We published an update on this Long Idea on May 4, 2022. A copy of the associated Earnings Update report is here.

We published an update on this Long Idea on April 28, 2021. A copy of the associated Earnings Update report is here.

Added to our Focus List – Long Model Portfolio on May 16, 2018.

Earnings season can provide opportunities to investors who are willing to buck the market trend. It can be scary to buy a stock that’s just dropped 30%, but sometimes the drop is simply an overreaction to one bad quarter. If the long-term trend in fundamentals remains intact, an unwarranted drop in valuation can lead to a great buying opportunity.

We recommended this stock to investors in April 2016, and we doubled down on the call after it dropped 25% on an earnings miss a few months later. The stock rebounded and ended up outperforming the market over a two-year holding period, after which we closed the position this March. However, a recent 30% price decline after Q1 earnings leaves the stock undervalued again and makes Skechers (SKX: $30/share) this week’s Long Idea.

Long-Term Profit Growth is Strong

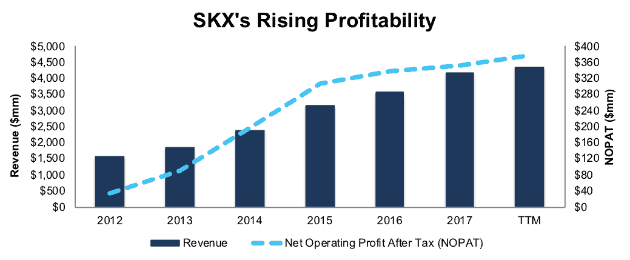

When we first recommended Skechers, we highlighted its rapid growth, both top and bottom line. At the time, the company had grown revenue by 32% and after-tax operating profit (NOPAT) by 57% in the most recent year. That high level of growth was obviously not sustainable, but we believed that Skechers could continue to grow at an above-average rate for several years.

Sure enough, Skechers has maintained double-digit revenue growth over the past two years. Revenue is up 19% and NOPAT is up 13% year over year for the trailing twelve months (TTM) period. Figure 1 shows the company’s steady growth in revenues and profits since 2012.

Figure 1: Consistent Growth in Revenue and NOPAT

Sources: New Constructs, LLC and company filings

More impressively, Skechers has managed this growth while also earning a high return on invested capital (ROIC). The company has improved its ROIC from 2% in 2012 to 13% TTM. NOPAT margins have improved from 2.2% to 8.7% over that time, while average invested capital turns (a measure of balance sheet efficiency) are up from 1.1 to 1.5.

These metrics declined slightly from their peak in 2016 and 2017 due to heavy investment in new store openings and distribution facilities, but 1Q18 showed that they are starting to rebound as those investments pay off.

Earnings Drop Creates Opportunity

The 30% drop in Skechers’ stock price after 1Q18 was especially unwarranted given that its earnings report was actually quite good. Revenue was up 17% year over year, pre-tax earnings from operations were up 20%, and gross margins improved to 46.6%, up from 44.8% the year before.

Despite these positives, the market focused on the disappointing guidance from management. The company projected 2Q18 revenues of $1.12 billion to $1.145 billion (10% YoY growth) and EPS of 38-43 cents (8% growth). Meanwhile, analysts had been projecting 2Q18 revenues of $1.157 billion (13% growth) and EPS of 57 cents (50% growth).

While those 2Q18 projections are legitimately disappointing, it’s important to note the inherent lumpiness of Skechers’ business. ~70% of its sales still come through wholesale distributors, and the timing of sales to those distributors can have a big impact on any individual quarter. A large part of the decrease in expectations for 2Q18 comes from the company’s expectation that shipments to several key distributors will be pulled back from 2Q18 into the second half of 2018.

We saw a similar overreaction to disappointing earnings in July of 2016. 2Q16 earnings came in poor with revenue growth of ~10% and EPS slightly down year over year, which caused the stock to drop over 20%. The quarter had been negatively impacted by shipments pulled forward into 1Q16 as well as a difficult comp from the prior year, which was inflated due to pent up demand from U.S. port issues.

Despite the poor quarter, full year 2016 revenue increased by 13% while NOPAT grew by 9%. Investors that bought in after the initial drop post 2Q16 saw SKX rise 75% prior to the recent drop post 1Q18. Even after this recent decline, investors that bought right after the drop in July 2016 are up ~21%, roughly in line with the market.

SKX is a volatile stock, but buying the dip can be a good path to long-term profits.

Investors Underrate Skechers Brand

The strong negative reaction to every bad quarter highlights the market’s skepticism of the Skechers growth story. Investors just can’t seem to believe that a company like Skechers can compete with premium brands such as Nike (NKE), Adidas, and Under Armour (UAA).

