funds amplifies the problems created by noise traders.

More than a quarter of all adults in the U.S. with internet connections currently act as self-directed investors. Some of these investors may be performing diligent analysis, but many won’t have the time or expertise to do so. In addition, research suggests that many self-directed investors trade as much for enjoyment as they do to make money. Betting on the “retail apocalypse” narrative is more fun than diligently reading through 200+ page 10-K’s to analyze the true cash flows of these businesses.

ETFs Undermine Market Efficiency

In addition, the rise of passive index investing means too many stocks move in sync even though they have nothing in common except for membership in the same ETF. While reports of the death of retail have been greatly exaggerated, it’s true that competitive pressure from Amazon and others have led to significant challenges for poorly run retailers such as Sears (SHLDQ). The poor performance of these struggling retailers may lead investors to exit retail-heavy funds, which in turn creates unnecessary selling pressure on the profitable retailers in Figure 1.

Making Value Investing Profitable Again

The more influence noise traders have, the less incentive dedicated value investors have to incur the cost of endeavoring to make markets more efficient. In other words, being a true value investor has not paid well for much of the past 25 years. We still believe our analysis of the retail sector is correct, but any fund manager that invested based on our analysis in 2018 underperformed significantly.

We still believe these stocks will move towards their fair values over the long-term, and we’ve seen evidence of that already in 2019. GameStop (GME) is up 25% so far in 2019 after news of a potential private equity buyout, bringing the stock back into positive territory since our original call.

We expect other dedicated investors, whether that’s private equity, large institutions, or increasingly sophisticated individuals, to spur similar price increases for the other retailers in Figure 1 going forward.

One We Got Wrong

Being a value investor sometimes means sticking to your guns even when the market turns against you (see above), but it also means being willing to acknowledge when you’re wrong. While we stand by our retail call, there are some Long Ideas from 2018 that we no longer have confidence in.

In particular, jet-leasing company Aircastle Corp (AYR) was one of our worst performers in 2018. From our original article on January 24 through the end of the year, the stock declined by 29% while the S&P 500 fell by 10%. In our original thesis, we highlighted the company’s consistent growth, superior profitability compared to peers, and cheap valuation.

In the year since our article, AYR’s NOPAT is down 15% TTM and its ROIC has fallen below competitor AerCap Holdings (AER). Its PEBV of 0.6 looks cheap, but it’s the highest valuation of the stock since 2007. What’s worse, economic earnings and free cash flow have turned negative.

Looking back, it appears that we underestimated the impact of rising interest rates and fuel costs on the company’s business, while putting too much emphasis on the stock’s low PEBV. In addition, we missed the financial troubles at a major customer, Avianca Brazil (AVH), which declared bankruptcy in December.

AYR is up 10% so far in 2019 as the entire sector has been lifted by the news that GE’s (GE) jet leasing business may be acquired by Apollo Global Management. This bounce marks an opportunity to officially close our recommendation on AYR and cut our losses on a pick we got wrong.

This article originally published on January 9, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] See the 1987 NBER paper “The Economic Consequences of Noise Traders” by De Long, Shleifer, Summers, and Waldmann.