Sell Baker Hughes Before The Stock Goes Up In Fumes

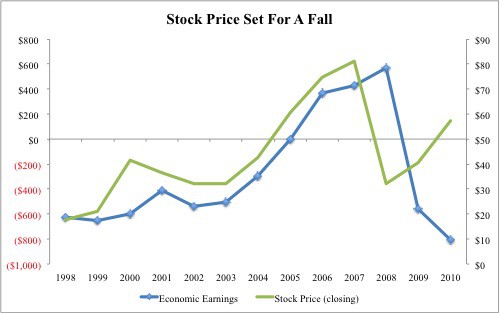

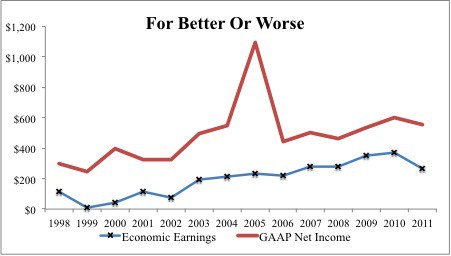

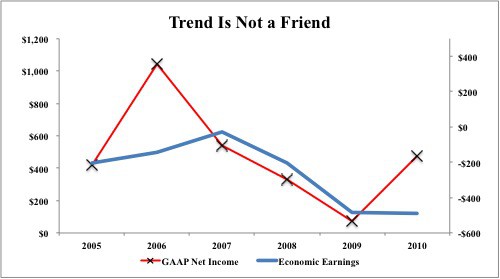

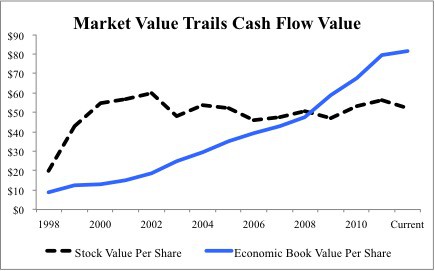

It is only a matter of time before oil and gas stocks stop moving with the price of oil and start reflecting their underlying economics.

When this happens, Baker Hughes (BHI – “very dangerous” rating) will be among the stocks that fall the hardest.

David Trainer, Founder & CEO