We published an update on this Long Idea on May 19, 2021. A copy of the associated Earnings Update report is here.

Disney is re-releasing Avengers: Endgame with deleted scenes on June 28th in a move that should vault the superhero flick to first place in the all-time global box office rankings. Endgame is gunning for the crown currently held by Avatar, which, now that the Fox acquisition has been completed, Disney also owns.

In fact, Disney-owned films now account for 10 of the top 15 global box offices of all-time. The company has achieved a level of box office dominance that is unprecedented in the modern era. This dominance is bad news, not just for its fellow movie studios, but for all other content producers out there, especially Netflix (NFLX).

Content is king, and Disney’s superior content will help it translate its dominance from the box office to the streaming video world. Disney (DIS: $140/share) is this week’s Long Idea.

Unprecedented Box Office Dominance

It may feel like Disney has always dominated the box office, but it’s position as the undisputed leader in the industry is actually a relatively new state of affairs. As recently as 2015, Disney finished second place to NBC/Universal (CMCSA) in terms of box office market share.

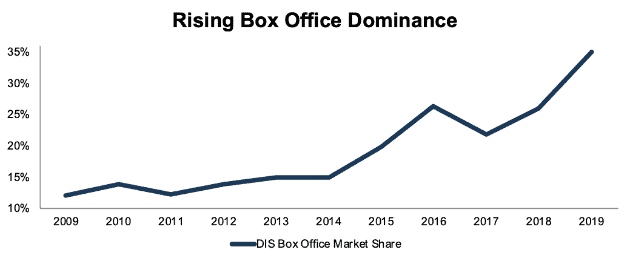

Figure 1 shows that Disney’s share of the domestic box office has nearly tripled over the past decade, from 12% in 2009 to 35% so far in 2019. With certain hits like The Lion King, Frozen 2, and Star Wars: The Rise of Skywalker still to come, Disney could plausibly push its market share even higher by the end of the year.

Figure 1: Disney’s Share of the Domestic Box Office: 2009-2019

Sources: Box Office Mojo

Disney’s current level of box office dominance goes far beyond anything we’ve seen in recent history. Since 2000, no other studio has managed to top 23% of the box office.

Disney manages this dominance despite releasing significantly fewer movies than peers. In 2018, Disney released just 10 movies, while the three studios behind it all released more than 30 movies each. Disney had the top three box office hits of 2018, and with the success of Toy Story 4 they now have the top four opening weekends of 2019.

This steady stream of reliable blockbusters gives Disney two key advantages over the competition:

- Leverage Over Movie Theaters: With The Last Jedi in 2017, Disney was able to demand 65% of the total box office take from movie theaters (up from the 50-60% studios typically get). As Disney continues to grow its box office share, it has the potential to squeeze movie theaters even harder.

- Franchises and Spinoffs: Big blockbusters create a self-sustaining ecosystem of sequels and spinoffs. Disney now has a wide-variety of franchises that can promise a guaranteed audience for any new installment, whether it’s a movie sequel or a tv show set in the same universe.

This second point is key as Disney expands its direct-to-consumer offerings. The launch of Disney+ later this year will receive a big boost from the tentpole franchises that Disney can include in the service.

Disney Can Win the Streaming Wars

As Disney+ prepares to take on Netflix, the two companies exist at opposite ends of the spectrum in terms of their approach to content development. Netflix takes a “hands-off” approach that greenlights a ton of projects (~700 shows and movies in 2018) and gives a great deal of leeway to the creators. As a result, Netflix creates a large number of niche shows that appeal to limited audiences.

Meanwhile, Disney, as noted above, leans on a small number of recognizable franchises that appeal to wide audiences. The company’s approach can be summed up by CEO Bob Iger, speaking at the MoffettNathanson Media & Communications Summit earlier this year:

“When we build things based on IP that's already popular, you tend to get higher returns on those investments.”

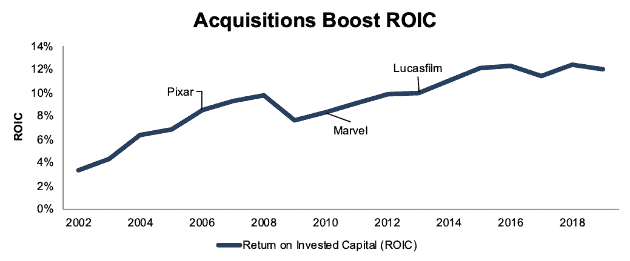

Iger was referring to the company’s parks strategy with that answer, but it applies to their content spending as well. Disney consistently builds its content strategy around preexisting IP, including acquiring recognizable IP through acquisitions of Pixar, Marvel, Lucasfilm, and now Fox. As Figure 2 shows, this strategy has led to a long-term increase in return on invested capital (ROIC) from 3% in 2002 to 12% in 2018. As we’ve written about before, Disney’s focus on ROIC is an underrated competitive advantage.

