We closed this position on July 31, 2020. A copy of the associated Position Update report is here.

Disappointing short-term trends can mask long-term value creation and lead noise traders to sell off a quality company. These knee-jerk reactions create opportunity for sophisticated investors.

This firm has consistently grown profits for two decades, holds nearly 50% market share, recently expanded into Europe via acquisition, and has a history of successfully integrating acquired firms. Despite these positives, the market remains focused on a couple of recent disappointing quarters, and the stock is priced as if profits will permanently decline. Thor Industries (THO: $59/share) is this week’s Long Idea.

Market Ignores THO’s Long-Term Value Creation

Thor Industries was first a Long Idea in June 2016. We closed the position in October 2016 after the stock rose 30% and was downgraded to Neutral. THO fell over 60% in 2018, and, now, its cheap valuation means the stock earns our Very Attractive rating again.

In our 2016 report, we noted Thor’s unique ability to grow profits through all economic cycles and successfully integrate acquisitions to create shareholder value. Those abilities remain strong, but the market is myopically focused on the two most recent quarters’ disappointing numbers.

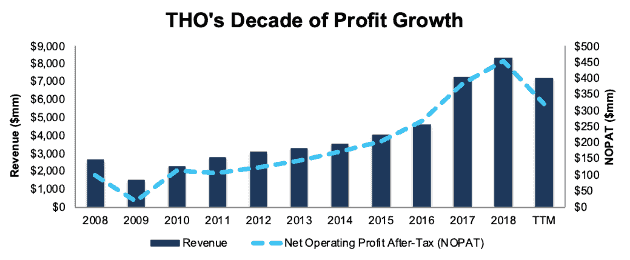

TTM GAAP net income is down 47% while TTM NOPAT is down 33% over the prior year, per Figure 1. Record revenue and profits in fiscal 2018 led to overstocking at dealers and abnormally low revenues over the first half of fiscal 2019 as dealers work through excess inventory.

Looking beyond the last two quarters, THO has grown revenue by 13% compounded annually and after-tax operating profit (NOPAT) by 17% compounded annually since 1998.

Figure 1: THO’s Revenue & NOPAT Since 2008

Sources: New Constructs, LLC and company filings

THO Maintains It’s Industry Lead

According to the RV Industry Association (RVIA), there are ~60 RV manufacturers in the U.S and Canada. Of these manufacturers, Thor Industries has consistently increased its market share to become the largest RV manufacturer in North America. Thor Industries increased its market share in travel trailer and fifth wheel RVs from 28% in 2014 to 50% in 2018. The company increased its market share in motorhome RVs from 25% to 40% over the same time.

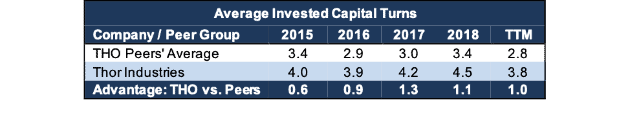

Thor Industries has built its leading market share through acquisitions and prudent capital stewardship. Figure 2 shows that Thor has achieved greater invested capital turns – annual revenue divided by average invested capital – than its peers in each of the past four years and the TTM period. Peers in the analysis below include Winnebago (WGO), LCI Industries (LCII), Camping World Holdings (CWH), and Patrick Industries (PATK).

Figure 2: THO’s Invested Capital Turns Vs. Peers

Sources: New Constructs, LLC and company filings

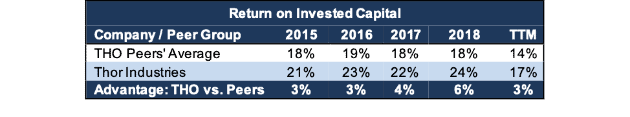

Per Figure 3, THO has also consistently earned a higher return on invested capital (ROIC) than its peers, even in the TTM period when ROIC’s fell.

Figure 3: THO’s ROIC Vs. Peers

Sources: New Constructs, LLC and company filings

Bears’ Focus on Recent Results is Shortsighted

THO bears will argue the drop in profits over the TTM represents the end of a growth cycle and the beginning of a long-term decline in the RV market. This argument ignores the short-term nature of the situation that led to the drop.

Inventory mismanagement at RV dealerships caused the drop in sales in the first half of fiscal 2019. Record sales in prior years led to inventory shortages at the end of fiscal 2017, so dealers over-ordered in fiscal 2018 and ended that year with excess inventory. As a result, THO saw sales decline as dealers worked through the excess inventory.

Now, that excess inventory is drying up. THO notes in its fiscal 2Q19 quarterly presentation that dealer inventories were up 26% YoY in July 2018, up 5% YoY in October 2018, and down 11% YoY in January 2019. As dealers finish right sizing their inventory level, management expects sales to return to more normal levels.

