We closed this Long Idea on January 24, 2024. A copy of the associated Position Close report is here.

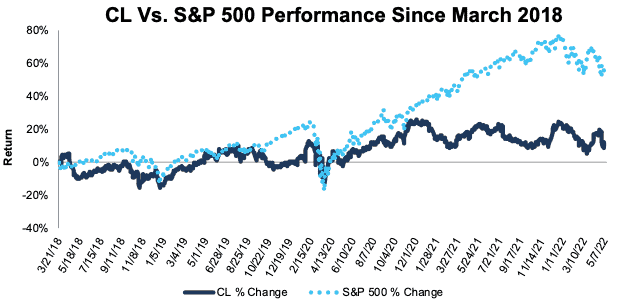

We first made Colgate-Palmolive (CL: $77/share) a Long Idea in March 2018. Since then, the stock is up 12% compared to a 48% gain for the S&P 500. Despite its underperformance, the stock still offers investors favorable risk/reward, especially amid the current market volatility. We think the stock is worth at least $104/share today – a 35%+ upside. Our last report (May 2021) on Colgate is here.

This report leverages our cutting-edge Robo-Analyst technology to deliver proven-superior[1] fundamental research and support more cost-effective fulfillment of the fiduciary duty of care.

Colgate’s Stock Has Strong Long-term Upside Based on:

- the company’s large share of the global toothpaste and manual toothbrush market

- the near-recession-proof resilience of Colgate’s products

- the company’s large distribution network

- expected long-term growth in the company’s key markets

- the current price has 35% upside at consensus growth rates.

Figure 1: Long Idea Performance: From Date of Publication Through 5/10/2022

Sources: New Constructs, LLC

What’s Working

Strong Global Brand and Distribution Network Support Revenue Growth: Colgate-Palmolive has strong brands and a vast distribution network that create a strong competitive advantage. According to the Kantar Brand Footprint Survey, Colgate products are in more than 60% of all global households and it is second only to Coca-Cola as the world’s most chosen brand. Smaller competitors cannot match Colgate’s distinctive brands, distribution network, and retail shelf space. These advantages helped the company improve its organic sales 4% year-over-year (YoY) in 1Q22[2].

The company is well-positioned to continue its revenue growth throughout the remainder of 2022. The company’s manufacturing and distribution are back to full capacity, and the company plans to increase advertising spending. Given these developments, Colgate increased its 2022 revenue guidance range from 4% to 5% at the midpoint.

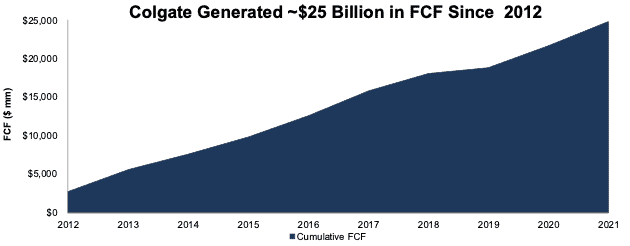

Steady Cash Flows in Multiple Market Environments: Colgate’s strong brand, extensive distribution network, and resilient demand for its products enable the company to generate consistent free cash flow (FCF). No matter the economic environment, oral care, soap, deodorant, and cleaning products are essential for everyday life and exhibit strong demand.

Colgate has generated positive FCF each year since 1998 (earliest available data). Over the past decade, Colgate generated $24.7 billion (38% of market cap) in FCF, per Figure 2. Colgate’s consistent cash flows make its stock a natural choice for investors looking for stability amidst economic uncertainty.

Figure 2: Colgate’s Cumulative Free Cash Flow Since 2012

Sources: New Constructs, LLC and company filings

Colgate’s Digital Transformation: Colgate is quickly developing a strong digital channel that will leverage the same manufacturing and distribution advantages its current channels enjoy. Colgate’s digital sales grew 27% YoY in 2021 and comprised 13% of total sales. The company’s improved online capabilities better prepare it to compete with the increased number of direct-to-consumer competitors in its end markets.

