We closed this position on November 16, 2020. A copy of the associated Position Update report is here.

Trivago (TRVG: $14/share), a hotel search platform, is going public at a time when the company can tout robust revenue growth and a high-profile in the U.S. from heavy advertising. Trivago is positioned in the fast-growing travel, hotel, and leisure business and boasts access to 1.3 million hotels worldwide. Management believes this strong performance can be maintained through further global expansion, mobile product adoption, and the overall shift to online travel booking.

The stock (at the midpoint of its IPO range) gets our Dangerous rating, and we advise caution when considering an investment in it because:

- Big future profits are already factored into the IPO price.

- Major red flags on lack of internal controls and corporate governance found in the footnotes.

- The firm’s middleman business model lacks the differentiation and competitive advantage needed to achieve and sustain profitability.

Do Not Buy Shares For Ownership In The Firm

Ownership in a firm usually comes with the benefit of voting rights and a voice on business matters such as acquisitions/mergers and board decisions. However, those purchasing TRVG for ownership in the company will not have much of a voice at all. The 28.5 million shares offered at IPO will have just an 8% economic interest in the business operations and less than 1% voting power, subsequent to the post-IPO merger. The voting interest will be split between holders of Class B shares (which represent 10 votes per share) and the Class A shares. Post IPO, Expedia (EXPE), previously in the Danger Zone in September 2015 will hold 65% of the voting power, the founders will hold 34.1%, and remaining class A shareholders will hold 0.9% voting power.

History Of Revenue Growth Without Profits

The percentage of unprofitable firms going public has been growing since 2011 when 45% of IPOs made no money compared to 66% in 2015. Trivago is another firm to add to the “unprofitable IPO” list, with the likes of previous Danger Zone picks Square (SQ) and Box (BOX) in recent years. SQ has underperformed the market since IPO and BOX is down 34% since we put them in the Danger Zone.

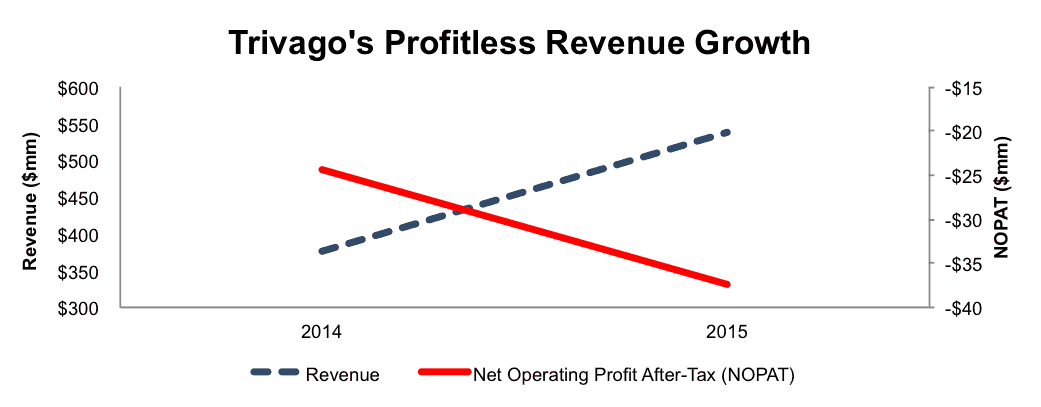

Over the last two years, Trivago’s after-tax profit (NOPAT) has declined from -$24 million to -$37 million, or -54% year-over-year (YoY). Meanwhile, revenue has grown from $376 million to $538 million, or 43% YoY during the same time.

Figure 1: Unprofitable Revenue Growth

Sources: New Constructs, LLC and company filings

Trivago’s NOPAT margin has slightly declined, from -6.5% in 2014 to -6.9% in 2015 and its return on invested capital (ROIC) has fallen from -3% to -4% over the same time.

Weak Competitive Position Undermines Ability To Generate Profits

Due to Trivago’s unique business model, operating as a middleman between booking agencies and hotel consumers, we question whether it can sustain impressive revenue growth while also becoming profitable.

We’ve noted the many drawbacks to a middleman business model in prior Danger Zone reports on Netflix (NFLX), Shutterstock (SSTK), and Zillow (ZG). Trivago is no different. Ultimately, Trivago generates revenue by referring users to a specific booking agency, such as Expedia, Travelocity, or Priceline (PCLN). However, as a middleman, Trivago’s service is simply an aggregation of commodity-like data that is available through any number of booking sites, search providers (Google), and hotel specific sites.

