Warren Buffett looks prudent for buying this recent tech IPO because the stock has more than doubled since he bought it. However, investors with fiduciary responsibilities should pause before following the Oracle of Omaha into this stock now. At $245/share, Snowflake Inc. (SNOW: $245/share) is priced as if the firm will own 46% of its total addressable market compared to <1% today and is this week’s Sell Idea.

As the stock price rises, momentum investors may believe there is opportunity left in this stock. However, fiduciaries should beware of the risks in owning this stock:

- Competition includes Google (GOOGL), Microsoft (MSFT) and Amazon (AMZN), who are already integrated with Snowflake’s clients and can offer similar/same services

- Doing the math: valuation implies Snowflake takes 46% of its TAM (vs. <1% currently)

Growth Story Is Losing Steam

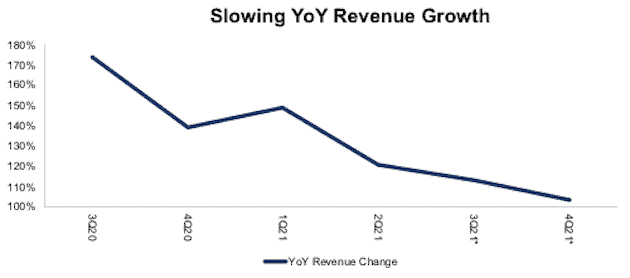

Snowflake has experienced tremendous revenue growth over the past eight quarters, which garners the attention of investors looking for the next big growth story. Overall, the firm grew revenue by 174% from fiscal-year-ended (FYE) 2019 to FYE 2020. However, the year-over-year (YoY) growth rate is falling.

Figure 1 shows YoY revenue growth fell from 175% in 3Q19 to 121% in 2Q20. Consensus estimates expect this trend to continue as the revenue expectations for 4Q21 imply a 103% YoY revenue increase. As Snowflake’s impressive revenue growth rates stem from a small revenue base ($265 million in FYE 2020), it should come as no surprise growth rates would fall accordingly.

Figure 1: Snowflake’s Slowing Revenue Growth

Sources: New Constructs, LLC and company filings & Seeking Alpha

*Consensus Estimates

Intense Competition Is Already Replicating Snowflake’s Offerings

Snowflake’s revenue growth rate is likely to continue its downward trend as the firm operates in an industry with heavy competition.

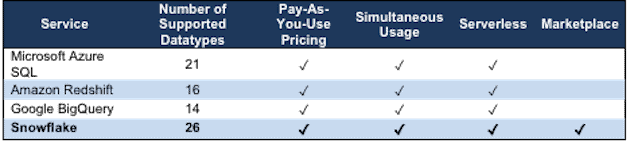

Snowflake offers customers flexible and user-friendly data storage and analytics that provides the ability to scale-up and -down as computing and storage needs change. More specifically:

- simultaneous usage (allowing multiple users to access and run queries on the platform at the same time)

- pay-as-you-use pricing

- ability to use the service without buying and maintaining servers

- a seamless data sharing platform with internal and external businesses

- a marketplace where firms can buy and sell datasets that are easy to use and manage within the Snowflake platform.

While Snowflake is building a reputation for the ease of use and scalability of its storage and analytics, Figure 2 shows that Microsoft (MSFT), Amazon (AMZN), and Google (GOOGL) already offer similar services and are not that far away from matching all of the features Snowflake provides.

Figure 2: Select Features Offered by Snowflake and Competitors

Sources: New Constructs, LLC, and company filings

Competition Makes Snowflake’s Endgame Unlikely

Snowflake’s ultimate goal is to achieve scale where it can monetize the collective network effect of its users. As the firm gathers more users, more data is made available to everyone in the Snowflake network. If Snowflake gathers a critical mass of data within its network, then the value of the data can draw even more users to its service. However, network effects are diminished in an ever-connected world because it is very difficult to maintain proprietary data advantages when so many users can access data from multiple services, locations, and in many forms.

Given the strength and resources of Snowflake’s competition, we do not believe the firm will ever achieve the scale required to drive demand for a proprietary data network.

