We closed this position on June 28, 2017. A copy of the associated Position Update report is here.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and Marketwatch.com

The saying goes “birds of a feather flock together.” With the news that Valeant (VRX) had named Joseph Papa, its new CEO, we began to analyze just what Valeant was getting. Through this analysis, we found that Perrigo Company (PRGO: $97/share), the firm Mr. Papa is leaving behind, exhibits many similarities to Valeant, including misleading non-GAAP measurements, aggressive, shareholder destructive acquisitions, and executive compensation misaligned with shareholders’ interests. Perrigo is in the Danger Zone.

History of Success Wiped Out In A Few Short Years

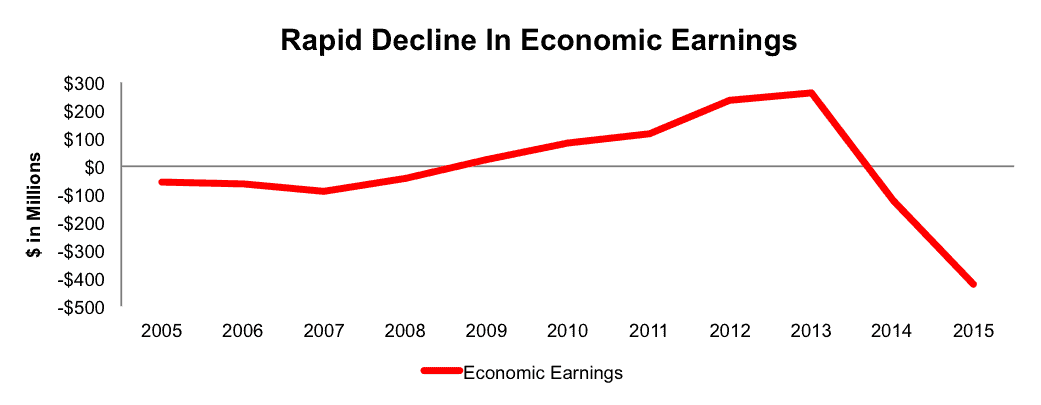

Many years of good decisions can be wiped out by one bad one, and Perrigo’s leadership made many bad decisions. We won’t debate the history of success from 1998-2012. Perrigo grew economic earnings, the true cash flows of business, from -$597 in 1998, to $232 million in 2012. The problems started when Perrigo began engaging in financial engineering, including “accretive acquisitions” and its 2013 tax inversion through the acquisition of Elan. Since 2013, Perrigo’s economic earnings have declined from $259 million to -$421 million, as per Figure 1. See the reconciliation of Perrigo’s GAAP net income to economic earnings here.

Figure 1: Economic Earnings Drastically Falls

Sources: New Constructs, LLC and company filings

This decline in economic earnings mirrors Perrigo’s return on invested capital (ROIC), which has fallen from 14% in 2012 to a bottom-quintile 4% in 2015.

Further compounding the issues, Perrigo has greatly increased debt and diluted shareholders over this time frame. From 2012-2015, Perrigo’s debt increased 55% compounded annually to $5.6 billion. Its shares outstanding grew from 93 million to 146 million, or 16% compounded annually from 2012-2015. Perrigo funded its acquisition-based growth at the expense of shareholders.

Non-GAAP Metrics Paint A False Reality

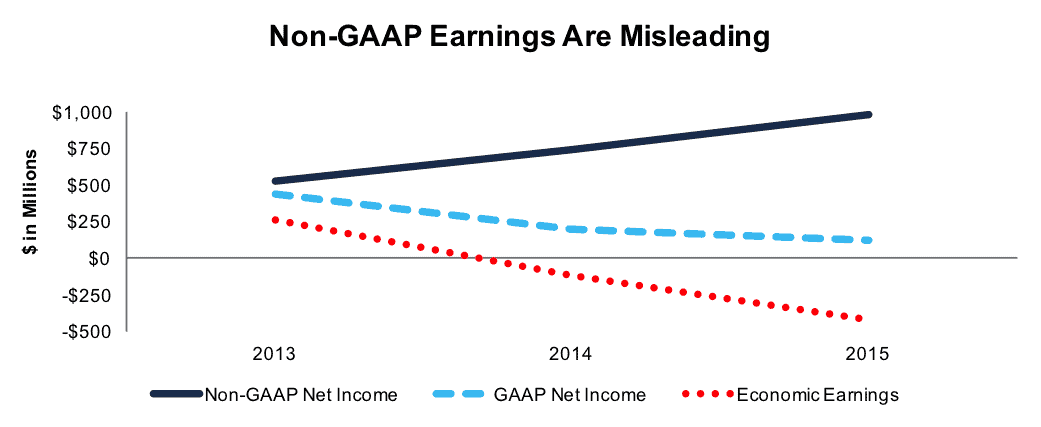

Investors listening only to Perrigo management’s focus on non-GAAP earnings would have a vastly different view of the company than those of us looking through to the underlying economics of the business. The fall of Valeant makes the dangers of non-GAAP metrics clear. Here are the expenses Perrigo removes to calculate its non-GAAP net income:

- Acquisition related amortization expenses

- Integration-related charges

- Mylan defense fees

- Acquisition-related foreign currency hedge losses

- Amortization of inventory step-up related to acquisitions

- Intangible asset impairment charges

In 2015, Perrigo’s non-GAAP net income was a staggering $981 million, compared to $128 million GAAP net income and -$421 million economic earnings. Figure 2 shows the discrepancies between GAAP, non-GAAP, and economic earnings

Figure 2: Perrigo’s Non-GAAP Is Nonsense

Sources: New Constructs, LLC and company filings

Executives Were Incentivized To Destroy Shareholder Value

The cause of the shareholder destructive behavior is the company’s executive compensation plan. Perrigo bases executives’ short-term incentive pay on non-GAAP operating income, adjusted to remove standard operating expenses as detailed above. Through this plan, executives are incentivized to grow revenue through any means, while ignoring the cash flow impact of their actions.

The misalignment of incentives at Perrigo proved particularly damaging to shareholders in 2015 in a series of events that mimicked the disaster for Men’s Wearhouse investors that resulted from the Jos. A Bank acquisition (see special report). In 2015, Mylan (MYL) launched a takeover bid for Perrigo, which valued PRGO at $26 billion. Perrigo spent nearly $87 million to fight off the takeover and claimed the deal was not in the best interests of its shareholders. Today, PRGO has a market cap of $14 billion. Shareholders ended up $12 billion poorer, but guess who got richer? After fighting off this takeover, executives were rewarded for “their key contributions related to Mylan’s takeover attempt. In total, executives received $3.5 million in bonuses while investors lost $12 billion.

Low ROIC Puts Perrigo At A Disadvantage

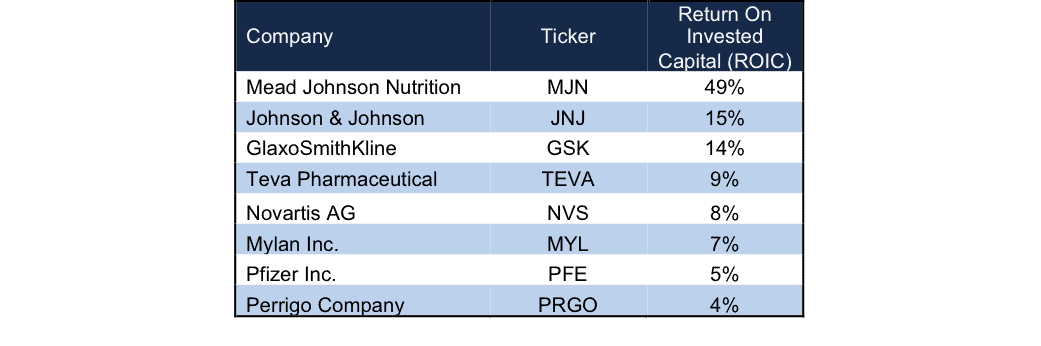

Perrigo operates worldwide in the over the counter pharmaceutical industry. It offers many store brand medicines aimed at ailments such as cough, allergy, sinuses, as well as infant formula, animal health products, and vitamins and minerals. By offering a wide range of drugs, Perrigo faces competition from many different players in the pharmaceutical industry, including Mead Johnson Nutrition (MJN), Johnson & Johnson (JNJ), Novartis AG (NVS), and Pfizer (PFE). Each of these competitors has a higher ROIC than Perrigo, which limits pricing power and profitability in a highly competitive industry. See Figure 3 for more details.

Figure 3: Comparing Perrigo’s ROIC

Sources: New Constructs, LLC and company filings

CEO Departure Doesn’t Equal Greener Pastures: Risks Abound

Many bulls will claim the large decline in share price when Mr. Papa resigned is an overreaction to the news. At the same time, they also argue that with a new CEO, Perrigo can get back to its successful ways prior to 2013. Unfortunately, these beliefs ignore the larger issues facing Perrigo, and assume that Mr. Papa left the company simply for monetary reasons.

First off, the entire pharmaceutical industry is facing scrutiny for pricing policies. This renewed focus on ensuring affordability in the drug market leaves little pricing power for all players. In this environment, Perrigo, as the least profitable among its peers, suffers more because it needs to raise prices and, therefore, margins more than the more profitable competitors. Case in point, Perrigo has already lowered guidance twice in 2016, citing competitive pressures.