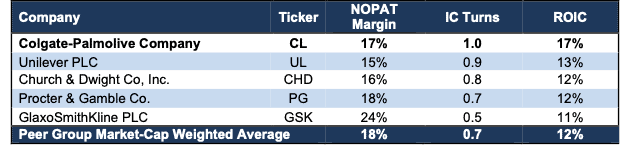

Colgate Is More Profitable Than Competitors: Colgate has the highest invested capital turns amongst its peers listed in Figure 3. High invested capital turns help the company deliver superior return on invested capital (ROIC) compared to competitors too. Colgate’s ROIC of 17% is much higher than the market-cap weighted average of its peers at 12%.

Figure 3: Colgate Vs. Peers: NOPAT Margin, IC Turns & ROIC: TTM

Sources: New Constructs, LLC and company filings

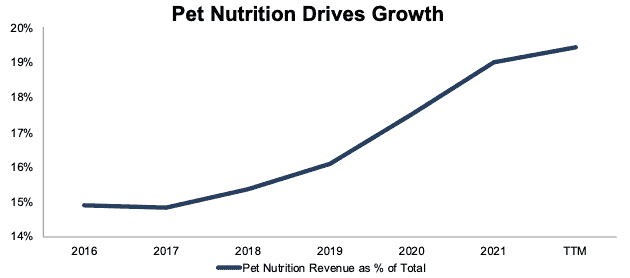

Pet Nutrition Is a Growth Driver: Over the TTM, Colgate’s pet nutrition segment accounted for ~20% of total sales, and since 2016, pet nutrition has grown faster than the rest of the company’s total sales. Looking ahead, Grand View Research forecasts the global pet food market to grow at a 4.4% CAGR through 2030.

Furthermore, added capacity from Colgate’s newly acquired pet food manufacturing facility will support continued growth in Colgate’s pet nutrition segment.

Figure 4: Pet Nutrition Revenue as Percent of Total Since 2016

Sources: New Constructs, LLC and company filings

GAAP Earnings Are Understated: Colgate is more profitable than investors realize. Colgate’s GAAP earnings have fallen from $2.7 billion in 2020 to $2.0 billion TTM. However, the company’s TTM Core Earnings, which measure the normalized operating profits of the business, of $2.6 billion are much higher. Should GAAP earnings more closely reflect the company’s Core Earnings in the future, its shares could move higher on an earnings surprise.

What’s Not Working

Lagging Sales from North America and Europe in 1Q22: Colgate pushed through aggressive price increases to achieve strong 1Q22 organic sales growth in emerging markets, which grew 4.5% YoY in 1Q22. However, the company delayed raising prices in North America and Europe until the end of 1Q22. As a result, organic sales in North America rose just 0.5% YoY and organic sales in Europe fell 3% YoY. Management noted in its 1Q22 earnings call, that they’re seeing “strong sales” from North America and Europe in April. Assuming demand remains strong, the price increases implemented at the end of the first quarter will flow through to profits in coming quarters.

Margins Are Falling: In its recent 1Q22 earnings call, Colgate’s management admitted, “2022 is shaping up as a more difficult year than we anticipated with greater-than-expected increases in raw materials as you have seen from others, particularly fats and oils and logistics.” Specifically, the company is experiencing a 60% YoY increase in the cost of fats and oils, which are used in each of its product segments. Colgate is also experiencing higher transportation costs. Freight rates from its manufacturing facilities in Mexico to its distribution facilities in the U.S. are 30% higher than in 2021.

Though revenue grew in 1Q21, rising costs affected the bottom line. Core Earnings fell from $708 million in 1Q21 to $646 million in 1Q22. Increased raw material and transportation costs are eating away at the company’s gross margins and Colgate’s net operating profit after tax (NOPAT) margin has fallen from 19% in 2019 (before the pandemic) to 17% over the TTM.

However, over the long term, we expect Colgate will effectively offset increased raw material and transportation costs with price increases. Rising inflation has likely created a more elastic pricing environment for Colgate’s products as its competitors are forced to adjust their pricing upwards as well. Most importantly, Colgate’s superior ROIC and operational efficiency position is to weather input price inflation and continue to generate free cash flow better than competitors.

