We published an update on BIRD on February 7, 2022. A copy of the associated update report is here.

Allbirds (BIRD: $2 billion expected valuation) is expected to go public in the coming weeks with an expected valuation of roughly $2 billion, which would earn the stock our Unattractive rating.

In our view, Allbirds is not worth anywhere near $2 billion, a valuation that implies Allbird’s revenue will grow over five times current levels, and that the company will become more profitable than all of its competitors, which is all highly unlikely.

We think the stock is worth as little as $119 million, as it faces steep competition from established companies such as Nike (NKE), Adidas (ADDYY), and Tommy Hilfiger, among others.

While Allbirds is a brand known for its sustainability and eco-friendly operations, Allbirds is struggling to scale its business as revenue from new customers declined year-over-year in 2020 and the company hasn’t ever been profitable. Allbirds losses will only get worse as it heavily invests in a costly brick-and-mortar strategy to complement its digital strategy.

Also, ESG investors shouldn’t overlook Allbirds’ poor corporate governance.

Our IPO research aims to provide investors with more reliable fundamental research.

Allbirds Is Not Profitable

Allbirds admits in its S-1, “We have incurred significant net losses since inception, and anticipate that we will continue to incur losses for the foreseeable future.”

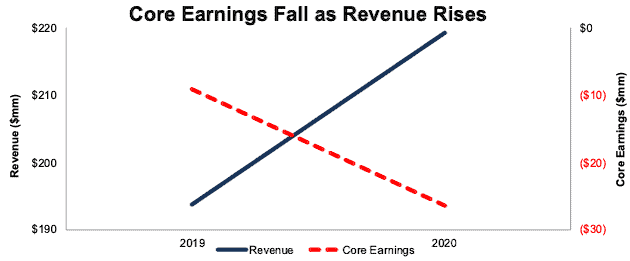

Even after sales benefited from demand for casual clothing and footwear, spurred on by the COVID-19 pandemic, Core Earnings[1] fell from -$9 million in 2019 to -$26 million in 2020.

Figure 1: Allbird’s Revenue & Core Earnings: 2019-2020

Sources: New Constructs, LLC and company filings

Top-Line Growth Is Decelerating

Allbirds’ digital sales growth, while above U.S. online shoe sales growth, is slowing quickly. The firm’s digital sales grew 42% YoY in 2019, but just 21% in 2020. The firm’s total YoY revenue growth fell from 54% in 2019 to just 13% in 2020. For reference, the more mature, casual footwear maker Crocs’ (CROX) revenue also grew 13% YoY in 2020. More concerning for a firm seeking to take market share, Allbirds is having difficulty drawing new customers to its brand. Sales from new customers fell from $105 million in 2019 to $103 million in 2020.

And Building Out a Retail Network Will Exacerbate Negative Margins

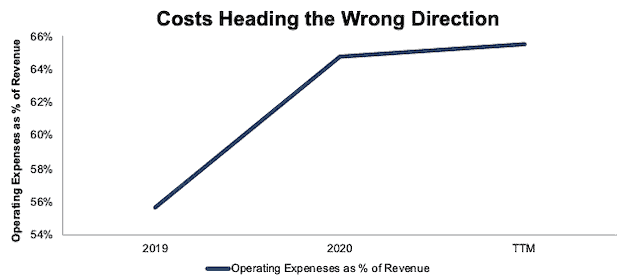

While Allbirds acknowledges in its S-1 that its operating expenses as a percent of revenue will need to decline in its pursuit of profitability, operating expenses have ballooned since 2019. Figure 2 shows operating expenses as a percent of revenue rose from 56% in 2019 to 65% over the TTM.

To combat slowing revenue growth, the firm plans to quickly add physical stores to its digital offering. Rent and employee costs associated with such a brick-and-mortar expansion will drive increases in operating expenses.

Allbirds’ marketing expense is also on the rise. The firm’s marketing expense as a percent of revenue increased from 23% in 2019 to 25% over the TTM. Allbirds’ marketing costs aren’t likely to fall anytime soon, as the firm has recently expanded its marketing efforts from targeted, digital conversion marketing into a much broader approach including TV advertising.

