As more investors fear a reversal of the huge market gains since mid-March, they should first eliminate extremely risky holdings from their portfolios. At the top of our list of extremely risky stocks investors should sell is Tesla (TSLA: $1,887/share).

Since we put Tesla in the Danger Zone on July 29, 2019, the stock is up ~700% while the S&P 500 is up just 12%. While this performance, including the recent stock-split-driven price spike, makes TSLA more attractive to many momentum/technical traders, more cautious investors and fiduciaries should only be more wary and should consider the unusually high level of risk in the stock given that fundamentals are not driving the price.

This report shows investors of all types just how extreme the risk in TSLA is based on:

- Overstated earnings from short-term regulatory credits

- Overlooked, but huge, EV market share that incumbent automakers will take

- Doing the math: the revenue, profit and production increases implied by the current valuation are highly unrealistic. Not even the most bullish analysts have forecasted the growth baked into the current price.

The Most Valuable Car Company in the World, or Most Overvalued?

In July 2020, Tesla became the most valuable car company in the world when it eclipsed the market cap of Toyota Motors (TM).

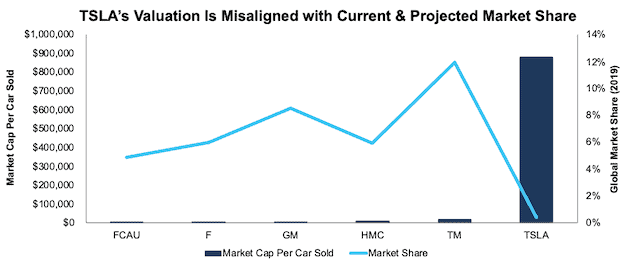

Figure 1 compares the market share and market caps per car sold for Tesla, Toyota, Honda Motors (HMC), General Motors (GM), Ford (F), and Fiat Chrysler (FCAU). Of the incumbent automakers, Toyota’s market cap per car sold is the highest at ~$19.7k. Tesla’s market cap per car sold over the TTM period is $880.2k, or more than 44 times higher than Toyota.

Is Tesla, with less than 1% of the global automotive market, worth that much more than Toyota, with ~12% of the market in 2019? Even if Tesla warrants this huge valuation premium now, how much upside is left from here?

Figure 1: Market Cap per Car Sold: Tesla vs. Peers – TTM

Sources: New Constructs, LLC, and company filings

Tesla Turns a Profit Selling Regulatory Credits, Not Vehicles

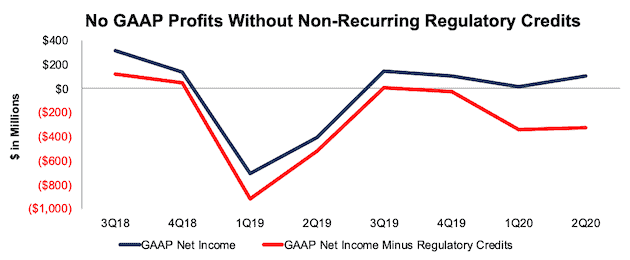

Tesla’s recently reported profits are based on sales of free regulatory credits to gasoline automakers, whose fleets, on average, don’t meet regulatory required emissions levels.

Tesla enjoys a 100% profit margin on these credits since the company gets them as a free byproduct of being an all-electric vehicle maker. In 2Q20 alone, Tesla sold $428 million in regulatory credits on its way to reporting GAAP net income of $104 million. When we remove these credits, Tesla’s GAAP net income would have been negative in each of the past three quarters, per Figure 2.

Figure 2: GAAP Profits with and Without Regulatory Credits: 3Q18 – 2Q20

Sources: New Constructs, LLC, and company filings

Selling credits isn’t a viable long-term strategy. As other firms ramp up production of EVs and earn more credits, they purchase less from Tesla. For example, Fiat Chrysler CEO Mike Manley noted in the firm’s 1Q19 earnings call that it expects to be compliant without the help of credits from Tesla by 2022. Without the profits from selling free regulatory credits, Tesla will have trouble increasing its already overstated profits.

Market Share Will Drop Precipitously as Incumbents Enter the EV Market

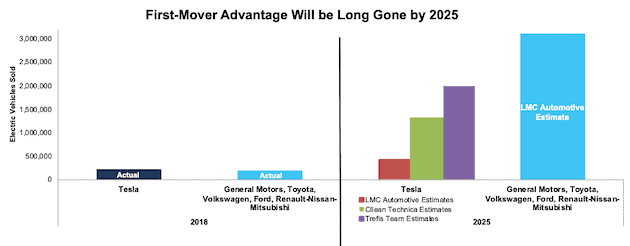

Tesla bulls tend to overlook the slow, but deliberate and large, entrance that incumbent automakers will make in the EV market. By 2025, these firms are expected to sell ~3.1 million EVs, which is significantly more than even the most optimistic estimates for Tesla sales in 2025. For comparison, Tesla sold ~368,000 cars in 2019 and expects to sell 500,000 in 2020.