Figure 2: DIS ROIC Since 2002

Sources: New Constructs, LLC and company filings

What’s more, evidence increasingly suggests that consumers prefer Disney’s franchise strategy to Netflix’s more scattershot approach. When consumers are presented with hundreds of movies and TV shows to watch, they become overwhelmed and end up going back to familiar programs.

This phenomenon explains why The Office, Friends, and Grey’s Anatomy consistently rank at the top of the most streamed shows on Netflix. It also suggests that Netflix is in big trouble when these shows leave the services, as will be the case with The Office at the end of next year.

Right as Netflix is starting to lose some of its most valuable content, Disney+ is coming to market with a vast array of classic movies, Fox content like The Simpsons, original shows set in the Star Wars and Marvel universes, and, crucially, a $7/month price tag that’s almost half of Netflix’s $13/month cost.

With these advantages, plus the flexibility for consumers to bundle with ESPN+ and Hulu, Disney+ should be able to rapidly gain market share in the streaming space.

Underrated Strength in Legacy Businesses

While investor attention has been focused on the Fox acquisition and Disney+, the company’s legacy business segments continue to deliver solid performance. The Media Networks segment, which contains ESPN, ABC, and a variety of other cable channels, has been a source of concern for investors due to declining cable subscriptions. However, operating income for that segment has stayed flat year-over-year through the first six months of 2019.

Meanwhile, the Parks, Experiences, and Products segment continues to be a strong performer for the company. Operating income in this segment grew 12% year-over-year through the first six months of 2019.

While the pivot to streaming may be key to the long-term health of the company, it’s important to note that the current business model continues to deliver solid cash flows.

Money Will Get Reallocated to Disney When the Micro-Bubble Bursts

We’ve discussed the topic of the Micro-Bubble a number of times over the past year. While the valuation of the market as a whole may not be unusually high by historical standards, there are a collection of stocks with bubble-like valuations. These stocks share a few key qualities:

- Rapid growth driven by (usually overhyped) technological innovation

- Low or negative cash flows

- Valuations based on the premise that they will capture a huge share of existing markets from incumbents

This last point explains why so much of our discussion of Disney’s valuation focuses on Netflix. Right now, Netflix is overvalued and Disney is undervalued based on the premise that Netflix will eat into Disney’s core market. As it becomes clearer that Disney will win the streaming video war, we expect to see Netflix’s valuation decrease sharply, and much of that valuation re-allocated to Disney.

The Numbers Behind the Valuation

Our dynamic DCF model demonstrates the extent to which Netflix is overvalued and Disney is undervalued by quantifying the expectations baked into their valuations.

Netflix’s current valuation of $350/share implies the firm will achieve an after-tax operating profit (NOPAT) margin of 17% (equal to Disney) and grow revenue by 35% a year for seven years. In this scenario, NFLX earns $129 billion in revenue in year 7, which equates to over 700 million subscribers paying $15/month. See the math behind this dynamic DCF scenario.

Disney’s current valuation of $140/share implies the firm will maintain 2018 margins and grow revenue by 19% compounded annually for two years (driven by the Fox acquisition) and then 5% compounded annually in years 3-7. See the math behind this dynamic DCF scenario.

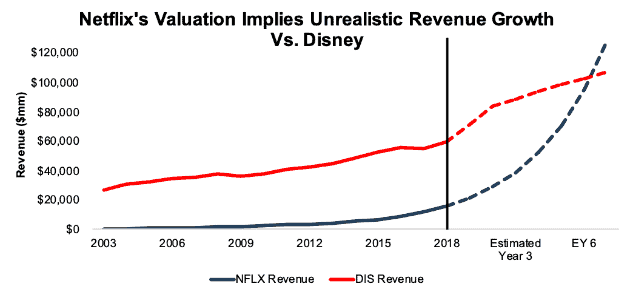

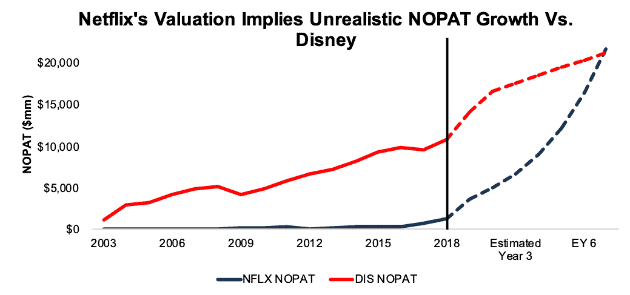

Figures 3 and 4 compare the revenue and NOPAT growth implied by these scenarios to the historical results of these companies dating back to 2003.

