We closed this position on November 3, 2016. A copy of the associated Position Update report is here.

Much like our recent Long Idea on General Motors (GM), this week’s long idea is a company that has excellent fundamentals but poor technicals. Long-term investors should be licking their chops as this stock offers a 9% yield (dividend plus share buybacks) in addition to meaningful capital appreciation potential. This week’s Long Idea is Qualcomm Inc. (QCOM: $55/share).

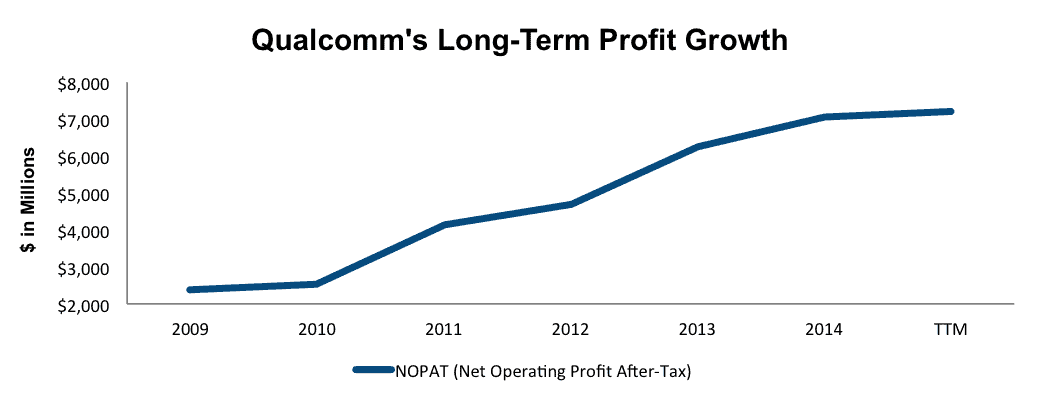

Profit Growth is Strong Through The Years

Our thesis on Qualcomm has not changed since last December. In the current market turmoil, we think this stock is one where investors can find safety of principle and good returns. Because Qualcomm is not growing profits as rapidly as it has in the past, the market is unfairly punishing the shares. Even if the rate of growth has slowed, the company’s performance since 2009 is impressive:

- After-tax operating profits (NOPAT) have grown 24% compounded annually

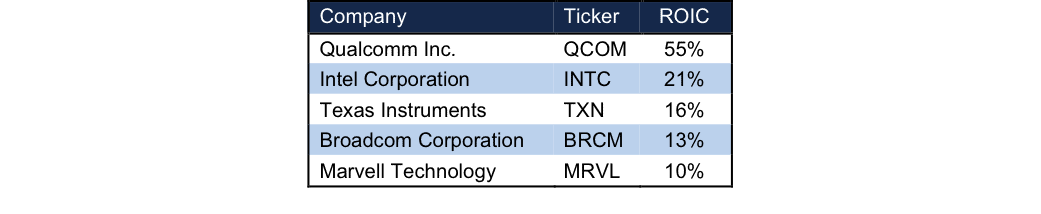

- Return on invested capital (ROIC) is also up from 22% to a top-quintile 55%

- The company has generated over $26 billion in free cash flow

Figure 1: Qualcomm’s Impressive Profit Growth

Sources: New Constructs, LLC and company filings

Qualcomm Possesses a Formidable Competitive Advantage

Qualcomm has one of the best competitive advantages in the industry: its high ROIC. A company with a higher ROIC is able to internally sustain higher R&D spending than a company with a lower ROIC. Over the past three years alone, Qualcomm has spent 20% of revenue on R&D, or around $4 billion a year, while achieving one of the highest ROICs in the industry and growing into the world’s largest mobile chipset supplier.

Figure 2: Qualcomm: Best In Class Returns on Invested Capital

Sources: New Constructs, LLC and company filings

Bear Case Is Short-Sighted

The current stock price implies Qualcomm’s profits will permanently decline by 30%. We think that expectation is far too pessimistic even in the face of the bear arguments.