- Volkswagen plans to produce 1.5 million EVs in 2025.

- General Motors plans to sell 1 million EVs by 2025.

- Toyota plans to produce 500,000 EVs and ~5.3 million electrified vehicles (EVs and hybrids), or half its global sales in 2025.

- Ford is expected to sell ~332,000 EVs in 2025.

Figure 3 illustrates how the incumbent automakers will dominate, relative to Tesla, the EV market by 2025. Projections for Tesla’s vehicle sales in 2025 vary widely: 2 million from the Trefis Team, 1.3 million from Clean Technica, and 413,000 from LMC Automotive. We have not found an estimate for Tesla sales that is not well below the incumbents expected EV sales of ~3.1 million EVs in 2025.

Both Volkswagen and Renault-Nissan-Mitsubishi are expected to sell more cars, individually, than Tesla by 2025.

Figure 3: Past & Projected Electric Vehicle Sales by Manufacturer: 2018 & 2025

Sources: New Constructs, LLC, and LMC Automotive, Clean Technica and Trefis Team

Unable to Match Incumbents’ Investment in EVs

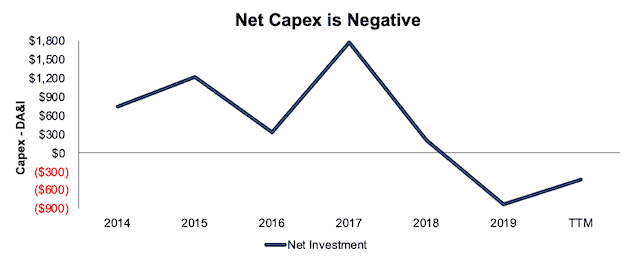

After investing heavily in its operations for years, Tesla has reversed course, presumably to meet profit goals and reduce dependence on outside capital. Tesla’s capex in 2019 ($1.3 billion) represented just 62% of its depreciation, amortization, and impairment ($2.2 billion). In other words, net investment was -$827 million.

Over the TTM period, depreciation, amortization, and impairment remains higher than capex and net investment is -$429 million, per Figure 4.

Tesla is ramping down spending as competitors are ramping up.

Figure 4: Tesla Capex Minus Depreciation, Amortization, and Impairment: 2014-TTM

Sources: New Constructs, LLC, and company filings

Even if Tesla maintained its capex investment at past levels, it would still be just a small fraction of the incumbent automakers’ spending on EV over the next few years. For example:

- Volkswagen Group plans to spend 33 billion euros (~$39 billion at current exchange rates) through 2024.

- General Motors plans to spend $20 billion through 2025.

- Daimler (Mercedes Benz) plans to spend 10 billion euros (~$11.8 billion at current exchange rates) through 2022.

- Ford plans to spend $11 billion through 2022.

- Total for these four alone: $82 billion

Consulting firm AlixPartners puts the overall incumbent investment in EV even higher at $255 billion by 2022.

Tesla’s capex over the TTM period was just $1.8 billion and plans for future spending remain unclear.

In the firm’s 4Q19 earnings call, when asked about guidance for capex in 2020, CEO Elon Musk said “I don't know if we wanted to tell you, I don't think we want to say what our capex is going to be this year”.

Tesla must find a way to fund numerous capital intensive projects to have any hope of growing production capacity and preserving its EV market share:

- Building the Berlin Gigafactory

- Build capacity for Model Y at the Shanghai Gigafactory

- Building the next US Gigafactory in Austin, Texas

- Increase production of Model 3 and Y in its Fremont plant

- Develop and built the Tesla Semi, Cybertruck and Roadster

Perhaps, Tesla’s lack of real profits becomes a real problem as the company’s ability to sell stock at such high prices diminishes and the firm cannot get the capital needed to grow its business.

Incumbents Make Better & Cheaper Cars and Their Market Share Gains Will Persist

Investors should note the operational competitive advantages of the incumbent automakers. Specifically, they enjoy superior manufacturing, distribution, and marketing scale advantages over Tesla. Those advantages mean they can produce better vehicles at a lower cost as well as distribute and sell vehicles with more scale and efficiency. As we approach 2025, the cash flow benefits of those competitive advantages will manifest.

Meanwhile, as Tesla struggles to scale up production, vehicle quality complaints have scaled up, too. J.D. Power first noted issues with the quality of Tesla’s vehicles in 2017. In the 2020 J.D. Power Initial Quality Survey, Tesla vehicles, in their first year included in the study, would[1] have ranked last among major automakers. The vehicles were found to have 250 problems per 100 vehicles, much higher than the industry average of 166 problems.

Dodge, owned by Fiat Chrysler, tied with Kia for first with an initial quality score of 136, and Chevrolet, owned by General Motors, ranked just behind the two with a score of 141. Hyundai, General Motors, BMW, Ford, Nissan, and Toyota respectively earned the most vehicle model level awards. General Motors’ Yantai Dongyue 2 plant received the Platinum Quality Award for producing vehicles with the fewest defects or malfunctions.