Long-Term Secular Demand for RVs Further Weakens Bear Case

Broadly, the outlook for the overall RV market remains positive. RV industry analyst Dr. Richard Curtin and the RV Industry Association project actual 2019 RV sales to be higher than any year prior to 2017.

Furthermore, Dr. Curtin notes that “income, employment, and household wealth will continue to exert a positive force on RV sales.” Long-term, industry research provider Mordor Intelligence projects the North American RV market to grow by 7% compounded annually through 2023.

Longer-term, crowded urban areas, unaffordable housing, or lifestyle changes will usher in new uses for RVs, such as year-round living. The RVIA estimates there are currently 1 million Americans living full-time in RVs. The growing trend of “tiny houses/tiny living” could spur increased demand for RVs as an alternative to traditional homes as well for the foreseeable future.

The lower age of current RV buyers also underpins expectations for long-term secular growth. From its 2016 study, RVIA found that half of new RV sales were to Americans under 45, which was a stark contrast to the 20th century, when retirees made up the majority of sales. These younger buyers are sources of future growth as they trade-in and upgrade their RVs as their income increases.

These long-term, secular growth trends do not suggest the industry is in decline as the current stock price implies.

While bears sell THO based on short-term issues, long-term value investors can profit.

Improving ROIC Correlated with Creating Shareholder Value

Numerous case studies show that getting ROIC right is an important part of making smart investments. Ernst & Young recently published a white paper that proves the material superiority of our forensic accounting research and measure of ROIC. The technology that enables this research is featured by Harvard Business School.

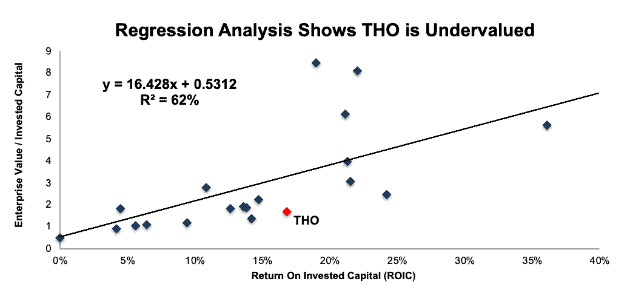

Per Figure 4, ROIC explains 62% of the difference in valuation for the 24 Leisure Products firms under coverage. THO’s stock trades at a significant discount to peers as shown by its position below the trend line.

Figure 4: ROIC Explains 62% Of Valuation for Apparel & Accessories Retailers

Sources: New Constructs, LLC and company filings

If the stock were to trade at parity with its peer group, it would be worth $117/share – a 98% upside to the current stock price. Given the firm’s leading market share, history of successful acquisitions, and industry growth projections, one would think the stock would garner a premium valuation. Below we’ll use our DCF model to quantify just how high shares could rise assuming conservative profit growth.

THO Is Priced for Permanent Profit Decline

At its current price of $59/share, THO has a price-to-economic book value (PEBV) ratio of 0.8. This ratio means the market expects THO’s NOPAT to permanently decline by 20%. This expectation seems rather pessimistic given that THO has grown NOPAT by 26% compounded annually over the past five years and 17% compounded annually since fiscal 1998. THO now trades at the same PEBV as during the depths of the recession in 2008, when RV sales were falling over 50% from 2007-2009.

Even if we assume THO grows below the expected industry rates, shares are significantly undervalued. Specifically, If THO can maintain TTM NOPAT margins, which are 4.5% compared to 5.3% average of last five years, and grow NOPAT by just 2% compounded annually over the next decade, the stock is worth $77/share today – a 31% upside. See the math behind this dynamic DCF scenario. Such a scenario could prove conservative given THO’s proven ability to grow profits faster than the industry in past years.

What Noise Traders Miss with THO

These days, fewer investors focus on finding quality capital allocators with shareholder friendly corporate governance. Instead, due to the proliferation of noise traders, the focus tends toward technical trading tends while high-quality fundamental research is overlooked. Here’s a quick summary for noise traders when analyzing THO:

- Short-term results don’t stop long-term profit trend

- Industry leading efficiency and profitability help maintain market share

- Valuation implies permanent profit decline and gives THO significant upside

Catalysts to Push Shares Higher

Lowered Expectations: the dealer issues in the first half of fiscal 2019 have greatly lowered the expectations for THO. Consensus EPS estimates from fiscal 2019 have fallen from over $10/share back in March 2018 to ~$6/share in March 2019. Any surprise earnings beat off these lowered expectations could send shares soaring after being beaten down so much over the past year.

