“Non-Commenced leases” are the new version of operating leases, an accounting loophole that companies used to hide debt off-balance sheet prior to Accounting Standards Update (ASU) 2016-02. This new accounting trick is another in the long history of companies exploiting loopholes in Generally Accepted Accounting Principles (GAAP) to manage earnings and make it more difficult for investors to understand the true profitability of a firm.

Our Analyst team identified 13 companies exploiting the non-commenced lease loophole in calendar 1Q21. We feature some of the most egregious offenders in this report, including Cytokinetics (CYTK), Yum China (YUMC), Roku (ROKU), eMagin Corporation (EMAN), Twitter (TWTR), Knowles Corp (KN), SunPower Corp (SPWR) and Cheniere Energy (LNG).

What’s the Issue? – Non-Commenced Leases Help Firm’s Understate Debt

Under ASU 2016-02, operating leases are recorded on the balance sheet when the following has occurred:

- A contract is signed, and payments have begun – the contract date

- The company receives the leased asset and begins using it – the commencement date

The loophole emerges when there is a lag between the contract date and the commencement date, in which a company signs a contract for a lease and begins making payments, but is not yet using the leased asset. In these cases, the lease is considered “non-commenced.” Under current rules, companies do not have to record “non-commenced” leases on their balance sheet.

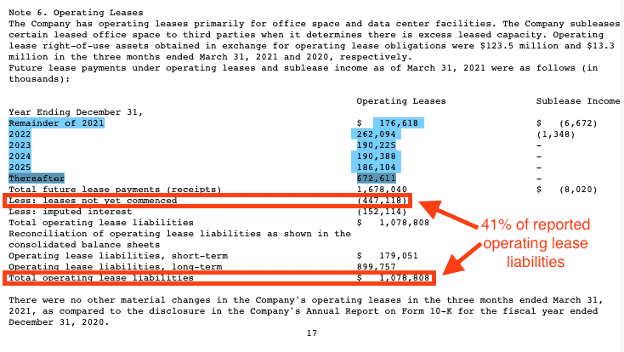

Figure 1 illustrates how Twitter removes $447 million in “leases not yet commenced” in 1Q21, which is 41% of the firm’s reported total operating lease liabilities and 7% of reported debt. When we include these non-commenced leases, and apply a standardized discount rate, Twitter’s true operating lease liability as of March 31, 2021 is $1.4 billion, or 29% higher than reported. Total debt, which includes all the lease liabilities, is 5% higher than reported debt.

Figure 1: Twitter’s Non-Commenced Leases 1Q21 10-Q

Sources: New Constructs, LLC and company filings

As shown in Figure 1, non-commenced leases are often disclosed in the yearly lease payments table. They can also be disclosed only in a separate footnote, but in either instance, these lease liabilities do not appear on balance sheets. Even when non-commenced leases are disclosed in the yearly payments table, they’re often removed from a company’s calculation of the present value of future minimum lease payments, thereby understating the future payments required.

The Solution – Technology to Find and Collect Non-Commenced Leases

Leveraging our Robo-Analyst technology, we have always included the effects of operating leases in our models, even prior to ASU 2016-02, and will continue to do so going forward. We provide details on how operating leases impact our models in general in The Impacts of Operating Leases Moving to the Balance Sheet.

To ensure companies are not able to hide future liabilities off-balance sheet, we include all non-commenced leases in our calculation of the present value of operating leases. This treatment ensures our calculation of invested capital, the denominator in our return on invested capital (ROIC) calculation, encompasses all capital invested in a business, not just what is reported on the balance sheet.

Beyond operating leases, we identify and fix accounting loopholes by making 30+ adjustments to provide clients more reliable & proprietary fundamental data and research, as proven in The Journal of Financial Economics.

The Impact – Material Change in Future Lease Payments and Debt

FASB’s narrowing of the loophole that allowed companies to hide trillions of dollars in capital off the balance sheet was a good first step. However, non-commenced leases present a new loophole that has a similar impact.

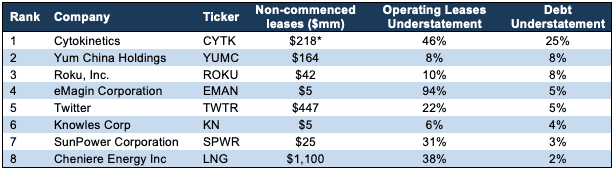

Figure 2 shows eight firms, Cytokinetics (CYTK), Yum China (YUMC), Roku (ROKU), eMagin Corporation (EMAN), Twitter (TWTR), Knowles Corp (KN), SunPower Corp (SPWR) and Cheniere Energy (LNG) our analyst team flagged with large non-commenced leases. By excluding these non-commenced leases from the balance sheet, these firms materially understate their reported operating lease liabilities and debt. See Figure 2.

Figure 2: Non-Commenced Leases Result in Understated Lease Liabilities & Debt – As of Calendar 1Q21

Sources: New Constructs, LLC and company filings

*Commenced on March 31, 2021. Details on CYTK’s operating leases below.

Below, we provide specific examples of the ways companies use non-commenced leases to understate reported operating lease liabilities and debt.