Growth of Private Labels: A long-term challenge facing many consumer product companies is the growth of private label products. Consumers have grown increasingly accepting of private labels. The long-term shift toward private label products accelerated during the COVID-19 pandemic, which saw nearly 40% of U.S. consumers try new brands in the midst of widespread supply-chain problems. Many of these consumers continue to stick with the private-label products they chose during the pandemic.

However, Colgate is better positioned than most consumer product companies since its private label competition is largely limited to its hand soap and toothbrush markets.

Market Share Losses During the Pandemic: Though Colgate remains the largest global toothpaste and manual toothbrush provider, the company lost market share during the pandemic. Colgate’s share of the global toothpaste market fell from 42% in 1Q19 to 39% in 1Q22, while the company’s share of the global manual toothbrush market fell from 32% to 31% over the same time.

Though its market share has slightly fallen from pre-pandemic levels, Colgate’s share of the global toothpaste and manual toothbrush market has remained unchanged since 1Q21. Additionally, in the U.S., Colgate’s share of the manual toothbrush market rose from 42% in 1Q19 to 44% in 1Q22.

Geopolitical Risks: In response to the Russia/Ukraine conflict, Colgate suspended sales of all products in Russia except for “essential health and hygiene products for everyday use”. In its 1Q22 10-Q, Colgate states that its actions in response to the Russia/Ukraine conflict “have not had a material impact on our business.” For reference, sales to Eurasia, constituted ~2% of total sales in 2021.

While the conflict in Ukraine could heighten the risk of more conflicts across the globe, Colgate’s exposure to any singular country outside of the U.S. is limited. Approximately 70% of the company’s sales were generated in more than 200 countries outside of the U.S. in 2021. The company’s primary geopolitical risk is input costs, which is a risk shared by its competitors.

Stock Is Priced for Decline in Profits

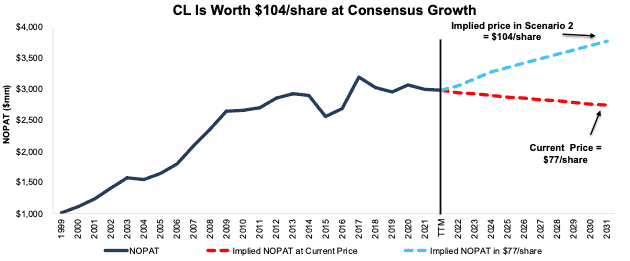

Colgate’s price-to-economic book value (PEBV) ratio is just 0.9, which means the market expects its profits to fall and permanently remain 10% below TTM levels. Below, we use our reverse discounted cash flow (DCF) model to analyze the expectations for future growth in cash flows baked into a couple of stock price scenarios for Colgate.

In the first scenario, we quantify the expectations baked into the current price. We assume:

- NOPAT margin remains at TTM levels of 17% (below five-year average of 19%) from 2022 – 2031, and

- revenue falls 1% (vs. 2022 – 2024 consensus estimate CAGR of 4%) compounded annually from 2022 to 2031.

In this scenario, Colgate’s NOPAT falls 1% compounded annually through 2031, and the stock is worth $77/share today – equal to the current price.

Shares Could Reach $104 +

If we assume Colgate’s:

- NOPAT margin remains at TTM levels of 17% from 2022 – 2031,

- revenue grows at a 4% CAGR from 2022 – 2024 (equal to consensus estimate CAGR from 2022 – 2026), and

- revenue grows by just 2% (vs. 3% CAGR over the past two decades) compounded annually from 2027 – 2031, then

the stock is worth $104/share today – 35% above the current price. In this scenario, Colgate grows NOPAT by 2% compounded annually over the next 10 years. For reference, Colgate has grown NOPAT by 2% compounded annually over the past five years and 5% compounded over the past two decades. Should Colgate’s NOPAT growth improve to historical levels, the stock has even more upside.

Figure 5: Colgate’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

This article originally published on May 11, 2022.

David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.

[2] Colgate defines organic sales as net sales excluding, as applicable, the impact of foreign exchange, acquisitions and divestments.