Recap from November Picks

Our Most Attractive Stocks (-2.4%) underperformed the S&P 500 (-1.1%) last month. Most Attractive Large Cap stock Goodyear Tire & Rubber (GT) gained 6% and Most Attractive Small Cap stock Orbotech (ORBK) was up 24%. Overall, 18 out of the 40 Most Attractive stocks outperformed the S&P 500 in November.

Our Most Dangerous Stocks (+0.4%) underperformed the S&P 500 (-1.1%) last month. Most Dangerous Large Cap stock Macquarie Infrastructure (MIC) fell by 5% and Most Dangerous Small Cap Stock Astrotech Corporation (ASTC) fell by 13%. Overall, 15 out of the 40 Most Dangerous stocks outperformed the S&P 500 in November.

The successes of the Most Attractive and Most Dangerous stocks highlight the value of our forensic accounting. Being a true value investor is an increasingly difficult, if not impossible, task considering the amount of data contained in the ever-longer annual reports. By analyzing key details in these SEC filings, our research protects investors’ portfolios and allows our clients to execute value-investing strategies with more confidence and integrity.

21 new stocks make our Most Attractive list and 32 new stocks fall onto the Most Dangerous list this month. December’s Most Attractive & Most Dangerous stocks were made available to members on December 3, 2015.

Our Most Attractive stocks have high and rising return on invested capital (ROIC) and low price to economic book value ratios. Most Dangerous stocks have misleading earnings and long growth appreciation periods implied by their market valuations.

Most Attractive Stock Feature for December: Gentex Corp (GNTX: $16/share)

Gentex Corp (GNTX), automobile parts supplier, is one of the additions to our Most Attractive List for December.

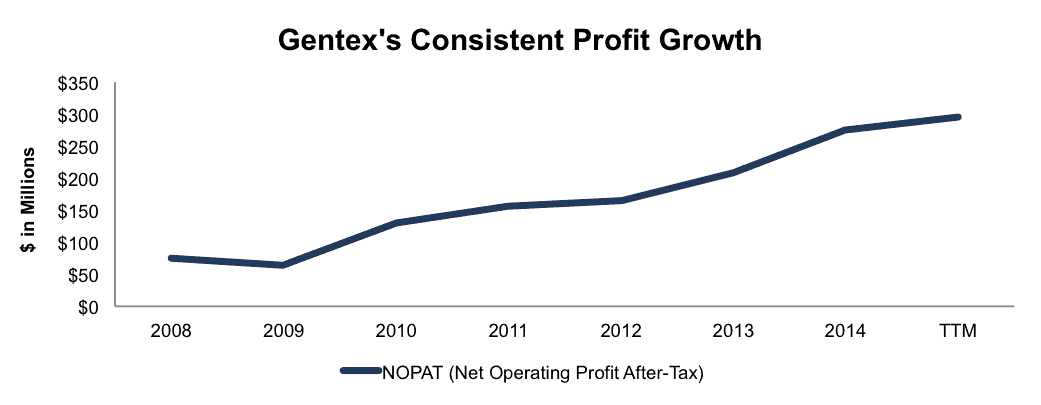

Gentex has built a dominant (90% market share in 2014), and more importantly, highly profitable business supplying automatic dimming rearview mirrors and electronics to the automotive industry. Since the industry crashed in 2008, Gentex has grown after-tax profit (NOPAT) by 24% compounded annually. This impressive profit growth can be seen in Figure 1.

Figure 1: Gentex Exhibits Strong NOPAT Growth

Sources: New Constructs, LLC and company filings

In addition to profit growth, Gentex currently earns a top quintile return on invested capital (ROIC) and has grown NOPAT margins from 12% in 2009 to 20% on a trailing-twelve-month basis. It’s worth noting that the NOPAT margin in 2009 is the lowest achieved by Gentex dating back to 1998, the furthest our model covers. Even in one of the worst recessions in history, especially as it relates to the automobile industry, Gentex remained profitable and achieved a double digit NOPAT margin.

Impact of Footnotes Adjustments and Forensic Accounting

In order to derive the true recurring cash flows, an accurate invested capital, and a real shareholder value, we made the following adjustments to Gentex’s 2014 10-K:

Income Statement: we made $19 million of adjustments with a net effect of removing $15 million (1% of revenue) in non-operating income. We removed $17 million in non-operating income, including $6 million in investment income, and $2 million in non-operating expenses. Despite removing this income, Gentex’s NOPAT still grew over 30% year-over-year in 2014.

Balance Sheet: we made $708 million of adjustments to calculate invested capital with a net decrease of $552 million. One notable adjustment was the inclusion of $60 million due to asset write-downs. This adjustment represented 3% of reported net assets.