The main bear argument is that Qualcomm, because of the problems with Snapdragon 810, has permanently lost market share and profit potential. The company is in a competitive business, true, but not so competitive that one misstep takes you out of the game. We do not think that Qualcomm has lost its innovative abilities.

What the bear concerns fail to recognize is the strategic advantage Qualcomm gets from its profitability. Spending ~$4 billion a year on R&D is more than likely going to produce something good eventually, especially for a firm like Qualcomm that has a history of producing market-leading technology. Case in point here is the Snapdragon 820, Qualcomm’s next mobile processor. The 820 is expected to offer faster performance, better power efficiency, and better graphics performance. Qualcomm’s president Frank Meng has already noted that over 30 smartphones are being designed around the Snapdragon 820.

We feel that the failure of the Snapdragon 810 is more of an exception rather than the rule. As such, we believe the company looks poised to continue creating best-in-class products starting with the 820 chip.

Another bearish concern, the investigation of Qualcomm’s Chinese operations has been resolved through a settlement. While Qualcomm still believes that Chinese licensees are underreporting sales, with the antimonopoly investigation in the past, Qualcomm can focus on turning China back into a vehicle for growth, much to the dismay of Qualcomm bears.

Bears Have Created An Excellent Buying Opportunity

The concerns above have helped push QCOM shares down 25% on the year. At its current price of $55/share, Qualcomm has a price to economic book value (PEBV) ratio of 0.7. This ratio implies that the market expects the company’s profits (NOPAT) to permanently decline by 30%. This expectation seems rather pessimistic given Qualcomm’s excellent profit growth history and strong competitive advantage in its industry.

Even if we assume Qualcomm is unable to grow profits again, its current economic book value, or no growth value, is $74/share today – a 34% upside from current price

However, if Qualcomm can grow NOPAT by just 5% compounded annually for the next decade, the stock is worth $96/share – a 74% upside.

Industry Growth Is A Tailwind

So where will the profit growth come from? To start, there remains excellent growth potential in the mobile processor industry. Qualcomm’s CEO notes that LTE connectivity, something most across the U.S. already access, has only a 10% penetration worldwide. Such low global penetration means there is plenty of room for the cell phone market to grow. We think that growth, in concert with the continuous improvements in standards of living will continue to stoke demand for more advanced mobile processors for the foreseeable future. We expect Qualcomm to participate in that growth as a leader, most likely, because of its strong brand and high R&D.

Management Focused on Profit Growth

Apart from industry growth, Qualcomm management is also focused on making operations more efficient to help grow the bottom line. Qualcomm has announced a restructuring plan that will cut costs by $1.1 billion through workforce reductions and cut stock-based compensation by $300 million. While this restructuring plan may be in reaction to one lackluster year, it is clear that management is willing to take aggressive steps to drive profits and maintain its already stellar ROIC.

Share Buyback Plus Dividend Yields Equal 9%

With a current dividend yield of 3.7%, Qualcomm’s impressive share buyback activity provides additional safety to investors. On a trailing twelve-month (TTM) basis, the company repurchased $10.2 billion worth of stock or 12% of the company’s $88 billion market cap. The remaining $9.1 billion in authorized repurchases would last two years assuming they repurchase at $4.5 billion a year (the same level as fiscal year 2014). $4.5 billion in repurchases equals 5% of the current market cap, which equals a 9% yield when combined with the current 3.7% dividend yield. 9% is a rather nice margin of safety to protect investors if Qualcomm does not return to its market-leading chip-making ways.

Insider Trading Raises No Alarms

Over the past 12 months, insiders have purchased just over 500,000 shares and sold ~1.3 million shares for a net effect of 800,000 insider shares sold. This amount represents less than 1% of shares outstanding.

Change In Executive Compensation Is a Positive Step

As part of the restructuring, ROIC will now be used in the determination of equity-based awards. By using this metric, Qualcomm has a clearer link between profitability and management performance. In the past, cash bonuses and equity awards have been based on metrics including non-GAAP revenue, non-GAAP operating income, total shareholder return, and time-based service and performance conditions as determined by the compensation committee. While we would prefer the non-GAAP metrics be removed, including ROIC is certainly a step in the right direction to ensuring executive pay aligns with shareholder interests.

