No Light at the End of the Tunnel for This Stock

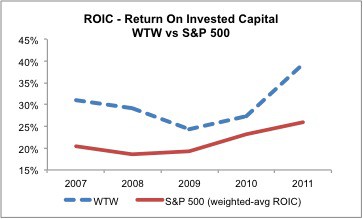

This firm's shrinking cash flows can’t cover its debt burden, its accounting is confusing and possibly unreliable, its industry faces technological disruption, and its valuation assumes implausibly high profit growth.

Sam McBride