We closed MCD on April 20, 2023. A copy of the associated Position Close report is here.

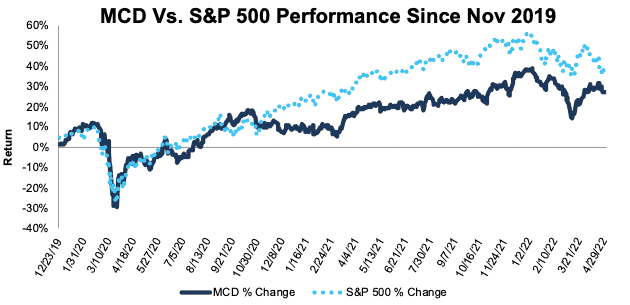

We first made McDonald’s Corporation (MCD: $246/share) a Long Idea in November 2012. After closing the position in May 2017, we then featured McDonald’s as a Long Idea again in November 2019. Since then, the stock is up 34% compared to a 54% gain for the S&P 500. Despite underperforming the market, we think the stock is worth $310+/share today – a 26%+ upside. See our latest update (May 2021) on McDonald’s here.

This report leverages our cutting-edge Robo-Analyst technology to deliver proven-superior[1] fundamental research and support more cost-effective fulfillment of the fiduciary duty of care.

McDonald’s Stock Has Strong Upside Based on:

- the company’s ability to outperform competitors in challenging environments

- the company’s superior distribution network

- the company’s ability to maintain culturally relevant menus around the world

- very limited downside risk over the long run and 26%+ upside if consensus is correct

Figure 1: Long Idea Performance: From Date of Publication Through 5/2/2022

Sources: New Constructs, LLC

What’s Working

Improved Operational Capabilities: As we saw during the pandemic-related shutdowns that put more than 10% of restaurants out of business in the U.S., McDonald’s superior operation enabled the company to not just survive in an extremely challenging environment, but to recover with improved digital and delivery capabilities. In 1Q22, for McDonald’s top six markets’ digital sales comprised more than 30% of systemwide sales, up from 20% in 2020. Additionally, the percent of McDonald’s restaurants offering delivery rose from 65% in 1Q19 to 80% as of 1Q22.

More Market Share Gains: In McDonald’s 1Q22 earnings call, management noted that the restaurant’s core burger business and growing chicken segment have made market share gains recently. McDonald’s share of the U.S. informal eating out (IEO) burger segment at the end of 1Q22 was over 33%, up a percentage point since pre-pandemic 2019 levels.

After introducing its Crispy Chicken Sandwich in February 2021, McDonald’s has improved its share of the chicken sandwich market by half a percentage point.

Highly Profitable and Staying that Way: McDonald’s superior distribution network enables the company to operate cost-efficiently while delivering a consistent level of quality. Additionally, the company has a strong ability to cater its menu to different cultural preferences around the world. It isn’t just changing the name of the burger to Royale with Cheese, but rather crafting menus with local appeal specific to, for example, India. Delivering low-cost, consistent quality food, that satisfies local preferences creates a large moat that enables the business to profitably grow across the globe.

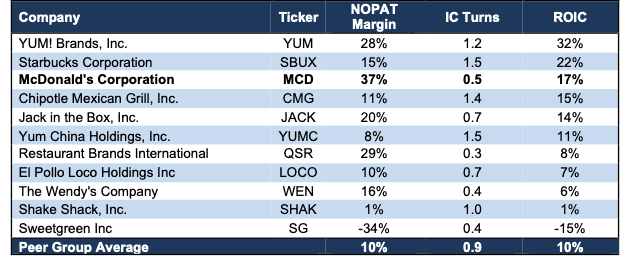

The company’s ability to steadily improve its profitability proves the strength of its operational capabilities. Over the past two decades, McDonald’s drove its return on invested capital (ROIC) from 7% in 2001 to 17% in 2021. McDonald’s ROIC of 17% over the trailing-twelve-months (TTM), is much higher than the 10% average ROIC of the peer group listed in Figure 2.

With increased digital and delivery capabilities, McDonald’s has plenty of opportunities to improve its ROIC.

