The market looks more overvalued each week, a trend in place for quite some time. Fundamentals do not seem to matter, and stocks continue to rise no matter what happens. But, stocks can’t go up and defy cash flows forever. Eventually, fundamentals matter, and overvalued stocks crash back to realistic valuations.

So, how can you make sound investments in this volatile market? One way to find your safe haven is to find companies that pay high dividends consistently and generate the free cash flow (FCF) needed to make those dividend payments.

After rigorous analysis of our database of 7,300+ ETFs and mutual funds, we found a mutual fund that successfully picks strong dividend-paying companies with high FCF, while charging below-average fees. Manning & Napier Disciplined Value Series Fund (MDVWX) is this week’s Long Idea.

Forward-Looking Research Reveals a Very Attractive Fund

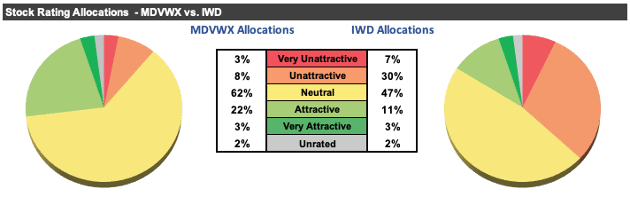

MDVWX earns our Very Attractive Predictive Fund Rating, while Morningstar gives it a 2-Star (backward-looking) rating. Our analysis of holdings reveals the fund allocates more to good stocks, i.e. profitable companies with undervalued stock prices, than its benchmark, iShares Russell 1000 Value ETF (IWD). See Figure 1.

We leverage our Robo-Analyst technology[1] to assess a mutual fund’s portfolio quality by analyzing the fund’s individual stock holdings.

Through this rigorous analysis, we find that MDVWX allocates 25% of its assets to Attractive-or-better rated stocks compared to just 14% for IWD. On the flip side, MDVWX allocates just 11% of its assets to Unattractive-or-worse rated stocks compared to 37% for IWD.

Figure 1: MDVWX Holdings Vs. IWD Holdings

Sources: New Constructs, LLC, company, ETF, and mutual fund filings

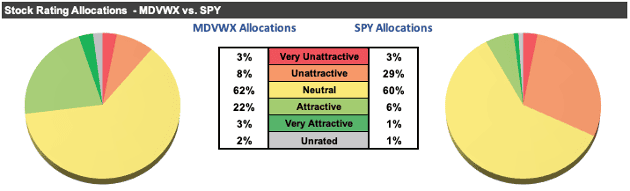

Per Figure 2, our holdings analysis also reveals MDVWX’s portfolio is of much higher quality than the S&P 500 as represented by State Street SPDR S&P 500 ETF Trust (SPY). SPY earns our Attractive rating, but only 7% of SPY’s portfolio is allocated to stocks rated Attractive-or-better and 32% is allocated to stocks rated Unattractive-or-worse.

Figure 2: MDVWX Holdings Vs. SPY Holdings

Sources: New Constructs, LLC, company, ETF, and mutual fund filings

The Fund’s Strategy Finds Companies with Quality Cash Flows

MDVWX’s investment strategy, led by Manning & Napier, is to offer a diversified portfolio of dividend-paying mid-to-large cap U.S. stocks, in which stocks are selected based on:

- the company’s free cash flow generation and earnings power,

- dividend yield equal to or exceeding the dividend yield of the broad equity market,

- dividend sustainability, and

- the company’s financial health, based on factors such as profitability and leverage.

Regarding dividends, free cash flow (FCF) is the most important metric, since it directly impacts the company’s ability to pay its dividends. It’s a big red flag if a company does not generate enough FCF to afford to pay its dividends/distributions. Note that FCF is the key metric in both our Safest Dividend Yields and Dividend Growth Stocks Model Portfolios.

With MDVWX, Manning & Napier’s view on the importance of FCF as a key metric directly aligns with our views. Without detailed information regarding how Manning & Napier calculates FCF, we can only judge the effectiveness of their stated strategy by analyzing the holdings of the mutual fund. In doing so, it’s clear the fund allocates to companies with strong FCF generation. Companies with strong FCF generation can pay strong dividends and have the potential to increase their dividend payments in the future.

Given the fund’s superior asset allocation (compared to its benchmark and the SPY), it’s clear that the managers successfully implement their philosophy of finding high-yielding stocks with quality FCF, as we’ll detail in our holdings analysis below.

Quality Stocks Drive Very Attractive Risk/Reward Rating

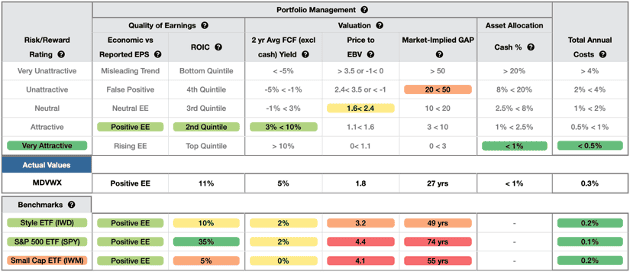

Figure 3 contains our detailed rating for MDVWX, which includes each of the criteria we use to rate all mutual funds under coverage. These criteria are the same for our Stock Rating Methodology, because the performance of a mutual fund’s holdings is responsible for the performance of the mutual fund after fees. Figure 3 also compares MDVWX’s rating with those of IWD and SPY.