Figure 2: Allbirds’ Operating Expenses as % of Revenue: 2019-TTM

Sources: New Constructs, LLC and company filings

Allbirds Faces Heavy Competition

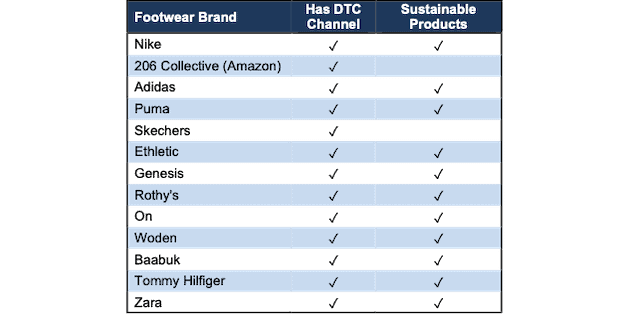

Allbirds’ path to profitability is filled with immense competition in a fragmented market with low barriers to entry. Though Allbirds attempts to differentiate itself with its direct-to-consumer (DTC) model and sustainability-focused brand, neither create a lasting competitive advantage. Figure 3 provides a sample of other sustainability-focused firms, traditional fashion and footwear companies, and other DTC brands, most of which have the same “differentiators” as Allbirds.

Figure 3: Allbirds’ Competitors Offer Similar Products

Sources: New Constructs, LLC and company filings

Giving Away Innovation Won’t Create a Moat

Allbirds touts its innovative SweetFoam sole and wool material as examples of innovation that distinguishes its brand from others. However, as part of its commitment to global sustainability goals, the firm decided to give its SweetFoam technology to the industry for free. Innovation won’t bring Allbirds an advantage if it continues to give its technology away to its competitors. Worse yet, giving away innovation invites competition to copy winning products. Look no further than Amazon’s 206 Collective, which offers a nearly identical-looking shoe, without the eco-friendly manufacturing and materials, for half the price.

A Purpose-driven Brand Doesn’t Guarantee Lasting Success

Allbirds’ purpose-driven brand may create a strong customer connection, but that doesn’t guarantee its long-term success, as the rise and fall of TOMS shoes shows. Once the novelty of TOMS’s famous buy-one-give-one model wore off, and competition moved in, from the likes of Sketchers’ BOBS, which donated two pairs of shoes for every one sold, TOMS’s fast-growth came to an end. As the novelty of sustainable footwear wears off, and even more competitors enter the market with sustainable product lines, Allbirds runs the risk of following the same fate as TOMS shoes.

Supply Chain Advantages Aren’t Helping Much Either

Allbirds points to its vertically integrated supply chain as the reason for its gross margin improvement in 2020. However, as we’ve already shown, large operating expenses far outweigh whatever cost advantages its supply chain provides. Furthermore, by utilizing only a concentrated number of suppliers, the firm is at risk of significant supply chain disruption, as many firms have come to realize in 2021. If any of its suppliers experience difficulties keeping up with demand, or fail to live up to Allbirds’ high standards of sustainability, Allbirds could have a major supply-chain problem on its hands, which would likely lead to a rise in supply costs, and further drop in profitability.

Fundamentals Don’t Stack Up Well Against Competition

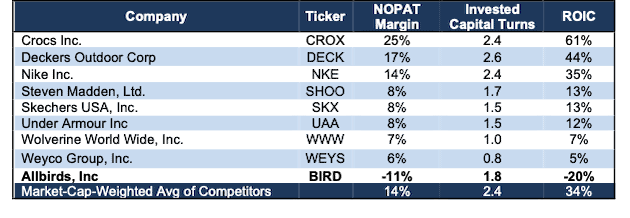

Allbirds believes its expanding gross margin indicates it’s on the path to profitability, but a closer look reveals that is not the case. The firm’s gross margin slightly improved from 51.0% to 51.4% YoY in 2020, but its net operating profit after-tax (NOPAT) margin, which incorporates all of the firm’s operating expenses, fell from -4% to -11% over the same time.