In this middleman role, Trivago is heavily reliant upon booking agencies to continue operations. Expedia and Priceline represented 39% and 28% of revenue in 2015, respectively. Essentially, 67% of 2015 revenue came from firms that also compete directly with Trivago, and provide more in depth services (hotel search and booking).

Non-GAAP Metrics Give Misleading View of Profitability

U.S. companies are not the only firms using non-GAAP metrics in an effort to “better represent the business operations.” Unfortunately, most of these attempts fail to better represent and actually provide a more distorted view of the firm’s economics. Two of Trivago’s more unique non-GAAP metrics include:

- Return On Advertising Spend (ROAS)

- Revenue Per Qualified Referral (RPQR)

Each of these metrics fails to adequately measure the profitability of Trivago. ROAS only looks at referral revenue vs. advertising spend, which, while important, ignores many other costs of the firm. Similarly, RPQR only measures the revenue derived from a referral and ignores the costs of obtaining such revenue.

Trivago also reports adjusted EBITDA, which excludes share-based compensation to help TRVG minimize the losses of the business. This adjustment allowed Trivago to report adjusted EBITDA of -$1 million in 2015, compared to GAAP net income of -$43 million and economic earnings of -$105 million.

Strong Competition Undermines Trivago’s Growth Plans

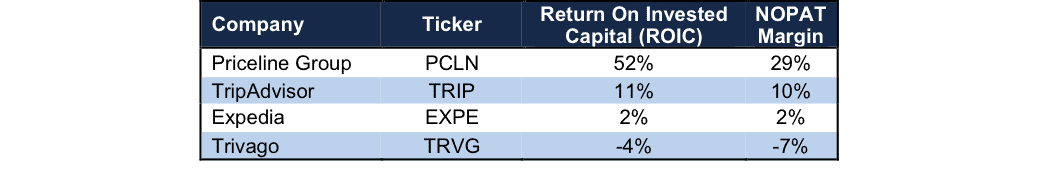

As a referral tool for booking sites, Trivago’s profitability is well below competitors that sell the booking of a hotel. Per Figure 2, Trivago’s NOPAT margins are well below Expedia, TripAdvisor, and Priceline. Additionally, as we noted in our Danger Zone on Expedia, Priceline exercised intelligent capital allocation when making acquisitions, and its superior profitability gives it a strong competitive advantage. Add in competition from (1) Google Search, where reservation options are shown in line with search results, (2) Amazon, which offers a travel-booking site that could be expanded to its entire user base, and (3) non-traditional services like Airbnb, and it’s easy to see that Trivago faces an uphill battle to profitability.

Figure 2: Trivago’s Negative Profitability

Sources: New Constructs, LLC and company filings

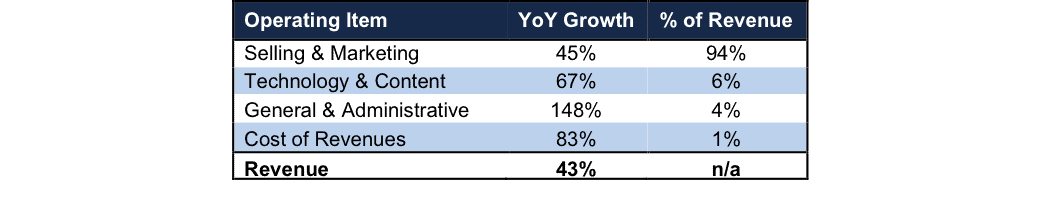

Heaving Spending Undermines Any Revenue Growth

Apart from the underwriters of the IPO, whose research is clearly conflicted, bulls will point to Trivago’s impressive revenue growth as reason to buy into the company. More important, however, is the fact that operating expenses needed to achieve such revenue growth are soaring, per Figure 3, Trivago’s selling and marketing, technology and content, and general & administrative costs have grown 45%, 67%, and 148% YoY respectively while revenue grew at a lower rate, 43% YoY. Trivago has foregone profitability to establish market share.

Trivago’s valuation is built upon the idea that it can leverage its middleman model, expand its footprint, and increase margins to become profitable. However, in order to leverage its model and expand its reach, the company must continue to spend significant amounts of capital on items such as advertising around the globe. Until Trivago is able to slow down advertising spend, margins will remain low and/or negative.

However, as noted earlier, even when it wins market share, the firm gains little competitive advantage or moat, as its middleman business model gives it very limited bargaining power over suppliers or customers.

Figure 3: Trivago’s Expenses Growing Faster Than Revenues

Sources: New Constructs, LLC and company filings

Worst of all, despite the negative profitability and significant spending required to achieve revenue growth, Trivago’s IPO price implies immediate profitability and immense profit growth. Even meeting the expectations already embedded in the stock price will be a difficult task for TRVG.