Is there a bigger competitive advantage in the auto business than the ability to produce higher quality cars at scale? Maybe, marketing can offset some of that advantage, and Elon Musk is an excellent marketer. Nevertheless, we think the incumbents will reveal that Tesla is just a flashy boutique automaker that cannot compete with them in the long run, which begins in 2025.

Not the Only (or Best) Self-Driving Tech in Town

Tesla has boasted about its vehicle’s self-driving capabilities for a long time, even going as far as selling an “Autopilot” feature for $2,000-$3,000 and a “Full Self Driving” feature for $7,000. The names of these features are misleading.

Tesla’s misleading marketing of these features has run into trouble with regulators, with a German court banning the use of “full potential for autonomous driving” and “Autopilot inclusive” from German marketing materials. In the United States, the National Transportation Safety Board (NTSB) criticized Tesla for not taking adequate steps to prevent “foreseeable abuse” of its Autopilot technology.

Furthermore, the Los Angeles Times reports that the NTSB provided recommendations in 2017 for driver-assist systems to prevent driver inattention and misuse. Automakers including Volkswagen, Nissan, and BMW reported on their attempts to meet the recommendations, but Tesla did not. On this topic, NTSB Chairman Robert Sumwalt remarked: “Sadly, one manufacturer has ignored us, and that manufacturer is Tesla. We’ve heard nothing; we’re still waiting.”

Meanwhile, Tesla is not the only firm with self-driving auto aspirations. Audi, BMW, Daimler, Volvo, Ford, General Motors, Honda, and Toyota each have their own driver assist and self-driving platforms. Other automakers, such as Jaguar Land Rover, Nissan, and Renault are partnering with Waymo (owned by Alphabet (GOOGL) to assist in their self-driving capabilities.

Importantly, Tesla lags some of the incumbent manufacturers and those partnering with traditional automobile firms. For instance, Consumer Reports ranked General Motors’ Super Cruise ahead of Tesla’s Autopilot system. MES Insights, an industry research provider, ranks Waymo, GM Cruise, and Ford’s Argo AI startup ahead of Tesla in terms of expertise and capabilities for self-driving. Lastly, Guidehouse Insights ranked Waymo, Ford and General Motors first, second, and third respectively in their Automated Driving Vehicles leaderboard. Tesla ranked last out of the 18 firms included in the analysis.

Battery Technology Will Not Save Tesla’s Stock

Many Tesla bulls readily concede that the stock’s valuation is not based on the car business. Instead, they say the company’s vastly superior battery technology and its potential impact on the distribution and storage of power are the real drivers of future profits.

We do not think the current facts support that thesis. At one time, Tesla was way ahead of the competition in the quality and scale of its battery factories, but that edge has eroded over the last few years.

Cost Advantages Are Fading. As we noted in our Long Idea report on General Motors, the firm’s Ultium battery pack is expected to cost as little as $120/kilowatt-hour (kWh), and the firm believes the cost will soon fall below $100/kWh. Volkswagen expects the costs for its ID series will reach $152/kWh by 2020. Across the industry, the average battery pack cost was $161/kWh, which is down from $236/kWh in 2017.

For comparison, Cairn Energy Research Advisors estimates Tesla batteries cost $158/kWh in 2019.

Range Advantages Are Fading. General Motors recently announced its new battery offers up to 400 miles of range (a feat Tesla only recently achieved in June 2020, despite a multi-year head-start) and will be used in several of its new fully electric models, including the Cruise Origin and Cadillac luxury SUV.

Rivian, an EV startup backed by Ford, will offer the option to equip its 2021 R1T with a range over 400 miles. BMW expects its i4 will provide 370 miles of range, which is equal to the top end of the expected range of Ford’s Mustang Mach-E. Additionally, Lion Smart, a German based engineering firm aiming to develop energy storage solutions for auto manufacturers, revealed a BMW i3 with 435 miles of range as a proof-of-concept.

Tesla’s competition on this front grows larger and more advanced every day. All the EV makers are focused on increasing range of their vehicles, and they are succeeding.

Manufacturing Advantages Are Gone. It’s hard to make a straight-faced argument that Tesla’s battery production has any kind of an edge over competitors.

- In early 2018, Volkswagen AG secured $25 billion in battery supplies to begin an aggressive push into electric cars. More recently, Volkswagen announced it was building a battery plant at its Salzgitter site in Germany with an expected production capacity of 16 gigawatt hours.

- China’s Contemporary Amperex Technology, which supplies BMW, Volkswagen, Toyota, Honda, Daimler, and more, expects to increase its total production capacity to 137 gigawatt hours in 2022.

- SK Innovation, which supplies Volkswagen, Kia, Land Rover, and more, is investing $3.9 billion to expand its annual production to 33 gigawatt hours by 2022.

