We published an update on this Long Idea on May 19, 2021. A copy of the associated Earnings Update report is here.

One thing we’ve learned in our years picking stocks is that it’s not enough to find a company that’s undervalued: a catalyst for the market to recognize the stock’s true value must exist. Without a catalyst, a stock can stay undervalued for years.

We recommended Disney (DIS: $109/share) to investors two years ago. Absent any major catalysts, the stock underperformed in 2017. The announcement of the 21st Century Fox (FOXA) acquisition and Disney/ESPN streaming services provided a boost that helped DIS beat the S&P 500 in 2018. The expected completion of the Fox acquisition and launch of Disney+ should, along with other catalysts, provide further upward momentum for the stock. We are reiterating our buy recommendation for Disney in this week’s Long Idea.

Track Record of Value-Creating Acquisitions

The key to our Disney thesis is its tremendous platform value. No other company can match Disney in terms of brand value, creative expertise, or the breadth of its content monetization channels. These assets enable the company to buy up beloved intellectual property (Pixar, Marvel, LucasFilm), churn out multiple blockbuster films, and, then, aggressively monetize the success of those films through theme park attractions, licensed toys, and spin-off TV series.

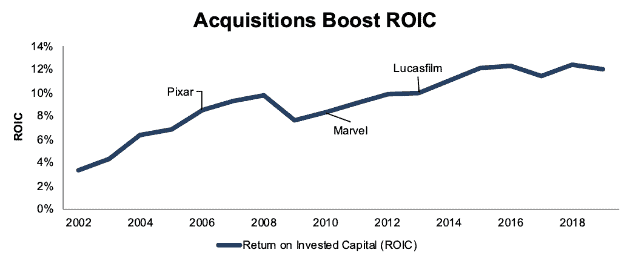

Figure 1 shows the company’s long-term track record of success creating value through acquisitions. Disney’s return on invested capital (ROIC) has improved from 7% in 2005, the year before it bought Pixar, to 12% TTM.

Figure 1: DIS ROIC Since 2002

Sources: New Constructs, LLC and company filings

At a price tag of ~$70 billion, Disney’s acquisition of most of 21st Century Fox’s assets will be nearly five times larger than those three major acquisitions combined. For that price tag, Disney will get:

- Avatar: the highest grossing movie of all time with a rumored 4 sequels upcoming

- X-Men and Deadpool: rounding out the Marvel Cinematic Universe

- Smaller but still successful franchises like Ice Age and Planet of the Apes

- A large number of critically acclaimed TV series from the FX network that can meaningfully contribute to a potential streaming service

- A controlling stake in Hulu, which is currently growing at a faster rate than Netflix (NFLX)

It’s impossible to break out the exact cash flows of these assets due to the fact that they’re bundled with other Fox assets that won’t be part of the transaction, such as the Fox broadcast network, Fox News, and its regional sports networks. Therefore, we can’t model how this acquisition will impact ROIC in the short-term. However, Disney’s track record of creating value from acquisitions should give investors confidence that this deal will create value over the long-term.

Superior Exec Comp Ensures Efficient Capital Allocation

Disney’s track record of improving ROIC is no coincidence. The company places a high emphasis on ROIC as its primary measure of profitability. In a recent interview with Barron’s, CEO Bob Iger gave this response when asked how he measures profitability in the movie business:

“It’s all about return on invested capital. I just mentioned box office, but I’m much more focused on ROIC. The ROIC in the broader movie business is probably in the low single digits, and we have years that it’s above 30%. And that’s because of choices we’re making. The franchises and the name value of these. There was a purpose to all of this. It didn’t just happen. It was designed.”

That emphasis on ROIC extends to executive compensation. Roughly 90% of compensation for Disney executives comes in the form of performance-based bonuses, and 25% of performance-based compensation is tied to ROIC. Even better, Disney calculates ROIC in a fairly rigorous manner (better than most) that lines up well with economic reality.

Disney’s compensation practices give us confidence that management will continue to be responsible stewards of shareholder capital. We think it’s safe to say Iger and the rest of the executive team have done their diligence to ensure that the economics of the Fox acquisition will create value for shareholders. After all, their bonuses depend on it.

Combining the Best in Class Media Companies

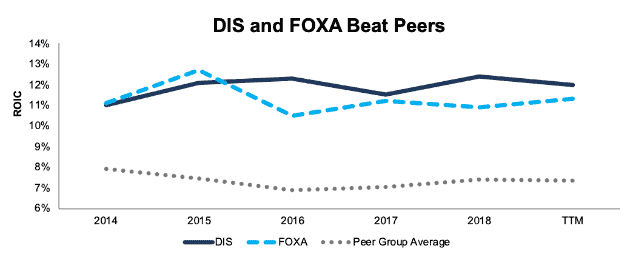

In addition to acquiring numerous valuable assets in the Fox deal, Disney will partner with one of the few media companies that has managed to rival it in terms of profitability in recent years. Figure 2 shows that both Disney and Fox have consistently earned a higher ROIC than their peer group[1] since 2014.