Further complicating Snowflake’s efforts is its reliance on Microsoft, Amazon, and Google’s public clouds. Ultimately, these competitors determine the viability and profitability of Snowflake. The firm notes as much in its S-1, regarding the availability of its services:

“…if our contractual and other business relationships with our public cloud providers are terminated, suspended, or suffer a material change to which we are unable to adapt, such as the elimination of services or features on which we depend, we could be unable to provide our platform and could experience significant delays and incur additional expense in transitioning customers to a different public cloud provider.”

And regarding profitability:

“Our platform currently operates on public cloud infrastructure provided by Amazon Web Services (AWS), Microsoft Azure (Azure), and Google Cloud Platform (GCP), and our costs and gross margins are significantly influenced by the prices we are able to negotiate with these public cloud providers, which in certain cases are also our competitors.”

In other words, these firms own the platform upon which Snowflake’s business relies, and they sell competing services. At any time, they can shift their strategies to focus on cutting Snowflake out of this business.

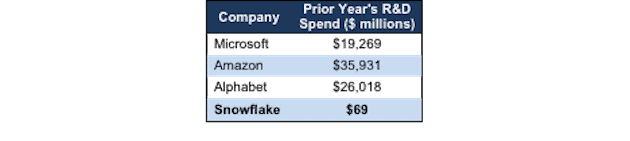

Competition Will Keep Getting Better, Too

Snowflake may be experiencing fast revenue growth, but the competition is not sitting by idly waiting to lose market share. Amazon, Google, Microsoft are quickly adding new features and improving existing functionality to match Snowflake’s services. Snowflake’s competitors have more than enough capital to invest in ensuring their services remain competitive over the long term. Per Figure 3, Microsoft, Amazon, and Alphabet spend hundreds of times more than Snowflake on Research and Development.

Figure 3: Competition R&D Spend Dwarfs Snowflake

Sources: New Constructs, LLC, and company filings

Microsoft recently upgraded its own data analytics service as a way to directly compete with Snowflake’s data analytics capabilities. According to The Information, Microsoft is trying to convince customers to buy Microsoft services instead of Snowflake’s.

Amazon has also stepped up its game recently and is making heavy investments in its own Redshift service.

Google is also competing directly with Snowflake by making its BigQuery service more flexible and scalable for customers. Beyond the big three tech firms, data warehouse offerings from Teradata (TDC) and Oracle (ORCL) and open-source platforms like Altinity stand in the way of Snowflake achieving the 46% market share implied by its current valuation.

The bottom line is that the more success that Snowflake sees with its service, the more attention and capital it will attract from competitors such as Microsoft, Amazon, and Google.

Don’t Overlook Employee Stock Options

In addition to a bleak competitive environment facing the company, fiduciaries should be particularly concerned with Snowflake’s large outstanding employee stock option liability (ESO). This liability represents future dilution which will directly reduce the free cash flow available to shareholders (FCF). The value of after-tax ESOs increased from $7.1 billion in FYE 2019 to $12 billion (18% of market cap) in FYE 2020. Fiduciaries should be sure to include this adjustment in their valuation of the firm.

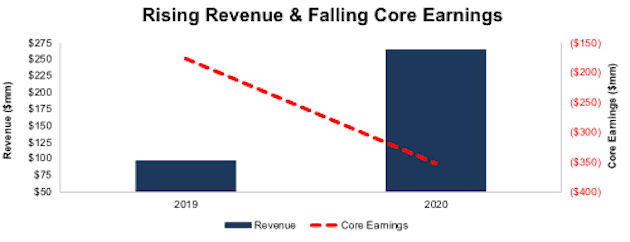

Snowflake’s Profits Are Heading Lower

Given the competitive forces detailed above, it may not surprise you that Snowflake’s profits are trending in the wrong direction, despite revenue growing from $97 million in FYE 2019 to $265 million in FYE 2020. Snowflake’s core earnings[1] fell from -$175 million to -$354 million over the same time. Snowflake also generated a -$164 million in FCF in FYE 2020.