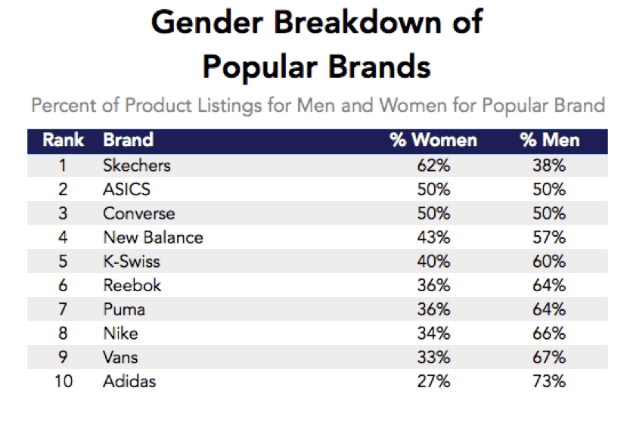

These skeptics are half-right. Skechers certainly doesn’t have the “cool” factor of these brands, and it’s not going to win the coveted market of young men spending $100+ on a pair of shoes. However, management understands this fact, which is why they have focused on demographics that larger athletic footwear companies tend to ignore: seniors and women.

Figure 2: Skechers Wins with Women

Sources: datafinity

Figure 2 shows that Skechers is the only major sneaker brand to market its shoes more heavily to women than to men. By targeting an underrepresented market, Skechers has built a valuable brand at a cheaper price. Nike and Under Armour both spend ~10% of revenue on advertising, and they end up in bidding wars to sponsor NBA stars such as Kevin Durant. Skechers only spends 6% of revenue on advertising, and it engages in much cheaper sponsorships, such as golfer Brooke Henderson and Olympic distance runner Kara Goucher, as well as retired athletes like Joe Montana to appeal to seniors.

Because it’s spending less money on high-end sponsorships, Skechers can afford to sell its shoes at a much lower price. According to its most recent 10-Q, the average selling price per pair in the domestic wholesale unit was just $20.53 in 1Q18. Even factoring in a decent markup from retailers, that’s well below the $65-$175 range that the most popular shoes from Nike, Adidas, and Under Armour sell at.

Skechers might not be “cool,” but it has built a valuable brand around comfort, quality, and affordability. It’s never going to earn the outsized profits of a company like Nike that can charge $200 for a pair of Jordans, but it is well positioned in a growing segment of the market.

Investments in Manufacturing and Distribution Continue to Pay Off

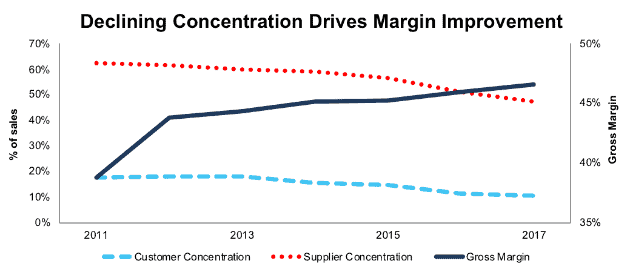

One of the key points in our original Long Idea on Skechers was that the company’s declining customer and supplier concentration would give it increased margin flexibility. We highlighted the fact that the share of products coming from its five largest suppliers had declined from 71% in 2010 to 57% in 2015, while the share of sales to its five largest customers had dropped from 25% in 2009 to 15% in 2015.

Figure 3 shows the continuation of that trend. The share of its top five suppliers is down to 48% in 2017, while the top five customers now account for just 11% of sales. This growing diversification helped Skechers achieve record high gross margins of 47% in 2017.

Figure 3: Trend in Concentration and Margins Since 2011

Sources: New Constructs, LLC and company filings.

Skechers’ declining customer concentration has come primarily from the growth of its retail and international segments. The company has been growing its retail store count at an annual rate of 15%, and it now has about 700 company owned stores worldwide, along with ~2,000 stores operated by third-party distributors or joint venture partners.

These stores have been extremely successful and continue to grow rapidly, with same-store sales growing 9.5% year over year in 1Q18. The company is also growing its e-commerce business rapidly, especially in China, where online sales are growing in the high double digits. The success of Skechers’ retail strategy is a further testament to the strength of its brand.

Skechers has supported its growing retail presence through increased investment in distribution. The company expanded its European distribution facility in 2016, and it plans to break ground this year on a new distribution center in China that will be completed in 2019. This distribution center should help the company meet its goal of $1 billion in Chinese sales.

