We closed this position on May 7, 2018. A copy of the associated Position Update report is here.

On the back of a strong holiday season, retailers are back in the spotlight. To start out the new year, we want to take the time to circle back to two of our previous long ideas on some of the giants in the retail industry: Wal-Mart (WMT) and Target (TGT).

We recommended both of these companies to investors in 2015. So far, both picks have underperformed. WMT is up 1% since our call, vs. 14% for the S&P 500. TGT has dropped by 11% while the S&P is up 6%.

Both stocks still look sound, while earning our Attractive rating. Since these are two of the largest retailers in America, and direct competitors, it seems fair to ask: which is the better stock for investors in 2017?

In this article, we will judge Wal-Mart and Target on five key categories:

- Profitability

- Valuation

- Cash Flow Yield

- Corporate Governance

- Growth Opportunities

Two stocks enter. One stock leaves. Who will emerge the champion in this faceoff of retail giants?

Profitability

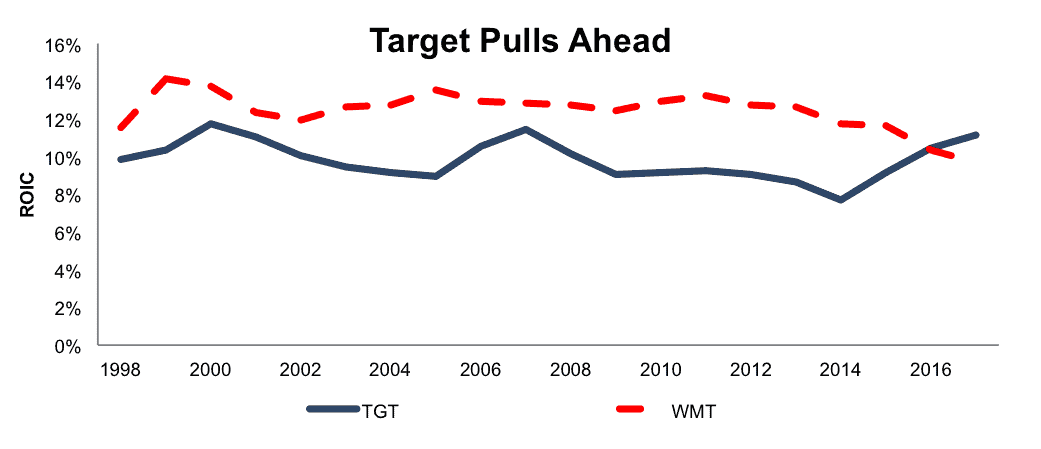

From 1998 to 2015, Wal-Mart dominated this category. The company earned a superior return on invested capital (ROIC) in every single year over that time frame. Per Figure 1, however, that dominance evaporated last year.

Figure 1: Wal-Mart Vs. Target ROIC: 1998-Current

Sources: New Constructs, LLC and company filings.

Target’s ROIC has surged in the past few years as it has sold off unprofitable business lines and refocused on its core competencies. Wal-Mart’s ROIC has gone in the opposite direction as it has overpaid for acquisitions and seen its already thin margins further squeezed by rising labor costs.

Though Wal-Mart’s profitability dominated Target for most of the last twenty years, we’ve seen Target make some big improvements while Wal-Mart has faltered. Right now, Target is the more profitable company, and we expect that edge to last.

Scoreboard: Target 1, Wal-Mart 0

Valuation

Both of these stocks are cheap. A variety of factors, from low growth potential, to the evergreen fears over Amazon (AMZN), have weighed on their stock prices.

WMT was up 13% in 2016, while TGT was flat, but both stocks are still quite cheap based on their current profits. Both stocks have a price to economic book value ratio (PEBV) of just 0.6. This ratio means the market expects a permanent 40% decline in after-tax operating profit (NOPAT) for both companies.

While it’s certainly fair to be wary of the risks facing traditional retailers, such a pessimistic outlook seems unwarranted. Both Wal-Mart and Target are appealingly cheap, which makes this round a push.

Scoreboard: Target 1.5, Wal-Mart 0.5

Cash Flow Yield

Cash is king. This fact goes double for companies like Wal-Mart and Target that require heavy capital investment and return a large amount of capital to shareholders through dividends and buybacks.