Allbirds’ invested capital turns, a measure of capital efficiency, fell from 2.3 in 2019 to 1.8 over the TTM. Falling NOPAT margin and invested capital turns drive the firm’s return on invested capital (ROIC) from -9% in 2019 to -20% TTM.

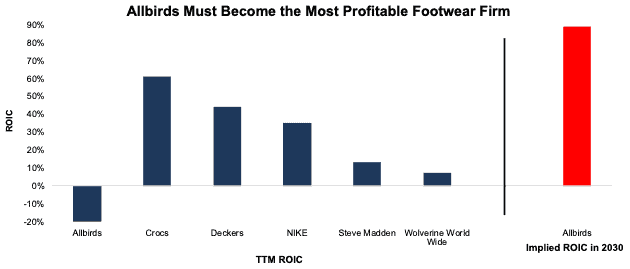

Figure 4 shows that Allbirds competes against much more profitable firms, and its ROIC of -20% ranks last amongst its main competition.

Figure 4: Allbirds’ Profitability Vs. Footwear Competition: TTM

Sources: New Constructs, LLC and company filings

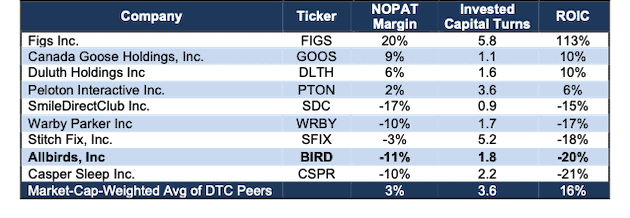

Allbirds Ranks Poorly Among Other Unprofitable DTC Peers

Allbirds believes its DTC model helps the firm be more competitive in the footwear market, and investors hope it will help the firm garner a higher valuation. However, DTC businesses do not necessarily translate to highly profitable enterprises. Per Figure 5, while Figs’ (FIGS) ROIC of 113% stands out, the profitability of most DTC peers such as Peloton (PTON), Warby Parker (WRBY), Casper Sleep (CSPR), and more is very low or negative.

Figure 5: Allbirds’ Profitability Vs. DTC Peers: TTM

Sources: New Constructs, LLC and company filings

And Its Poor Ranking Is Unlikely to Improve

Allbirds’ is one of the least profitable DTC firms from Figure 5 and is likely to remain that way. The company operates within a digital market that historically has grown at a much slower rate than the rest of ecommerce. U.S. online shoe sales have grown 11% compounded annually since 2015 while overall U.S. ecommerce sales have grown at a much faster 18% compounded annual rate over the same time.

The slower growth of U.S. online shoe sales compared to other forms of ecommerce will make it difficult for Allbirds’ profitability to outperform DTC firms in other higher-growth markets going forward.

An Acquisition Is Allbirds’ Best Hope, but Don’t Bet on It

On its own, the firm is unlikely to generate the profits needed to justify a valuation of $2 billion. The best hope IPO investors in Allbirds have is for an established footwear company to acquire the firm. A larger operation might see an opportunity to acquire the Allbirds’ brand and distribute it across its much larger distribution network.

However, Amazon has already proven that firms with larger manufacturing capabilities and distribution channels can easily replicate Allbirds’ styles and materials. Existing manufacturers can create purpose-driven and sustainable products themselves at a much cheaper cost than acquiring Allbirds at its expected valuation, especially if Allbirds continues to give away its sustainable technology.

Furthermore, Allbirds’ status as a public beneficial corporation, and the requirements around that status (which we discussed in our report on Warby Parker), make an acquisition less attractive to potential buyers.

