Authentic Brands (AUTH: $10 billion expected valuation), a brand licensing firm, will be the first IPO we’ve analyzed since Figs (FIGS) that has a realistic chance to achieve the profit growth implied by its expected valuation of ~$10 billion.

Authentic Brands’ expected valuation is far more reasonable than many companies that have come to market so far this year. We see 30% upside to the ~$10 billion valuation, and this IPO is one of very few that we think could be a great addition to investors’ portfolios.

Unlike many recent IPOs, Authentic Brands is profitable, in large part due to operational efficiency and successful acquisition and licensing of well-known brands.

Authentic Brands is worth as much as $13 billion if the firm can grow profits at rates achieved in recent years. If the firm grows any faster, the stock is worth even more.

However, despite a more reasonable valuation, investing in any IPO is not without risks. Our IPO research aims to provide investors with more reliable fundamental research to analyze such risks.

Revenue and Profits on an Upward Trend

By purchasing and licensing more than 30 brands since the company’s founding in 2010, Authentic Brands has grown revenue by 86% compounded annually over the past decade.

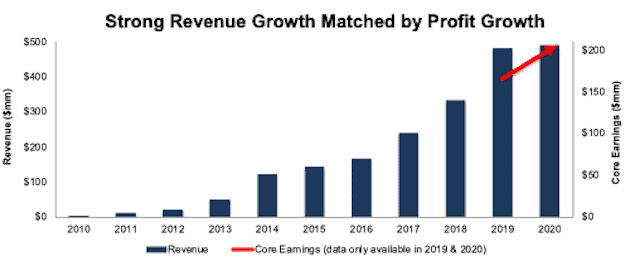

Per Figure 1, revenue grew from $1 million in 2010 to $489 million in 2020. Unlike most IPOs we see these days, Authentic Brands’ Core Earnings[1] are positive and grew from $165 million in 2019 to $200 million in 2020. As a brand licensor, Authentic Brand’s business was less negatively impacted during the Covid-19 pandemic as return on invested capital (ROIC) only slightly declined from 13% in 2019 to 12% in 2020. Net operating profit after-tax (NOPAT) margin declined only 1% from 60% to 59% over the same time.

Figure 1: Authentic Brands’ Revenue and Core Earnings: 2010-2020

Sources: New Constructs, LLC and company filings

Business Model Leverages Brands, Not Stores

Some investors might get spooked when they see that Authentic Brands’ name attached to failed retailers such as Forever 21 and Aeropostale. However, Authentic Brands does not operate retail stores, manufacture clothing, or even manage inventory. Instead, Authentic Brands generates revenue by licensing the brand names that it owns to third parties, and supporting the brands’ identity, strategy, marketing, and promotion. Additionally, Authentic Brands’ portfolio is very diverse and includes the likes of Barneys New York, Nine West, Eddie Bauer, Thomasville, Shaquille O’Neal, Sports Illustrated, and even Graceland.

This asset-light model lowers operating costs and allows the firm to generate exceptionally high margins compared to its peers.

Guaranteed Revenues and Profits

Not only are margins higher, but a large portion of revenues are both guaranteed and recurring. The third parties that license Authentic Brands trademarks must pay the firm guaranteed minimum royalties (GMR), which accounted for 83% of Authentic Brands’ total revenue in 2020.

Authentic Brands is also entitled to additional royalties once third-party sales reach a predetermined threshold. The firm generally signs contracts with third parties between three and ten years, with long-term renewal options, guaranteeing GMR revenue over the life of the contract. For instance, as of March 31, 2021, future GMRs totaled more than $2.6 billion, or more than 5x 2020 revenue, and more than $400 million in GMR is already contracted for both 2021 and 2022.

An Acquisition Strategy That Actually Creates Value

Most acquisition strategies destroy shareholder value, as companies overpay for targets, fail to capture synergies, or squander cost savings potential during integration. However, Authentic Brands has a track record for successful strategic acquisitions over the past decade.