Figure 4: Snowflake’s Revenue and Core Earnings Since 2019

Sources: New Constructs, LLC, and company filings

Snowflake’s Profitability Has a Long Way to Go to Catch Up With Peers

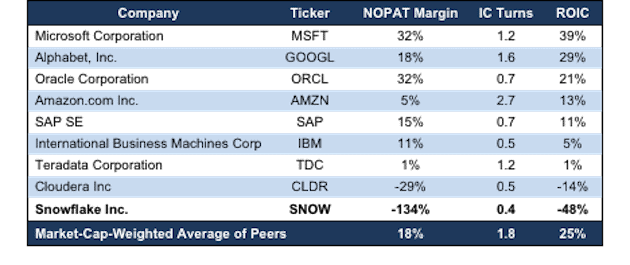

Snowflake’s peer group includes firms that provide data warehousing services such as Microsoft, Alphabet, Oracle Corporation, Amazon, SAP SE (SAP), International Business Machines Corp (IBM), Teradata Corporation, and Cloudera Inc (CLDR).

Snowflake’s net operating profit after-tax (NOPAT) margin of -134%, invested capital turns of 0.4, and return on invested capital (ROIC) of -48% rank last among all peers, including Teradata, which we placed in the Danger Zone in January 2020.

Drastic improvements in profitably are required to justify the expectations baked into the stock price.

Figure 5: Snowflake & Peers’ NOPAT Margin, Invested Capital Turns & ROIC

Sources: New Constructs, LLC, and company filings

Defining Snowflake’s TAM

Snowflake provides both traditional data warehousing and business intelligence and analytics services. Prescient & Strategic Intelligence expects the global data warehouse as a service market to reach $10.9 billion by 2027. Coherent Market Insights expects the business intelligence and analytics market to reach $55.2 billion by 2027. We combine these two forecasts to arrive at Snowflake’s 2027 total addressable market (TAM) of $66.1 billion.

While lower than Snowflake’s own TAM estimate of $81 billion, we prefer to rely on third-party sources to get an unbiased look at the market opportunity available.

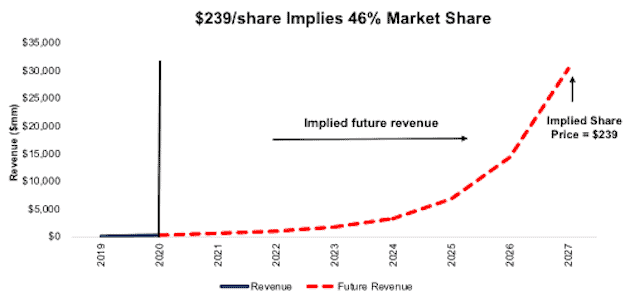

Snowflake Is Priced to Own 46% of Its TAM

To justify its current price of $245/share, Snowflake must:

- Grow revenue at 97% (vs. consensus estimates from 2021 to 2024 of 81%) compounded annually over the next seven years

- Immediately achieve a 10% NOPAT margin, which is above Amazon’s but below Microsoft’s and Alphabet’s TTM margins. For reference, SNOW’s NOPAT margin is currently -134%

See the math behind this reverse DCF scenario. In this scenario, Snowflake’s revenue in 2027 would reach $30.3 billion, or 46% of its TAM. This scenario implies Snowflake must grow revenue at an extraordinarily high annualized rate of 97% for seven years.

Figure 6: Current Valuation Implies Huge Market Share Growth

Sources: New Constructs, LLC and company filings

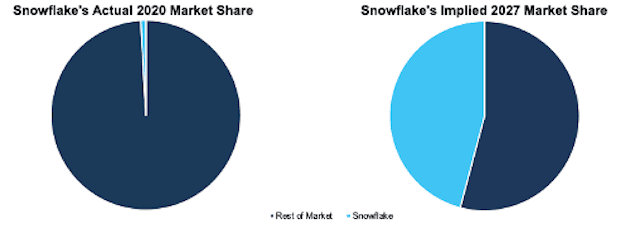

SNOW’s Price Means Extraordinary Market Share Growth

Snowflake’s revenue in FYE 2020 represented just 1% of the firm’s 2020 TAM. The revenue growth required to justify its stock price means Snowflake will hold 46% of the its 2027 TAM. In other words, Snowflake’s valuation implies it will take nearly half of its TAM while competing against the likes of Microsoft, Alphabet, Oracle Corporation, and Amazon.

