We closed WMT on June 23, 2023. A copy of the associated Position Close report is here.

We published an update on DIS on January 5, 2022. A copy of the associated Earnings Update report is here.

These two best-of-breed firms are positioned to continue to create shareholder value over the long term. Walmart (WMT: $142/share) and Disney (DIS: $170/share) are this week’s Long Ideas.

We leverage more reliable fundamental data, proven in The Journal of Financial Economics[1], with qualitative research to highlight these firms whose stocks present excellent risk/reward. Below, we revisit our Walmart Long Idea thesis and provide a brief update on Disney post calendar 1Q21 earnings.

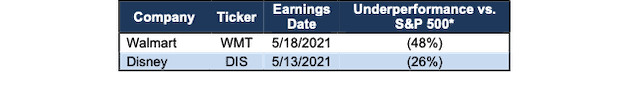

Figure 1: Long Idea Performance: From Date of Publication Through 5/18/2021

Sources: New Constructs, LLC

*Measured from the date of publication of each respective original report. Dates can be seen in each company section below. Performance represents price performance and is not adjusted for dividends.

Walmart Remains Best-in-Class and Undervalued

We first made Walmart a Long Idea in June 2011. Since then, the stock is up 171% vs. 218% for the S&P 500. The stock has underperformed the S&P 500 by just 1% since we reiterated the idea in August 2018 and by 3% since reiterating it in December 2018.

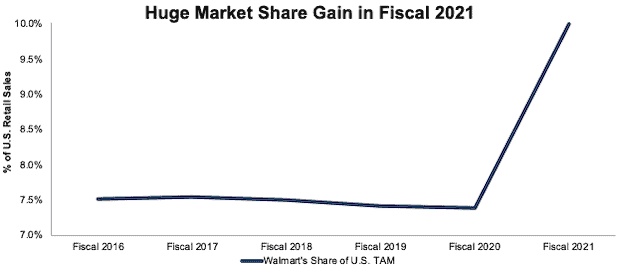

Scale Advantages Lead to Large Market Share Gains: The COVID-19 pandemic led to more than 12 thousand retail store closures across the U.S. in calendar 2020. Walmart’s extensive supply, distribution, and store network coupled with an effective ecommerce strategy positioned the firm to take the market share left behind. Walmart’s share of its U.S. total addressable market (TAM) rose to 10% in fiscal 2021, after it fell from 7.6% in fiscal 2016 to 7.4% in fiscal 2020.

Figure 2: Walmart’s Share of U.S. TAM

Sources: New Constructs, LLC, company filings, and U.S. Census Bureau.

Walmart’s global market share improved from 2.5% in fiscal 2020 to 2.6% in fiscal 2021, based on total retail sales across the world. However, international sales are likely to decline from fiscal 2021 levels with the sale of its businesses in Argentina, Japan, and the U.K. For reference, in fiscal 2020 (most recently available year) Walmart operated 92 stores in Argentina and in fiscal 2021, the firm operated 328 stores in Japan and 632 stores in the U.K. The firm’s international segment generated $121.4 billion in net sales in fiscal 2021 which accounted for 22% of the firm’s fiscal 2021 total net sales.

Continuous Efficiency Gains: As the world’s largest retailer (by retail revenue), Walmart continues to effectively manage its retail space and expenses to capitalize on its scale. The firm’s sales per square foot of store space has improved from $464/square foot in fiscal 2018 to $499/square foot in fiscal 2021, while its operating, selling, general and administrative expenses as a percent of total sales fell from 21.3% to 20.8% over the same time. Furthermore, by exiting low-performing businesses, Walmart should be able to operate even more efficiently in the years ahead as it focuses on its core markets.

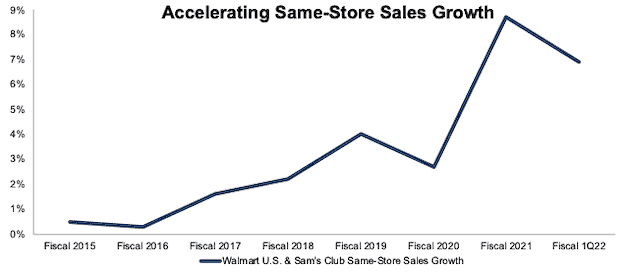

Same-Store Sales Continue Upward Climb: Figure 3 shows how Walmart’s year-over-year (YoY) same-store sales rate increased in four of the past five years with a large YoY increase in fiscal 2021.

We do not expect Walmart’s fiscal 2022 same-store sales to grow at the same rate as fiscal 2021. Walmart guided in its fiscal 1Q22 earnings report for U.S. same sales to be up in the “low single digits” for fiscal 2022. Even with a likely decline in the YoY same-store sales growth rate in fiscal 2022, we expect Walmart’s same-store sales to continue the long-term pre-pandemic growth trajectory given its accelerated ecommerce growth, which contributes to same-store sales.

