Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and Marketwatch.com

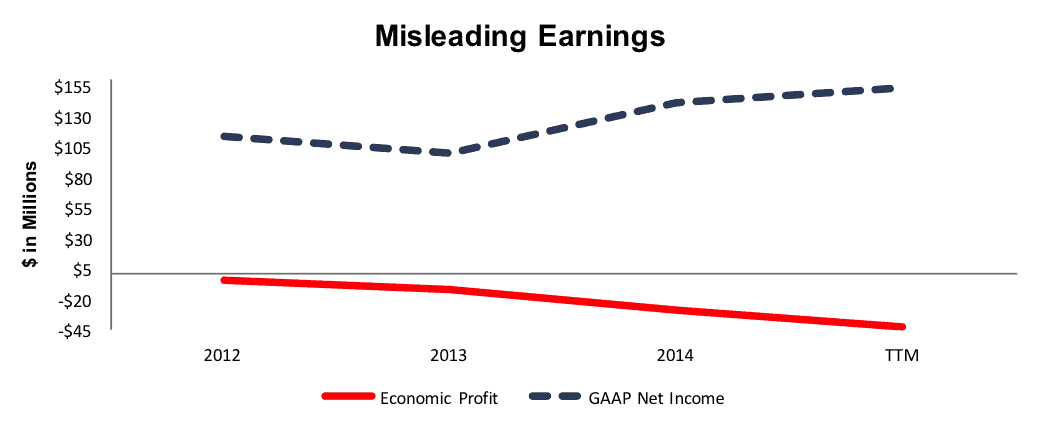

If 2015 was the year of overvalued tech firms’, 2016 could be the year of the ill-advised acquisition. As the signs of global slowdown mount, more companies look to acquisitions to artificially prop up earnings to make their numbers. This week’s Danger Zone focuses on a company with a history of failed acquisitions that operates in a crowded market. Once the rest of the market catches on to the divergence between economic and accounting earnings (see Figure 1), this stock is in for a big drop. For these reasons and more, WhiteWave Foods (WWAV: $37/share) lands in the Danger Zone this week.

WhiteWave’s Business Model Hasn’t Created Profits

Since going public in 2012, WhiteWave has done nothing but destroy shareholder value. As can be seen in Figure 1, while reporting GAAP net income growth of 11% compounded annually since 2012, economic earnings, also known as true cash flows available to shareholders, have declined from -$5 million in 2012 to -$43 million over the last twelve months.

Figure 1: GAAP Income Overstates Profits

Sources: New Constructs, LLC and company filings

So how has WhiteWave grown GAAP net income so positively? Acquisitions. WhiteWave has undergone multiple acquisitions aimed to grow its footprint in plant-based nutrition market since 2012. We’ve touched on this topic before, most recently in regards to the Newell Rubbermaid acquisition of Jarden. Per the high low fallacy, company’s can exploit acquisition accounting to grow EPS while destroying shareholder value.

Since 20012, WhiteWave has announced three major acquisitions, which cost upwards of $1.3 billion. While these acquisitions were “accretive” to EPS, they were harmful to the balance sheet. From 2012-2014, WhiteWave’s debt grew at 39% compounded annually to $1.6 billion. Over the last twelve months, debt has increased further to nearly $2.3 billion. Free cash flow is a startling -$789 million or 14% of the market cap.

This expansion of the balance sheet has come at significant cost. In 2014, the capital charge incurred on WhiteWave’s invested capital equaled $1.19/share. This cost and other adjustments, when removed from GAAP net income, reveal that WhiteWave’s economic EPS was actually -$0.17 compared to the reported $0.81 GAAP EPS.