Figure 2: DIS and FOXA ROIC vs. Peers

Sources: New Constructs, LLC and company filings

By acquiring Fox, Disney gains great content while absorbing the company that poses the most competition.

Timing Is Right for Disney+ to Gain Market Share

Another benefit of the Fox acquisition, as noted above, is that it gives Disney new content to flesh out its upcoming Disney+ service. Critically acclaimed FX shows such as Atlanta, The Americans, Fargo, and more will complement Disney’s existing, more family-friendly content. Disney will also be licensing third-party content for its streaming service, which will allow it to build out an impressive content library from the get go.

All this content will make Disney+ a serious competitor to Netflix right as the streaming giant’s position looks somewhat vulnerable. Investors love to focus on Netflix’s original content, but analysis from 7Park data suggests that licensed content still accounts for over 60% of streaming hours on the platform.

This reliance on licensed content could hit Netflix hard in 2019 and 2020 when the owners of all that content start pulling their shows in order to launch their own services. In addition to Disney, NBCUniversal plans to launch a streaming service in 2020, and Warner Media has plans for its own service. Those two companies own The Office and Friends, the #1 and #3 streaming shows on Netflix, respectively.

7Park also found that, in 2017, 42% of Netflix subscribers watched almost solely licensed content. Even if that amount has fallen by half since then, that leaves 20% of Netflix subscribers that will derive significantly less value from the service when licensed content starts to disappear.

Add in the fact that Netflix is raising its price again this year, from $11/month to $13/month, and there may be plenty of subscribers looking to switch. Iger has already promised that Disney+ will be priced below Netflix, so the service could prove to be an attractive alternative.

In addition, Disney already has a rapidly growing streaming service in Hulu, which recently topped 25 million subscribers, up 50% from a year ago. Disney plans to expand Hulu internationally in the near future, which could be a significant growth driver.

ESPN+ has also been a modest success for Disney. The sports streaming service, which only includes events and shows that aren’t broadcast on its cable networks, topped 2 million subscribers in its first year. Many analysts were skeptical that the second-tier content offerings would find a following, but its quick growth proves that live sports are still extremely valuable.

Each of these different offerings will allow Disney to segment its audience and maximize the value of its content.

Micro-Bubble Winner

If Disney+ and other new streaming services successfully pull subscribers away from Netflix, it should burst what we call the “Micro-Bubble” in NFLX stock, and further benefit Disney. Netflix is one of a handful of companies we identified last year as being significantly overvalued as our reverse DCF model shows the current stock price embeds unrealistic profit growth and its attendant market share gains.

Conversely, we see Disney as a winner when the micro-bubble bursts. Right now, Disney’s valuation is depressed due to overblown fears that Netflix will hurt the profitability of its existing business. When the Netflix business model proves to be unsustainable and Disney shows it can successfully compete in the streaming space, we believe a great deal of the investor capital currently allocated to NFLX should flow to DIS instead.

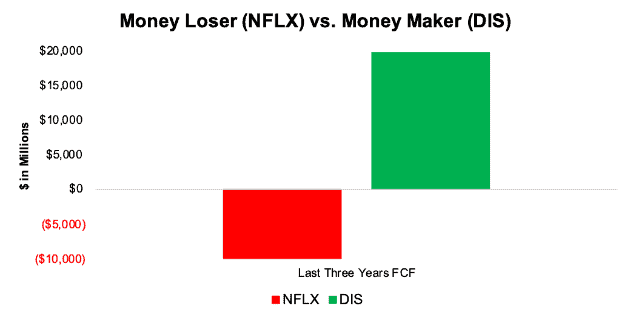

Currently, both NFLX and DIS have market caps of ~$160 billion. However, as Figure 3 shows, their free cash flow is very different. Disney has generated nearly $20 billion in FCF over the past three years, while NFLX has lost over $10 billion.

Figure 3: NFLX Loses Billions While DIS Makes Billions

Sources: New Constructs, LLC and company filings

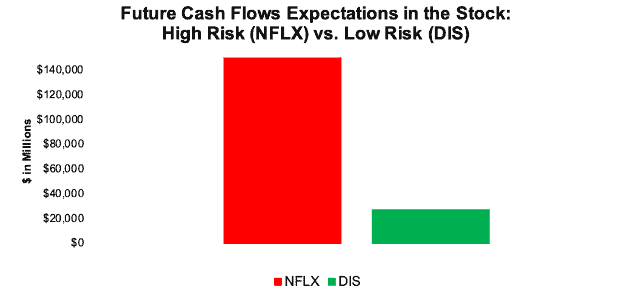

Despite its negative free cash flow, 99% of Netflix’s current stock price depends on future cash flow growth.[2] On the other hand, Disney’s valuation implies less than 20% growth in future cash flows. See Figure 4.