Figure 3: Walmart’s YoY Change in U.S. Same-Store Sales Since Fiscal 2015

Sources: New Constructs, LLC and company filings.

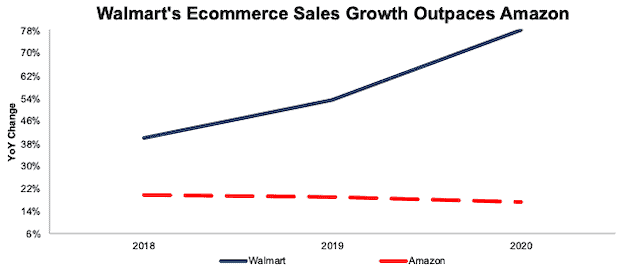

Gaining on Amazon: Walmart is the second largest ecommerce retailer in the U.S., and its global ecommerce net sales rose from $25.1 billion in fiscal 2019 to $64.9 billion in fiscal 2021, or 61% compounded annually.

For reference, Walmart’s fiscal 2021 ecommerce net sales are 69% of Target’s total TTM revenue. Ecommerce is becoming an increasingly larger share of Walmart’s global revenue as the firm develops its omnichannel presence and accounted for 12% of the firm’s global sales in fiscal 2021, up from just 5% in fiscal 2019.

While Amazon still dominates the global ecommerce market, Walmart is catching up. Amazon’s share of the global ecommerce market fell from 10% in calendar 2019 to 9.4% in 2020, while Walmart’s share grew from 1.1% to 1.5% over the same time.

Per Figure 4, the YoY percent change in Walmart’s U.S. ecommerce sales accelerated from 40% in calendar 2018 to 78% in calendar 2020, while the YoY percent change in Amazon’s U.S. retail sales fell from 20% to 17% over the same time.

Figure 4: Walmart vs. Amazon: U.S. Ecommerce Sales YoY Change*

Sources: New Constructs, LLC, company filings, and Statista.

*Dates represent calendar years.

Walmart’s ecommerce growth is likely to continue in calendar 2021. Research firm eMarketer expects Walmart.com’s calendar 2021 online gross value of product (GVP) to grow by 21%, which is faster than its expected 15% YoY GVP growth for Amazon over the same time. Walmart.com’s expected calendar 2021 GVP of $65 billion would be larger than eBay (EBAY), Apple (AAPL), and the combined GVP of Best Buy (BBY), Target (TGT), and Home Depot (HD).

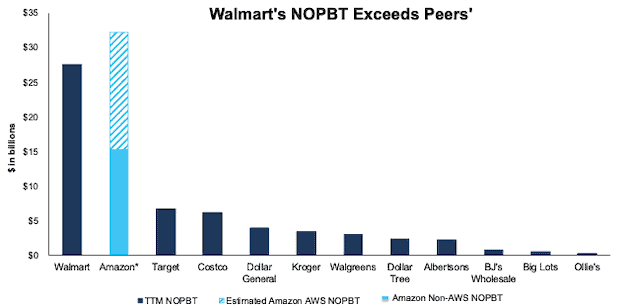

Profitability Remains Best-in-Class: Walmart’s scale is a major competitive advantage that drives the firm’s superior net operating profit before tax (NOPBT) that dwarfs its peers[2], per Figure 5. Walmart’s TTM NOPBT of $27.7 billion is 2x Amazon’s TTM non-AWS NOPBT and nearly equal to the combined TTM NOPBT of Target Corporation (TGT), Costco Wholesale Corp (COST), Dollar General (DG), The Kroger Company (KR), Walgreens Boots Alliance (WBA), Dollar Tree (DLTR), and Albertsons Companies (ACI).

Clearly, Walmart’s position as the #1 retailer is very strong. There’s a good chance it will only get stronger as the firm combines its world-leading brick-and-mortar store network with its growing ecommerce offerings to build one of the best omni-channel retail goods delivery platforms in the world.

The good news for investors in WMT is that the stock’s valuation implies the company will enjoy no such success and profits will decline precipitously from current levels.

Figure 5: TTM Net Operating Profit Before Tax (NOPBT) vs. Competitors

Sources: New Constructs, LLC and company filings.

*Amazon’s total TTM NOPBT is split between AWS and non-AWS NOPBT

Walmart’s free cash flow (FCF) enables it to invest in its best-in-class distribution network and growing ecommerce business. Walmart generated $55.8 billion (14% of market cap) in FCF over the past five years. For reference, Amazon burned $68.8 billion (4% of market cap) in FCF over the past five years.