Second, believing that the shareholder destruction will stop with Mr. Papa may be short-sighted. Mr. Papa is choosing to leave a company where he has been CEO for a decade for a company that was on the verge of default and is under investigation by the SEC and other regulators. It does not appear Mr. Papa is trading up. Regardless of compensation, one has to wonder if, perhaps, Mr. Papa is leaving Perrigo because Valeant is, after bottoming, on the way up while Perrigo is not. Perhaps, it’s no coincidence that Perrigo announces significant cuts to 2016 guidance on same day it announces the CEO departure,.

Perhaps, the greatest risk to the bear case, and greatest hope for bulls is that the company returns to its intelligent, organic growth strategy that drive economic earnings higher from 2005-2013. However, in this scenario, expectations would need to be reset, as the company could no longer grow at the levels to which investors have become accustomed . Additionally, taking market share in a highly competitive industry, with large players such as Johnson & Johnson and Pfizer as primary competition, will be increasingly difficult.

Acquisition Hopes Cannot Justify Valuation

Despite its efforts to fight off acquisition in the past, Perrigo may change its tune in the future. However, we think it is highly unlikely the company will ever fetch a valuation like the one Mylan offered.

First, Perrigo has hidden liabilities that make it more expensive than the accounting numbers suggest.

- $1.7 billion in deferred tax liability (12% of market cap)

- $149 million in off-balance sheet debt (1% of market cap)

- $16 million in outstanding employee stock options (<1% of market cap)

After adjusting for these hidden liabilities, we can model multiple purchase price scenarios. Unfortunately for investors, we think that Perrigo turned down perhaps the best offer it may ever get when they fought off Mylan’s takeover attempt.

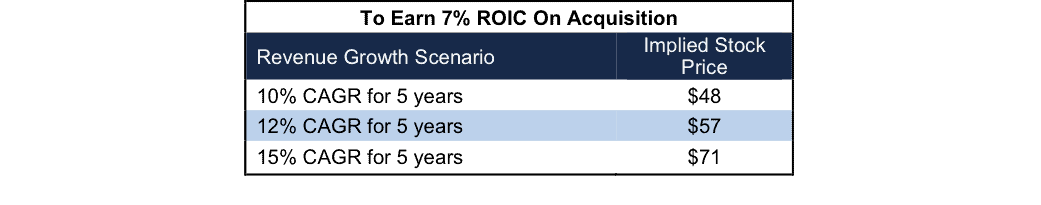

To highlight how overvalued PRGO is, Figures 4 and 5 show what we think Mylan should pay for PRGO to ensure the deal is truly accretive to shareholder value. Each implied price, is based on a ‘goal ROIC” assuming different levels of revenue growth. There are limits on how much MYL should pay to earn a proper return, given the NOPAT or cash flows being acquired. For each of the scenarios, we assume Perrigo achieves a 13% NOPAT margin post acquisition. This margin is higher than PRGO’s current margin (11%), but lower than Mylan’s 15% margin, which is higher due to Mylan’s focus on prescription drugs. We give PRGO a slight increase in margins due to Mylan’s ability to aggressively market/advertise using resources from MYL’s other profitable business lines.

Figure 4: Implied Acquisition Prices For MYL To Achieve 7% ROIC

Sources: New Constructs, LLC and company filings.

The first “goal ROIC” is Mylan’s weighted average cost of capital (WACC) or 7%. Figure 4 shows the prices Mylan should pay for PRGO assuming different levels of revenue growth achieved post acquisition. For reference, the OTC industry grew by only 5% in 2015 . Even with revenue growth that significantly outpaces the market, the most MYL should pay for Perrigo is $71/share – a 27% downside. We only include this scenario to provide a “best-case” view. Regardless, any deal that only achieves a 7% ROIC would be value neutral, as the return on the deal would equal Mylan’s WACC.

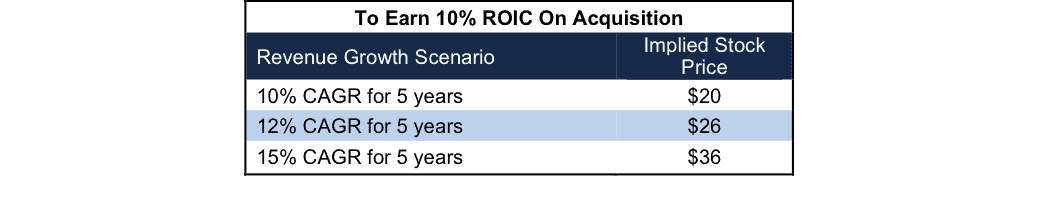

Figure 5: Implied Acquisition Prices For MYL To Achieve 10% ROIC

Sources: New Constructs, LLC and company filings.