Figure 4: Cash Flow Expectations for NFLX Are Dangerously High

Sources: New Constructs, LLC and company filings

As it becomes clear that the growth expectations implied by Netflix’s stock price are unrealistic, we expect to see investors pull money out of NFLX and bid up DIS.

Cheap Valuation Creates Upside Opportunity

To put Figure 4 in more context, at its current valuation of $109/share DIS has a price to economic book value (PEBV) ratio of 1.2. This ratio means the market expects Disney to grow after-tax operating profit (NOPAT) by no more than 20% from its TTM level over the remainder of its corporate life. This expectation seems overly pessimistic for a company that has grown NOPAT by 13% compounded annually since 2002.

If Disney can maintain an ROIC of ~12% after the Fox acquisition and then grow NOPAT at 4% compounded annually in years 2-10, the stock is worth $170/share today, a 56% upside from the current stock price. See the math behind this dynamic DCF scenario.

With its long-term track record of profit growth and improving ROIC, that scenario may prove conservative for Disney.

More Potential Catalysts on the Horizon

In addition to closing the Fox acquisition and launching Disney+, we see more catalysts for DIS in 2019.

1. Reorganization Highlights Strength of Parks Business

Disney announced a reorganization of its operating segments last year that began to take effect in the most recent quarter. This reorganization will break out direct-to-consumer operations into its own segment so investors have more visibility into the profitability of the company’s streaming efforts.

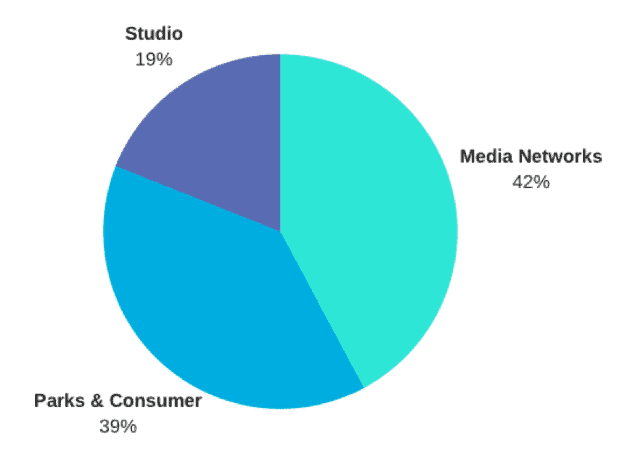

In addition, the reorganization combined the “Parks and Resorts” and “Consumer Products” into a single segment. Despite getting significantly less attention than the movie or TV business, this segment accounted for nearly 40% of operating income in 2018, as shown in Figure 5.

Figure 5: Segment Operating Income For 2018

Sources: New Constructs, LLC and company filings

The Parks & Consumer segment’s operating income grew by 11% in 2018 and maintained that year-over-year growth rate in Q1 2019. While the Studio segment is volatile and the Media Networks segment has faced pressure from cord-cutters in recent years, the Parks business has grown operating income by at least 9% every year since 2011. While the Consumer segment has not performed as well, the new combined segment should maintain a solid growth rate and could soon become the largest contributor to operating income.

Most investors have primarily focused on the direct-to-consumer business, so there’s upside to bringing more focus to the strongest-performing segment of the company.

2. Blockbuster After Blockbuster Films Coming

Despite the strong performance from the Parks & Consumer business in Q1 2019, Disney’s ROIC dipped slightly due to a year-over-year decline in the Studio segment. The company faced a tough comp due to the success of Thor: Ragnarok and Star Wars: The Last Jedi in Q1 2018. However, the upcoming release schedule should drive profit growth in the studio business once again. Over the next few months, Disney will release the following movies:

- March: Captain Marvel

- April: Avengers: Endgame

- May: Aladdin

- June: Toy Story 4

- July: Spider Man: Far From Home and The Lion King

- November: Frozen 2

- December: Star Wars: Episode IX

As good a year as 2018 was for Disney’s Studio segment, 2019 could end up even better. This strength in the studio segment should drive even more growth for the Parks and Consumer Products business, due to Disney’s impressive monetization platform, as noted above.