Figure 7: Current Valuation Implies Huge Market Share Growth

Sources: New Constructs, LLC, company filings, Prescient & Strategic Intelligence, and Coherent Market Insights

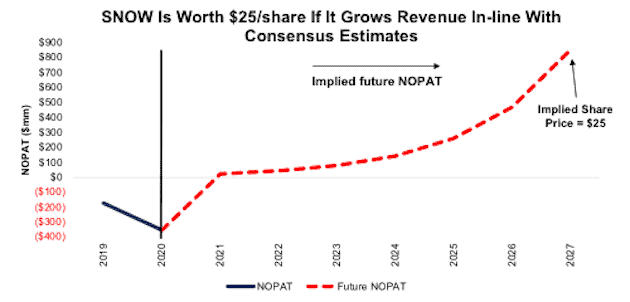

SNOW Has 90% Downside Risk if It Grows In-line With Consensus Estimates

Even if Snowflake grows at consensus estimates, the stock is severely overvalued. In this scenario, Snowflake:

- Grows revenue at 81% (vs. average consensus estimates from 2021 to 2024 of 81%) compounded annually over the next seven years

- Immediately achieves a 5% (equal to Amazon’s TTM margin) NOPAT margin

See the math behind this reverse DCF scenario. In this scenario, Snowflake grows NOPAT from -$354 million in FYE 2020 to $849 million in 2027, and the stock is worth just $25/share – a 90% downside. For reference, Teradata’s TTM NOPAT is $11 million.

Figure 8: SNOW Could Fall 90% Even If Profits Exceed Those of Teradata

Sources: New Constructs, LLC and company filings

Each of the above scenarios also assumes Snowflake is able to grow revenue, NOPAT and FCF without increasing working capital or fixed assets. This assumption is highly unlikely but allows us to create best-case scenarios that demonstrate how high expectations embedded in the current valuation are.

Acquisition Would Be Unwise

Often the largest risk to any bear thesis is what we call “stupid money risk”, which means an acquirer comes in and buys Snowflake at the current, or higher, share price despite the stock being overvalued. Given our analysis above, the only plausible justification for SNOW trading at such a high price is the expectation that another firm will buy it. Given the stock’s extremely high valuation and the fact that it wasn’t acquired prior to its IPO, we think the stupid money acquisition risk here is low. But stranger things have happened than a firm being acquired at an unnecessarily high premium to its intrinsic value.

Below, we quantify the high acquisition hopes that are priced into the stock.

Walking Through the Acquisition Math

First, investors need to know that Snowflake has large liabilities that make it more expensive than the accounting numbers would initially suggest.

- $12 billion in outstanding employee stock option (18% of market cap) liabilities

- $227 million in operating lease (<1% of market cap) liabilities

After adjusting for all liabilities, we can model multiple purchase price scenarios. For this analysis, we chose Salesforce.com Inc. (CRM) as a potential acquirer of Snowflake given Salesforce is an investor in Snowflake and could integrate Snowflake into its offerings. While we chose Salesforce, analysts can use just about any company to do the same analysis. The key variables are the weighted average cost of capital (WACC) and ROIC for assessing different hurdle rates for a deal to create value.

Even in the most optimistic of scenarios, Snowflake is worth much less than its current share price.

Figures 9 and 10 show what we think Salesforce should pay for Snowflake to ensure it does not destroy shareholder value. There are limits on how much Salesforce should pay for Snowflake to earn a proper return, given the NOPAT or free cash flows being acquired.

Each implied price is based on a ‘goal ROIC’ assuming different levels of revenue growth. In the first scenario, we use 117% revenue growth in years one through five (equal to 2021 consensus estimate). In the second scenario, we use a revenue growth rate of 174% in years one through five (equal to 2020’s YoY revenue growth). We use the higher growth rate in scenario two to illustrate a best-case scenario where we assume Snowflake could grow revenue faster while being integrated within Salesforce’s existing customer base.

We optimistically assume that Salesforce can grow Snowflake’s revenue and NOPAT without spending any working capital or fixed assets beyond the original purchase price. We also optimistically assume Snowflake achieves a 10% NOPAT margin, which is above Snowflake’s TTM margin of -134% and Salesforce’s TTM margin of 1%.