Ecommerce and Market Share Gains Provide Growth Opportunities: Bears also argue that Walmart has few remaining growth opportunities as its U.S. segment has limited prospects for new store openings, and its international revenue is in decline. However, the firm’s strong same-store sales demonstrates that Walmart is still able to attract new customers or sell additional products to existing customers. And, with an increased focus on ecommerce, the firm is better positioned to reach new customers that may never enter its stores.

While Walmart is unlikely to continue the large YoY revenue growth it saw in fiscal 2021, the firm’s market share gains throughout the pandemic should persist due to the permanent closure of such a large number of competitors and the fact that its ecommerce business is taking market share. Notably, Walmart saw increased grocery and ecommerce sales in fiscal 1Q22 as the firm realizes pent-up demand from customers preparing to engage in more social activities during 2021.

Rising Labor Costs Will Pass Through to Customers: The growing difficulty to hire and retain entry-level labor means Walmart may be forced to increase wages, which would put pressure on margins. While the labor market may compress Walmart’s margins temporarily, all retailers will face the same challenge and will likely offset rising costs with increased prices.

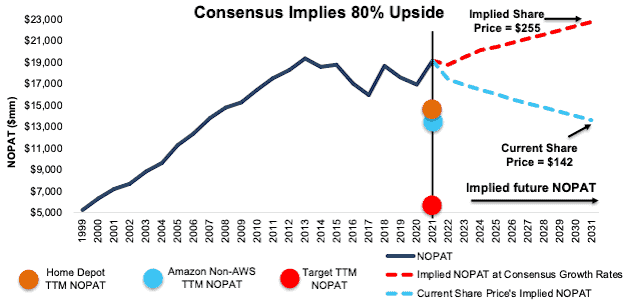

Walmart’s Current Price Implies NOPAT Falls ~30%: Investors don't need Walmart to beat or even meet record setting earnings comps over the last few quarters because its stock is already pricing in a major decline in profits from fiscal 2021 levels. These depressed expectations give the stock superior risk/reward compared to other quality retailers. No better example of how valuation matters than what we saw when Walmart and Home Depot (HD) reported top and bottom line beats for their first quarter results on May 18, 2021: Home Depot’s stock fell 1% while Walmart’s stock jumped 2%.

Below, we use our reverse discounted cash flow (DCF) model to analyze the expectations for future growth in cash flows baked into Walmart’s current share price.

In this scenario, we assume:

- Walmart’s net operating profit after-tax (NOPAT) margin falls to 3.2% (all-time low vs. 3.4% in fiscal 2021) and

- revenue falls 3% compounded annually (vs. consensus estimates of +6% from fiscal 2022 - fiscal 2024) until fiscal 2031

In this scenario, Walmart’s NOPAT falls 4% compounded annually over the next decade and the stock is worth $142/share – equal to its current price. See the math behind this reverse DCF scenario. In this scenario, Walmart’s fiscal 2031 NOPAT is 29% below fiscal 2021 levels and nearly equal to fiscal 2007 levels.

WMT Has 80%+ Upside: If we assume Walmart:

- maintains its TTM NOPAT margin of 3.4% (equal to fiscal 2021) from fiscal 2022-2031 and

- revenue grows 2% (vs. consensus estimates of +6% from fiscal 2022 through fiscal 2024) compounded annually from fiscal 2022-2031 then

the stock is worth $255/share today – an 80% upside to the current price. In this scenario, Walmart’s NOPAT grows just 2% compounded annually over the next 10 years. See the math behind this reverse DCF scenario. Research And Markets expects global retail sales to grow 7% compounded annually from 2020 to 2025. Should Walmart grow sales closer in line with industry expectations, the stock has even more upside.

Figure 6: Walmart’s Historical vs. Implied NOPAT: DCF Valuation Scenarios*

Sources: New Constructs, LLC and company filings.

*Dates in Figure 6 represent Walmart’s fiscal year. For example, 2021 is Walmart’s fiscal 2021 which ended on January 31, 2021.

Disney Has 41%+ Upside

We made Disney a Long Idea in July 2017 and most recently reiterated it in March 2021. The stock is up 55% vs. 83% for the S&P 500 since our original report and has underperformed the S&P 500 by 14% since our report in March 2021. Here’s what we learned from 1Q21 earnings and why the stock still provides attractive risk/reward despite its underperformance.

What’s Working: The firm’s revenue continues to rebound. Revenue in fiscal 2Q21 was 18% lower YoY compared to a 22% YoY decline in fiscal 1Q21, -23% in fiscal 4Q20, and -42% in fiscal 3Q20. While much of the firm’s revenue is still down YoY, Disney’s media and entertainment distribution segment performed better as its fiscal 2Q21 revenue of $12.4 billion was unchanged from 2Q20.