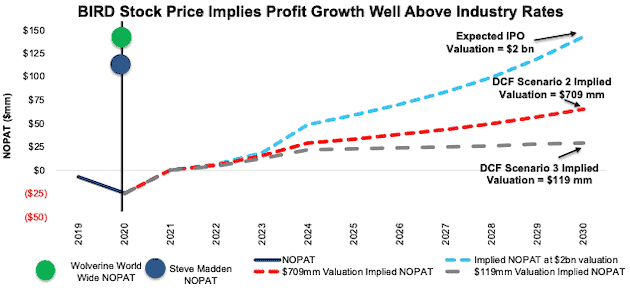

Allbirds Is Priced to Grow Revenue by 5x

When we use our reverse discounted cash flow (DCF) model to analyze the future cash flow expectations baked into Allbirds’ expected valuation, we can provide clear, mathematical evidence that the $2 billion valuation is too high and offers unattractive risk/reward.

To justify a $2 billion valuation, Allbirds must:

- improve its NOPAT margin to 0% in 2021 (compared to -11% TTM), 2% in 2022, 5% in 2023, and 11% (midpoint of Nike’s and Sketchers’ TTM margins) from 2024-2030

- grow revenue by 19% (vs. 13% in 2020) compounded annually for the next ten years, which is over 8x the expected industry growth rate through 2026.

In this scenario, Allbirds would generate over $1.3 billion in revenue, or over 5x its TTM revenue and $142 million in NOPAT, which is nearly equal to the TTM NOPAT of Wolverine World Wide (maker of Merrell, Chaco, Saucony, Sperry, and Wolverine) and 1.3x greater than the TTM NOPAT of casual footwear competitor Steve Madden.

In this scenario, Allbirds’ ROIC soars to 89% in 2030, and is far superior to Crocs’ TTM ROIC of 61%, Deckers Outdoors’ TTM ROIC of 44%, and Nike’s TTM ROIC of 35%. Figure 6 compares Allbird’s expected ROIC in 2030 with the TTM ROICs of its competitors.

Figure 6: Allbirds’ Implied ROIC Vs. Competitors TTM ROIC

Sources: New Constructs, LLC and company filings

DCF Scenario 2: Growth Exceeds 2020 Levels

We review an additional DCF scenario to highlight the downside risk should Allbirds’ revenue grow at 6x projected industry growth, and faster than its YoY growth rate in 2020.

If we assume Allbirds:

- improves its NOPAT margin to 0% in 2021 (compared to -11% TTM), 2% in 2022, 5% in 2023, and 8% (equal to Steve Madden, Sketchers, and Wolverine World Wide’s TTM margins) from 2024-2030

- grows revenue by 14% (vs. 13% in 2020) compounded annually from 2021-2030, then

Allbirds is worth just $709 million today – a 65% downside to the expected IPO valuation. See the math behind this reverse DCF scenario.

DCF Scenario 3: Growth Is Double Industry Expectations

We review a final DCF scenario to highlight the downside risk should Allbirds’ grow revenue twice as fast as industry expectations.

In this scenario, we assume Allbirds:

- improves its NOPAT margin to 0% in 2021 (compared to -11% TTM), 2% in 2022, 5% in 2023, and 11% (midpoint of Nike’s and Sketchers TTM margins) from 2024-2030

- grows revenue by 5% (vs. ReportLinkers global footwear forecasted CAGR of 2.3% through 2026) compounded annually from 2021-2030

In this scenario, Allbirds is worth just $119 million today – a 94% downside to the expected IPO valuation.

Figure 7 compares the firm’s implied future NOPAT in these three scenarios to its historical NOPAT.

Figure 7: Expected IPO Valuation Is Too High

Sources: New Constructs, LLC and company filings

Each of the above scenarios also assumes Allbirds grows revenue, NOPAT, and FCF without increasing working capital or fixed assets. This assumption is highly unlikely given the firm’s plans to ramp up its brick-and-mortar presence, but allows us to create best-case scenarios that demonstrate the expectations embedded in the current valuation. For reference, Allbirds’ invested capital nearly doubled from $83 million in 2019 to $160 million in 2020. If we assume Allbirds’ invested capital increases at a similar rate in DCF scenarios 2 and 3 above, the downside risk is even larger.