- General Motors entered into a joint venture with LG Chem to produce batteries for its EVs. The plant, which will be in Lordstown Ohio, will have an annual production capacity of 30+ gigawatt hours.

- LG Chem also supplies many other automakers, such as Audi and Mercedes-Benz, with current capacity of 70 gigawatt hours, and plans to increase capacity to 100 gigawatt hours by end of 2020.

- Total capacity from these producers is ~316 gigawatt hours.

For comparison, Tesla’s Gigafactory in Nevada has a theoretical capacity of 35 gigawatts, but production issues keep the plant running below full capacity.There is little evidence that any of the knowledge or experience at this original factory are translating into success at other factories.

The Gigafactory in Shanghai, which houses production of the Model 3 (and Model Y in 2021), is not expected to make its own batteries. In mid 2019, Bloomberg reported Tesla agreed to buy batteries from LG Chem for use in vehicles produced in China, and “plans to use multiple battery suppliers for its China-made cars.”

Battery production at the Gigafactory in Berlin, which is currently under construction and expected to be operational in July 2021, remains unclear. When the factory was first announced, Elon Musk noted it would have battery production on site. However, in July 2020, Tesla submitted an updated application for environmental approval with the local government and battery production plans were removed from the application.

Lastly, details on the recently announced Gigafactory in Austin remain minimal, besides that it will house production for the Cybertruck, Semi, Model 3 and Model Y. Unless it will produce batteries at a greater capacity than any existing plant, Tesla can no longer claim to have a scale advantage in battery production.

More generally, Tesla’s battery strategy leaves industry experts skeptical. Michael Ramsey, senior director and analyst with Gartner’s CIO Research Group believes, “Tesla is more willing to risk their battery not lasting eight to 10 years and just dealing with the consequences on the back-end.” Additionally Tesla’s decision to use aluminum, in addition to nickel and cobalt leads to maximum range, but higher fire risk and shorter life cycle, as reported by The Washington Post.

We think the promise of the earth-shattering battery technology is like many of Mr. Musk’s promises: a distraction from the true fundamentals of Tesla’s business.

Battery Day Is Just Another Distraction. As usual, rumors of what to expect for this event run the gamut: a battery that lasts one-million-miles, technological advances in design and/or manufacturing, or that Tesla will become a battery supplier to the entire auto industry. We do not buy this hype any more than we should have bought any prior hype. The fact is that the number of missed deadlines from Mr. Musk far exceeds the number of fulfilled rumors.

The event is more likely to deliver far more pedestrian news. Electrek believes the key announcement will be how “Tesla plans to not be completely reliant on third-party [battery] manufacturers anymore.” Nothing earth shattering to be sure. We do not expect there will be any news that will remotely justify the cash flow expectations baked into the current stock price.

The stock might rally no matter the news as it often rallies for non-fundamental reasons. We think investors with fiduciary responsibilities would be wise to sell into that strength.

Doing the Math: Reverse DCF Analysis Reveals Unrealistic Expectations

We’ve outlined the competitive forces that will challenge Tesla, and, now, we will illustrate just how overvalued the stock is in the face of these forces.

We also want to take a moment to recognize that the performance of this stock has rarely, if ever, been about valuation and that it has earned tremendous returns for many, many investors. Nevertheless, we think the time has come for those with fiduciary responsibilities to consider just how much risk they take by owning TSLA at anywhere close to current levels.

At its current price of ~$1,900, Tesla is priced as if it will not only achieve the scale and production of a mass-market automaker and capture a majority of the electric vehicle market, but do so while maintaining its well-above-average vehicle prices. Below, we use our reverse DCF model to quantify the cash flow expectations baked into Tesla’s current stock price.

Already Priced for Market Dominance:

To justify its current price of ~$1,900/share, Tesla must:

- Immediately achieve a 7% NOPAT margin, which is equal to Toyota’s NOPAT margin (7%), and above Tesla’s TTM NOPAT margin of 5.6%.

- Grow revenue by 32% compounded annually for the next 11 years, which given the margin improvement, means NOPAT grows 50% compounded annually over the same time.

- Grow revenue, NOPAT and FCF without increasing working capital or fixed assets – a highly unlikely assumption that creates a truly best-case scenario. For reference, Tesla’s invested capital has grown 56% compounded annually since 2010 and 36% compounded over the past five years

See the math behind this reverse DCF scenario. In this scenario, Tesla would earn $524 billion in revenue 11 years from now, (which would equal 65% of 2027’s projected EV revenues) and the firm’s NOPAT in 2030 would equal $36.1 billion (vs. $1.5 billion TTM). For comparison, Toyota, the world’s second largest (by revenue) automobile manufacturer, generated TTM NOPAT of $19.4 billion.

Over the TTM period, only two companies generated NOPAT greater than the NOPAT implied by Tesla’s valuation: Apple (AAPL) at $54.5 billion and Microsoft (MSFT) at $44.8 billion.