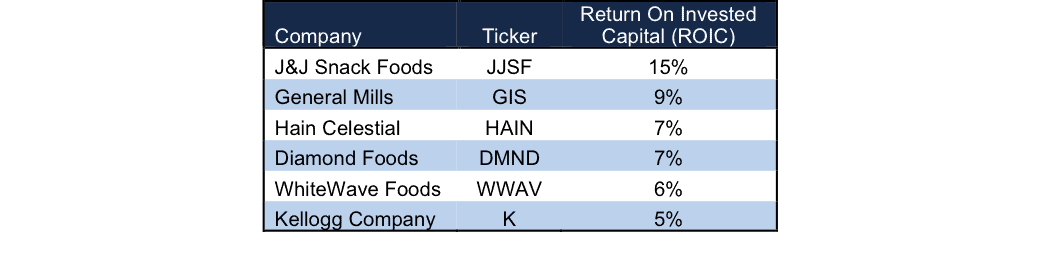

Not surprisingly, WhiteWave’s acquisitions have lowered its return on invested capital (ROIC) from 7% in 2012 to 6% over the last twelve months.

Competitors Have An Advantage Over WhiteWave

WhiteWave operates in the highly competitive natural and organic food market. Just being in the space doesn’t ensure success. Whole Foods Market (WFM) saw its share price decline over 40% last year. While WhiteWave helps stock the shelves of Whole Foods, not actually operating a grocery store, it is plagued with one of the same problems at Whole Foods: low profitability. WhiteWave’s low ROIC of 6% only surpasses one large food company competitor, Kellogg. Otherwise, WhiteWave operates at a competitive disadvantage when it comes to pricing power and operating flexibility. Add in private and foreign competition such as Nestle, Group Danone, Organic Valley, and many others, and it is hard to see how WhiteWave ever gets it profits out of the cellar and can create shareholder value.

Figure 2: WhiteWave Lacks Profitability

Sources: New Constructs, LLC and company filings

Bull Case Ignores History Of Failed Acquisitions

The bull case for WhiteWave centers around its ability to continue growing its top and bottom line. The problem here is that WhiteWave is not profitable. The bottom line is not growing. And continuing the current strategy only exacerbates cash flow issues. If the company does continue down the acquisition path, it will require significant additional capital and dilute existing stock holders.

Even if WhiteWave were to turn its business around and start making money, the best case scenario for such an event is already more than baked into the stock price.

Overvalued Even When Including Hopes Of Buyout

Playing the Wall Street favorite roll up role, WWAV is up over 100% since going public in late 2012, which is over three times the return of the S&P 500. This large price increase has left shares greatly overvalued. Many publications have speculated the Coca Cola (KO) could be a potential suitor to purchase WhiteWave outright. The belief is that KO could significantly upgrade its beverage business and reach new markets in one deal. For a deal to occur, Coca Cola would have to take on certain hidden liabilities that make WhiteWave more expensive than the accounting numbers suggest.

- $162 million in outstanding employee stock options ( 3% of market cap)

- $83 million in off balance sheet operating leases (1% of market cap)

- $237 million in net deferred tax liabilities (4% of market cap)

However, even if we believe there is an acquisition premium embedded in WWAV, the company is still overvalued. To illustrate this, we assume that Coca Cola acquires WhiteWave and WWAV immediately achieves Coca Cola’s margins and ROIC. In this scenario, WhiteWave would have to grow NOPAT by 20% compounded annually the next 14 years to justify a purchase at the current price. A more realistic price for Coca Cola to pay is $31/share, which is the value of WhiteWave’s business based on the value of the firm if its achieves Coca Cola’s 16% NOPAT margin in year one of the acquisition.

If we eliminate the acquisition scenarios, and give WhiteWave credit for 10% compounded annual NOPAT growth for the next decade, the stock is worth only $11/share today – a 70% downside.

Multiple Events Could Bring WWAV Back To Earth

In the current market, with volatility returning and fundamentals being brought back to the forefront, there are many events that would cause the market to realize how overvalued WWAV is.