Red Flags Show Allbirds Is Missing the “G” in ESG

With a lofty valuation that implies significant improvement in both revenue and profits, investors should be aware that Allbirds’ S-1 also includes these other red flags.

Public Shareholders Have No Rights: A downside of investing in Allbirds’ IPO, and other recent IPOs, is the fact that the shares provide little to no say over corporate governance. Investors in the IPO will get Class A Shares, with just one vote per share. Allbirds’ co-CEOs will retain control of the firm as holders of Class B shares, which will get 10 votes per share.

In other words, this IPO gives investors no voting power or control of corporate governance.

The Founders and Environment Benefit, but What About Shareholders?: The firm voluntarily elected in 2016 to be treated as a public-benefit corporation, which means the firm has legal requirements to balance the financial interests of shareholders with the best interests of all stakeholders, including the public benefit of environmental conservation. Simply put, the firm cannot guarantee that it will make decisions in the best financial interests of shareholders.

Non-GAAP EBITDA Understates Losses: Long a favorite of unprofitable companies, Allbirds’ chosen non-GAAP metric, Adjusted EBITDA, shows a much rosier picture of the firm’s operations than GAAP net income or our Core Earnings. Adjusted EBITDA gives management significant leeway in how it presents results.

For instance, Allbirds’ adjusted EBITDA in 2020 removes $7 million (3% of revenue) in share-based compensation expense and $7 million (3% of revenue) in depreciation and amortization. After removing all items, Allbirds reports adjusted EBITDA of -$15 million in 2020. Meanwhile, economic earnings, the true cash flows of the business, are much lower at -$31 million.

While Allbirds’ adjusted EBITDA fell alongside economic earnings from 2019 to 2020, investors need to be aware that there is always a risk that Adjusted EBITDA could be used to manipulate earnings going forward.

We Don’t Know If We’ll Get Full Financial Transparency: Allbirds is going public as an emerging growth company which means its, “consolidated financial statements may not be comparable to the financial statements of issuers who are required to comply with the effective dates for new or revised accounting standards that are applicable to public companies.”

More specifically, Allbirds is exempt from:

- auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, specifically the requirement to obtain an auditor’s opinion on internal control over financial reporting

- disclosing all the obligations regarding executive compensation in periodic reports, proxy statements, and registration statements

- immediately complying with new or revised accounting standards

Additionally, Allbirds is not required to hold a stockholder advisory vote on executive compensation or previously unapproved golden parachute payments. While the firm is committed to being transparent about its carbon footprint, it unfortunately seems less committed to financial transparency to its shareholders.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

Fact: we provide superior fundamental data and earnings models – unrivaled in the world.

Proof: Core Earnings: New Data and Evidence, forthcoming in The Journal of Financial Economics.

Below are specifics on the adjustments we make based on Robo-Analyst findings in Allbirds’ S-1:

Income Statement: we made $4 million of adjustments, with a net effect of removing $1 million in non-operating expenses (<1% of revenue). You can see all the adjustments made to Allbirds’ income statement here.

Balance Sheet: we made $158 million of adjustments to calculate invested capital with a net decrease of $68 million. The most notable adjustment was $44 million in operating leases. This adjustment represented 23% of reported net assets. You can see all the adjustments made to Allbirds’ balance sheet here.

Valuation: we made $507 million of adjustments with a net effect of decreasing shareholder value by $364 million. The largest adjustment to shareholder value was $204 million in preferred stock. This adjustment represents 10% of the expected IPO valuation of $2 billion. See all adjustments to Allbirds’ valuation here.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

This article originally published on September 23, 2021.

Disclosure: David Trainer, Kyle Guske II, Alex Sword, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Only Core Earnings enable investors to overcome the flaws in legacy fundamental research, as proven by The Journal of Financial Economics.

1 Response to "Allbirds Is Already Overvalued at Expected IPO Valuation"

excellent news and info.

very much interested in, like it to pursue.

thanks,

harshad