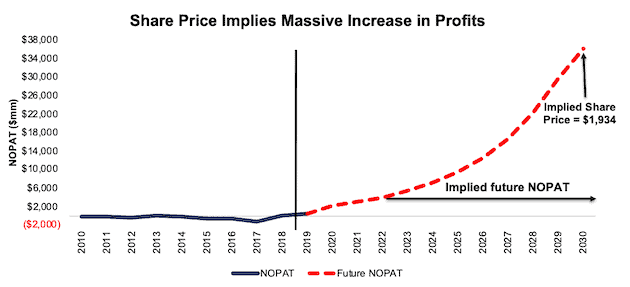

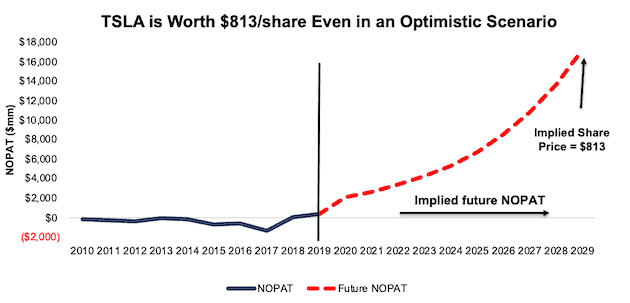

Figure 5 compares the firm’s implied future NOPAT in this scenario to its historical NOPAT. In any scenario worse than this one, TSLA holds significant downside risk, as we’ll show.

Figure 5: Current Valuation Implies Drastic Profit Growth

Sources: New Constructs, LLC and company filings.

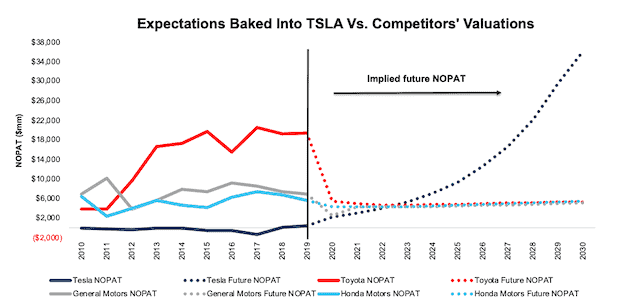

Figure 6 illustrates the expectations baked into Tesla’s stock price compared to the expectations baked into the next three largest auto manufacturers by market cap: Toyota, Honda Motors, and General Motors. As you can see, the market currently prices the three incumbents as if profits will severely and permanently drop, while Tesla’s profits will soar.

Figure 6: Current Valuation Implies Tesla Profits Soar and Competitors Fall

Sources: New Constructs, LLC and company filings.

No One Expects the Revenues Implied by Tesla’s Stock Price

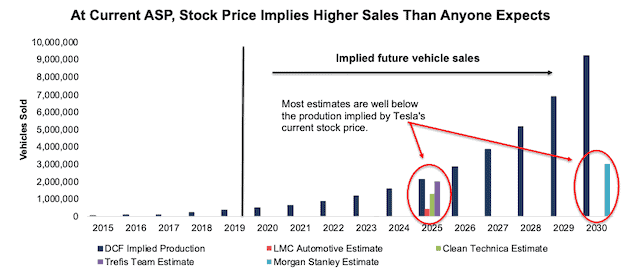

Per Figure 7, at its current ASP of ~$57k, the current stock price implies the firm will sell 9.2 million vehicles in 2030, or 35% of the entire EV market and 1747%[2] more than expected sales in 2020.

Figure 7: Current Valuation Implies Significant Increase in Number of Vehicles Sold

Sources: New Constructs, LLC, company filings, LMC Automotive, Clean Technica, Trefis Team & Morgan Stanley.

If Tesla’s ASP falls to ~$37k, or the average car price in the U.S. in 2019, its implied sales volume in 2030 increases to 14.2 million vehicles in 2030, or 54% of projected EV sales in that year and 2730% more than expected sales in 2020.

Even if Tesla meets the most optimistic estimate and sells 2 million vehicles by 2025, can it make another quantum leap in production from 2 million to 9.2 million, or 14.2 million, by 2030?

Morgan Stanley analyst Adam Jonas projects Tesla will sell 3 million units a year by 2030, or less than a quarter of the sales volume implied by its valuation. The implied value of the stock based on sales of 3 million units in 2030 at the ~$57k ASP is $533/share today – a 72% downside.

We think it is highly unlikely that Tesla will ever sell such a high volume of cars at its current ASP because the luxury car market is not very large[3] relative to the overall automobile market. The fact of the matter is that there are not very many people on earth that are wealthy enough to afford such an expensive car.