Figure 9: Implied Acquisition Prices for Value-Neutral Deal

Sources: New Constructs, LLC and company filings

Figure 9 shows the implied values for SNOW assuming Salesforce wants to achieve an ROIC on the acquisition that equals its WACC of 6%. This scenario represents the minimum level of performance required not to destroy value. Even if Snowflake can grow revenue by 174% compounded annually for five years and achieve a 10% NOPAT margin, the firm is worth less than $245/share to Salesforce. It’s worth noting that any deal that only achieves a 6% ROIC would not be accretive, as the return on the deal would equal Salesforce’s WACC.

Figure 10: Implied Acquisition Prices to Create Value

Sources: New Constructs, LLC and company filings

Figure 10 shows the implied values for SNOW assuming Salesforce wants to achieve an ROIC on the acquisition that equals 8%, which is greater than its WACC and current ROIC of 1%. Acquisitions completed at these prices would be accretive to Salesforce’s shareholders. Even in this best-case growth scenario, the implied value is far below Snowflake’s current price. Without significant increases in the margin or revenue growth assumed in this scenario, an acquisition of SNOW at its current price destroys significant shareholder value.

Catalyst – Lock-up Expiration Is Coming

Prior to the firm’s IPO on September 16, 2020, employees and shareholders were placed under lock-up agreements that restricted the transfer of their vested holdings. Three months after the IPO, 49 million (18% of shares outstanding) shares will become eligible for transactions. Should these shareholders decide it’s time to take gains, especially after the stock price soared post-IPO, heavy selling pressure could send shares lower.

Additionally, should the firm’s relationship with Microsoft, Amazon, or Google deteriorate, Snowflake’s operations and/or prospects for future profitability could deteriorate in parallel. With this threat always hanging over the stock, investors could easily start selling shares at the first sign of negative news.

What Noise Traders Miss With SNOW

These days, fewer investors pay attention to fundamentals and the red flags buried in financial filings. Instead, due to the proliferation of noise traders, the focus tends toward technical trading trends while high-quality fundamental research is overlooked. Here’s a quick summary for noise traders when analyzing SNOW:

- Slowing revenue growth rates

- Entrenched and well-funded competition that Snowflake relies upon to operate

- Valuation implies massive market share growth

Lack of Disclosure Leaves Shareholders in the Dark

Snowflake is classified as an “emerging growth company,” which means it can provide less information about executive compensation than is required of other companies.

Snowflake does state that the firm is authorized to issue stock options, restricted stock awards, restricted stock unit awards, stock appreciation rights, and performance awards as part of its executive compensation plan. However, Snowflake’s lack of disclosure on the details of its compensation plan leaves shareholders with many unanswered questions and no way to truly measure whether executives are properly incentivized.

Snowflake should link executive compensation with improving ROIC, which is directly correlated with creating shareholder value, so shareholders’ interests are properly aligned with executives’.

Insider Trading and Short Interest

Over the past three months, insiders have purchased 840 thousand and haven’t sold any shares.

Information about the short interest in this stock is currently unavailable.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings as shown in the Harvard Business School and MIT Sloan paper,"Core Earnings: New Data and Evidence”.

Below are specifics on the adjustments we make based on Robo-Analyst findings in Snowflake’s filings:

Income Statement: we made $30 million of adjustments, with a net effect of removing $5 million in non-operating income (2% of revenue). You can see all the adjustments made to Snowflake’s income statement here.

Balance Sheet: we made $125 million of adjustments to calculate invested capital with a net increase of $124 million. One of the most notable adjustments was $16 million in operating leases. This adjustment represented 3% of reported net assets. You can see all the adjustments made to Snowflake’s balance sheet here.

Valuation: we made $12.3 billion of adjustments with a net effect of decreasing shareholder value by $12.3 billion. There were no adjustments that increased shareholder value. The most notable adjustment to shareholder value was $12 billion in outstanding ESOs. This adjustment represents 18% of Snowflake’s market cap. See all adjustments to Snowflake’s valuation here.

Unattractive Funds That Hold SNOW

There are currently are no funds under coverage allocate significantly to SNOW.

This article originally published on October 7, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our core earnings are a superior measure of profits, as demonstrated in Core Earnings: New Data & Evidence a paper by professors at Harvard Business School (HBS) & MIT Sloan. The paper empirically shows that our data is superior to “Operating Income After Depreciation” and “Income Before Special Items” from Compustat, owned by S&P Global (SPGI).