Valuation: we made $931 million of adjustments with a net effect of increasing shareholder value by $327 million. The largest adjustment was the inclusion of $629 million due to excess cash. This adjustment represents 13% of Gentex’s market cap.

GNTX Is Undervalued At Current Prices

Despite the strength exhibited by Gentex’s operations, GNTX is down 10% year-to-date (YTD), which has left shares undervalued. At its current price of $16/share, Gentex has a price to economic book value (PEBV) ratio of 1.2. This ratio means that the market expects Gentex to grow NOPAT by only 20% over its remaining corporate life despite the fact that it has grown profits by over 20% compounded annually each year since 2008.

If Gentex can grow NOPAT by just 10% compounded annually for the next decade, shares are worth $23/share today – a 44% upside.

Most Dangerous Stock Feature: Groupon, Inc. (GRPN: $3/share)

Groupon, Inc. (GRPN), local deal and coupon retailer, finds itself back on Most Dangerous stocks list in December. We’ve previously highlighted the problems with Groupon’s business model in our Danger Zone report from June of this year. GRPN is down 48% since this report, and we still see more downside ahead.

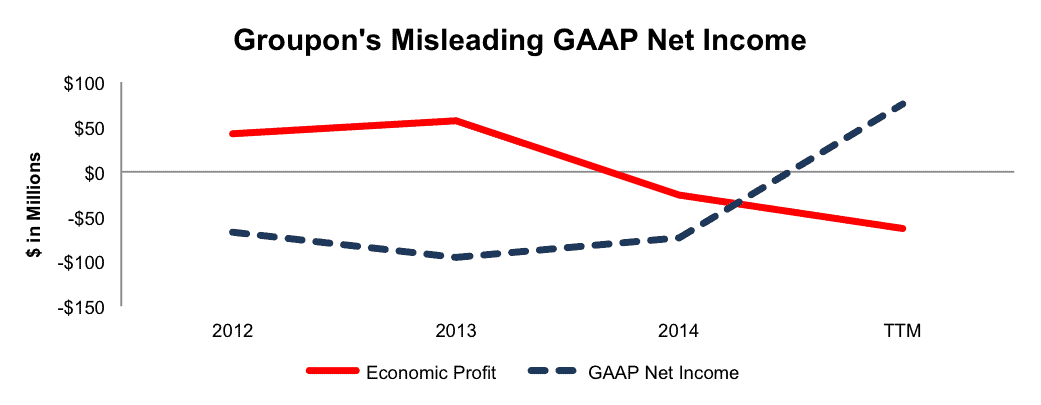

Aside from the issues raised in our initial report, the acceleration of Groupon’s misleading GAAP net income could pose the biggest risk to unknowing investors. As you can see from Figure 2, Groupon reported GAAP net income of $76 million on a TTM basis while economic earnings, the true cash flows available to investors, continued to decline to -$64 million.

Figure 2: GAAP Net Income Can Be Misleading

Sources: New Constructs, LLC and company filings

In addition to rising GAAP net income and falling economic earnings, Groupon’s already struggling business has gotten worse. NOPAT margins have fallen from -0.2% in 2014 to -1% on a TTM basis while ROIC is currently a bottom quintile -9%, well below the -2% earned in 2014. No matter which way you cut it, Groupon’s business model has continued to deteriorate throughout 2015.

Forensic Accounting Reveals Overstated EPS

In order to derive the true recurring cash flows, an accurate invested capital, and a real shareholder value, we made the following adjustments to Groupon’s 2014 10-K

Income Statement: we made $76 million of adjustments with a net effect of removing $68 million in non-operating expenses (2% of revenue). We removed $72 million related to non-operating expenses, including $31 million in foreign currency losses, and $4 million related to non-operating income. Despite removing $68 million in non-operating expenses, Groupon still earned negative NOPAT in 2014.

Balance Sheet: we made $1.4 billion of adjustments to calculate invested capital with a net decrease of $671 million. The most notable adjustment was the inclusion of $177 million (20% of net assets) due to operating leases.

Valuation: we made $1.2 billion of adjustments with a net effect of increasing shareholder value by $447 million. The largest adjustment was the inclusion of $807 million in excess cash. This adjustment represents 44% of Groupon’s market cap.

Valuation Is Still Too High

With GRPN down nearly 64% YTD, you may wonder, “how much further can it fall?” Even at $3/share, Groupon remains significantly overvalued. To justify its current price, Groupon must immediately achieve 3% pre-tax margins (-1.5% on a TTM basis) and grow revenue by 15% compounded annually for the next 15 years. In this scenario, Groupon would be generating $26 billion in revenue in 15 years, which is nearly equal to food giant McDonalds’ 2014 revenue.

Meanwhile, if we’re conservative and assume GRPN can achieve 1% pre-tax margins and grow revenue by 11% compounded annually for the next decade, shares are worth just over $1.25/share today – a 58% downside.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.