So, investors should consider the implied vehicle sales based on lower ASPs:

- 14.2 million vehicles - ASP of $37k (average car price in U.S. in 2019)

- 21.9 million vehicles - ASP of ~$24k (equal to Toyota)

- 32.9 million vehicles - ASP of ~$16k (equal to General Motors[4])

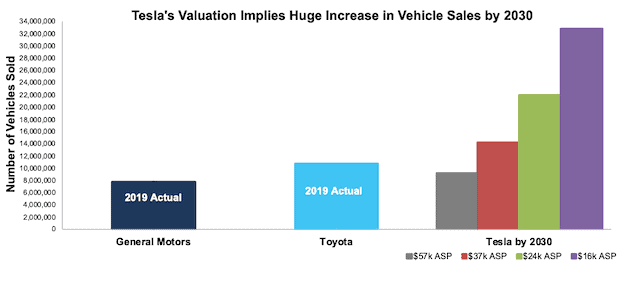

Figure 8 provides another view into how overvalued TSLA is at current levels. It shows how many vehicles Tesla must sell at lower ASPs compared to Toyota and GM’s actual 2019 vehicle sales.

Tesla’s valuation implies the company will either sell more cars at a higher ASP than there are buyers or more cars at a lower ASP than the largest automakers in the world.

Figure 8: Tesla’s Implied Vehicle Sales Vs. Toyota and General Motors’ 2019 Results

Sources: New Constructs, LLC and company filings.

In other words, Tesla’s current valuation implies that, by 2030, the firm will produce and sell at least 33% more vehicles than Toyota and 84% more than GM produced in 2019. Such an increase in production appears well beyond the realm of possibility for a firm that has struggled as much and taken as long as it has to reach 368,000 vehicles sold.

Meanwhile, the incumbents’ stock prices imply their vehicle production (measured from 2019 levels) will have declined by 19% in 2030

Owning or recommending clients own TSLA at these levels does not appear to be a fiduciarily-responsible option, in our opinion.

Significant Downside Even in an Optimistic Scenario

Even if we assume Tesla can achieve a 7% NOPAT margin, equal to Toyota, and grow revenue by 26% compounded annually (in line with consensus estimates through 2025) for the next decade, the stock is worth only $813/share today – a 57% downside to the current stock price. See the math behind this reverse DCF scenario.

Figure 9 compares the firm’s implied future NOPAT in this scenario to its historical NOPAT. This scenario implies Tesla’s NOPAT 10 years from now will be over $17 billion. For reference, Toyota’s TTM NOPAT is just 13% higher, at $19 billion.

Figure 9: Tesla Has Large Downside Risk: DCF Valuation Scenario

Sources: New Constructs, LLC and company filings.

Even More Downside in A More Likely Scenario

We think it is likely that Tesla never generates more than $5 billion in NOPAT, which gives it a fundamental value ~$144/share. Our most likely scenario is that investors wake up to Tesla’s competitive disadvantages and knock the stock down to $250-300/share where a white knight buyer might scoop it up.

S&P 500 Inclusion May Not Be the Boon Some Expect

The big development at the end of 2Q20 was that, due to its fourth consecutive quarter of GAAP net income, Tesla would now be eligible for inclusion in the S&P 500. Many believe inclusion would cause billions in capital to flow into TSLA, as fund managers and ETFs that index to the S&P 500 would be forced to buy shares of Tesla.

However, the effects of index inclusion may be short-lived, and not nearly as meaningful as some investors expect. A new working paper from professors at Ohio State University, Tulane University, and Lancaster University, “Does Joining the S&P 500 Index Hurt Firms?” investigates the impact of firms of joining the S&P 500 index from 1997 to 2017.

Most importantly on the topic of Tesla’s inclusion, the paper makes two key findings. First, joining the index has a transitory positive effect but no long-term effect on stock prices in the first half of the sample period (1997-2007). Second, stock prices of firms joining the index experience no transitory positive effect and negative risk-adjusted long-term return in the second half of the sample period (2008-2017). In other words, the effect of being added to the S&P 500 is negative in recent years.

Catalyst: Market Can Remain Irrational, But These Events Could Send Shares Lower

While Tesla reported four consecutive quarters of GAAP profits, it’s clear from our analysis that these profits aren’t sustainable.

The regulatory credits not only mislead investors about Tesla’s profitability, but they also teach investors to focus on GAAP profits, which could set the firm up to miss expectations in the coming quarters. Unlike many other firms, consensus expectations for Tesla have not fallen as precipitously due to the COVID-19 pandemic. In fact, expectations for 2020 EPS currently sit at $8.66/share. Meanwhile, expectations for 2021 are nearly two times as high, at $14.54/share. If Tesla fails to meet or beat these soaring expectations, shares could fall significantly to a more rational level.

Further, our market share analysis shows that the music will stop for Tesla at some point in the next few years. With the current stock valuation implying greater market share than Tesla or even its bullish analysts predict, it is only a matter of time before analysts and investors will have to reconcile their unrealistic hopes with reality.

