Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

The real earnings season, annual 10-K filing season, is happening right now. Analyzing the footnotes of 10-K filings is the only way to calculate true profits of companies. From the first week and a half of filing season, we’re highlighting two of the firms with economic earnings going the opposite direction of reported profits. These companies also have overvalued stocks and a history of value-destroying acquisitions. Expedia Group (EXPE: $129/share) and United Technologies (UTX: $128/share) are in the Danger Zone.

Expedia Group (EXPE)

We downgraded Expedia Group to Very Unattractive (from Unattractive) after we analyzed its 2018 10-K. Since we last put EXPE in the Danger Zone in September 2015, the stock has underperformed the market (+10% vs. S&P +42%).

However, the stock is up 24% (vs S&P +3%) over the past year after the company beat consensus EPS expectations in each of the last three quarters. We dug through the footnotes of its 2018 10-K and found that these growing EPS aren’t what they seem.

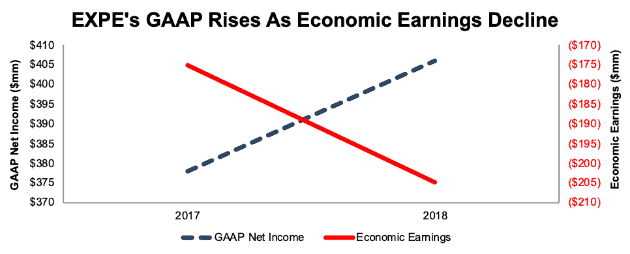

Misleading Earnings: In 2018, GAAP net income grew by 8% YoY while economic earnings, the true cash flows of the business, fell 17% to -$205 million, per Figure 1.

Figure 1: EXPE’s Misleading GAAP Net Income Hides Falling Economic Earnings

Sources: New Constructs, LLC and company filings.

This disconnect between GAAP net income and economic earnings, which are more comprehensive than EPS, can be partially attributed to $78 million (19% of GAAP net income) in refunded payments by the city of San Francisco. We found this non-operating income hidden in operating earnings, which artificially boosts GAAP net income, on page F-39 (page 105 overall) of EXPE’s 2018 10-K. Only by removing this non-recurring income can we evaluate the recurring profits of EXPE’s operations.

We also made the following adjustments to the balance sheet:

- $734 million (7% of reported net assets) in off-balance sheet operating leases

- $86 million (1% of reported net assets) in goodwill impairment

- $42 million (<1% of reported net assets) in impairment of intangible assets

By adding these items back to invested capital, we hold EXPE accountable for all capital invested in the business. These adjustments, when combined with a rising weighted average cost of capital (6.5% in 2018, up from 5.7% in 2017), increase the capital charge and decrease economic earnings.

In addition to negative and declining economic earnings, Expedia still faces some of the same issues we noted in our original Danger Zone report. EXPE’s NOPAT margin remains depressed since acquiring HomeAway and Orbitz in 2015. In the three years since those acquisitions, NOPAT margin has averaged 5% compared to 7% prior to the acquisitions. Low margins pose competitive challenges considering that competitors TripAdvisor (TRIP) and Booking Holdings (BKNG) earn 8% and 31% NOPAT margins respectively.

Shares Are Now Overvalued: We believe that that the 24% increase in EXPE’s stock price over the past year has been driven by noise traders fooled by the company’s rising accounting earnings. When we remove the accounting distortions and look at the expectations implied by the stock price, EXPE appears significantly overvalued.

To justify its current price of $129/share, EXPE must achieve 7% NOPAT margins (three year average prior to HomeAway and Orbitz acquisitions vs. 5% in 2018) and grow NOPAT by 12% compounded annually for the next decade. See the math behind this dynamic DCF scenario. These expectations seem overly optimistic given that EXPE has grown NOPAT by just 3% compounded annually over the past decade.

Even if EXPE can maintain current NOPAT margins (5%) and grow NOPAT by 9% compounded annually for the next decade, the stock is worth just $93/share today – a 28% downside. See the math behind this dynamic DCF scenario.

United Technologies (UTX)

We downgraded United Technologies to Unattractive (from Neutral) after we analyzed its 2018 10-K. We previously covered UTX’s acquisition of Rockwell Collins and highlighted how the hefty purchase price would make creating long-term shareholder value very difficult. Even though the acquisition hurt economic earnings, it has provided a boost to reported earnings due to the “high-low fallacy”.

UTX posted an impressive streak of earnings beats in 2018 and has surpassed consensus EPS expectations in each of the last eight quarters and 15 of the past 16 quarters. Despite these beats, UTX’s economic earnings have fallen in each of the past two years.

