Avalara, Inc. (AVLR: $20/share midpoint of IPO price range), a provider of cloud-based tax compliance software, will IPO on Friday, June 15. At a price range of $19 to $21 per share, the company plans to raise up to $181 million and has an expected market cap of ~$1.3 billion. At the midpoint of its price range, AVLR currently earns our Unattractive rating.

Avalara joins a long list of cloud software providers that fail to earn a profit at the time of their IPO. However, lack of profits has not stopped investors from plowing capital into cloud stocks. For example, salesforce (CRM) is up 250% over the past five years (S&P up 75%) despite consistently generating negative economic earnings.

This report aims to help investors sort through Avalara’s financial filings to understand the fundamentals and valuation of this IPO.

GAAP Net Income Overstates Losses

AVLR earns revenues by charging subscription fees for each of its software solutions. The company notes it processed an average of 16 million tax determinations per day in 2017 and has over 600 pre-built integrations with leading enterprise resource planning, e-commerce, and customer relationship management systems.

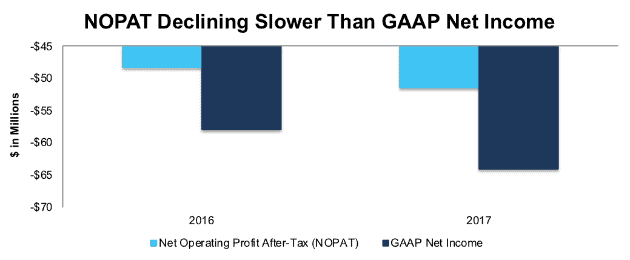

At first glance, AVLR’s GAAP net income fell from -$58 million in 2016 to – $64 million in 2017, or 11% year-over-year. After-tax operating profit (NOPAT) also fell, but at a decreased rate. NOPAT fell just 7% year-over-year.

Figure 1: AVLR GAAP Net Income and NOPAT Since 2016

Sources: New Constructs, LLC and company filings

Non-operating items overstated AVLR’s GAAP losses in 2017, which caused the greater decline in accounting results versus NOPAT. We remove both non-operating income and expense when calculating NOPAT to get at the true recurring profits of the business.

In 2017, Robo-Analyst[1] uncovered non-operating items, such as:

- $0.7 million in amortization of deferred rent

- $9.2 million in goodwill impairment & restructuring charges

After all adjustments, we removed net $13 million in non-operating expenses in 2017.

With only two years of history, it’s hard to draw any firm conclusions about the long-term trend in profitability for AVLR, but our adjustments show that NOPAT is falling less than GAAP net income would indicate.

Expense Growth Bucks Common Tech Startup Trend

In the past, we’ve been critical of business models that operate at a growing loss due to expenses growing even faster than revenue. See Trivago, which is down over 60% from its IPO midpoint as an example. However, Avalara bucks this common trend of rapidly growing tech stocks. Instead, AVLR has shown impressive cost control, which indicates the business may actually be able to effectively “scale”.

Since 2015, AVLR’s cost of revenue, research & development, sales & marketing, and general & administrative costs have grown 19%, 18%, 16%, and 1% compounded annually respectively. Over the same time, revenue has grown 32% compounded annually. The ability to scale its topline growth while maintaining cost controls can be credited for AVLR’s NOPAT margins, while still negative, improving from -29% in 2016 to -24% in 2017.

While AVLR is certainly not profitable, the trends in its expenses indicate that the business model is achieving expected benefits of scaling its software across its customers.

AVLR Looks Undervalued by Traditional Metrics

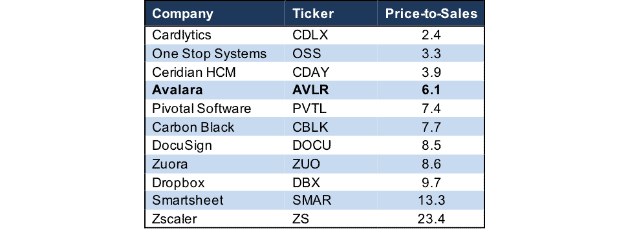

Figure 2 shows the price-to-sales ratio for the ten technology firms that went public in the first four months of 2018 and Avalara. We used the market cap of each firm at its IPO price to determine where AVLR’s valuation stood relative to recent tech IPOs. As can be seen, AVLR’s price-to-sales ratio is actually below many peer firms.

Figure 2: Valuations for Tech IPOs in 2018

Sources: New Constructs, LLC and company filings

Our Discounted Cash Flow Model Reveals AVLR is Overvalued

When we analyze the cash flow expectations baked into the stock price, we find that AVLR is overvalued at the midpoint of its IPO, despite what traditional metrics show. Our dynamic DCF model quantifies exactly what kind of future cash flows the market price of a stock implies a company will generate.

To justify the midpoint IPO price of $20/share, AVLR must immediately achieve 12% NOPAT margins (average of all software firms with positive margins under coverage) and grow revenue by 21% compounded annually (average of all software firms under coverage) for the next seven years. See the math behind this dynamic DCF scenario here. For reference, AVLR’s NOPAT margin was -24% in 2017 so this scenario implies immediate and drastic improvements in profitability.

In a more conservative scenario, if we assume AVLR can achieve a 4% NOPAT margins (slightly better than CRM at 3%) and grow revenue by 21% compounded annually for the next decade, the stock is worth just $7/share today – a 65% downside from IPO midpoint. See the math behind this dynamic DCF scenario here.

Previous Owners Leave Little Voting Power for Investors

Following the completion of its IPO, members of AVLR’s Board of Directors, executive officers, and 5% or greater shareholders will own ~62% of outstanding voting stock. This concentrated voting power means investors have little say on important strategic decisions such as a sale, merger, acquisition, or additional issuance of common stock. While we’ve certainly seen worse corporate governance when it comes to voting rights – Snapchat (SNAP) and Dropbox (DBX) come to mind – AVLR’s voting structure still gives investors little power.

Critical Details Found in Financial Filings By Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments[2] we make based on Robo-Analyst findings in Avalara’s 2017 S-1:

Income Statement: we made $17 million of adjustments, with a net effect of removing $13 million in non-operating expense (6% of revenue). We removed $2 million in non-operating income and $15 million in non-operating expenses. You can see all the adjustments made to AVLR’s income statement here.

Balance Sheet: we made $87 million of adjustments to calculate invested capital with a net increase of $86 million. The largest adjustments was $66 million in operating leases. This adjustment represented 157% of reported net assets. You can see all the adjustments made to AVLR’s balance sheet here.

Valuation: we made $237 million of adjustments with a net effect of decreasing shareholder value by $237 million. There were no adjustments that increased shareholder value. The largest adjustment to shareholder value was $129 million in outstanding employee stock options. This option adjustment represents 10% of AVLR’s proposed market cap.

This article originally published on June 14, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features the powerful impact of research automation in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[2] Ernst & Young’s recent white paper “Getting ROIC Right” demonstrates the link between an accurate calculation of ROIC and shareholder value.