In the second week of every month, we update our Exec Comp Aligned with ROIC Model Portfolio, and a few days later, we always feature a stock from the Model Portfolio. This month’s featured stock has been in this Model Portfolio for multiple consecutive months.

The idea behind featuring stocks and sharing these features with you is to give you free insights into the uniquely high value-add of our research. We want you to know how we do research, so you know more about how reliable research looks and how real Ai and machine learning work.

Today’s feature provides a quick summary of how we pick stocks for this Model Portfolio. This summary is not a full Long Idea report, but it gives you insight into the rigor of our research and approach to picking stocks. Whether you’re a subscriber or not, we think it is important that you’re able to see our research on stocks on a regular basis. We’re proud to share our work.

We always talk about the importance of companies aligning executive compensation with ROIC, but it is just as important that companies calculate return on invested capital (ROIC) correctly. We recently published two articles showing how wrong the ROIC calculations from legacy firms like FactSet (FDS) and Morningstar (MORN) can be. You deserve research you can trust, and we’re the only research firm delivering proven-superior fundamental research and ROIC.

What’s the point of aligning compensation with ROIC if the executives are manipulating ROIC to look better than it truly is?

This Model Portfolio discerns between companies that calculate ROIC with rigor and those that do not. We measure how close the companies’ versions of ROIC (even if they call it by another name) are to our ROIC. The goal is to showcase companies that have quality ROIC calculations and prioritize value creation for investors by rewarding their executives for improving ROIC. In our opinion, there’s not a better group of stocks out there as I explain in this special training.

We’re not giving you the name of the stock featured, because it is only available to our Pro and Institutional members. But, there’s still so much here to share. We want you to see how much work we do and to know where to set the bar when evaluating research providers.

We hope you enjoy this research. Feel free to share with friends and colleagues.

We update this Model Portfolio monthly, and September’s Exec Comp Aligned with ROIC Model Portfolio was updated and published for clients on September 13, 2024.

Recap from August Picks

The best performing stock in the portfolio was up 3%. Overall, 3 of the 15 Exec Comp Aligned with ROIC Stocks outperformed the S&P from August 15, 2024 through September 11, 2024.

This report leverages our cutting-edge Robo-Analyst technology to deliver proven-superior[1] fundamental research and support more cost-effective fulfillment of the fiduciary duty of care.

This Model Portfolio includes stocks that earn an Attractive or Very Attractive rating and align executive compensation with improving ROIC. This combination provides a unique list of long ideas as the primary driver of shareholder value creation is return on invested capital (ROIC).

Stock Feature for September: Industrials Company

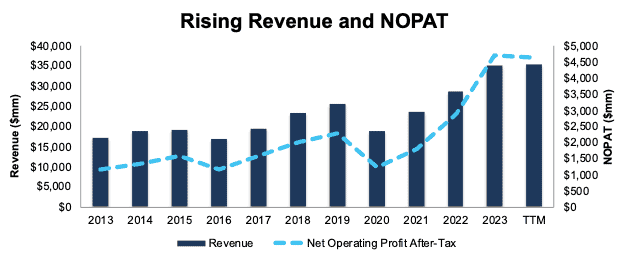

This company has grown revenue and net operating profit after tax (NOPAT) by 7% and 14% compounded annually, respectively, since 2013. The company’s NOPAT margin improved from 7% in 2013 to 13% in the TTM. Invested capital turns rose from 2.3 to 2.7 over the same time. Rising NOPAT margins and invested capital turns drive the company’s return on invested capital (ROIC) from 16% in 2013 to 36% in the TTM.

Figure 1: Revenue & NOPAT: 2013 – TTM

Sources: New Constructs, LLC and company filings

Executive Compensation Properly Aligns Incentives

This company’s compensation plan aligns the interests of executives and shareholders by tying a portion of its long-term cash awards to return on capital (ROC).

The company’s inclusion of ROC, a variation of ROIC, as a performance goal has helped create shareholder value by driving higher ROIC and economic earnings. When we calculate ROIC using our superior fundamental data, we find that the company’s ROIC has increased from 16% in 2013 to 36% in the TTM. Economic earnings rose from $803 million to $3.6 billion over the same time.

Figure 2: ROIC & Economic Earnings: 2013 – TTM

Sources: New Constructs, LLC and company filings

This Stock Has Further Upside

At its current price of $99/share, this stock has a price-to-economic book value (PEBV) ratio of 0.8. This ratio means the market expects this company’s NOPAT to permanently fall 20% from current levels. This expectation seems overly pessimistic for a company that has grown NOPAT 17% compounded annually over the last five years and 14% compounded annually since 2013.

Even if the company’s

- NOPAT margin falls to 9% (below 5-year average of 10% and TTM NOPAT margin of 13%) and

- revenue grows 6% (below the 7% CAGR over the last ten years) compounded annually through 2033 then,

the stock would be worth $126/share today – a 26% upside. In this scenario, the company’s NOPAT would rise just 2% compounded annually from 2023 through 2033.

Should the company grow NOPAT more in line with historical growth rates, the stock has even more upside.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

Below are specifics on the adjustments we made based on Robo-Analyst findings in this featured stock’s 10-Ks and 10-Qs:

Income Statement: we made over $940 million in adjustments with a net effect of removing around $125 million in non-operating expenses. Professional members can see all adjustments made to income statements on the GAAP Reconciliation tab on the Ratings page on our website.

Balance Sheet: we made over $9 billion in adjustments to calculate invested capital with a net decrease of around $7.5 billion. One of the most notable adjustments was hundreds of million in other comprehensive income. Professional members can see all adjustments made to balance sheets on the GAAP Reconciliation tab on the Ratings page on our website.

Valuation: we made under $7 billion in adjustments with a net increase of over $6 billion to shareholder value. The most notable adjustment to shareholder value was excess cash. Professional members can see all adjustments to valuations on the GAAP Reconciliation tab on the Ratings page on our website.

…there’s much more in the full report. You can start your membership here or login above to get access to this report and much more.