Red Flags: IPO Disclosures & Loopholes

We found these red flags buried in the IPO filings:

- Material Weakness In Internal Control: In its prospectus, Trivago notes “we have identified a material weakness in our internal control over financial reporting.” Trivago blames this material weakness on its existence as “a private company with limited accounting personnel” and its conversion from German Commercial Code (German GAAP) to U.S. GAAP reporting standards. Regardless of the excuse, a material weakness in internal control is a red flag for any prospective investor.

- Emerging Growth Company: Trivago qualifies as an “emerging growth” company under the 2012 JOBS Act. This qualification imposes less stringent disclosure requirements such as only two years of audited financials, It also opens the door to corporate governance concerns because TRVG is not required to submit executive compensation matters for vote or to disclose the correlation between compensation and performance. The risks of investing in stocks that avoid these disclosures are covered in detail in our Danger Zone report “Are You Aware of the Hidden Dangers in IPOs.”

- Foreign Private Issuer: Under the Exchange Act, Trivago qualifies for foreign private issuer status. This qualification exempts the company from certain reporting obligations required of U.S. public companies. Most importantly, as a foreign private issuer, TRVG is not required to submit public reports of insider stock ownership and trading activities and quarterly reports such as 10-Qs.

IPO Valuation Prices Out Any Upside Potential

At $13 to $15 per share, Trivago is pricing at a level that already implies significant profit growth despite not generating any profits to date.

In order to justify the midpoint of its IPO price ($14/share) Trivago must achieve 2% NOPAT margins (equal to Expedia) and grow revenue by 43% compounded annually (same as 2015 revenue growth) for the next decade. It seems as if the best-case scenario is already priced in.

TRVG’s IPO price is even more overvalued if we assume a more reasonable scenario. If Trivago can achieve 2% NOPAT margins and grow revenue by 20% compounded annually (average of Expedia and Priceline last five years) for the next decade, the stock is worth only $2/share today – an 86% downside. Each of these scenarios also assumes TRVG is able to grow revenue and NOPAT/free cash flow without spending on working capital or fixed assets. This assumption is unlikely but allows us to create very optimistic scenarios that demonstrate how high expectations in the current valuation are.

Without closely reading prospectuses and studying accounting rules, investors may not realize just how much risk they’re taking if they buy into this IPO.

Weak IPO Market Keeps Share Price Capped

In many regards, 2016 has been a poor year for IPOs. Dealogic reports that of the 57 IPOs through July of this year, only two priced above range, and total capital raised was half the level raised in 2015.

This environment, coupled with the poor fundamentals of TRVG, makes this stock a risky bet for any investor. Eventually a reconciliation between the valuation and the fundamentals will take place and those purchasing on IPO date may be in for a damaging ride.

Impact of Footnotes Adjustments and Forensic Accounting

In order to derive the true recurring cash flows, an accurate invested capital, and a real shareholder value, we made the following adjustments to Trivago’s F-1:

Income Statement: we made $9 million of adjustments with a net effect of removing $5 million in non-operating expense (1% of revenue). We removed $2 million related to non-operating income and $7 million related to non-operating expenses. See all the adjustments made to TRVG’s income statement here.

Balance Sheet: we made $147 million of adjustments to calculate invested capital with a net increase of $143 million. The most notable adjustment was $57 million (8% of reported net assets) related to operating leases. See all adjustments to TRVG’s balance sheet here.

Valuation: we made $145 million of adjustments with a net effect of decreasing shareholder value by $145 million. There were no adjustments that increased shareholder value. Apart from total debt, which includes $57 million in off-balance-sheet operating leases, the most notable adjustment was $63 million related to deferred tax liabilities. This adjustment represents 1% of TRVG’s market cap assuming midpoint of offering price.

This article originally published here on December 15, 2016.

Disclosure: David Trainer, Kyle Guske II, and Kyle Martone receive no compensation to write about any specific stock, style, or theme.

Scottrade clients get a Free Gold Membership ($588/yr value) as well as 50% discounts and up to 20 free trades ($140 value) for signing up to Platinum, Pro or Unlimited memberships. Login or open your Scottrade account & find us under Quotes & Research/Investor Tools.

Click here to download a PDF of this report.

Photo Credit: Trivago

3 replies to "Trivago (TRVG) – Let This IPO Travel Alone"

thanks for the info

TRVG falls over 20% after 3Q earnings report. Now down 30% since our original Danger Zone report while the S&P is up 13%

TRVG falls over 20% after 1Q earnings report and lackluster guidance. Now down over 57% since our original Danger Zone report while the S&P is up 16%.