Figure 5 shows the next “goal ROIC” of 10%, higher than the 7% earned in the last twelve months. This deal would be truly accretive to shareholders as it would increase Mylan’s ROIC, which is directly correlated to increasing valuation. In the best case growth scenario, the most MYL should pay for PRGO is $36/share (63% downside).

If Mylan did return to the bargaining table with Perrigo, it would be in a better bargaining position since PRGO spurned the last offer.

Overly Optimistic Organic Growth Expectations Embedded In Stock Price

To justify its current stock price ($97/share) via organic growth, Perrigo must grow NOPAT by 14% compounded annually for 13 years. In this scenario, 13 years from now, Perrigo would be generating $25 billion in revenue, which is greater than AstraZeneca’s (AZN) 2015 revenue and more than half the estimated 2015 market size of OTC drugs. Are those not irrationally exuberant expectations?

A more realistic scenario, given that PRGO is facing competitive pressures and weakness in its consumer health business, if PRGO can grow NOPAT by 8% compounded annually for the next decade, the stock is worth only $35/share today – a 64% downside.

Focus On Fundamentals & Earnings Miss Will Drive Shares Down

PRGO has had a rough 2016, with shares falling over 23% when it announced the departure of its CEO. Even after this decline, PRGO has further to fall as the issues Mr. Papa leaves behind will not be fixed overnight. Perrigo may be nearing the “end of the line” as it pertains to maintaining the illusion created by non-GAAP earnings. PRGO has tapped out its balance sheet and significantly diluted shareholders but doesn’t have any profit growth to show for it.

In addition to recently lowered guidance, Perrigo is forecasting weakness in its Omega Pharma acquisition and acknowledges it may have to write down the value of Omega. With these challenges, it would not surprise us if Perrigo’s earnings come in even lower than expected, or, even worse, the company turns to more poor acquisitions in an attempt to stoke revenue growth. If the latter occurs, any bull hopes of a return to the profitable “pre-2013” operations are gone. The high-low fallacy allowed acquisitions to help Perrigo mask poor operations in the short-term with EPS growth, but, as we saw with Valeant, accounting loopholes and/or non-GAAP earnings cannot pay the cash costs of running a business. Another earnings miss could prompt investors to look beyond EPS and uncover the truth about Perrigo’s profitability. Valeant showed just how quick valuations can rationalize when investors begin doing proper diligence.

Insider Sales and Short Interest Remain Low

Over the past 12 months 39,000 shares have been purchased and 92,000 shares have been sold for a net effect of only 53,000 insider shares sold. These purchases represent <1% of shares outstanding. Additionally, there are 9.5 million shares sold short, or just over 7% of shares outstanding.

Impact of Footnotes Adjustments and Forensic Accounting

In order to derive the true recurring cash flows, an accurate invested capital, and a real shareholder value, we made the following adjustments to Perrigo’s 2015 10-K:

Income Statement: we made $708 million of adjustments with a net effect of removing $384 million in non-operating expenses (8% of revenue). We removed $546 million related to non-operating expenses and $162 million related to non-operating income. See all adjustments made to Perrigo’s income statement here.

Balance Sheet: we made $6.4 billion of adjustments to calculate invested capital with a net decrease of $3.9 billion. The most notable adjustment was $4.3 billion (24% of net assets) related to midyear acquisitions. See all adjustments to Perrigo’s balance sheet here.

Valuation: we made $7.9 billion of adjustments with a net effect of decreasing shareholder value by $6.8 billion. One of the largest adjustments was the removal of $1.7 billion (12% of market cap) in deferred tax liabilities.

Dangerous Funds That Hold PRGO

The following funds receive our Dangerous-or-worse rating and allocate significantly to Perrigo Company.

- SPDR S&P Pharmaceuticals ETF (XPH) – 4.1% allocation and Dangerous rating.

- PowerShares Dynamic Pharmaceuticals Portfolio (PJP) – 4.1% allocation and Dangerous rating.

- MainStay CornerStone Growth Fund (KLGRX) – 3.1% allocation and Dangerous rating

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Photo Credit: aaronequipment.com

2 replies to "Danger Zone: Perrigo Company (PRGO)"

PRGO down nearly 12% after 2017 guidance failed to meet expections. Other noteworthy items include:

Perrigo announced it would delay the filing of its annual report until March.

Auditor E&Y is evaluating its historical revenue recognition practices related to Tysabri. The company says no assurance can be given that financial statements for one or more periods will not need restating.

The company’s CFO is stepping down immediately.

PRGO is down 23% since being placed in the Danger Zone while the S&P is up 13% over the same time.

PRGO down 7% as offices searched in DOJ probe. Down 26% since our Danger Zone report noted corporate governance issues