Authentic Brands unique approach to acquisition and integration is key to this success. Before Authentic Brands considers making an offer, it approaches its network of over 800 licensees and establishes a customer base, or commitments to license a brand if the acquisition is completed, and a distribution network, which reduces execution risk by speeding up the post-acquisition integration process. Securing customers for your brand assets before you acquire it is good business.

Long-term recurring revenue commitments from its existing licensing contracts also affords Authentic Brands the financial strength to make timely acquisitions. The firm has purchased brands for bottom dollar from companies going out of business, which maximizes the potential return on acquisitions. For example, Authentic Brands bought the Forever 21 brand in 2021, and the Aeropostale brand in 2016, while both firms were entering bankruptcy.

Small Market Share in Growing Market

Authentic Brand is the third-largest licensor in the world, based on 2020 sales, and ranks behind just Disney (DIS) and Meredith Corp (MDP).

However, it terms of total addressable market (TAM), Authentic Brands has significant room to grow.

Authentic Brands notes in its S-1 that its gross merchandise value (GMV) TAM is $13 trillion, which represents total sales of products in which Authentic Brands holds trademarks. Authentic Brands generated $10 billion in GMV in 2020, which would give it less than 1% market share. While $13 trillion may seem optimistic as a TAM, the company also breaks down the actual revenue opportunity based on royalty rates associated with the GMV, which is similarly large.

Authentic Brands estimates its global revenue TAM (calculated as a percent of the $13 trillion GMV TAM) sits between $390 billion and $650 billion. Beyond hypothetical addressable markets, Authentic Brands’ portfolio of brands is positioned in fast growing markets, such as:

- Events: 11% compounded annual growth rate through 2028

- Luggage: 8% CAGR through 2025

- Home Décor: 4% CAGR through 2027

- Consumer Electronics: 5% CAGR through 2027

- Jewelry: 3-4% CAGR through 2025

- Watches: 1-3% CAGR through 2025

Authentic Brands has also significantly outperformed the global licensed goods market over the past six years in terms of revenue growth. Since 2014, Authentic Brands has grown revenue by 26% compounded annually while the global licensed goods market grew by just 3% compounded annually. For comparison, Meredith Corporation grew revenue by 11% compounded annually from 2014 to 2020 and PVH Corp grew revenue by just 3% compounded annually over the same time period.

We think the trend of outperforming the industry and peers is likely to continue, given Authentic Brand’s successful acquisition strategy, and will translate into the firm taking more market share than is implied by its valuation.

Potential Growth Opportunities on the Horizon

The trend towards ecommerce and challenges faced by retailers with too many stores or too much debt could lead to additional acquisition opportunities as more traditional retailers go bankrupt. Business Insider recently detailed 13 retailers that are at risk of defaulting in 2021, most of which could fit into Authentic Brands portfolio of brand names. Buying distressed companies to salvage the brand name and rebuild a more efficient operation would allow Authentic Brands to continue its impressive growth.

Competition Is Plentiful, but Authentic Brands Is More Profitable

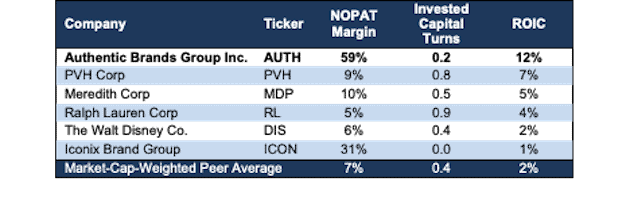

Although Authentic Brands owns less than 1% market share in terms of both GMV and revenue, it maximizes its asset-light model to be one of the most profitable firms amongst its peers. With a NOPAT margin of 59%, Authentic Brands is able to overcome low invested capital turns (due to high spend on acquisitions) and earn a 12% ROIC.

Per Figure 2, Authentic Brands’ ROIC ranks higher than each of its peers, which include the largest licensors in the world, Disney and Meredith, as well as other retailers that license and franchise their brands, PVH Corp (PVH) and Ralph Lauren (RL).