Figure 3: Manning & Napier Disciplined Value Series Fund Breakdown

Sources: New Constructs, LLC and company filings

MDVWX’s holdings are superior or equal to IWD in all five of the criteria that make up our Portfolio Management rating. Specifically:

- MDVWX’s holdings generate positive economic earnings, same as IWD and SPY.

- MDVWX’s ROIC is 11% and higher than the 10% earned by IWD’s holdings.

- MDVWX’s free cash flow (FCF) yield of 5% is higher than IWD and SPY’s at 2%.

- The price-to-economic book value (PEBV) ratio for MDVWX’s holdings is 1.8, which is much lower than IWD’s at 3.2 and SPY’s at 4.4.

- Our discounted cash flow analysis reveals an average market implied growth appreciation period (GAP) of just 27 years for MDVWX’s holdings compared to 49 years for IWD and 74 years for SPY.

Market expectations for stocks held by MDVWX imply profits will grow by nearly half as much as the stock’s held by IWD (measured by PEBV ratio).

In other words, MDVWX’s profitability is higher (measured by ROIC), yet the stocks held by MDVWX are significantly cheaper (as measured by PEBV and GAP).

A Closer Look at Holdings Reveals More Positives

Of the 125 MDVWX’s holdings in our coverage universe, 20 are also open Long Ideas of ours. These 20 stocks make up nearly 22% of MDVWX’s asset allocation.

Of the 125 holdings under coverage:

- 99% have a positive ROIC,

- 87% have a positive 2-year average free cash flow yield,

- 73% have a positive PEBV ratio of 1.8 or less, and

- 69% have a GAP of 27 years or less.

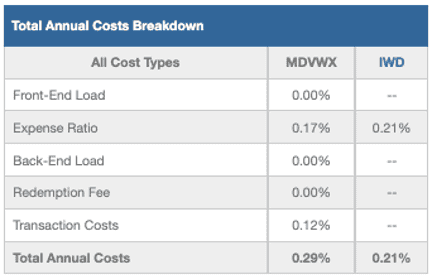

Quality Stock Selection at Below Average Cost

MDVWX’s 0.29% total annual costs (TAC) are below the 1.42% simple average and 1.02% asset-weighted average of the 283 other Large Cap Value mutual funds under coverage. Figure 4 shows our breakdown of MDVWX’s total annual costs, which is available for all 7,300+ mutual funds and ETFs under coverage.

Figure 4: MDVWX’s Total Annual Costs Breakdown

Sources: New Constructs, LLC and company filings

The Importance of Holdings Based Fund Analysis

We offer clients in-depth reports for all the 7,300+ ETFs and mutual funds under coverage. Click below for a free copy of our standard mutual fund report on MDVWX.

Smart fund (or ETF) investing means analyzing each of the holdings of a fund. Failure to do so is a failure to perform proper due diligence. Simply buying an ETF or mutual fund based on past performance does not necessarily lead to outperformance. Only thorough holdings-based research can help determine if a fund’s methodology leads managers to pick high-quality or low-quality stocks.

Most investors don’t realize they can access superior fundamental research that enables them to overcome inaccuracies, omissions, and biases in legacy fundamental research and data. Our Robo-Analyst technology analyzes the holdings of all 315 ETFs and mutual funds in the Large Cap Value style and ~7,300+ ETFs and mutual funds under coverage to avoid “the danger within”.

Build A Better Fund: Use our DIY ETF Tool

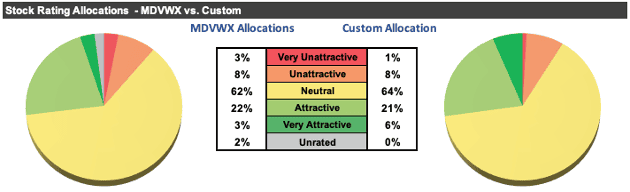

As we show in The Paradigm Shift to DIY ETFs, new technologies enable investors to create their own fund without any fees while also enabling better, more sophisticated weighting methodologies. For example, if we reallocate the fund’s capital to the companies with the best ROICs, our customized fund allocates:

- 27% of assets to Attractive-or-better rated stocks (compared to 25% for MDVWX)

- 9% of assets to Unattractive-or-worse rated stocks (compared to 11% for MDVWX)

Compare the quality of stock allocation in as-is MDVWX vs. our customized version of MDVWX in Figure 5.

Figure 5: MDVWX Vs. Custom Fund Allocations

Sources: New Constructs, LLC and company filings

Note that our DIY ETF tool allows clients to pick and weight portfolio holdings based on multiple proprietary metrics, such as Core Earnings, Economic Earnings, Free Cash Flow, Net Operating Profit After Tax and more.

Check Out Indices Based on New Constructs Research

While we’re talking about creating your own fund, we should highlight the indices we’ve developed with Bloomberg’s Index Licensing Group.

We have three indices in production now. You can get more details on them here.

- Bloomberg New Constructs 500 Index (ticker: B500NCT:IND)

- Bloomberg New Constructs Ratings VA-1 Index (ticker: BNCVA1T:IND).

This article was originally published on February 19, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.

[1] Our Robo-Analyst technology provides superior fundamental data, as proven in The Journal of Financial Economics, and a novel source of alpha.