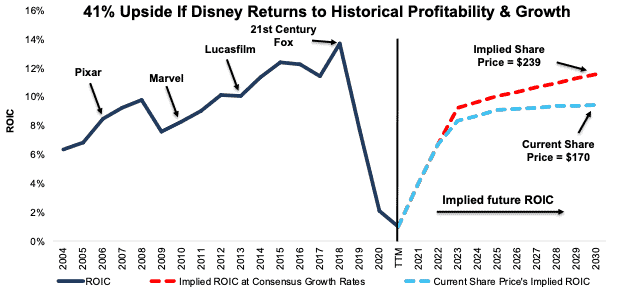

Disney has a history of creating shareholder value through its acquisitions. Per Figure 7, Disney’s return on invested capital (ROIC) rose during the firm’s Pixar, Marvel, and Lucasfilm acquisitions from 7% in fiscal 2005 to 14% in fiscal 2018. While Disney’s ROIC has declined since the Fox acquisition, we believe it will rebound as the firm continues to leverage its unmatched ability to create and monetize original content.

What’s Not Working: While the firm beat bottom-line expectations in 2Q21, it missed on the top line.

More important to investors though was Disney’s reported 104 million Disney+ subscribers, which was below expectations of 109 million. However, Disney+ quarter-over-quarter increase of 9 million more than doubled Netflix’s most recent quarter-over-quarter increase of just 4 million subscribers. Furthermore, Disney’s total paid subscribers (which includes, Disney+, Disney+ Hotstar, ESPN+, Hulu and Star+) rose from 146 million in 1Q21 to 159 million in 2Q21.

The firm noted it lost $1.2 billion in operating income due to its theme park shutdowns. However, since the end of the quarter, Disney re-opened two more of its parks. With the continued success of the vaccination rollout, and the easing of COVID-19 restrictions, Disney is well-positioned to see a continued rebound of customers returning to parks and cruises.

Current Price Means ROIC Stays Below 2012 Levels: Below, we use our reverse DCF model to quantify the expectations for future ROIC baked into DIS’s current price.

In this scenario, we assume:

- Disney’s NOPAT margin improves to 11% (average of 2019 and 2020) in 2021 as parks reopen and cruises resume and

- NOPAT margin improves to 15% in 2022 (equal to 2019) and reaches 18% (equal to its five-year average prior to the Fox acquisition, compared to 3% TTM) and each year thereafter through 2030

- revenue grows 11% (equal to 2021-2025 consensus estimates) from 2021 to 2025 and 2% each year thereafter through 2030

In this scenario, Disney’s NOPAT grows by 5% compounded annually from its 2018 pre-Fox-acquisition NOPAT through 2030 and the stock is worth $170/share today – equal to the current price. See the math behind this reverse DCF scenario. In this scenario, Disney’s ROIC in 2030 equals 10%, which is much lower than its pre-Fox-acquisition ROIC of 14%.

$239/Share If Disney Grows in Line With Historical Trends: If we assume:

- Disney’s NOPAT margin improves to 11% (average of 2019 and 2020) in 2021 as parks reopen and cruises resume and

- NOPAT margin improves to 15% in 2022 (equal to 2019), and reaches 20% (equal to 2018) in 2023 and each year thereafter through 2030

- revenue grows 11% (equal to 2021-2025 consensus estimates) from 2021 to 2025 and 6% (equal to its five-year pre-Fox-acquisition revenue CAGR) each year thereafter through 2030, then

the stock is worth $239/share today, or 41% above the current price. See the math behind this reverse DCF scenario. In this scenario, Disney grows NOPAT by 8% compounded annually from 2018 (before Fox acquisition) to 2030. For reference, Disney grew NOPAT 9% compounded annually from 2006 to 2018.

Furthermore, Disney’s purchase of 21st Century Fox means Disney has a much larger content base to monetize and generate incremental profits. However, even in this scenario, Disney’s ROIC in 2030 equals 12%, which is still lower than its pre-Fox-acquisition ROIC of 14%.

Figure 7 compares the firm’s implied future ROIC for both scenarios to its historical ROIC.

Figure 7: DCF Scenario 2: Historical vs. Implied ROIC

Sources: New Constructs, LLC and company filings.

This article originally published on May 19, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our reports utilize our Core Earnings, a more reliable measure of profits, as demonstrated in Core Earnings: New Data & Evidence, a paper by professors at Harvard Business School (HBS) & MIT Sloan. Recently accepted by the Journal of Financial Economics, the paper proves that our data is superior to all the metrics offered elsewhere.

[2] In this analysis, we break out net operating profit before tax (NOPBT) attributed to Amazon’s AWS business and Amazon’s non-AWS business. We estimate Amazon’s non-AWS NOPBT as 47% of NOPBT, which is equal to Amazon’s reported operating earnings attributed to its non-AWS segment as a percent of total operating earnings.