- Easy capital dries up and makes acquisitions (i.e. debt) more expensive. WhiteWave could face a situation in which they are unable to raise capital to make new acquisitions, or, it they’re able to raise capital, it will be at a higher cost, thereby making new acquisitions more costly. Given WhiteWave’s poor history of acquisitions, it can ill afford more costly capital.

- If WhiteWave forgoes its acquisition strategy and is left with its organic growth, there’s no way it can meet investors expectations.

- The longer the market remains in a downward trend, the more investors will focus on fundamentals and stock picking. Throughout the low interest rate environment, it was nearly impossible to lose money as long as one followed the hot stocks. As investors begin to focus on fundamental analysis, the true lack of profitability of WhiteWave will become a large focus, helping to push shares down.

Insider Sales and Short Interest Remain Low

Over the past 12 months 750 shares have been purchased and 2 million shares have been sold for a net effect of 2 million insider shares sold. These sales represent 1% of shares outstanding. Additionally, there are 8.5 million shares sold short, or 5% of shares outstanding.

Executives Win While Shareholders Lose

Taking a look at WhiteWave’s executive compensation plan helps explain why such destructive acquisitions occur. Under the current plan, 80% of executive short-term compensation is based upon meeting target financial objectives such as adjusted EPS, adjusted segment operating income, and segment net sales. These non-GAAP metrics conveniently remove certain expenses, including stock compensation expense for IPO grants, transaction costs related to acquisitions, restructuring costs, administrative costs incurred to manage the China Joint Venture investment, losses incurred in the investment in the China Joint Venture, and stock-based compensation expense (in addition to amounts already included in IPO grants). What better way to get paid than acquire another firm and then remove expenses from that acquisition to meet target goals. Until executives are no longer paid based upon EPS growth, look for WhiteWave to continue announcing acquisitions that prop up these adjusted metrics while destroying shareholder value.

Impact of Footnotes Adjustments and Forensic Accounting

In order to derive the true recurring cash flows, an accurate invested capital, and a real shareholder value, we made the following adjustments to Whitewave’s 2014 10-K:

Income Statement: we made $76 million of adjustments with a net effect of removing $42 million in non-operating expenses (1% of revenue). We removed $59 million related to non-operating expenses, including $1 million in asset disposal costs, and $17 million related to non-operating income.

Balance Sheet: we made $490 million of adjustments to calculate invested capital with a net decrease of $120 million. The most notable adjustment was $167 million (6% of net assets) related to midyear acquisitions.

Valuation: we made $2.7 billion of adjustments that decrease shareholder value. There were no adjustments that increased shareholder value. The largest adjustment was the removal of $2.3 billion (36% of market cap) in total debt, which includes $83 million in off balance sheet operating leases.

Dangerous Funds That Hold WWAV

The following fund receives our Dangerous rating and allocates significantly to WhiteWave Foods.

- JOHCM US Small Mid Cap Equity Fund (JODMX) – 3% allocation and Very Dangerous rating.

- AMG TimesSquare All Cap Growth Fund (MTGVX) – 2.8% allocation and Dangerous rating.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Photo Credit: Pengrin (Flickr)

3 replies to "Danger Zone: WhiteWave Foods Company (WWAV)"

WWAV already down 12% since Danger Zone report published. Over same time, S&P500 is down only 5%. The reconciliation between cash flows and valuation is here.

Not a complaint. But with the recent high priced acquisitions of companies like LinkedIn and WhiteWave, have you considered a reexamination of the model for acquisition pricing risks. We are in an environment where many companies are sitting on piles of cash earning virtually no return. Do you think this increases the temptation to make risky bets on companies with high valuations?

Roger,

Our models are based off of fundamental data related to profitability and growth expectations implied by the valuation, so we don’t plan to alter the model for acquisition risks. However, we certainly have been paying attention to the many recent acquisitions and are increasingly putting a higher consideration on acquisition risk when putting companies in the Danger Zone. In fact, stay tuned because we may have a blog post coming out in the near future discussing this risk.