A Terrible Business With An Incredibly Optimistic Valuation

Do you ever wonder how disconnected a stock’s valuation can possibly get from the fundamentals of the underlying business?

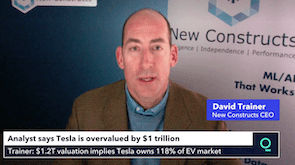

David Trainer, Founder & CEO