On the supplier side, Skechers’ decreased concentration has been a product of its more diversified product offering. In addition, the company has moved away from relying almost entirely on Chinese suppliers by shifting some production to Vietnam. By diversifying its suppliers, Skechers has more price leverage and less risk that issues with any one supplier will cause a major disruption to its supply chain.

Focus on Domestic Wholesale Business Misses the Whole Picture

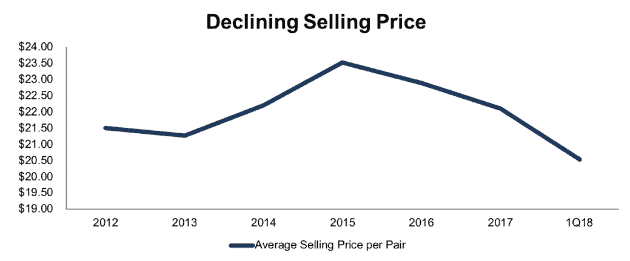

Analysts that are bearish on Skechers tend to focus on the company’s challenges in its domestic wholesale segment. They note that growth in the North American footwear market is relatively slow, competition is fierce, and prices are declining. As Figure 4 shows, the average selling price per pair for Skechers’ domestic wholesale business has declined from a peak of $23.53 in 2015 to $20.53 in 1Q18.

Figure 4: SKX Average Price Per Pair Since 2012

Sources: New Constructs, LLC and company filings.

Despite that price decrease, Skechers’ domestic wholesale segment continues to grow. Sales were up 8.5% in 1Q18, as a 15% increase in unit sales more than offset the price decline. The company’s unique branding and low prices continue to help it increase its market share.

Gross margins are down in the domestic wholesale segment, but as shown in Figure 3 they are still up overall. The domestic wholesale business now represents just 30% of Skechers’ revenue, and that share is declining. The company’s primary growth opportunities come through its international wholesale and retail segments, both of which have rising gross margins.

Bears see Skechers as a company that is going to get squeezed out of the sneaker wars by bigger and flashier competitors. In reality, it has mostly avoided direct competition with these companies by selling at a different price point and diversifying its customer base internationally.

Improving ROIC Correlated with Creating Shareholder Value

Numerous case studies show that getting ROIC right is an important part of making smart investments. Ernst & Young recently published a white paper that proves the material superiority of our forensic accounting research and measure of ROIC. The technology that enables this research is featured by Harvard Business School.

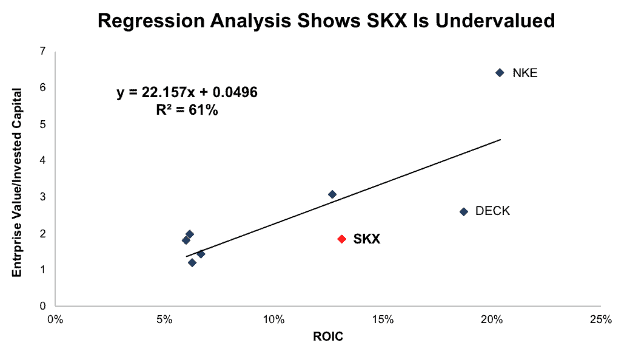

Per Figure 5, ROIC explains 61% of the difference in valuation for the eight footwear stocks we cover. After its recent drop, SKX trades at a significant discount to peers as shown by its position below the trendline in Figure 5. The company’s enterprise value/invested capital (a cleaner version of price to book) of 1.85 implies that the market expects its ROIC to decline to 8%. That’s a pessimistic expectation for a company with a 13% ROIC that is up year over year.

Figure 5: ROIC Explains 61% of Valuation for Footwear Stocks

Sources: New Constructs, LLC and company filings.

If the stock were to trade at parity with its peers, it would be worth $50/share, a 65% upside to the current stock price. The only footwear stock to trade at a similar discount is Deckers (DECK), which has grown revenue by just 4% over the past twelve months compared to Skechers 19% growth rate.

SKX Offers Significant Upside

For bears that believe Skechers’ growth rate will decline, it’s important to note that the stock’s valuation already reflects total stagnation.

At its current price of $30/share, Skechers has a price to economic book value (PEBV) of 1.0. This ratio implies that the market expects the company to never meaningfully grow NOPAT again.

Traditional valuation metrics don’t reflect how undervalued Skechers is. It’s P/E ratio of 22.4 is perfectly in line with the Consumer Cyclicals average. A $100 million (2% of revenue) one-time tax charge artificially decreased the company’s GAAP net income and now masks how cheap the stock really is.

If Skechers can maintain 2017 pre-tax margins of 10.6% (while benefiting from a decline in its cash tax rate to 15%) and grow revenue by 7% compounded annually over the next decade, the stock is worth $47/share today, a 57% upside to the current stock price. See the math behind this dynamic DCF scenario here.