Figure 2: Authentic Brands’ Profitability Vs. Brand Licensing Peers: 2020

Sources: New Constructs, LLC and company filings

Bet on Growth, Not a Buyout

Authentic Brands’ expected ~$10 billion valuation indicates investor optimism about its ability to grow well above industry growth rates. However, for those hoping the firm could be a buyout target, we don’t think it likely competitors will view Authentic Brands as a realistic acquisition target, at least not anywhere near the expected valuation.

In August 2021, competitor Iconix Brand was acquired for $585 million, which based on TTM revenue gives the deal a price to sales ratio of 5.6. Any acquisition at a similar multiple would value Authentic Brands at just under $3 billion. Management would be ignoring the best interest of shareholders by considering an acquisition at a similar multiple and could create more shareholder value by continuing to operate their current business and growing profits.

Additionally, Authentic Brands has several anti-takeover provisions that effectively prevent a hostile takeover.

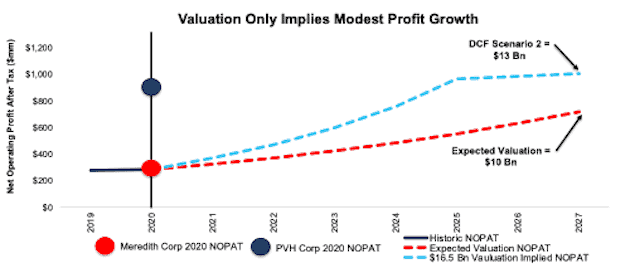

$10 Billion Valuation Implies No Market Share Gains

When we use our reverse discounted cash flow (DCF) model to analyze the future cash flow expectations baked into AUTH, we can provide clear, mathematical evidence, that the $10 billion valuation is, while optimistic, not as outlandish as other recent IPOs.

To justify the expected IPO valuation of $10 billion, Authentic Brands must:

- maintain a 59% NOPAT margin (equal to 2020, compared to 60% in 2019) and

- grow revenue by 14% compounded annually (compared to 28% CAGR over the past five years, and just above slower growing Meredith Corp’s 11% revenue CAGR since 2014) through 2027.

In this scenario, Authentic Brands would earn $1.2 billion in revenue in 2027, or just under 2.5x its 2020 revenue, and 40% of Meredith Corporation’s TTM revenue. If we assume the ratio of revenue to GMV remains the same (4.9% in 2020), this scenario also implies that Authentic Brands’ GMV grows to just over $24.5 billion, which would leave the firm as the third largest licensor in the world with less than 1% of its global revenue TAM or GMV. For reference, Authentic Brands has grown revenue by 86% compounded annually since 2010, which indicates a 14% growth rate could prove conservative.

DCF Scenario 2: Revenue Grows More In Line With Past

We review an additional DCF scenario to highlight the upside potential in the stock should Authentic Brands achieve revenue growth rates closer to what the firm has achieved over the past decade.

If we assume Authentic Brands:

- maintains its two-year average NOPAT margin of 60%

- grows revenue by 27% from 2021-2025 (equal to its three-year CAGR, compared to 86% CAGR over the past decade) and

- grows revenue by 2% compounded annually from 2026-2027 (equal to the growth of the entire global licensed goods market) then

AUTH is worth $13 billion today – a 30% upside to the expected IPO valuation. See the math behind this reverse DCF scenario.

In other words, Authentic Brand’s IPO valuation is reasonable relative to other recent IPOs like Warby Parker (WRBY) and Robinhood (HOOD), where it’s difficult to make a straight-faced argument to invest in at any price.

Figure 3 compares the firm’s implied future NOPAT in these scenarios to its historical revenue, along with the 2020 NOPAT of Meredith Corporation and PVH Corp.

Figure 3: Expected $10 Billion Valuation Could Prove Too Low

Sources: New Constructs, LLC and company filings

Red Flags Investors Need to Know About

Despite a more reasonable valuation relative to recent IPOs, investors should be aware that Authentic Brands’ S-1 is not absent of some red flags.