QCOM Will Increase After Earnings

Despite the growth opportunities and management actions noted above, expectations in Qualcomm have been muted due to the lackluster results in 2015. These lowered expectations setup a promising scenario, in which Qualcomm is able to not simply meet, but beat expectations in 2016. The release of the new Snapdragon 820 should provide excellent year over year results. We also believe there is upside potential from Qualcomm’s licensing business, Internet of Things expansions, and new ventures in drones and healthcare. Much like we noted in our recent report on Wal-Mart, market expectations have fallen so low that Qualcomm, with its vast resources and brand, should have no trouble surpassing them, pushing shares to new heights.

Impact of Footnotes Adjustments and Forensic Accounting

We have made several adjustments to Qualcomm’s 2014 10-K. The adjustments are:

Income Statement: we made $2.9 billion adjustments with a net effect of removing $931 million of non-operating income (<1% of revenue). We removed $1 billion in non-operating expenses and $1.9 billion in non-operating income.

Balance Sheet: we made $39.4 billion of balance sheet adjustments to calculate invested capital with a net decrease of $29.8 billion. The largest adjustment made was the removal of $31.5 billion due to excess cash. This adjustment represented 74% of reported net assets.

Valuation: we made $31 billion of adjustments with a net effect of increasing shareholder value by $27.1 billion. The most notable adjustment to shareholder value was the removal of $565 million due to outstanding employee stock options, which represents 1% of Qualcomm’s market cap.

Attractive Funds That Hold QCOM

The following funds receive our Attractive-or-better rating and allocate significantly to Qualcomm.

- Fidelity Select Communications Equipment Portfolio (FSDCX) – 19% allocation and Very Attractive rating

- Fidelity Advisor Series VII Communications Equipment (FDMIX) – 19.2% allocation and Very Attractive rating

- iShares PHLX Semiconductor Index Fund (SOXX) –8.5% allocation and Very Attractive rating.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Photo Credit: LinuxTag (Flickr)

2 replies to "Long Idea: Qualcomm (QCOM)"

Some good points and QCOM is worth exploring. A few considerations on investing in this name:

1) QCT fell behind Apple’s A7 in the 64-bit processor race and followed up with SD810, which fell short. While SD820 is an improvement, Apple isn’t standing still and moving ahead with A8. Apple is in the driver’s seat for now and I’d say it’s Apple’s to lose.

2) QCT lost credibility with Samsung and how long will it take (if at all) to regain that credibility or does Samsung just become an OEM competitor.

3) Other competitors at the low-end potentially gaining market share (HTC for example)?

4) 61% revenue exposure to China…2 points…1) Chinese cell-phone manufacturers (and the government for that matter) doesn’t really want QCOM to have leverage at the negotiating table; 2) China growth. What is happening to QCOM is also a reflection of its exposure to growth in the Chinese economy. See what has happened to WYNN, MU, YUM. QCOM is in the thick of this major economic slowdown, which could continue for a while.

5) Jana likely a good thing for QCOM. However, is QCT spin-off ultimately a good thing for QCOM? Maybe or maybe not. Perhaps a short term positive but QCT leverages QTL. Kind of reminds me of Microsoft break-up, which Ballmer and Gates opposed. Why shouldn’t QCOM be able to use its licensing cash cow to create better chip sets that ultimately lead to another cash cow?

6) Great points about valuation and 9% Yield providing a Margin of Safety. Still QCOM in the penalty box for some good reasons, which could turn out to be longer term than expected. Also, with each successive next-gen technology, QCOM loses a little bit of IP leverage. Granted, it is likely little but the trend is a drag.

Overall, it is tempting but a bit of a tougher call, IMO. You make some compelling arguments, though.

With today’s announced deal with Chinese smartphone maker Xiaomi, Qualcomm has patent licensing agreements with four of the top five handset makers in China. QCOM up over 5% today.