Don’t Trust the Dead Cat Bounce in Angie’s List

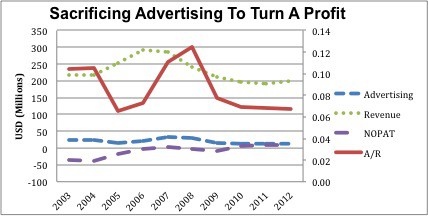

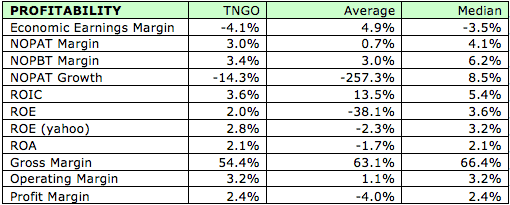

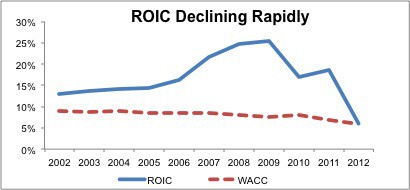

Investors beware: Angie's List may be on the rise but the bounce is nothing more than a dead cat. Quantitative Analytics Analyst, David Trainer, highlights Angie's Lists flawed business model, weak growth projections and the fact that insiders keep selling shares. Analysts might see "value" in the company but research shows that growth is slowing, and such growth as there is, is misleading with Customer feedback disappearing behind advertisers' payments. As new competitors move fast into the market, Analysts warn that Patricia Arquette's portrayal of the NGO's inspiring founder shouldn't blind investors to the harsh realities of Angie's List's poor business performance.

David Trainer, Founder & CEO