What Noise Traders Miss With TSLA

These days, fewer investors pay attention to fundamentals and the red flags buried in financial filings. Instead, due to the proliferation of noise traders, the focus tends toward technical trading tends while high-quality fundamental research is overlooked. Here’s a quick summary for noise traders when analyzing TSLA:

- Reported GAAP profits are a mirage driven by non-recurring regulatory credit sales

- Competition is projected to ramp up production and surpass Tesla in just a few years

- Declining net investment and lack of access to capital undermines Tesla’s growth potential

- Valuation implies Tesla can dominate all incumbent automakers and garner over half the projected 2027 EV market revenues

Executive Compensation Adds Additional Risk

Tesla made headlines in early 2018 with a new compensation plan for Elon Musk that the New York Times described as the “Boldest Pay Plan in Corporate History.” Bold is one way to describe the plan, which provides for 12 escalating tranches of stock option grants based on hitting market cap, revenue, and adjusted EBITDA levels. We would call it foolhardy.

In many ways, Musk’s compensation plan reminds us of the misaligned incentives that led to the blowup of Valeant (VRX). Like Valeant’s plan, Tesla’s compensation plan uses adjusted, “Non-GAAP” measures and outrageous valuation targets that incentivize excessive risk-taking with no accountability to the true fundamentals of the business. Tesla’s compensation plan could encourage value-destroying acquisitions, shareholder dilution, earnings management, and a focus on keeping the stock price higher, rather than building a long-term profitable business.

Without significant changes to its executive compensation, Elon Musk is incentivized to boost top-line growth numbers with no attention to prudent capital stewardship. We’d recommend the firm’s compensation committee tie pay to improving ROIC, which is directly correlated with creating shareholder value.

Insider Trading and Short Interest

Insider activity has been minimal over the past 12 months, with 15 thousand shares purchased and 253 thousand shares sold for a net effect of 238 thousand shares sold. These sales represent less than 1% of shares outstanding.

There are currently 11.9 million shares sold short, which equates to 6% of shares outstanding and less than 1 day to cover. The number of shares sold short has declined by 6% since last month.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings as shown in the Harvard Business School and MIT Sloan paper, "Core Earnings: New Data and Evidence”.

Below are specifics on the adjustments we make based on Robo-Analyst findings in Tesla’s 10-Q and 10-K:

Income Statement: we made $1.5 billion of adjustments, with a net effect of removing $1.3 billion in non-operating expenses (5% of revenue). You can see all the adjustments made to Tesla’s income statement here.

Balance Sheet: we made $9.7 billion of adjustments to calculate invested capital with a net decrease of $412 million. One of the most notable adjustments was $1.2 billion in asset write-downs. This adjustment represented 5% of reported net assets. You can see all the adjustments made to Tesla’s balance sheet here.

Valuation: we made $62.1 billion of adjustments with a net effect of decreasing shareholder value by $47.5 billion. The most notable adjustment to shareholder value was $37.7 billion in outstanding employee stock options. This adjustment represents 11% of Tesla’s market cap. See all adjustments to Tesla’s valuation here.

Unattractive Funds That Hold TSLA

The following funds receive our Unattractive-or-worse rating and allocate significantly to Tesla.

- Baron Partners Fund (BPTIX) – 31.3% allocation and Unattractive rating

- Baron Focused Growth Fund (GFGUX) – 25.3% allocation and Unattractive rating

- ARK Autonomous Technology & Robotics ETF (ARKQ) – 13.3% allocation and Unattractive rating

- ARK Innovation ETF (ARKK) – 10.8% allocation and Very Unattractive rating

- VanEck Vectors Low Carbon Energy ETF (SMOG) – 9.6% allocation and Unattractive rating

- American Beacon ARK Transformational Innovation Fund (ADNIX) – 9.5% allocation and Very Unattractive rating

This article originally published on August 18, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Tesla isn’t officially included in JD Power’s rankings, because according to Doug Betts, president of the automotive division at J.D. Power, “unlike other manufacturers, Tesla doesn’t grant us permission to survey its owners in 15 states where it is required. However, we were able to collect a large enough sample of surveys from owners in the other 35 states and, from that base, we calculated Tesla’s score.”

[2] Note that Tesla’s stated goal for sales in 2020 is 500,000 vehicles.

[3] See vehicle sales stats for BMW from 2007-2019, for Lexus from 2018-2019, for Audi from 2005-2019 and for Mercedes from 2018-2019.

[4] *ASP calculated as automotive revenue / number of vehicles sold.

16 replies to "Tesla: The Most Dangerous Stock for Fiduciaries"

Unbelievably great piece of work. Outstanding.

The wheels are falling off.

While I don’t disagree with the fundamentals from a manufacturing basis, is it possible that some (not the bandwagon) are betting on Tesla’s FSD machine learning to make the “step function” leap? How does the valuation change if this analysis is represented as a technology stock with potential world changing impact?

One of the best Danger Zone´s articles. Thank you, Kyle.

Thanks for reading!

Dave,

Sure, Tesla creates technology, but just like all of its competitors, they also have to manufacture and distribute that technology to ultimately profit. Thanks for reading.

Martin,

Thanks for reading!