What Noise Traders Miss With DIS

In general, markets aren’t good at identifying quality balance sheet management (i.e. capital allocation) that creates value. Instead, due to the proliferation of noise traders, markets are great at amplifying volatility, and therefore risk, in popular momentum stocks, while high-quality unconflicted & comprehensive fundamental research is overlooked. Here’s a quick summary for what noise traders miss when analyzing DIS:

- Management’s focus on ROIC that’s led to superior value creation

- Netflix’s pending loss of the licensed content (63% of its viewing hours) that could create an opening for Disney+ to quickly gain traction

- The growth and profitability of the Parks business that has been buried under all the discussion of other parts of the company

No Buybacks, But Safe 1.6% Dividend Yield

Disney has bought back shares aggressively in the past, but the company announced that it’s halting buyback activity for the foreseeable future as it pays for the Fox acquisition. While buybacks can be nice, it’s always better for a company to invest capital in profitable growth opportunities, so shareholders should be pleased with this decision.

Disney does still offer some capital return, as the company pays a semi-annual dividend of $0.88/share. The company has raised its dividend in 8 of the past 10 years, including the past two years amidst the Fox acquisition. Over the past three years, DIS has generated $20 billion in free cash flow vs. $7.3 billion in dividend payments, so it has plenty of resources to maintain and grow the dividend even with the capital requirements of the Fox deal.

Insider Trading and Short Interest Trends

There is little insight to be gained from recent insider trading trends, as they have been minimal. Over the past 12 months, 23 thousand shares have been purchased and 909 thousand shares have been sold, for a net sale of 932 thousand shares. These sales represent less than 1% of shares outstanding.

Short interest trends also don’t tell us much. There are currently 27.8 million shares sold short, which equates to 2% of the float and 4 days to cover. Short interest has been steady and low recently, so it doesn’t appear as if there’s been any major swing in sentiment against the stock.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments we make based on Robo-Analyst[3] findings in Disney’s fiscal 2018 10-K:

Income Statement: we made $$6.4 billion of adjustments, with a net effect of removing $1.7 billion in non-operating income (3% of revenue). We removed $4.1 billion in non-operating income and $2.3 billion in non-operating expenses. The most notable adjustment was a $2.1 billion benefit from the new tax law. You can see all the adjustments made to DIS’s income statement here.

Balance Sheet: we made $21.9 billion of adjustments to calculate invested capital with a net increase of $7.1 billion. Our most notable adjustment was $3.1 billion (4% of reported net assets) in accumulated other comprehensive loss. You can see all the adjustments made to DIS’s balance sheet here.

Valuation: we made $38.4 billion of adjustments with a net effect of decreasing shareholder value by $31.9 billion. Despite this deduction to shareholder value, the stock remains undervalued.

Attractive Funds that Hold DIS

The following funds receive our Attractive-or-better rating and allocate significantly to DIS.

- Christopher Weil & Company Core Investment Fund (CWCFX) – 6.9% allocation and Attractive rating.

- State Farm Growth Fund (STFGX) – 6.5% allocation and Very Attractive rating.

- Chestnut Street Exchange Fund (CHNTX) – 5.7% allocation and Very Attractive rating.

- Invesco Buyback Achievers ETF (PKW) – 5.4% allocation and Attractive rating.

- Amplify YieldShares CWP Dividend & Option Income ETF (DIVO) – 5.2% allocation and Very Attractive rating.

This article originally published on February 13, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Which consists of CBS (CBS), Comcast (CMCSA), and Viacom (VIAB).

[2] Future cash flow expectations (aka “PVGO”) equal the incremental present value of growth in future cash flows required to justify the stock prices. The calculation is market value minus economic book value.

[3] Harvard Business School features the powerful impact of our research automation technology in the case study New Constructs: Disrupting Fundamentals Analysis with Robo-Analysts.

3 replies to "Too Many Positive Catalysts to Count for This Media Giant"

I enjoyed reading the 2/13/19 analysis re DIS, especially re DIS+. I believe you may have understated the potential prowess of AT&T. AT&T has an excellent treasure trove of movies, but so does DIS. Not sure which co is superior, let’s say both are excellent. If neither DIS nor AT&T share these “treasures” with NFLX, NFLX has a problem. To offset this potential “problem,” NFLX is developing their own content, which suggests why NFLX needs to raise prices, in order to pay for development costs. Therefore, as a “catalyst,” believe DIS is “moat-like,” due to existence of its highly capable and successful studio. The winning stock is the company that provides the best value for the dollar spent on service. I think DIS. In that belief, is it possible to measure if DIS is taking market share from NFLX?

Thanks for your comment. Measuring Disney’s impact on Netflix’s market share will depend a great deal on how much disclosure Disney provides. Netflix gives its subscriber numbers quarterly, so it will be easy to determine if their growth slows down. However, it’s unclear at the moment whether Disney will provide regular disclosure of the subscriber numbers for Diseny+ when it launches. Without those numbers, it will be hard to measure if any changes in Netflix’s subscriber numbers are due to Disney, other competitors, or just saturation in the streaming market.

Our micro-bubble thesis in action – Disney up 11% and Netflix down 4% after Disney reveals pricing and content plans for Disney+