Figure 2: McDonald’s Vs. Peers: NOPAT Margin, IC Turns & ROIC: TTM

Sources: New Constructs, LLC

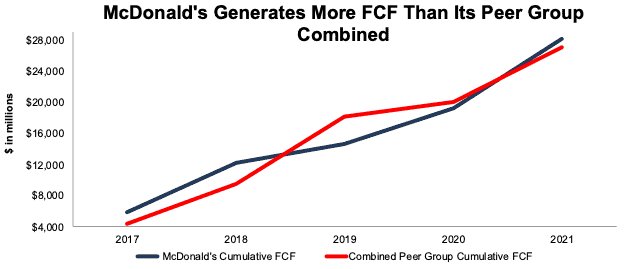

In a League of Its Own: McDonald’s generates more free cash flow (FCF) than any of its peers, by far. In four of the past five years, McDonald’s generated more FCF than the combined FCF of its peer group, per Figure 3. Since 2017, the company has generated $28.2 billion (15% of market cap) in cumulative FCF. Since 2017, McDonald’s alone generated $1.3 billion more FCF than its peer group’s combined total.

Figure 3: Free Cash Flow: McDonald’s Vs. Combined Peer Group: 2017 – 2021

Sources: New Constructs, LLC and company filings

What’s Not Working

Inflation Could Hurt Margins: Inflation is driving costs higher across the economy. Markets expect much tighter monetary policy by the Federal Reserve and other central banks, which would result in an economic slowdown and reduced discretionary spending. McDonald’s ability to improve net operating profit after tax (NOPAT) margin from 32% in 2020 to 37% in 2021 indicates the company has improved its operational efficiency while implementing “strategic price increases”. However, the company runs the risk of alienating its customer base if it raises prices too high, too quickly. If inflation continues its upward march, the company may be stuck with lower margins.

Geopolitics Threaten Global Operating Model: Before the pandemic, China accounted for ~4–5% of systemwide sales. While a surge in COVID restrictions led to lower same-store sales in China in 1Q22, the company plans to open 800 stores in the country in 2022.

McDonald’s is currently facing the additional challenge of increased global political tension due to Russia’s war in Ukraine. In response, McDonald’s has closed all its restaurants in both countries, which combine for ~ 2% of systemwide sales. Though 2% of systemwide sales may not materially affect the company’s profitability, political tension in countries that account for greater percentages of McDonald’s systemwide sales could have a much costlier impact to the business.

A Business that Commands a Premium: With a price-to-earnings (PE) ratio of 25, investors using traditional metrics may believe McDonald’s is too expensive at current levels. In contrast to high-flying stocks of recent years, the stocks of companies with uniquely durable business models, such as McDonald’s, and a long history of generating profits deserve a premium valuation. McDonald’s stock may not be “cheap”, and it may not make investors meme-stock-like returns on their investments, but MCD still offers upside with very limited downside risk at its current valuation in a market filled with uncertainty. A little safety in this uncertain market is a price worth paying.

Stock Has 26% Upside

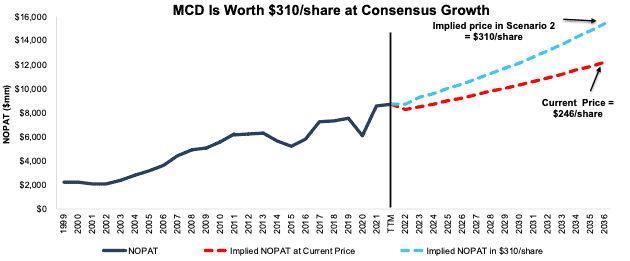

McDonald’s price-to-economic book value (PEBV) ratio of 1.3 means the stock is priced for profits to grow 30% from current levels. Below we use our reverse discounted cash flow (DCF) model to analyze the expectations for future growth in cash flows baked into a couple of stock price scenarios for McDonald’s.

In the first scenario, we assume McDonald’s:

- NOPAT margin falls to 35% (three-year average vs. 37% in 2021) from 2022 – 2036 and

- revenue grows by 3% (vs. 2022 – 2024 consensus CAGR of +4%) compounded annually through 2036.

In this scenario, McDonald’s NOPAT grows 2% compounded annually over the next 15 years and the stock is worth $246/share today – equal to the current price. For reference, McDonald’s grew NOPAT by 8% compounded annually over the past five years.

Shares Could Reach $310 or Higher

If we assume McDonald’s:

- maintains 2021 NOPAT margins of 37% in 2022 – 2036, and

- revenue grows at a 4% CAGR (equal to 2022 – 2024 consensus) through 2036, then

the stock is worth $310/share today – 26% above the current price. In this scenario, McDonald’s NOPAT grows by 4% compounded annually over the next decade. Should McDonald’s grow NOPAT faster, the stock has even more upside.

Figure 4: McDonald’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

This article originally published on May 4, 2022.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.

1 Response to "A Golden Stock Worth a Premium"

McDonalds’s is one of those big meat industry organizations that contribute largely to CO2 and methane.

It is also considered a real-estate company with their property ownership, which is kind of interesting.