I think the analysis is overly biased on the negative and looks at TSLA from the angle of traditional auto industry and typical balance sheet math. Misses many very significant upside potential areas like 1. Direct sale model without dealers (no discussion of actual margin differences) 2. Vertical integration giving much faster product cycle and better margins. 3. OTA software updates which continuously increase the functionality and thus value of the TSLA EV, 4. Software revenue with much higher margin and future projection. e.g. 25% of buyers are paying for Full Self Driving feature which has $8K price, 5. TSLA has the most advanced and most cost efficient automated manufacturing process in the industry which not only give better margin and lowest cost per unit of factory capacity in the industry but also superior scale. i.e. TSLA is currently building/extending 3 gigafactories at the same time. 6. Legacy automakers are knocked back by the Great Shutdown and have to scale back their programs and EV launch schedules. 7. Legacy automakers are behind and struggling in EV drive technology, battery tech, AI & autonomy technology, software defined EV etc etc. 8. TSLA has proven they can execute much faster than traditional automakers and look poised to extend their 3-4 year lead. 9. TSLA does not have a demand problem and don’t need to spend on ads, while traditional automakers have idle inventory and need to dole out incentives and rebates.

A fair analysis should include these substantial upsides and high margin factors – which the report entirely miss. How can this be? Perhaps the authors don’t deeply understand TSLA nor EV to the depth necessary for such a critical review.

Denis,

Thanks for your comment. The article explains how many incumbent automakers are catching up in battery technology and are even ahead of Tesla in self-driving technology. The valuation scenario represented by Figure 5 assumes Tesla achieves higher margins than it currently achieves, sells 9.2 million vehicles in 2030 and grow revenue by 1747% from 2020 to 2030 as demand for Teslas greatly increases, and reaches NOPAT levels in 2030 currently only seen by two other tech companies, Apple and Microsoft. After factoring in all of those assumptions, it is important for fiduciaries to consider the downside risks if those expectations go unmet. Thanks for reading!

Incumbent automakers have been “catching up” for years. Where are those “Tesla killers”? I have yet to see an electric car that comes close to my Model 3. And converting from ICE to electric will cost billions and is not easy to do. Traditional automakers have fallen way behind and many will go bankrupt trying to catch up. No one is close to Tesla in performance, battery technology, efficiency, not to mention the vast global Supercharger Network. I’m tired of the Tesla haters that don’t truly know what Tesla is all about. They are a TECHNOLOGY AND ENERGY company that just happen to also produce the absolute best cars on the road. I’m so glad I traded in my BMW 3 series dinosaur. I’m never looking back and I can’t wait for the rest of the world to finally see the future: TESLA

@Jose Perez,

Thanks for your thoughts!

I completely agree with Jose Perez

It is unbelievable but all I have heard from all my friends who own Teslas now is that they would never buy Audis or BMW or any other car again but a new Tesla they are completely enthused about everything Tesla

!!!

Hi Matt – Thanks for the time and effort on writing this research note on TSLA. It’s never a bad idea for a long-term investor to look at both the bull and the bear arguments for a company. My one question: now that Battery Day has concluded and the info is out there on how TSLA plans to executive a complete paradigm shift on battery manufacturing and innovation and come out with their $25k high-volume mainstream vehicle by 2024/25, can we expect an updated research note? I imagine that we can keep your original post and keep it as the bear scenario, and after plugging in new assumptions from Battery Day, use your same reverse DCF to come up with the new bull case. I think it’s totally fine to leave out the other options such as insurance, FSD, and other potential but unrealized non-auto tech innovations so the research remains apples to apples. Focus could remain on reduction in battery cost, improved travel distance/performance, and lower capital requirements from first principles redesign of their upcoming Giga/Terafactories versus similar plans to scale from legacy automakers (VW could be a strong contender).

Christian,

We do not believe that anything Tesla announced during its last Battery Day fundamentally changes our thesis on the company. As noted in our report, other firms are quickly catching up with Tesla in battery technology and costs. With respect to plans for the $25K high-volume mainstream vehicle, Figure 8 shows that Tesla would need to sell ~26 million vehicles with an ASP of $24K by 2030 to justify its current price. We believe that Tesla will have a difficult time reaching that level of scale by 2030 given that it sold just 368K cars in 2019. Thanks for reading!

Thank you so much. This is such good insight. You are a Gem!

FSD sub price * Take rate * number of cars in market

Lets say 4.4.5m cars in 2025 and 30% have FSD.

$100* 1.35m = 135m a month, = $1.6b in rev per year at probably a 85% gross margin. I have used conservative numbers here ($100 and 30% adoption rate) Piper Sandler was at close to 50% i think and has like 14B in FSD revenue in 2025. This analysis also excludes their Solar biz where musk has said they aim to be make it larger than the car business, and potentially insurance which could add a little bit of market cap but who knows. A lot of this hinges on how good they make their FSD- as the better the tech is, the higher they can price it and the higher the uptake rate will be.