Figure 3: Netflix Vs. Disney: Historical and Forecasted Revenue

Sources: New Constructs, LLC and company filings

The market’s expectations imply that Netflix, which has grown revenue by 31% compounded annually since 2003, will accelerate that revenue growth to 35% annually over the next seven years. Meanwhile, Disney’s long-term growth rate is forecasted to remain unchanged at 5%.

Figure 4: Netflix Vs. Disney: Historical and Forecasted NOPAT

Sources: New Constructs, LLC and company filings

Netflix has grown NOPAT by 45% compounded annually since 2003, but its valuation implies it will grow NOPAT by 50% compounded annually over the next seven years. Meanwhile, Disney has grown NOPAT by 17% compounded annually since 2003, but even with the boost from the Fox acquisition the market only expects 10% annual NOPAT growth over the next seven years.

Potential Upside for Disney

We last made Disney a Long Idea in February 2019. Since then, the stock is up 27% while the S&P 500 is up just 6%. We believe DIS will continue to outperform, and due to its cheap valuation, we see significant potential upside for Disney.

If Disney can earn the same ROIC from the Fox acquisition as it has for the rest of its business (12%) and grow organic revenue by 6% compounded annually over the next decade, the stock is worth $189/share today, a 34% upside to the current stock price. See the math behind this dynamic DCF scenario.

Even this scenario might prove too pessimistic. After all, it only implies a 12% compounded annual NOPAT growth rate, which is below the company’s historical average.

If Disney can grow NOPAT by 17% compounded annually over the next decade, equal to its historical growth rate, the stock has a fair value of $330/share today, a 135% upside to the current stock price. See the math behind this dynamic DCF scenario.

Sustainable Competitive Advantages That Will Drive Shareholder Value Creation

Here’s a summary of why we think the moat around Disney’s business will enable the company to generate higher profits than the current valuation of the stock implies. This list of competitive advantages helps DIS offer better products/services at a lower price and prevents competition from taking market share.

- Unrivalled collection of IP, from the classic Disney vault to Marvel, Star Wars, and now the Fox library

- A high-quality platform with movies, tv, parks, toys, and now streaming that allows the company to monetize IP better than anyone else

- Excellent management team focused on maximizing ROIC

What Noise Traders Miss with DIS

These days, fewer investors focus on finding quality capital allocators with shareholder friendly corporate governance. Instead, due to the proliferation of noise traders, the focus tends toward technical trading tends while high-quality fundamental research is overlooked. Here’s a quick summary for noise traders when analyzing DIS:

- Disney’s franchise-based strategy will differentiate its streaming platform in an era of overwhelming TV choice

- Loss of licensed content makes Netflix more vulnerable than many investors recognize

- Buried beneath the noise, Disney’s Media Networks and Parks segments continue to deliver strong results

Catalyst: Streaming Success Can Send Shares Higher

Disney’s next couple earnings reports will be difficult to analyze due to the impact of the Fox acquisition, so the next big turning point for the stock should be the launch of Disney+ in November. If the streaming service can quickly attract subscribers – and especially if it can pull customers away from Netflix – the stock should spike higher.

Longer-term, Disney’s ability to integrate and earn a high return on capital for the Fox deal will be a big factor driving the stock price. With several Avatar sequels on the way, the opportunity to integrate X-Men into the Marvel Cinematic Universe, and plenty of room to use this IP in the parks and toy-licensing business, we’re confident Disney will generate significant value from these assets going forward.

Superior Executive Compensation

Disney’s high-quality executive compensation practices give us a great deal of confidence in managements ability to create long-term value. Roughly 90% of compensation for Disney executives comes in the form of performance-based bonuses, and 25% of performance-based compensation is tied to ROIC. Even better, Disney calculates ROIC in a fairly rigorous manner (better than most) that lines up well with economic reality.

Disney’s compensation practices also give us confidence that management will continue to be responsible stewards of shareholder capital. We think it’s safe to say Iger and the rest of the executive team have done their diligence to ensure that the economics of the Fox acquisition will create value for shareholders. After all, their bonuses depend on it.