Closing the Erwin Hymer Acquisition: closing the Erwin Hymer acquisition represents opportunity for THO to expand internationally and entrench itself as the leading global RV manufacturer. With this acquisition, THO:

- Diversifies its product lines – In fiscal 2018, 72% of THO’s sales were Towable RVs and 26% were motorized RVs. Erwin Hymer’s sales were just 12% in Towable RVs and 77% in motorized RVs.

- Diversifies its geographical footprint – In fiscal 2018, 100% of THO’s sales were in North America. Just 9% of Erwin Hymer’s sales were to North American while 90% were in Europe.

- Expands its already leading market share – THO is already the leading North American RV manufacturer and Erwin Hymer is the largest RV manufacturer in Europe by revenue.

The timing of its entrance into Europe couldn’t be better either, as Europe is witnessing robust growth in the RV market. In 2018, sales grew just under 7% and topped 200,000 units for the first time since 2007. The European Caravan Federation expects 2019 sales to remain just as strong. Longer-term, Goldstein Research, an industry research provider, projects the European RV market will grow by 6% compounded annually through 2025.

Should Thor Industries have the same success with Erwin Hymer that it did with prior acquisitions (such as Jayco in 2016), shares should rise as the company surpasses the low expectations in the current stock price.

Dividends Offer Near 3% Yield and Possible Share Repurchases Could Provide Even More

Thor Industries has increased its regular annual dividend in nine of the past 10 years. Its annualized dividend has grown from $0.28/share in fiscal 2009 to $1.48/share in fiscal 2018, or 20% compounded annually. The current dividend provides a 2.6% yield. Best of all, Thor Industries generates the necessary cash flow to continue paying its dividend, even as it acquires smaller RV brands. Over the past decade, Thor Industries has generated $572 million (18% of market cap) in free cash flow while paying about $467 million in regular dividends.

In addition to dividends, Thor Industries has the ability to return capital to shareholders through share repurchases. In June 2018, the company’s Board of Directors authorized a $250,000 repurchase program. However, through the first six months of fiscal 2019, no repurchases have been made. Prior to this authorization, the last repurchase occurred in fiscal 2015.

Executive Compensation Plan Raises No Alarms

THO’s executive compensation plan, which includes base salary, annual incentives, and long-term incentives is focused on, as the company states “simplicity and transparency.” Both annual cash bonuses and long-term restricted stock units are awarded based on the one metric, net income before taxes. While focusing solely on accounting earnings isn’t ideal, it’s better than plans that use subjective non-GAAP metrics that are easily manipulated.

We would prefer to see executive compensation tied to ROIC, as there is a strong correlation between improving ROIC and increasing shareholder value. However, THO’s current exec comp plan has not led to executives getting paid while destroying shareholder value. In fact, quite the opposite is true. Economic earnings, the true cash flows of the business, have grown from $46 million in fiscal 2008 to $165 million TTM.

Insider Trading is Minimal While Short Interest Reflects Market Pessimism

Insider activity has been minimal over the past 12 months, with 634 thousand shares purchased and 531 thousand shares sold for a net effect of 103 thousand shares purchased. These purchases represent less than 1% of shares outstanding.

There are currently 2.7 million shares sold short, which equates to 5% of shares outstanding and 4.1 days to cover. Short interest has fallen 4% from the prior month. A return to profit growth after the right-sizing that occurred in the first half of fiscal 2019 could push shorts out and send shares higher.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments we make based on Robo-Analyst[1] findings in Thor Industries’ fiscal 2018 10-K:

Income Statement: we made $40 million of adjustments, with a net effect of removing $24 million in non-operating expense (<1% of revenue). We removed $8 million in non-operating income and $32 million in non-operating expenses. You can see all the adjustments made to THO’s income statement here.

Balance Sheet: we made $344 million of adjustments to calculate invested capital with a net decrease of $138 million. The most notable adjustment was $78 million in deferred tax assets. This adjustment represented 4% of reported net assets. You can see all the adjustments made to THO’s balance sheet here.

Valuation: we made $11 million of adjustments with a net effect of decreasing shareholder value by $11 million. There were no adjustments that increased shareholder value. The largest adjustment to shareholder value was $11 million in off-balance sheet debt. This adjustment represents <1% of THO’s market cap. You can see all the adjustments made to THO’s valuation here.

Attractive Funds That Hold THO

The following funds receive our Attractive-or-better rating and allocate significantly to Thor Industries.

- Managed Portfolio Reinhart Genesis PMV Fund (RPMFX) – 3.0% allocation and Attractive rating.

- Virtus KAR Small Cap Value Fund (VQSRX) – 2.5% allocation and Very Attractive rating.

- Alpha Architect U.S. Quantitative Value ETF (QVAL) – 2.4% allocation and Very Attractive rating.

- Managed Portfolio Reinhart Mid Cap PMV Fund (RPMVX) – 2.4% allocation and Attractive rating.

This article originally published on March 27, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.