In this scenario, Skechers would be earning $8.5 billion in revenue in 2027. The global athletic footwear market is projected to be ~$100 billion by that point, so Skechers would only have an 8-9% market share. Skechers doesn’t need to win the sneaker wars to create value for shareholders, it just has to continue carving out a profitable niche.

Executive Compensation Plan Could be Improved but Hasn’t Led to Value Destruction

Skechers gives little detail about its executive compensation practices. Annual incentives are tied solely to net sales growth. While sales growth doesn’t take into account the importance of profitability or the balance sheet, it is at least harder to manipulate than other common target metrics such as Adjusted EBITDA.

Long-term equity grants are made periodically and are only time-restricted, with no performance conditions for vesting. We would like to see Skechers tie long-term compensation to ROIC so that management does not fall into a “growth at any cost” mindset that ends up destroying value for shareholders. The is a strong correlation between improving ROIC and increasing shareholder value[1], and tying exec comp to ROIC ensures that executives’ interests are properly aligned with shareholders.

However, Skechers’ compensation plan has not led to shareholder destruction so far. The company has grown economic earnings, the true cash flows of the business, from $29 million in 2007 to $172 million in 2017, or 19% compounded annually.

Earnings Beats or Acquisition Could Drive Shares Higher

After its disappointing forecast for Q2, Skechers has set the bar so low that it should be relatively easy to jump over. Just as Skechers has a history of overreacting to earnings disappointments, the stock has also historically jumped big on earnings beats. Last October, the stock gained roughly 40% after Q3 earnings beat expectations. Investors that buy Skechers now get the benefit of extremely low expectations for future growth.

Additionally, the company’s cheap valuation could make it an acquisition candidate for an apparel retailer that wants to expand its footwear presence. Apparel company VF Corp (VFC) – which owns brands such as Vans, North Face, JanSport, and Wrangler, among others – makes sense as a potential acquirer. Skechers would fit into the company’s suite of outdoor, active brands while helping it significantly expand its retail footprint and distribution capabilities.

Even assuming zero synergies or growth, VFC could pay $33/share for Skechers and earn an ROIC equal to its cost of capital (WACC) at Skechers’ current $378 million in annual NOPAT. Given Skechers’ growth rate and the significant synergies the companies would have – such as eliminating redundancies, cross-selling between brands, and increasing leverage – one would have to imagine that VFC would be willing to pay significantly more.

Insider Trading and Short Interest Are Minimal

Insider activity has been minimal over the past 12 months with 1.35 million shares purchased and 1.26 million shares sold for a net effect of 83 thousand shares purchased. These purchases represent less than 1% of shares outstanding.

There are currently 9 million shares sold short, which equates to 7% of the float and 1.1 days to cover.

Share Repurchase Signals Confidence

In recent history, Skechers has not paid a dividend or bought back shares, instead preferring to reinvest profits in the business. However, the company authorized a $150 million (3% of market cap) buyback program in February and bought back $3 million worth of shares in Q1.

This buyback remains comparatively small, but it signals confidence in the company’s future and a belief that their profits will be more than enough to fund future investment opportunities.

Critical Details Found in Financial Filings By Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments we make based on Robo-Analyst[2] findings in Skechers’ 2017 10-K:

Income Statement: we made $197 million of adjustments, with a net effect of removing $171 million in non-operating expense (4% of revenue). We removed $13 million in non-operating income and $184 million in non-operating expenses. You can see all the adjustments made to SKX’s income statement here.

Balance Sheet: we made $2.1 billion of adjustments to calculate invested capital with a net increase of $740 million. The most notable adjustment was $1.2 billion in operating leases. This adjustment represented 58% of reported net assets. You can see all the adjustments made to SKX’s balance sheet here.

Valuation: we made $2 billion of adjustments with a net effect of decreasing shareholder value by $1 billion. Apart from $1.3 billion in total debt, which includes the $1.2 billion in operating leases noted above, the largest adjustment to shareholder value was $483 million in excess cash. This cash adjustment represents 10% of SKX’s market cap. Despite the net decrease in shareholder value, SKX remains undervalued.

Attractive Funds That Hold SKX

The following fund receives our Attractive-or-better rating and allocate significantly to Skechers.

- Innovator IBD 50 ETF (FFTY) – 2.0% allocation and Attractive rating.

This article originally published on May 16, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Ernst & Young’s recent white paper “Getting ROIC Right” demonstrates the link between an accurate calculation of ROIC and shareholder value.

[2] Harvard Business School features the powerful impact of our research automation technology in the case study New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

Click here to download a PDF of this report.

Photo Credit: Rainmain Lin (Flickr)