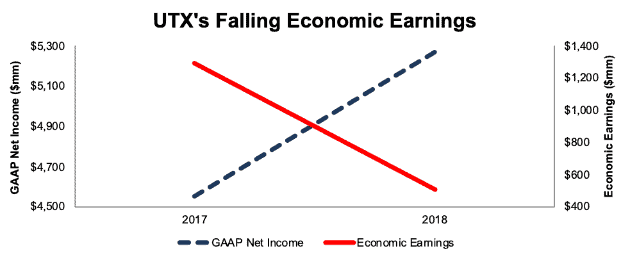

Misleading Earnings: In 2018, GAAP net income grew by 16% YoY while economic earnings fell 61%, per Figure 2.

Figure 2: UTX’s GAAP Net Income Rises While Economic Earnings Fall

Sources: New Constructs, LLC and company filings.

In its 10-K, we found non-recurring items that both increase and decrease reported profits. Specifically, reported profits are boosted by:

- $799 million (15% of GAAP net income) on the gain on sale of Taylor Company

On the other hand, these items decreased reported earnings:

- $162 million (3% of GAAP net income) in restructuring costs within SG&A

- $147 million (3% of GAAP net income in restructuring costs within cost of sales

- $112 million (2% of GAAP net income) in acquisition related costs within SG&A

When combined, we identified $378 million in net unusual income hidden in operating earnings that must be removed to calculate UTX’s true profits. UTX also has nearly $1.3 billion in non-operating income reported directly on the income statement, such as $765 million in non-service pension benefits.

In addition, UTX has over $2.4 billion (up from $1.9 billion in 2017) in off-balance sheet operating leases that we include in invested capital.

After making the adjustments, we see that UTX’s fundamentals are deteriorating, despite the steak of earnings beats. In addition to the decline in economic earnings, NOPAT margins have dropped from 10% in 2016 to 8% in 2018 while return on invested capital (ROIC) has fallen from 8% to 6% over the same time.

Shares Are Overvalued: UTX has underperformed the market over the past two years (+13% vs. S&P +17%), and those using flawed traditional valuation metrics would believe UTX is now undervalued. At its current price of $128/share, UTX has a price-to-earnings (P/E) ratio of 19.5, slightly below the overall Industrials industry average of 20. However, when we analyze the cash flow expectations baked into the stock price, we see that UTX is significantly overvalued.

To justify its current price of $128/share, UTX must achieve 10% NOPAT margins (10-year average vs. 8% in 2018) and grow NOPAT by 7% compounded annually for the next decade. See the math behind this dynamic DCF scenario. These expectations seem overly optimistic given that UTX’s NOPAT has actually fallen by 1% compounded annually over the past decade and by 5% compounded annually over the past five years.

If UTX can maintain current NOPAT margins (8%) and grow NOPAT by 5% compounded annually for the next decade, the stock is worth just $92/share today – a 28% downside. See the math behind this dynamic DCF scenario.

Question: Why does reading footnotes matter?

Answer: To find trillions of $ of important adjustments.

EXPE and UTX represent just two of the many examples where items hidden in footnotes or the MD&A have a material impact on profitability. Our analysts leverage our cutting edge Robo-Analyst technology[1] to uncover red flags hidden in the footnotes and make our models the best in the business.[2]

Our analysts work directly with our engineers to make our Robo-Analyst machine learning system smarter with every filing it reads so we can automate more of the analysis and empower our analysts to find more danger in the footnotes.

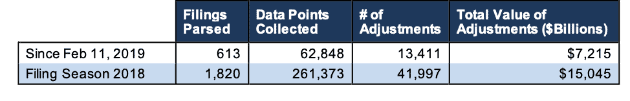

Figure 3 shows how much data we analyzed from February 11-23 along with the work we performed throughout the entirety of filing season 2018.

Figure 3: Filing Season Diligence

Sources: New Constructs, LLC and company filings.

During last year’s filing season (which lasted 5 weeks), we made 41,997 adjustments with a total value of over $15 trillion. Through just two weeks of the 2019 filing season we’ve made 13,411 adjustments with a total value of $7.2 trillion. Note that the filings come in relatively slowly at the beginning of the filing season.

Be on the lookout for our daily filing season updates and check out #filingseasonfinds on Twitter to see all the red flags and unusual items we uncover during this year’s filing season.

This article originally published on February 25, 2019.

Disclosure: David Trainer, Sam McBride and Kyle Guske II receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[2] Ernst & Young’s recent white paper, “Getting ROIC Right”, proves the superiority of our research and analytics.

2 replies to "Danger Zone: Finding Danger in the Footnotes"

The link to the Danger Zone Interview above returns a 404 error. Is there anywhere you guys have an archive to all David’s previous Danger Zone podcasts with Chuck/Moneylife? Thx

All of David’s previous Danger Zone podcasts can be found here.