Cytokinetics (CYTK) – Failure to Read Footnotes Leaves Investors in the Dark

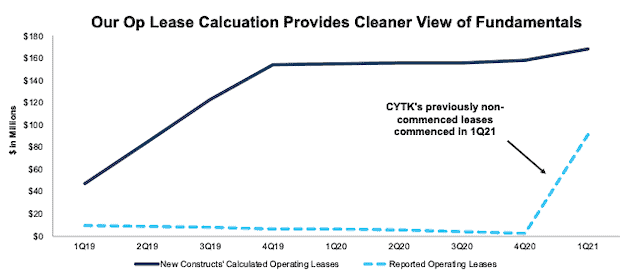

In its 2020 10-K, Cytokinetics reported $3 million in operating lease liabilities. However, in a paragraph above its yearly lease payments table on page 106 the firm disclosed $218 million in undisclosed lease payments related to a non-commenced operating lease for laboratory space in San Francisco (the “Oyster Point Lease”). At the time, the firm expected to commence the lease in September 2021.

In 1Q21, Cytokinetics’ reported operating lease liabilities increased nearly 3200% quarter-over-quarter to $91 million after the Oyster Point Lease commenced on March 31, 2021. Investors not aware of, or not accounting for, this non-commenced lease would likely be alarmed at the significant jump in operating lease liabilities.

However, our calculation of operating lease liability, which accounts for these non-commenced leases, increased just 6% quarter-over-quarter and provides a much more consistent and accurate representation of the firm’s operating lease liabilities. See Figure 3. After all adjustments to calculate total debt, Cytokinetics’ reported debt is understated by 25% at the end of 1Q21.

Figure 3: Cytokinetics’ Reported Op Lease Liability Soars When Non-Commenced Lease Commenced

Sources: New Constructs, LLC and company filings

Our calculated operating lease liability remains higher than Cytokinetics’ reported liability, even in 1Q21, due to differences in the operating lease discount rate used to calculate the liability. Cytokinetics uses an abnormally high 9% discount rate, which lowers the present value of reported leases. We use a standardized discount rate of 4.5% across all companies under coverage to ensure comparability and remove management discretion in calculating operating lease liabilities. Get more details on how operating lease discount rates can mislead investors here.

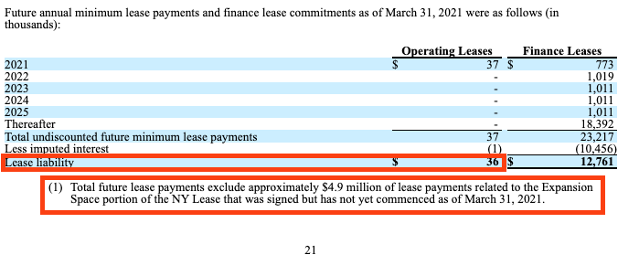

eMagin Corporation (EMAN) – Understated Operating Lease Liability

eMagin Corporation’s reported operating lease liability of just $37,000 understates its true lease liability by 94%. On page 21 of its 1Q21 10-Q, below the yearly payments table, eMagin discloses that this reported lease value excludes $4.9 million in non-commenced leases related to the expansion space of its NY lease. See Figure 4. When we calculate the present value of the firm’s true operating lease liability, we find it is much larger at $710,000. In total, eMagin’s use of non-commenced leases allows it to understate its debt by 5%.

Figure 4: eMagin’s Non-Commenced Leases Are 136x Reported Lease Liability – Through 1Q21

Sources: New Constructs, LLC and company filings

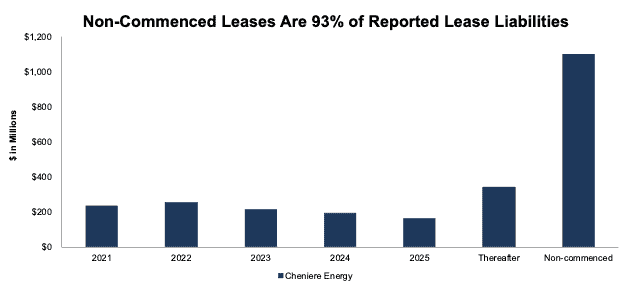

Cheniere Energy (LNG) – Non-Commenced Leases Are 93% Of Reported Lease Liability

Cheniere Energy’s reported operating lease liability as of 1Q21 is $1.2 billion, while our calculated operating lease liability is 61% larger at $1.9 billion. The discrepancy largely stems from Cheniere Energy’s $1.1 billion in non-commenced leases, which are disclosed below in the yearly payments table on page 21 of its 1Q21 10-Q.

In total, these non-commenced leases are equal to 93% of the firm’s reported operating lease liability, as shown in Figure 5. While the firm’s reported debt understates its total debt by just 2%, without diligent footnotes analysis, investors would be unaware of Cheniere’s significantly understated operating lease liabilities.

Figure 5: Cheniere Energy’s Non-Commenced Leases vs. Reported Yearly Payments – 1Q21 10-Q

Sources: New Constructs, LLC and company filings

Why This Diligence Matters – Required for Accurate Earnings Models

ASU 2016-02 aims to relieve investors of at least some of the rigorous footnotes analysis required to assess operating lease liabilities. However, as shown above, plenty of footnotes work remains to ensure we get the right value across 5,000+ companies for our clients and partners.

Our models leverage detailed footnotes analysis to capture the impact of off-balance sheet debt from operating leases on NOPAT, invested capital, (the two variables in our ROIC calculation) economic book value/valuation and the weighted-average cost of capital (WACC). This diligence is the backbone of our more reliable & proprietary fundamental data and research, as proven in The Journal of Financial Economics.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

This article originally published on May 24, 2021.

Disclosure: David Trainer, Kyle Guske II, Alex Sword, Hunter Anderson, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.