Public Shareholders Have Diminished Rights: A risk of investing in Authentic Brands’ IPO, and other recent IPOs, is the fact that the shares sold provide little to no say over corporate governance.

Authentic Brands is going public with three classes of common shares, each with different voting rights. A shares, which will be sold to the public will hold just one vote per share, B shares will hold 10 votes per share, and C shares will hold one vote as well.

Additionally, Authentic Brands will be a “controlled company”, meaning that the founder and a block of early investors called the “Voting Group” will control more than 50% of the company. In its S-1, Authentic Brands admits that the Voting Group “will be able to control virtually all matters requiring stockholder approval.”

In other words, this IPO takes investors’ money while giving them almost no voting power or control of corporate governance.

We Don’t Know If We Can Trust the Financials: Investors should take Authentic Brands’ GAAP numbers with a grain of salt.

As an emerging growth company, Authentic Brands is not required to have an independent auditor provide an opinion on the firm’s internal controls. While the lack of disclosure around the firm’s internal controls over financial reporting may never be an issue, it does increase the risk that the firm’s financials are fraudulent and/or misleading when compared to a firm required to have an auditor attest to its internal controls.

Immediate and Long-Term Dilution is Possible

Due to the fact that the price of class A stock will be higher than the tangible book value per share, Authentic Brands notes in its S-1, “If you purchase Class A common stock in this offering, you will incur immediate and substantial dilution.” Additionally, Authentic Brands recognizes that it will likely need additional financing to purchase brands in the future, which could lead to dilution in the form additional debt and equity offerings.

Non-GAAP EBITDA Overstates Profitability: Authentic Brands’ chosen non-GAAP metric, adjusted EBITDA, shows a much rosier picture of the firm’s operations than GAAP net income or our Core Earnings. Adjusted EBITDA gives management significant leeway in how it presents results. For example, Authentic Brands’ adjusted EBITDA calculation removes stock-based compensation expense, brand acquisition costs, losses from equity method investments, and “other items of a non-recurring nature”.

Authentic Brands’ adjusted EBITDA in 2020 removes $148 million (30% of revenue) in net expenses including $30 million in stock-based compensation expense. After removing all items, Authentic Brands reports adjusted EBITDA of $373 million in 2020. Meanwhile, 2020 economic earnings, the true cash flows of the business, are lower at $173 million.

While Authentic Brands’ adjusted EBITDA follows the same trend in economic earnings over the past two years, investors need to be aware that there is always a risk that adjusted EBITDA could be used to manipulate earnings going forward.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

Fact: we provide superior fundamental data and earnings models – unrivaled in the world.

Proof: Core Earnings: New Data and Evidence, forthcoming in The Journal of Financial Economics.

Below are specifics on the adjustments we make based on Robo-Analyst findings in Authentic Brands S-1:

Income Statement: we made $246 million of adjustments, with a net effect of removing $78 million in non-operating expenses (16% of revenue). You can see all the adjustments made to Authentic Brands’ income statement here.

Balance Sheet: we made $674 million of adjustments to calculate invested capital with a net decrease of $236 million. The most notable adjustment was $123 million in asset write downs. This adjustment represented 5% of reported net assets. You can see all the adjustments made to Authentic Brands’ balance sheet here.

Valuation: we made $2.5 billion in adjustments with a net effect of decreasing shareholder value by $2.0 billion. The largest adjustment to shareholder value was $262 million in minority interest. This adjustment represents 3% of Authentic Brands’ expected valuation. See all adjustments to Authentic Brands’ valuation here.

This article originally published on September 23, 2021.

Disclosure: David Trainer, Kyle Guske II, Alex Sword, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Only Core Earnings enable investors to overcome the errors, omissions and biases in legacy fundamental research, as proven in Core Earnings: New Data & Evidence, forthcoming in The Journal of Financial Economics.