Dividend Provides 1% Yield

Disney currently offers investors a $1.76 annualized dividend, which equates to a 1.3% dividend yield. Although the company has increased its dividend in 8 of the past 10 years, investors shouldn’t expect any dividend increases in the near future as Disney focuses on reducing its debt from the Fox acquisition.

Buybacks, which equaled $3.6 billion (2% of market cap) last year, are similarly on pause for the time being.

Insider Trading and Short Interest Trends are Minimal

Insider activity has been minimal over the past 12 months, with 1.6 million shares purchased and 2.6 million shares sold for a net effect of 1 million shares sold. These sales represent less than 1% of shares outstanding.

There are currently 16 million shares sold short, which equates to 1% of shares outstanding and 1 day to cover. There doesn’t appear to be much appetite to short the stock at this valuation.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments we make based on Robo-Analyst[1] findings in Disney’s 2018 10-K:

Income Statement: we made $16.4 billion of adjustments, with a net effect of removing $1.7 billion in non-operating income (3% of revenue). We removed $4.1 billion in non-operating income and $2.3 billion in non-operating expenses. You can see all the adjustments made to DIS’s income statement here.

Balance Sheet: we made $21.9 billion of adjustments to calculate invested capital with a net increase of $7.1 billion. You can see all the adjustments made to DIS’s balance sheet here.

Valuation: we made $111 billion of adjustments with a net effect of decreasing shareholder value by $70 billion million. Despite this decrease in value, DIS remains undervalued. You can see all the adjustments made to DIS’s valuation here.

Attractive Funds That Hold DIS

The following funds receive our Very Attractive rating and allocate significantly to Disney.

- Christopher Weil & Co. Core Investment Fund (CWCFX) – 7.6% allocation and Very Attractive rating

- State Farm Growth Fund (STFGX) – 6% allocation and Very Attractive rating

- Chestnut Street Exchange Fund (CHNTX) – 6% allocation and Very Attractive rating

- Amplify CWP Enhanced Dividend Income ETF (DIVO) – 5.3% allocation and Very Attractive rating

This article originally published on June 26, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

Click here to download a PDF of this report.

Photo Credit: Netflix/Disney/Erik Kain

5 replies to "Disney’s Avengers Spell Endgame for Netflix"

This article was published on June 26th when the Disney stock was 140$, yet on July 5th, with the stock 142$, the Disney stock got changed to Unattractive rating with a Sell recommendation by your own metrics. How should I reconcile these seemingly conflicting recommendations? Thanks.

Disney currently has a Suspended Rating in our system due to its acquisition of most of 21st Century Fox. What this means is that due to the impact of the acquisition, the company’s current financials are no longer a reliable indicator of the risk/reward of the stock. In particular, the company’s valuation metrics are distorted due to the fact that it has the additional debt/shares issued in the acquisition, but it has not yet gained any additional profits from the deal. For this reason, investors should not treat our current rating on Disney as definitive.

This article, on the other hand, does integrate the impact of the Fox acquisition into its analysis of profits and valuation. The company’s track record gives us confidence that this acquisition will create long-term value for shareholders, and as the DCF scenarios at the end of this article show, DIS has significant potential upside still.

Thanks Sam, that helps.

With the earning short fall Disney just released and the bad news of the Star Wars theme park revenue can this analytics described here be run again? I’m really curious to know if the failure of Star Wars under Disney has an impact to the entire stock.

Calling Star Wars a failure under Disney seems premature. 3 out of the 4 Star Wars movies they’ve put out have grossed over $1 billion worldwide. Galaxy’s Edge has struggled at its launch, but plenty of parks/attractions struggle at their launch before developing into profitable ventures. If Episode 9 flops in December, then we’d start to be more worried, but a couple of missteps does not mean that Star Wars has lost its value.

Meanwhile, the earnings miss has a lot more to due with analysts struggling to forecast results post-Fox acquisition than with any real problems with the fundamentals of the business. The company faced big expenses from the launch of Disney+, the consolidation of Hulu, integration costs with the Fox acquisition, and poor results from the Fox Studio (mainly due to the flop of Dark Phoenix). On the other hand, the studio segment has already broken its own record for single year box office gross, ESPN operating income has stabilized, and even with the Galaxy’s Edge issue the Parks segment continues to grow at a healthy rate.

We continue to see a lot of positives with Disney’s stock, and the announcement of the $12.99 bundle of Disney+, ESPN+, and ad-supported Hulu represents a massive threat to Netflix.