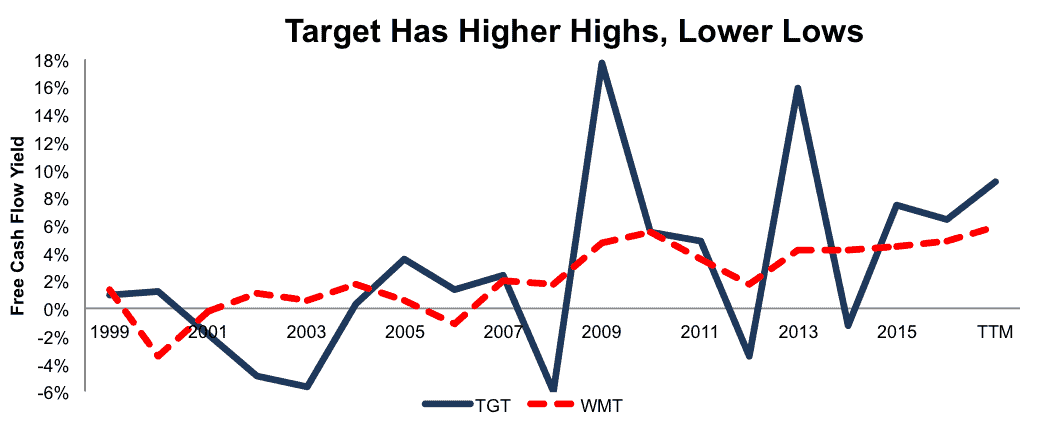

Both Target and Wal-Mart generate substantial free cash flow. Per Figure 2, that cash flow comes in different ways. Wal-Mart provides a steady stream of cash year after year, whereas Target has oscillated between years of great free cash flow and years of low or even negative cash flow.

Figure 2: Wal-Mart Vs. Target Free Cash Flow Yield: 1999-Current

Sources: New Constructs, LLC and company filings.

While Wal-Mart may have the more consistent stream of cash flow, Target has had a better free cash flow yield in four out of the past six years, and a superior average yield in that timeframe, so Target wins this round.

Scoreboard: Target 2.5, Wal-Mart 0.5

Growth Opportunities

Neither of these companies offers investors significant growth potential from their impressive brick-and-mortar footprints. Target’s sales have been flat to down recently, and it’s focusing on small stores that offer only incremental growth going forward. Wal-Mart has announced that it’s slowing the pace of its new store openings over the next couple years.

Online sales have been rosier. Target announced online sales grew by 26% in the most recent quarter. Wal-Mart acquired the rapidly growing Jet.com in a deal that, while richly valued, should provide a significant boost to its e-commerce efforts.

Consensus analyst forecasts have Wal-Mart’s revenue growing by 1.3% compounded annually over the next two years. That’s not a number to generate much excitement, but it’s better than their projection for a 1.9% compounded annual decline in Target’s sales. Wal-Mart wins this round.

Scoreboard: Target 2.5, Wal-Mart 1.5

Corporate Governance

Corporate governance, especially executive compensation, is a critical and underappreciated aspect of investment analysis. High quality executive compensation plans hold executives accountable for capital allocation and align their interests with shareholders. Low quality compensation plans can encourage executives to engage in activities that destroy shareholder value.

Both Wal-Mart and Target start off great by tying a significant portion of executive’s long-term stock grants to ROIC. Even better, they both make an effort to calculate an accurate ROIC and account for off-balance sheet debt due to operating leases.

Digging deeper though, Target’s ROIC methodology is more rigorous. It not only capitalizes operating leases, it also adds back the implied interest component of those leases. Meanwhile, Wal-Mart uses pretax operating income rather than NOPAT, which along with some other unorthodox practices makes its ROIC number less reliable.

We applaud those firms that make the effort to hold executives accountable to performance metrics that are directly aligned with shareholder value creation. Though ROIC is a simple concept, it is a rather major undertaking to get right, especially across multiple companies. Target’s efforts here are noteworthy.

Wal-Mart does better than most companies we cover at aligning executive incentives with shareholder value, but Target’s executive compensation plan is one of the gold standards in corporate America. Target wins this round and the match

Scoreboard: Target 3.5, Wal-Mart 1.5

Conclusion

You can’t go wrong with either of these stocks. They both have great track records of profitability and cheap valuations. If you have to choose just one, though, Target’s superior ROIC, cash flow, and executive compensation practices make it the better pick in 2017 for investors.

This article originally published here on January 3, 2017.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Click here to download a PDF of this report.

Scottrade clients get a Free Gold Membership ($588/yr value) as well as 50% discounts and up to 20 free trades ($140 value) for signing up to Platinum, Pro, or Unlimited memberships. Login or open your Scottrade account & find us under Quotes & Research/Investor Tools.

Photo Credit: Jotam Trejo (Flickr)